Forex Technical Analysis & Forecast 10.01.2020 (EURUSD, GBPUSD, USDCHF, USDJPY, AUDUSD, USDRUB, USDCAD, GOLD, BRENT, BTCUSD)

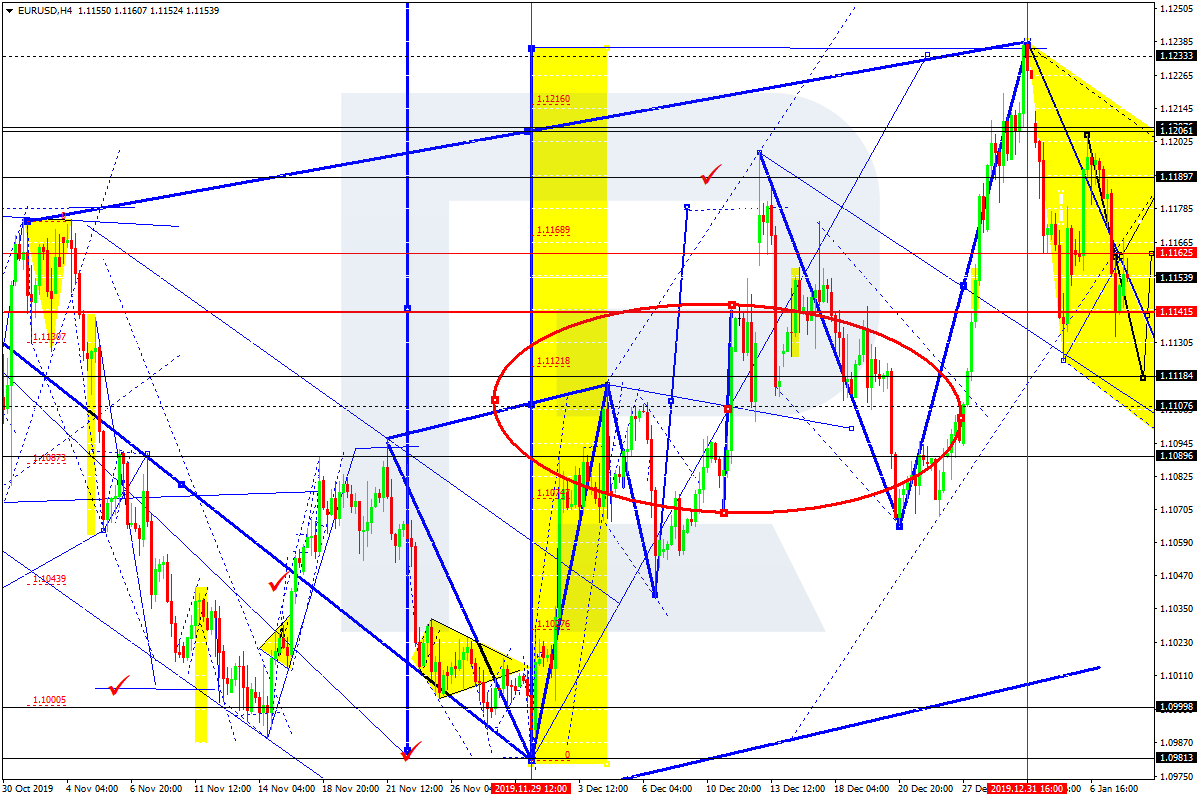

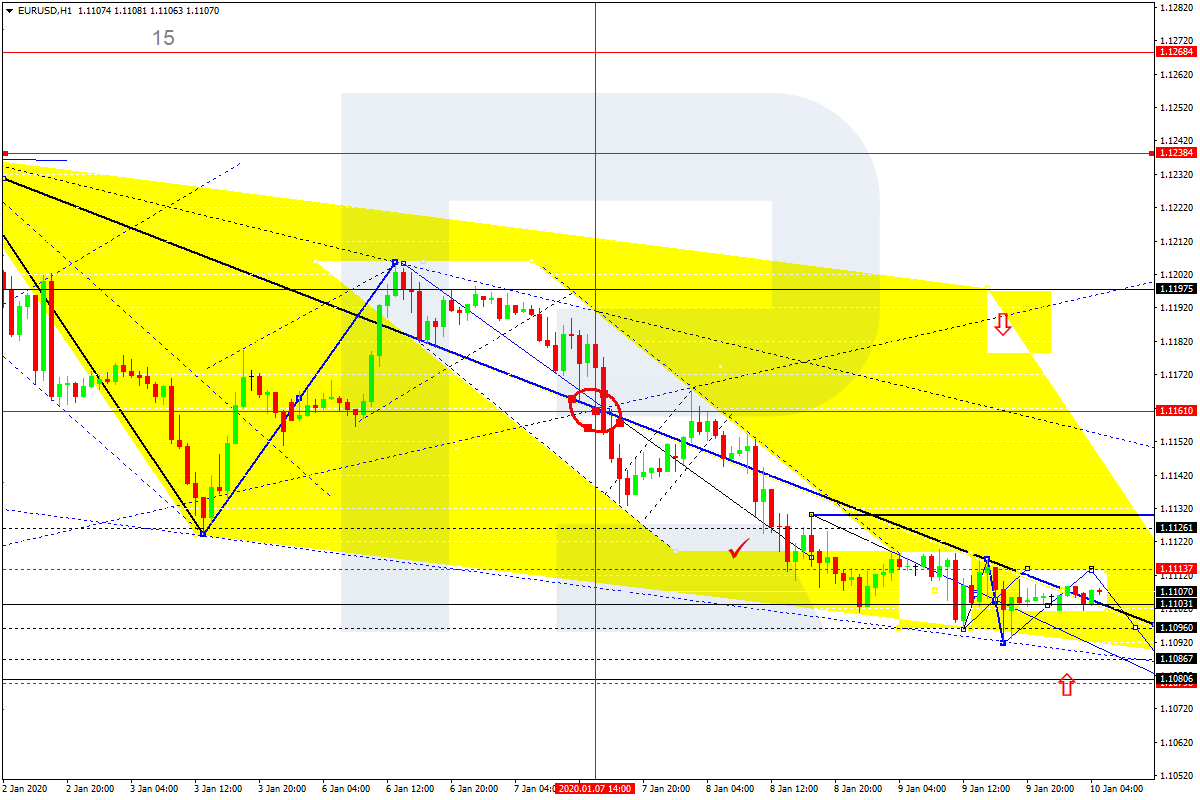

EURUSD, “Euro vs US Dollar”

EURUSD is still moving downwards; it has formed another consolidation range around 1.1107. Today, the pair may form a new descending structure towards 1.1090 to complete the correctional wave. If the price breaks 1.1111, the instrument may resume moving upwards with the first target at 1.1200.

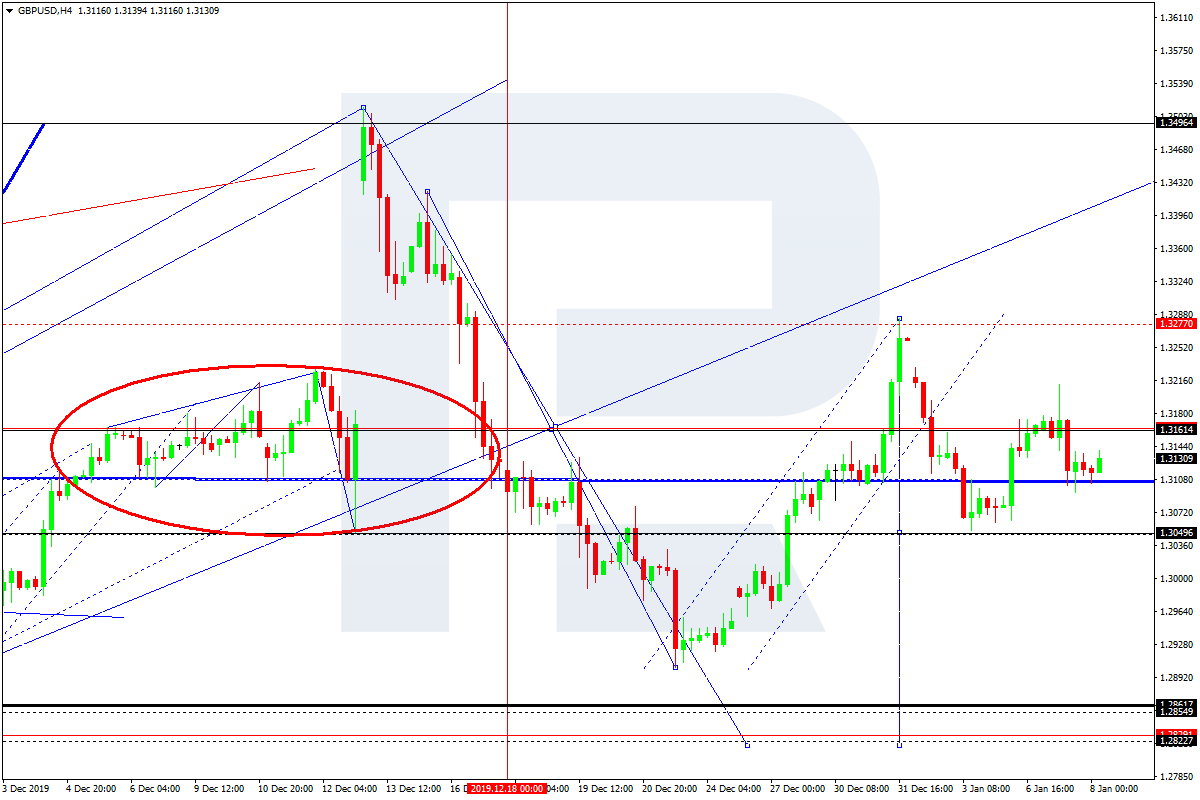

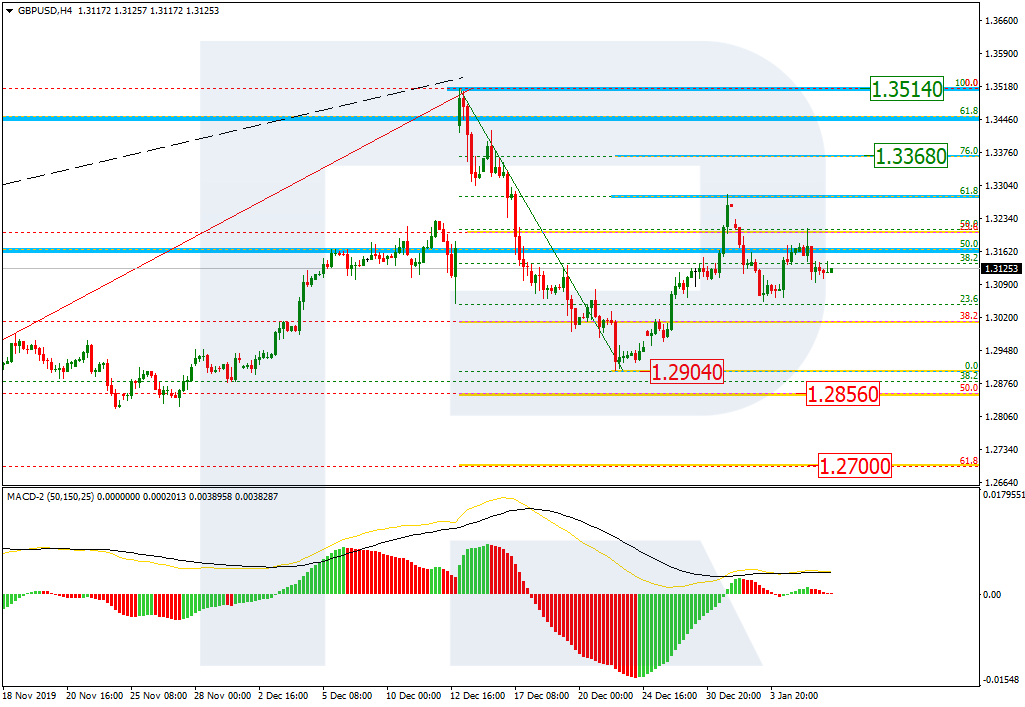

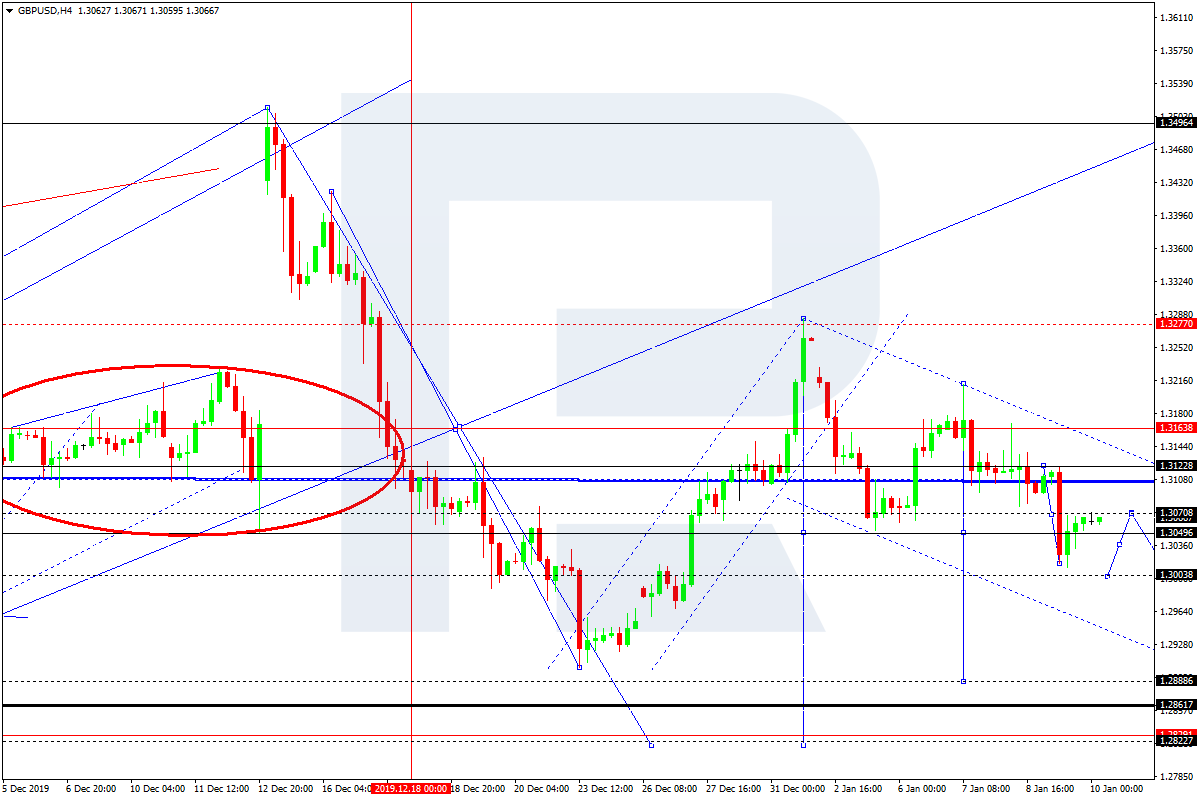

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has reached the target of the descending structure at 1.3050, which may be considered as the first half of the third wave. Possibly, today the pair may consolidate around this level and then expand the range down to 1.3000. Later, the market may resume falling with the short-term target at 1.2888.

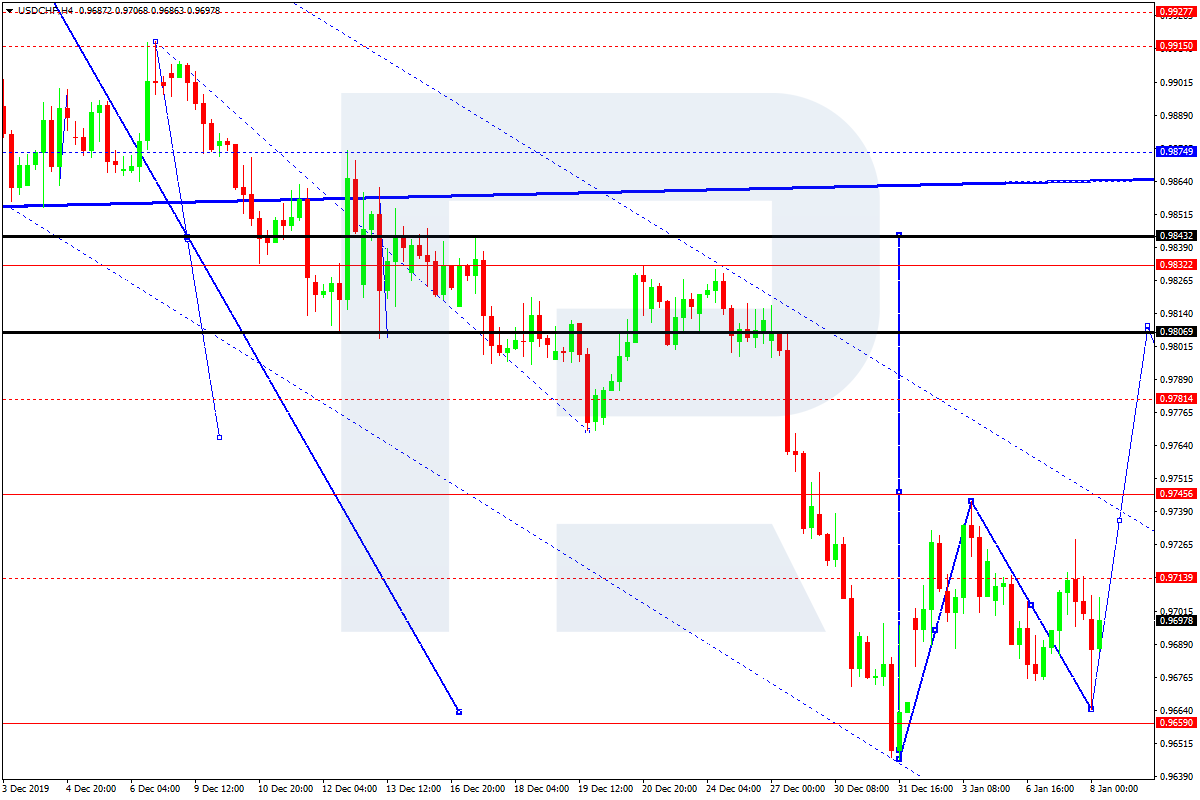

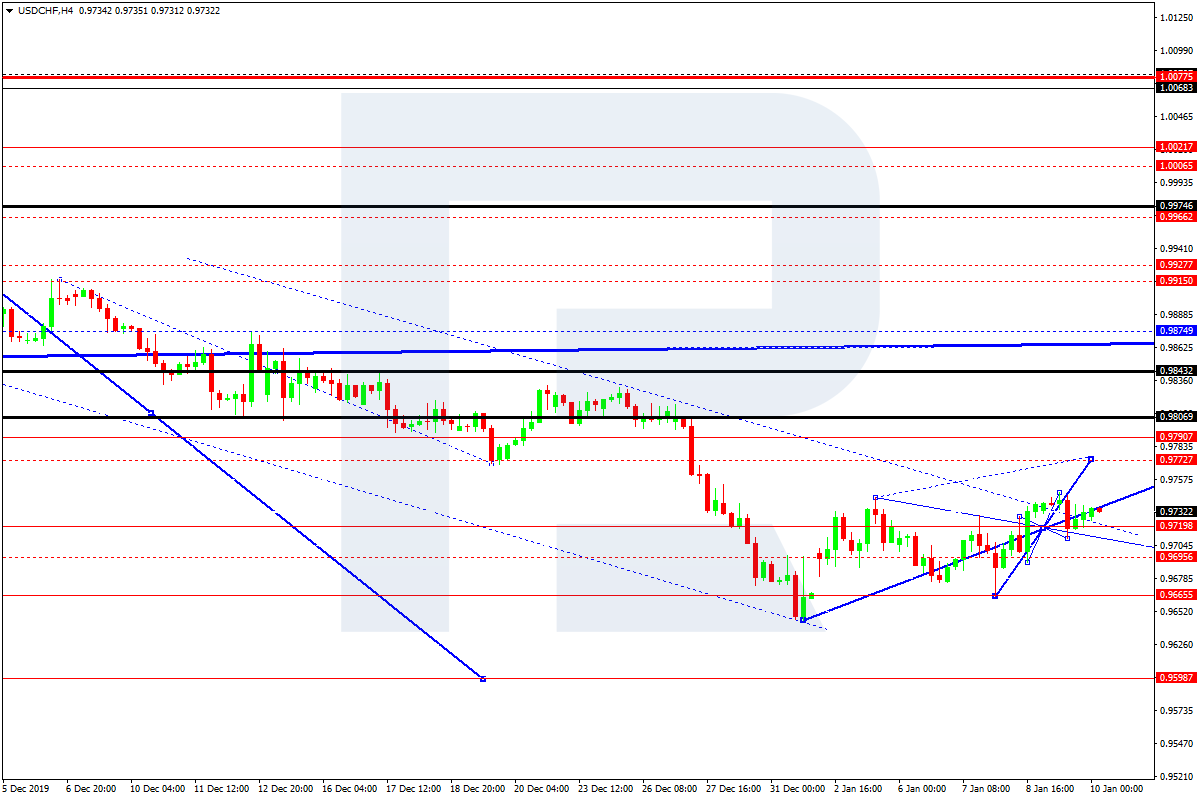

USDCHF, “US Dollar vs Swiss Franc”

USDCHF has formed another consolidation range around 0.9718. Possibly, today the pair may grow towards 0.9770. After that, the instrument may start a new decline to reach 0.9717 and then form one more ascending structure with the target at 0.9790.

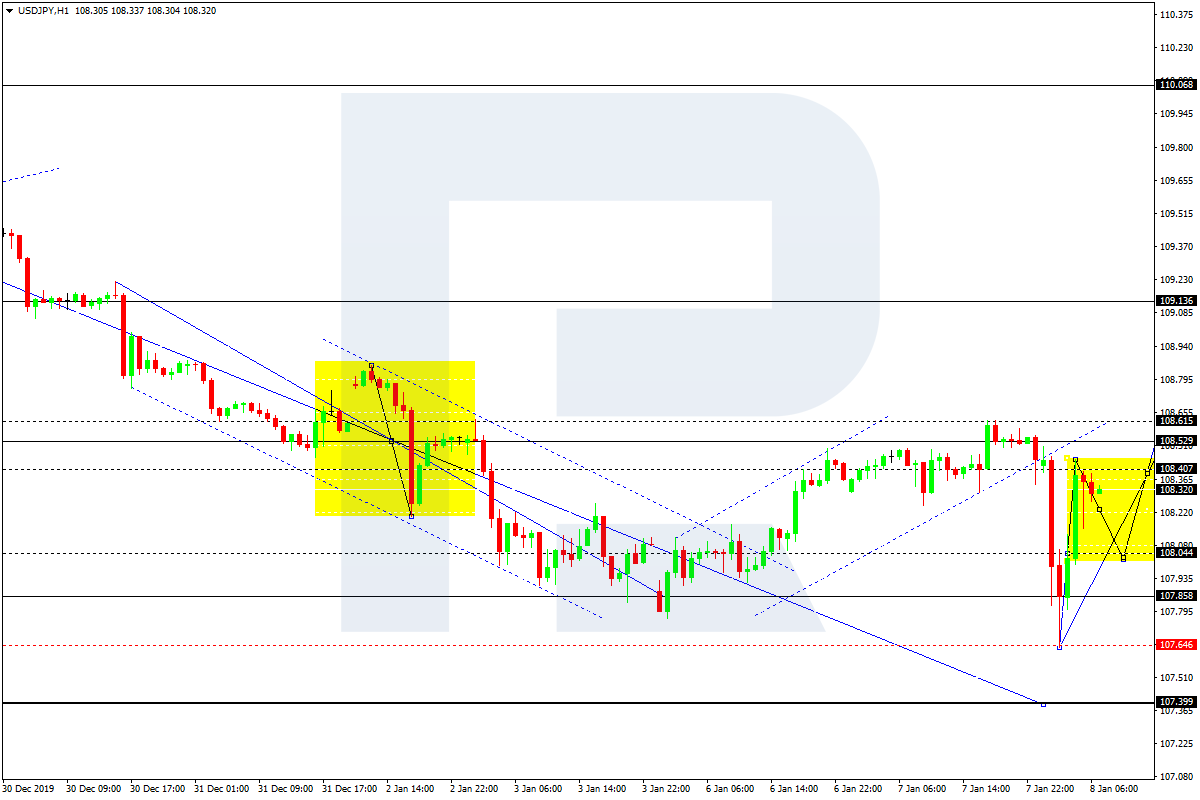

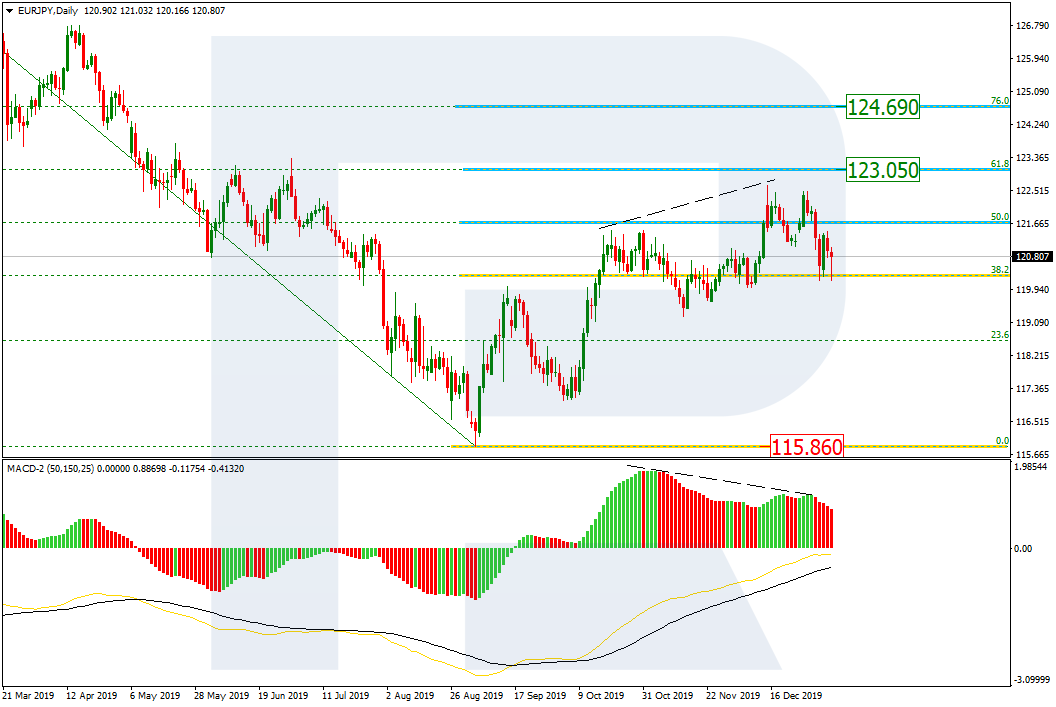

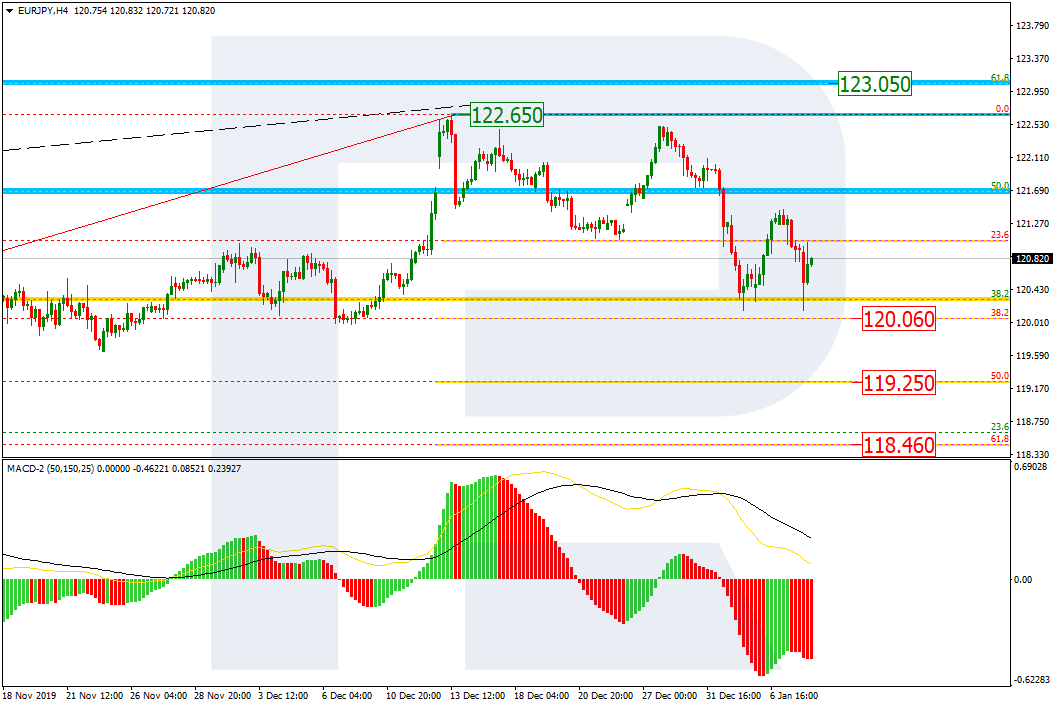

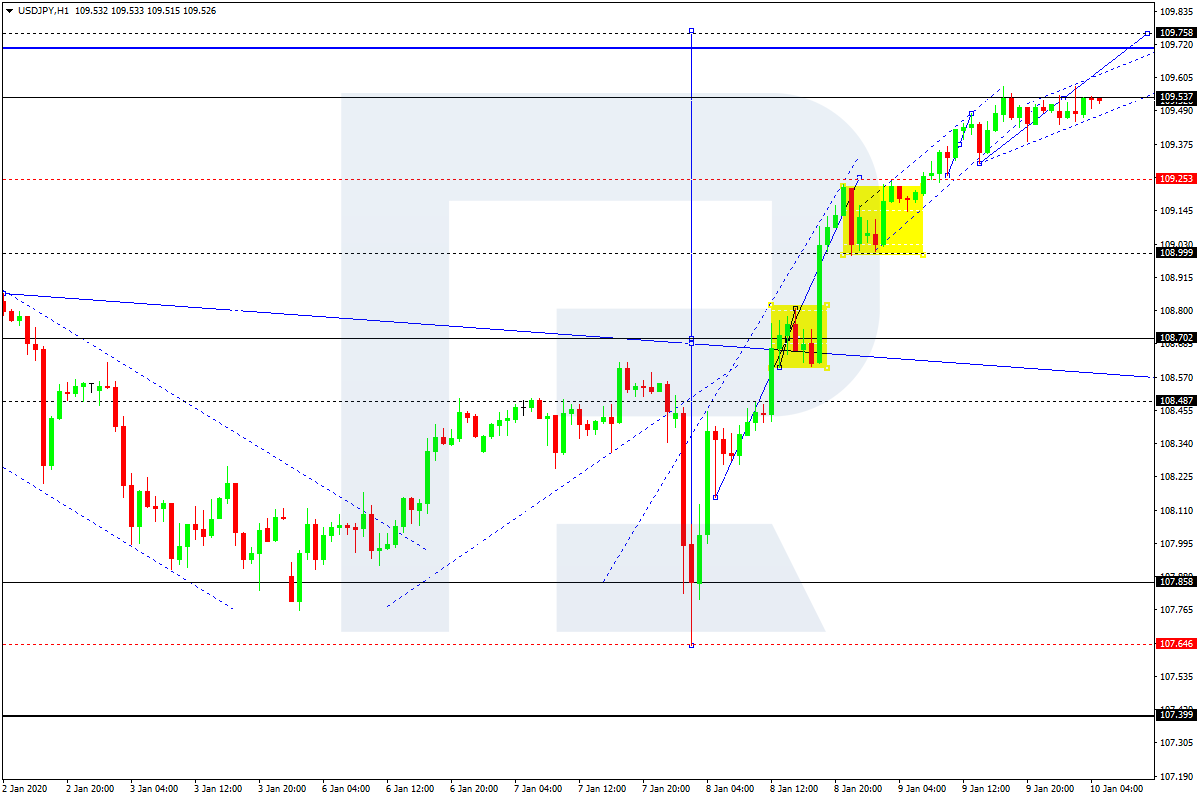

USDJPY, “US Dollar vs Japanese Yen”

USDJPY is growing with the target at 109.75. Today, the pair may reach 109.70. Later, the market may form a new descending structure towards 109.50 and then resume moving upwards to reach the above-mentioned target and complete this ascending wave. After that, the instrument may start another decline with the first target at 107.85.

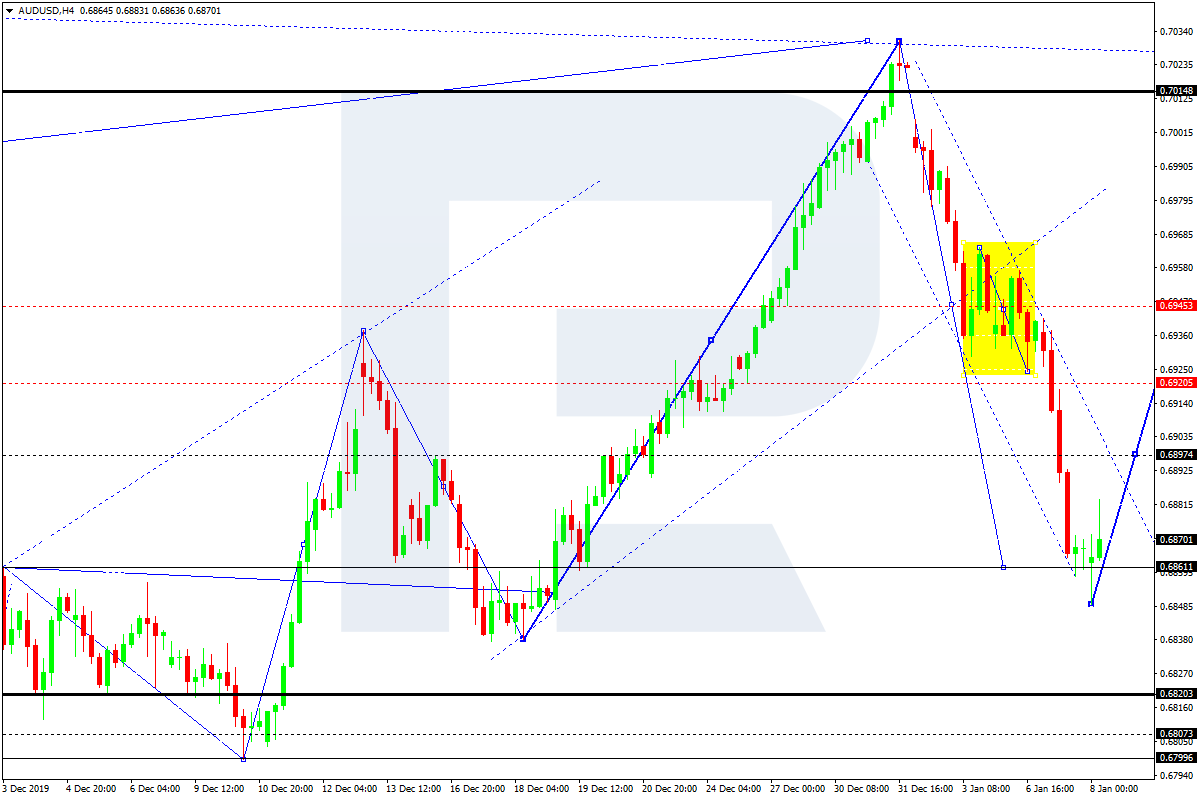

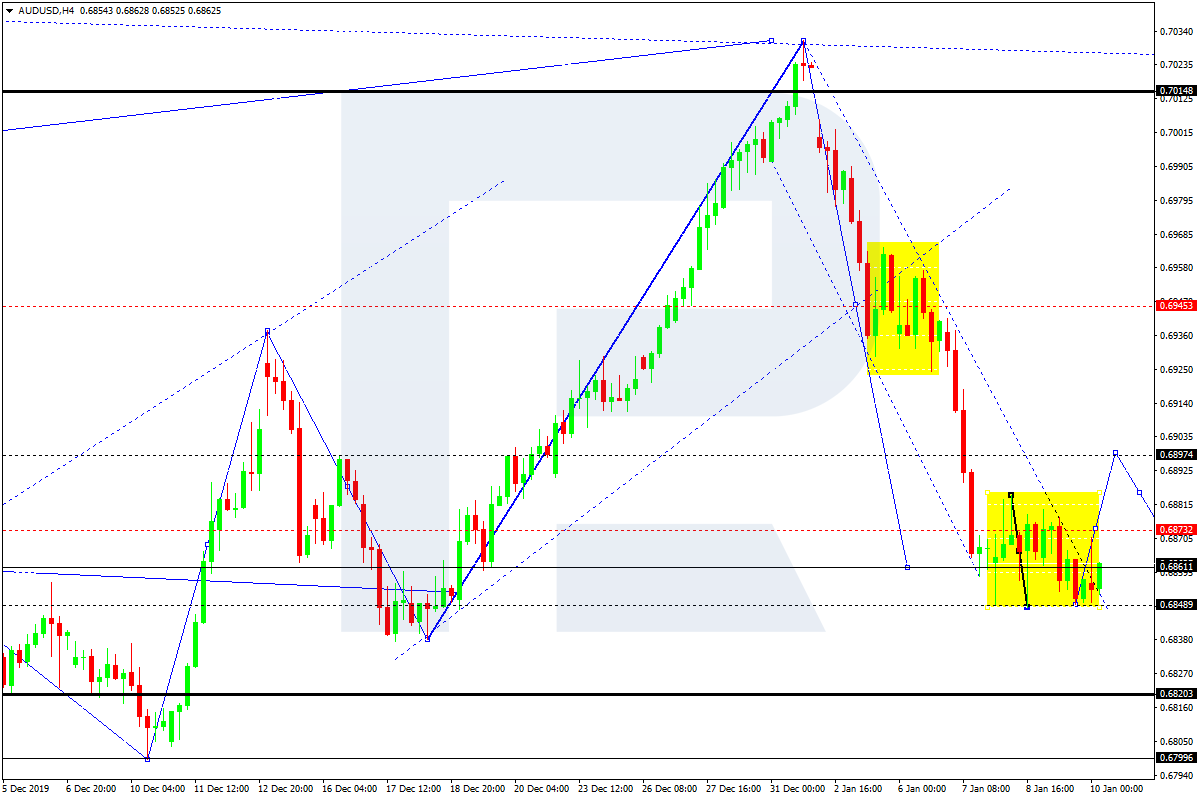

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD is still consolidating above 0.6850 without any particular direction. Possibly, the pair may form one more ascending structure towards 0.6898 and then resume moving downwards to reach 0.6872. continue growing with the target at 0.6945. After that, the instrument may start another growth to break 0.6898 and then continue trading inside the uptrend with the first target at 0.6945.

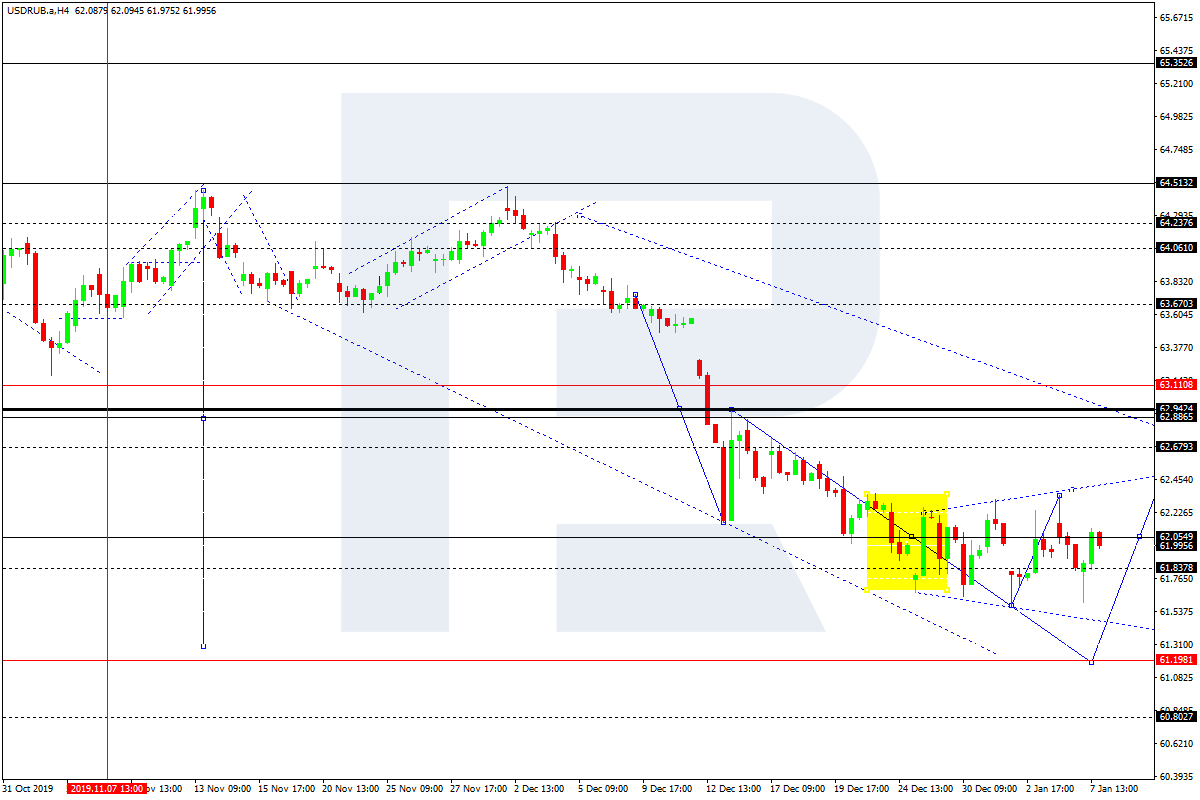

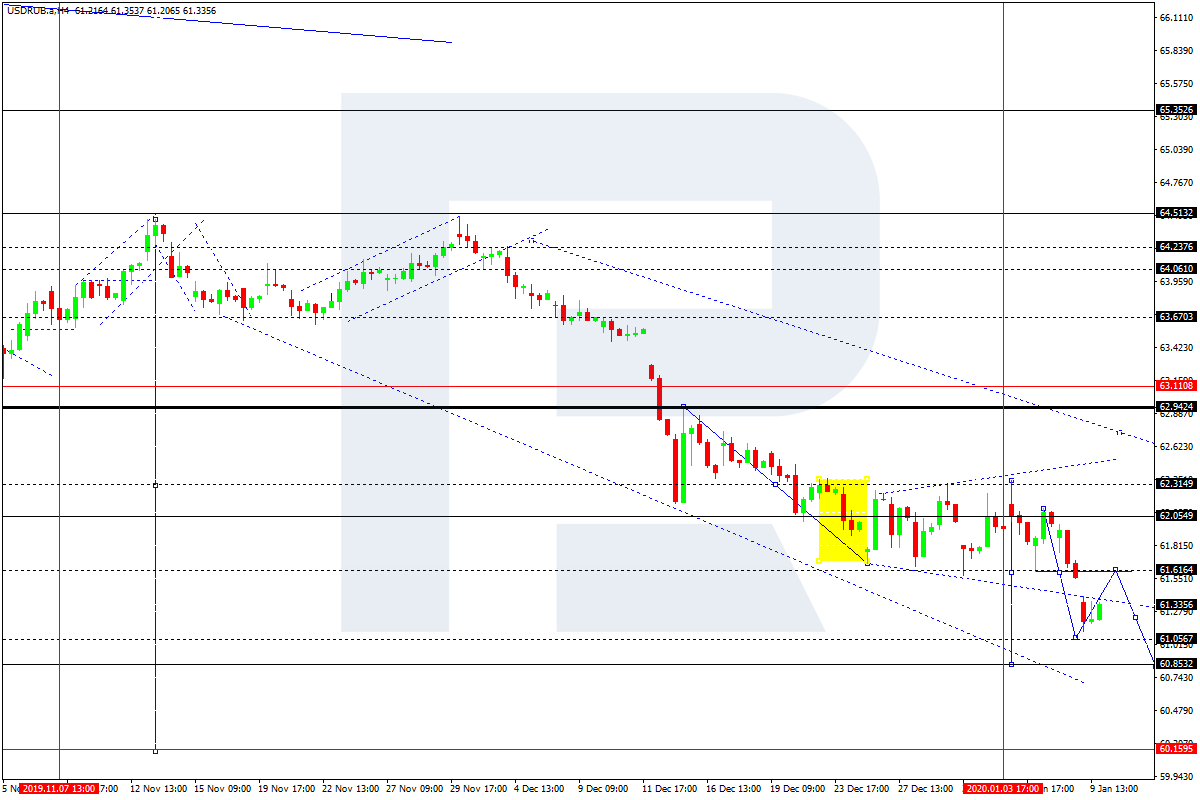

USDRUB, “US Dollar vs Russian Ruble”

USDRUB is falling towards 61.00; it has already reached the short-term target at 61.12. The main scenario implies that the price may test 61.50 from below and then resume trading inside the downtrend to reach 61.00.

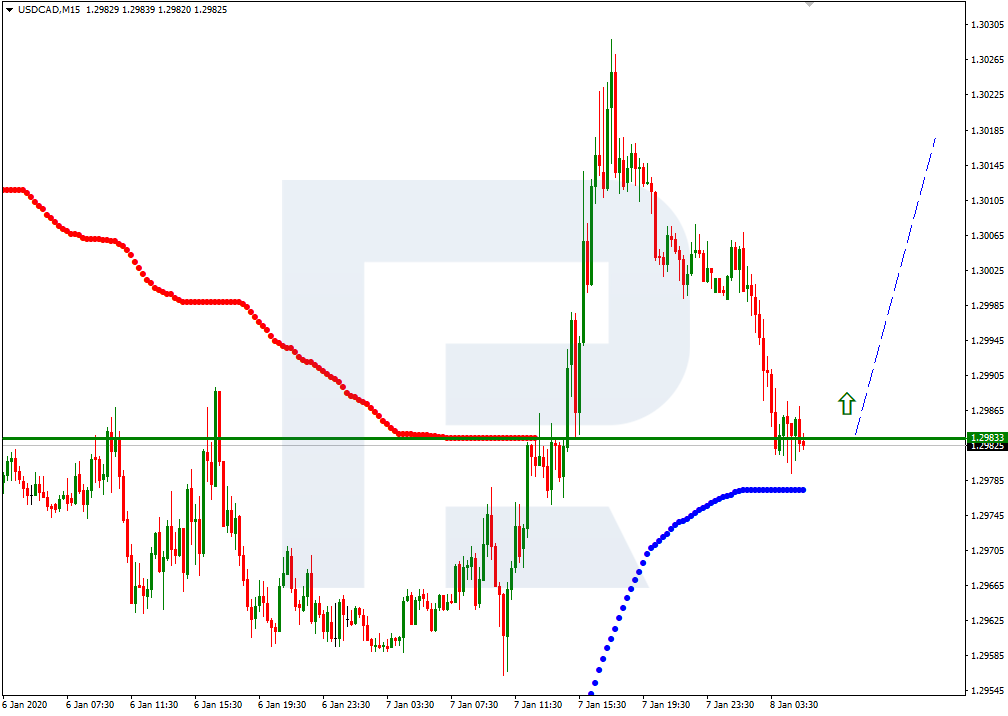

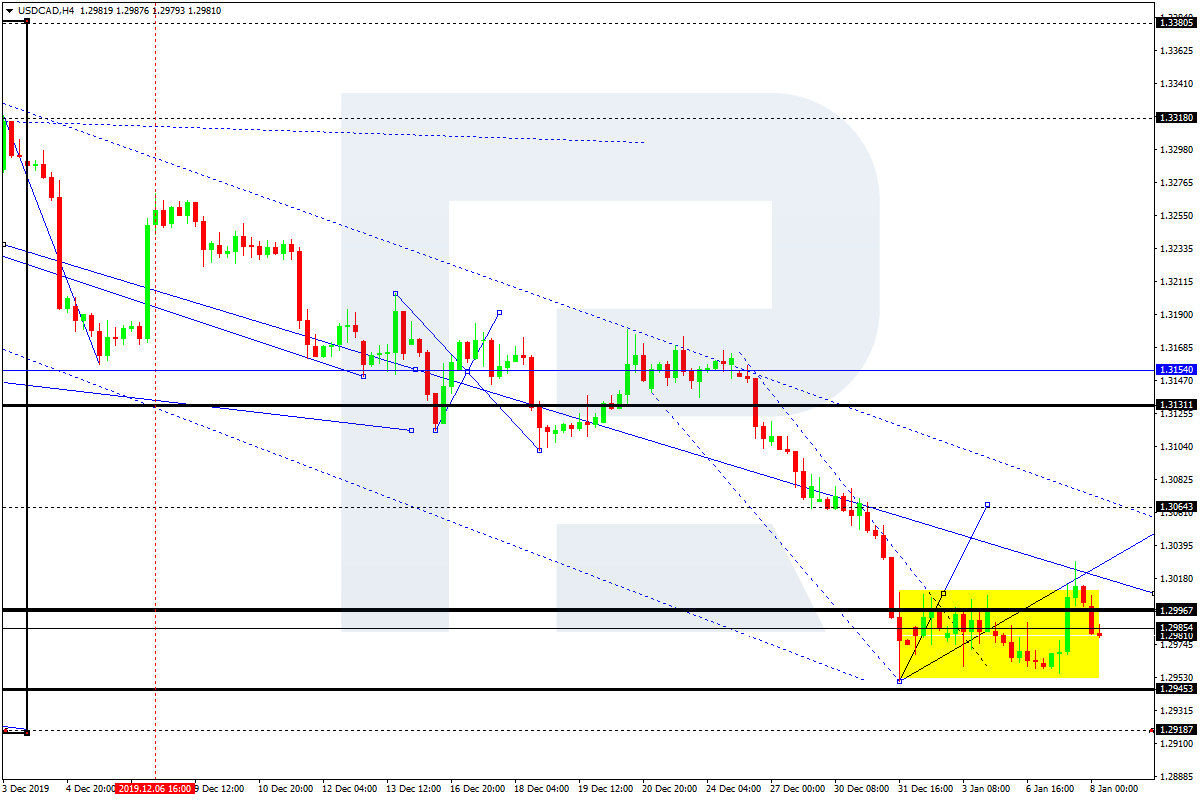

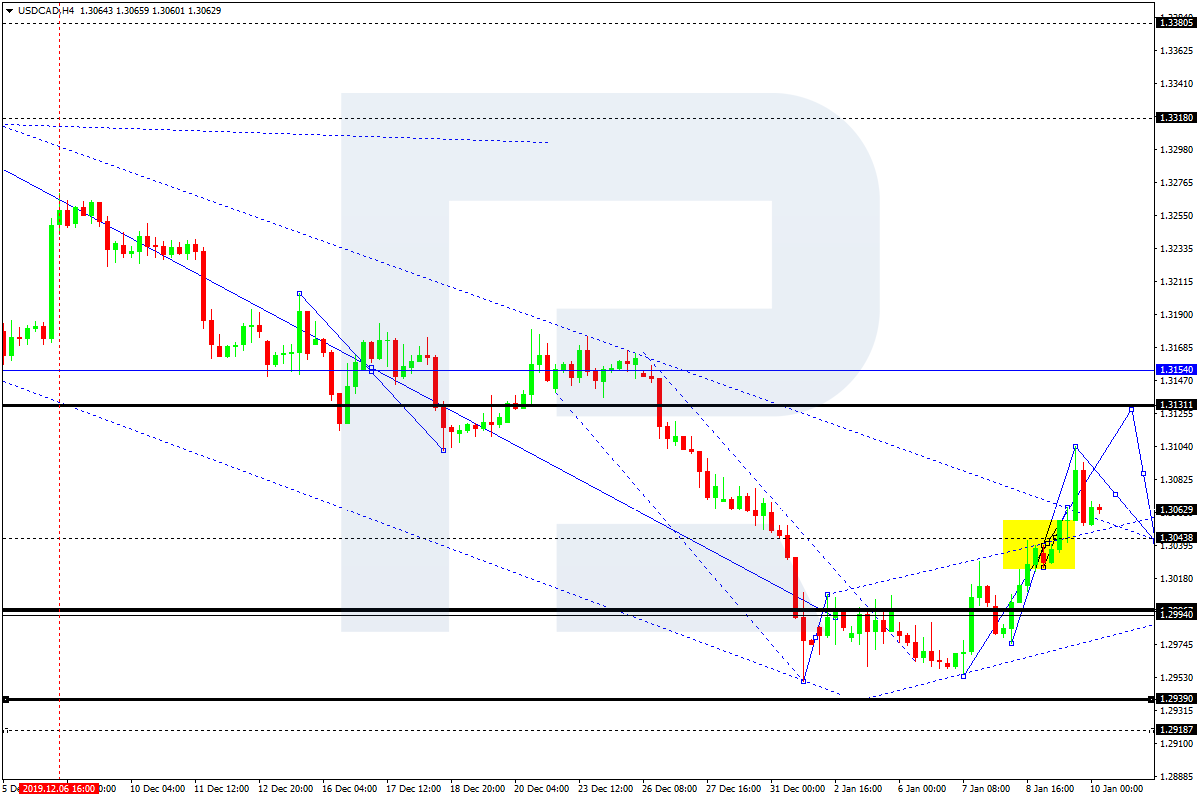

USDCAD, “US Dollar vs Canadian Dollar”

USDCAD continues growing towards 1.3131. Later, the market may start another decline to reach 1.3040 and then form one more ascending structure with the target at 1.3150.

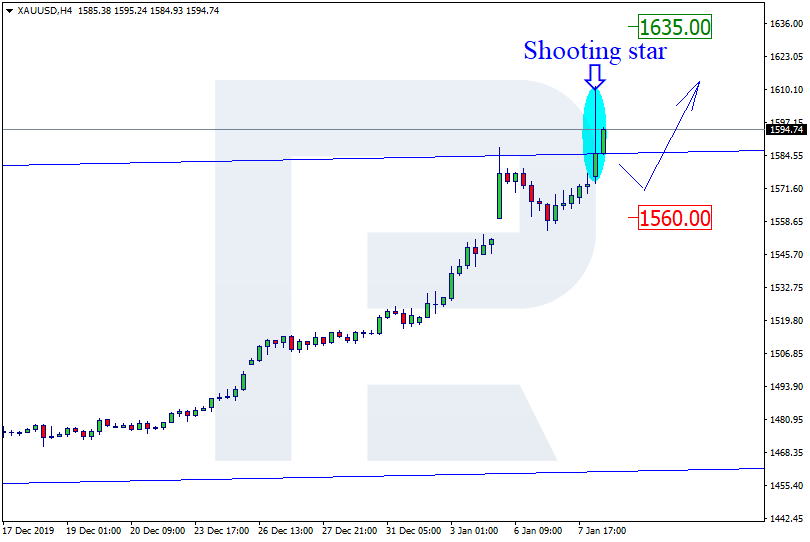

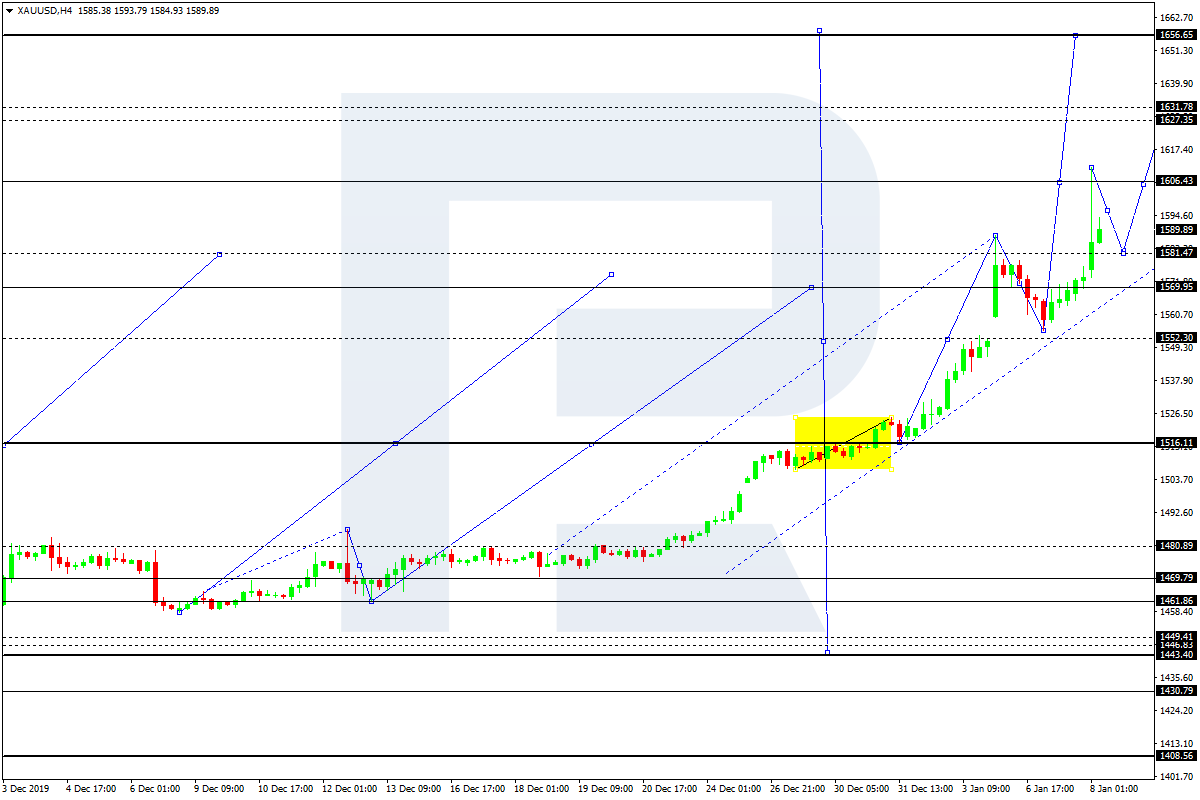

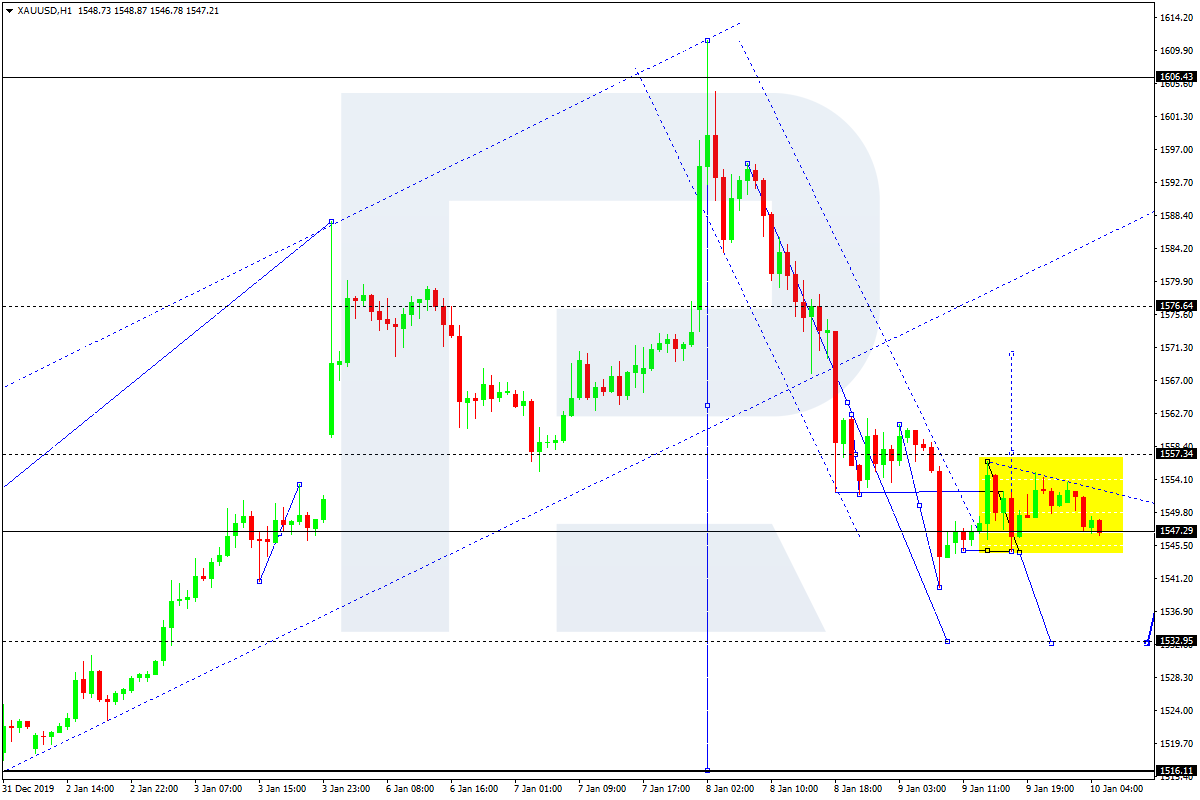

XAUUSD, “Gold vs US Dollar”

Gold continues moving downwards. After expanding the consolidation range down to 1540.00 and forming the ascending impulse towards 1556.40 along with the correction at 1547.30, Gold has defined the borders of a new consolidation range. If later the price breaks this range to the upside at 1558.00, the market may resume moving upwards to reach 1568.20; if to the downside at 1540.00 – start a new decline with the target at 1516.00.

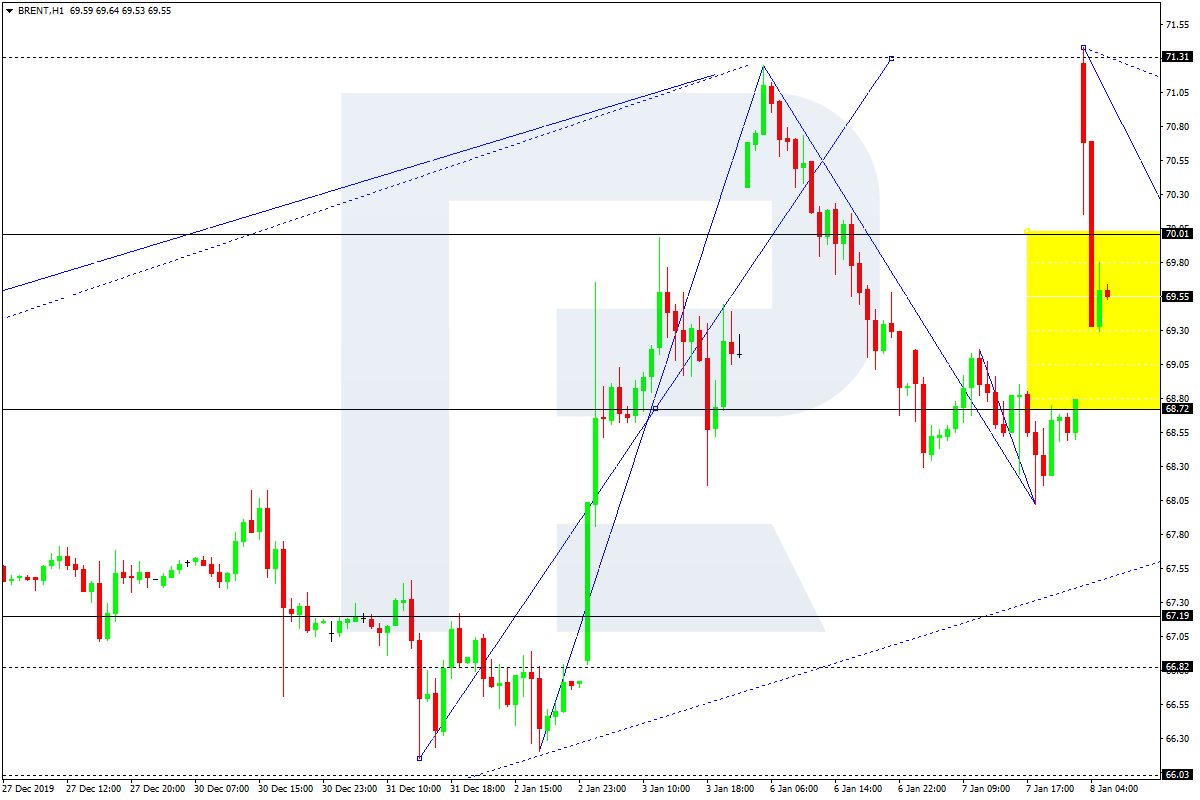

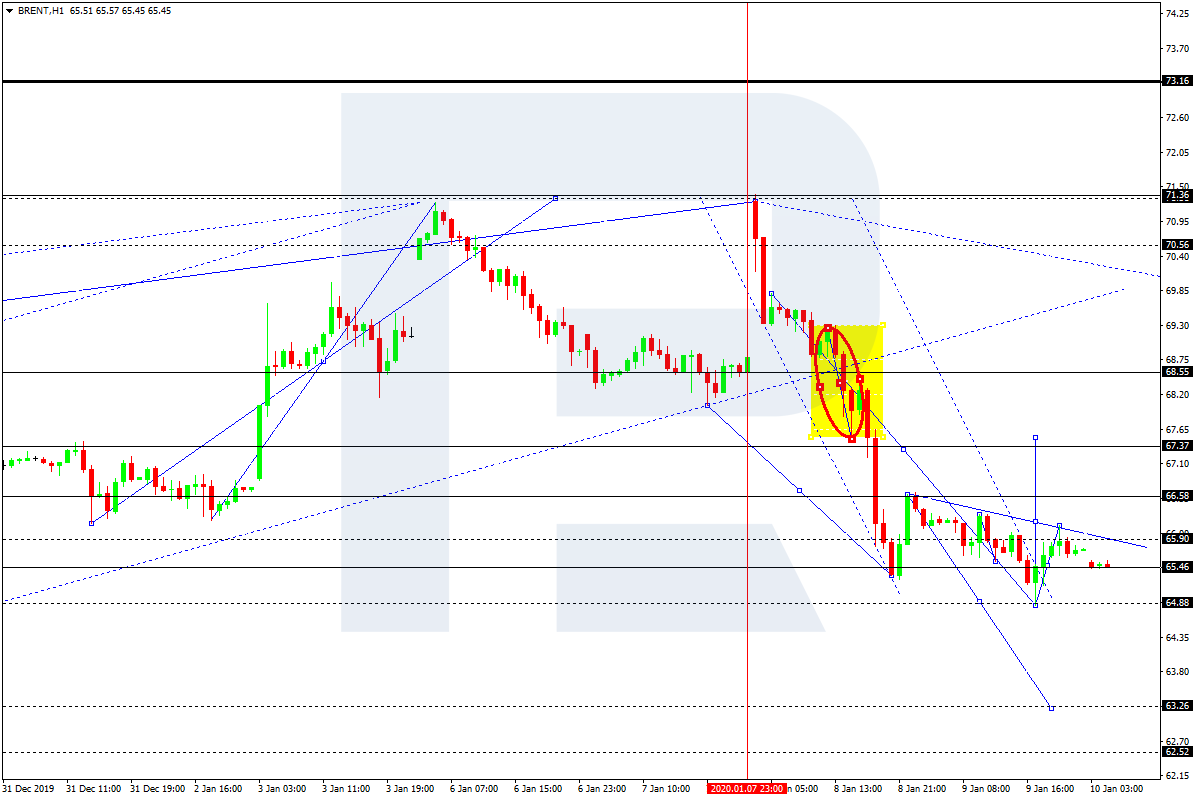

BRENT

Brent is consolidating around 65.95 and may resume growing. If later the price breaks this range to the upside at 66.60, the market may resume moving upwards with the first target at 68.55; if to the downside at 64.90 – extend the correction and form a new descending structure to reach 63.30.

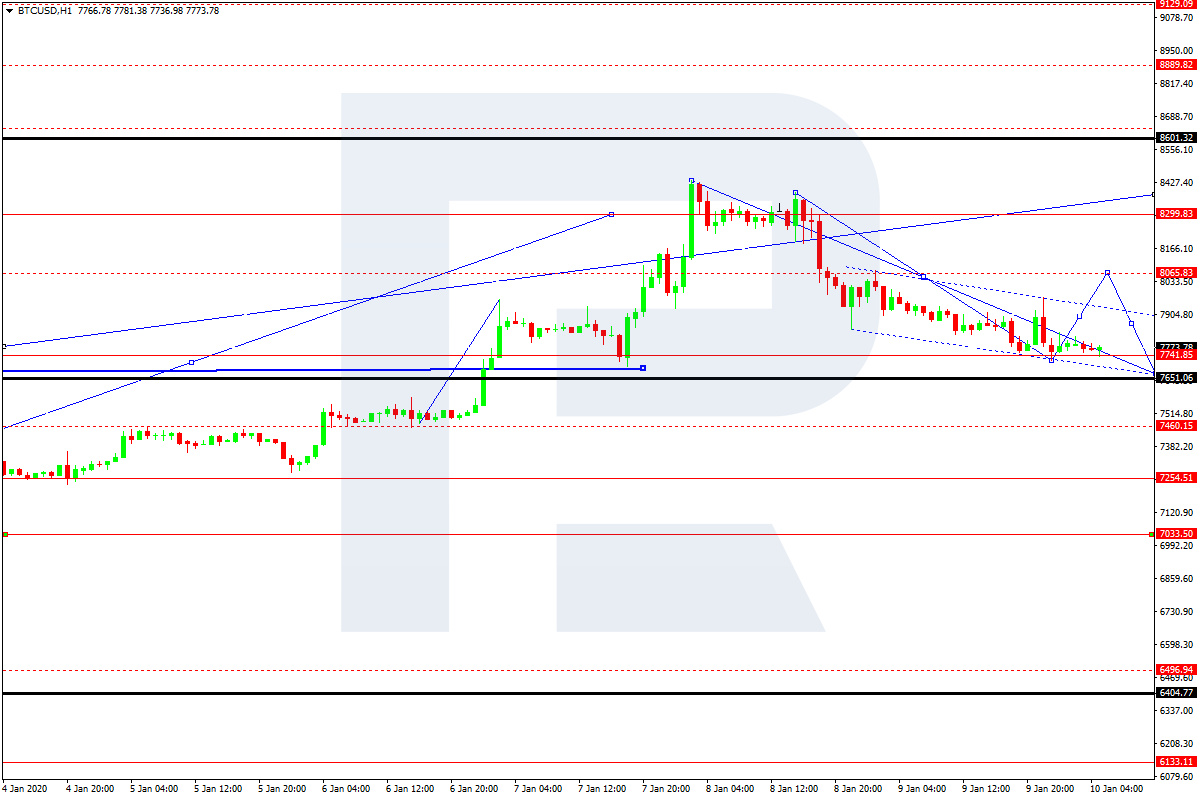

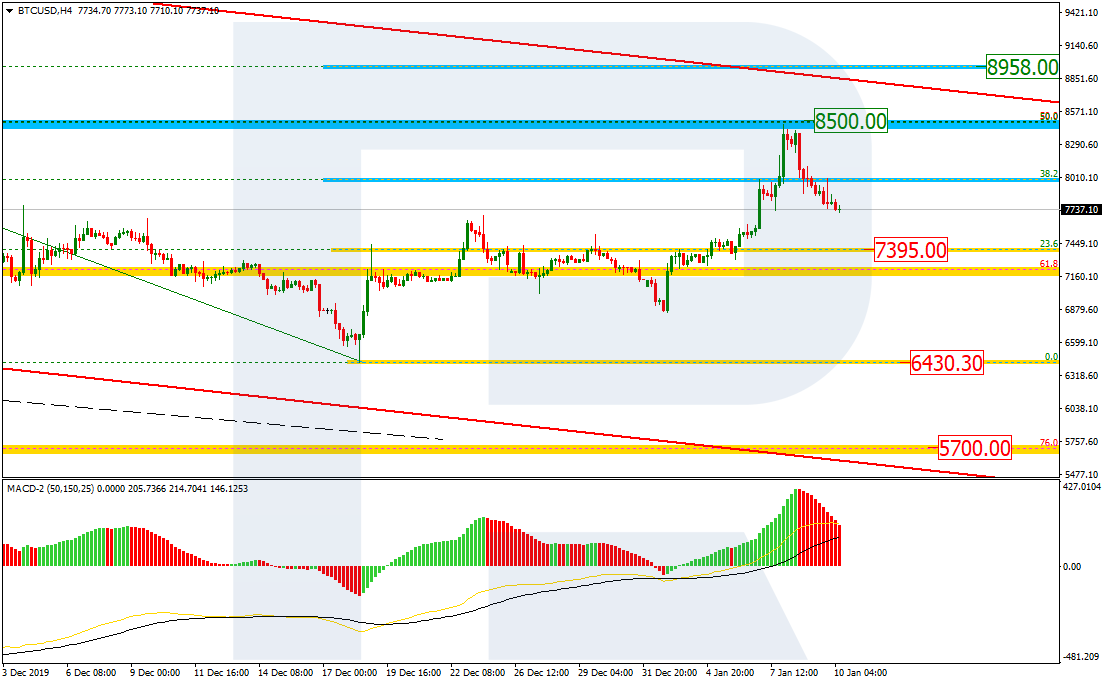

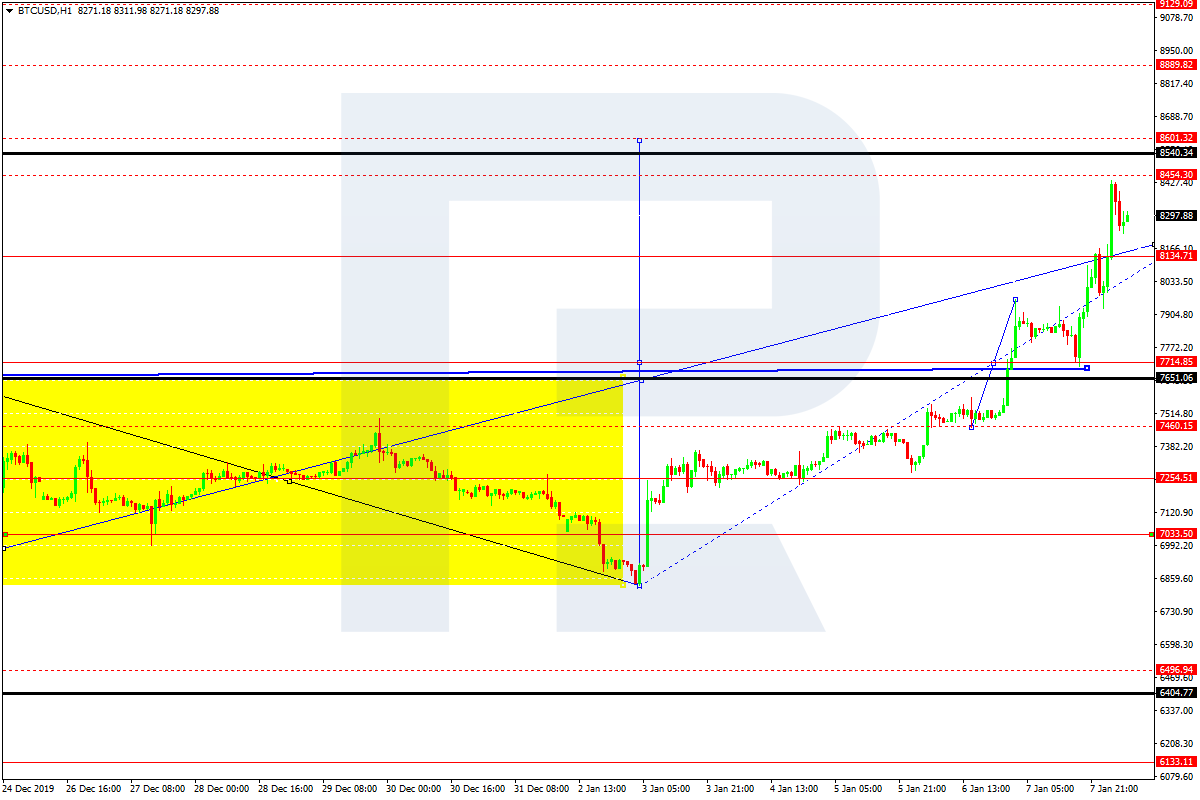

BTCUSD, “Bitcoin vs US Dollar”

BTCUSD has reached its short-term downside target at 7750.00. Possibly, today the pair may start a new growth to reach 8050.00 and then resume falling towards 7700.00 to finish the correction. Later, the market may form one more ascending structure with the target at 8600.00.