Ichimoku Cloud Analysis 05.05.2020 (EURUSD, GOLD, AUDUSD)

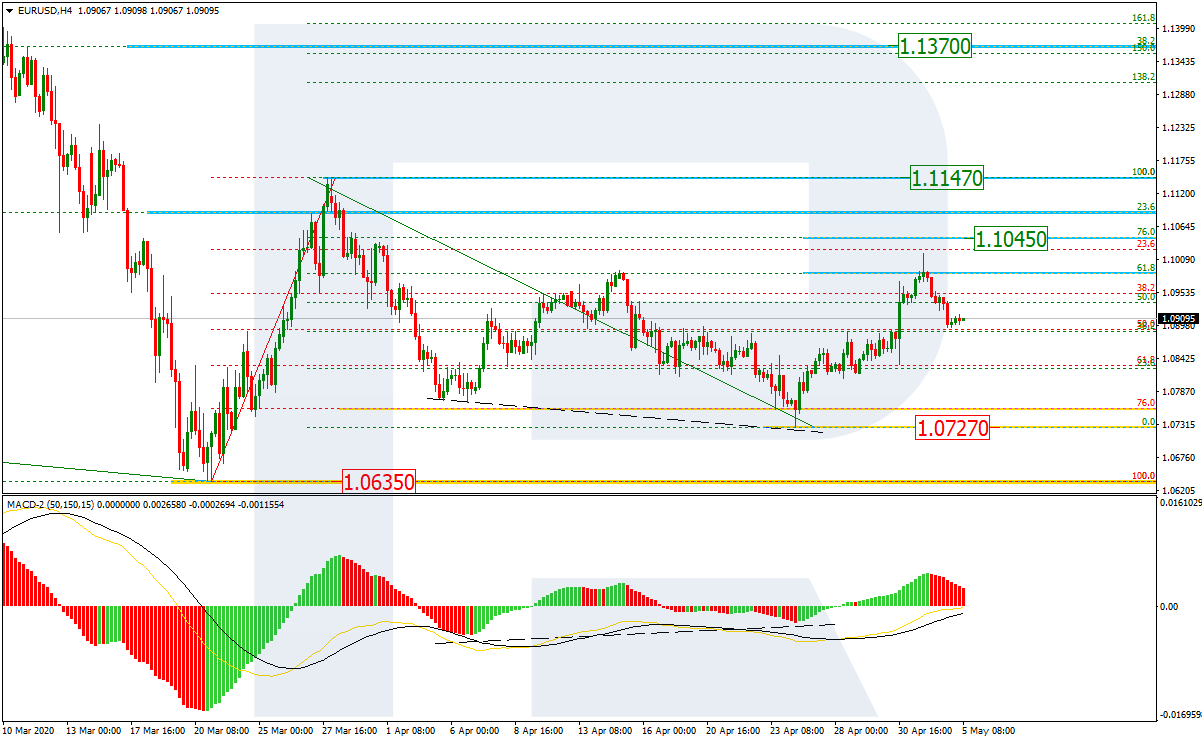

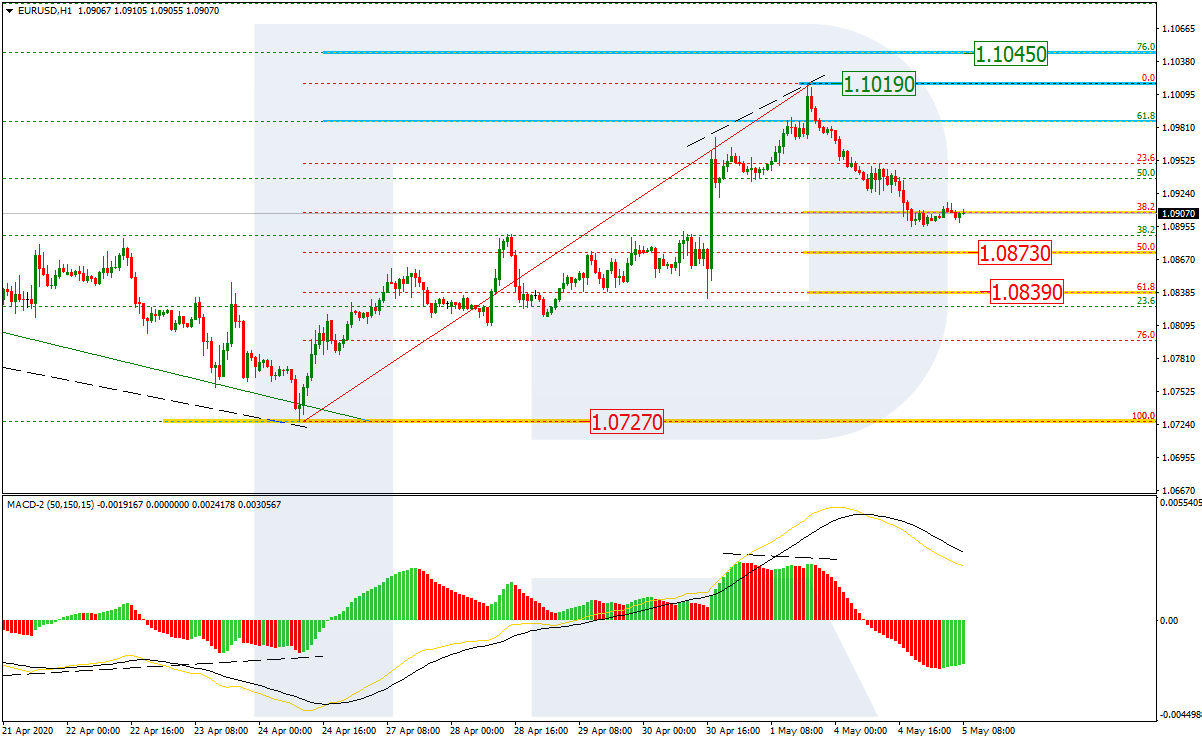

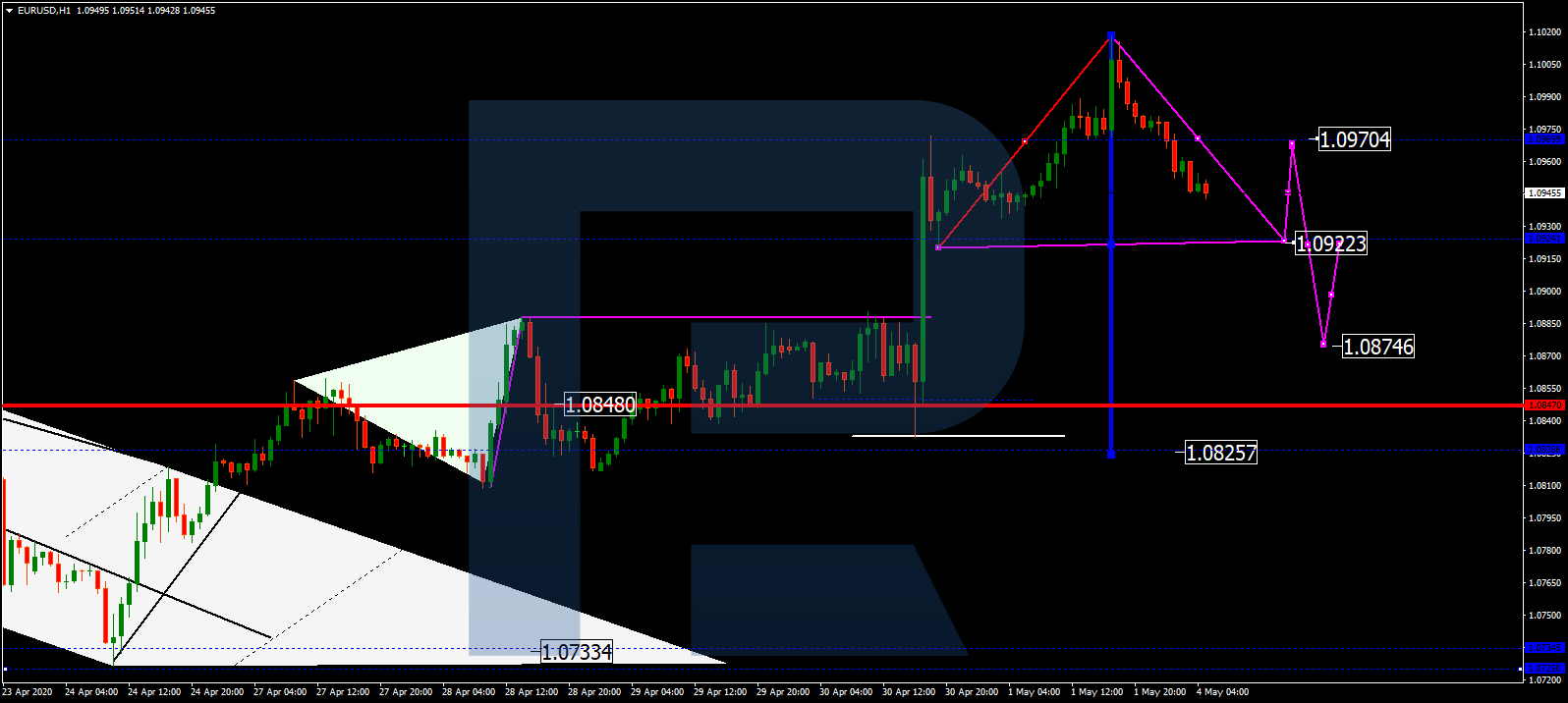

EURUSD, “Euro vs US Dollar”

The currency pair is trading at 1.0907 above the Ichimoku Cloud, suggesting an uptrend. A test of the upper border of the indicator Cloud near 1.0875 is expected, followed by growth to 1.1045. An additional signal confirming the growth will be a bounce off the lower border of the ascending channel. The growth will be canceled in the case of a breakaway of the lower border of the Cloud and closing below 1.0805, which will mean further falling to 1.0715.

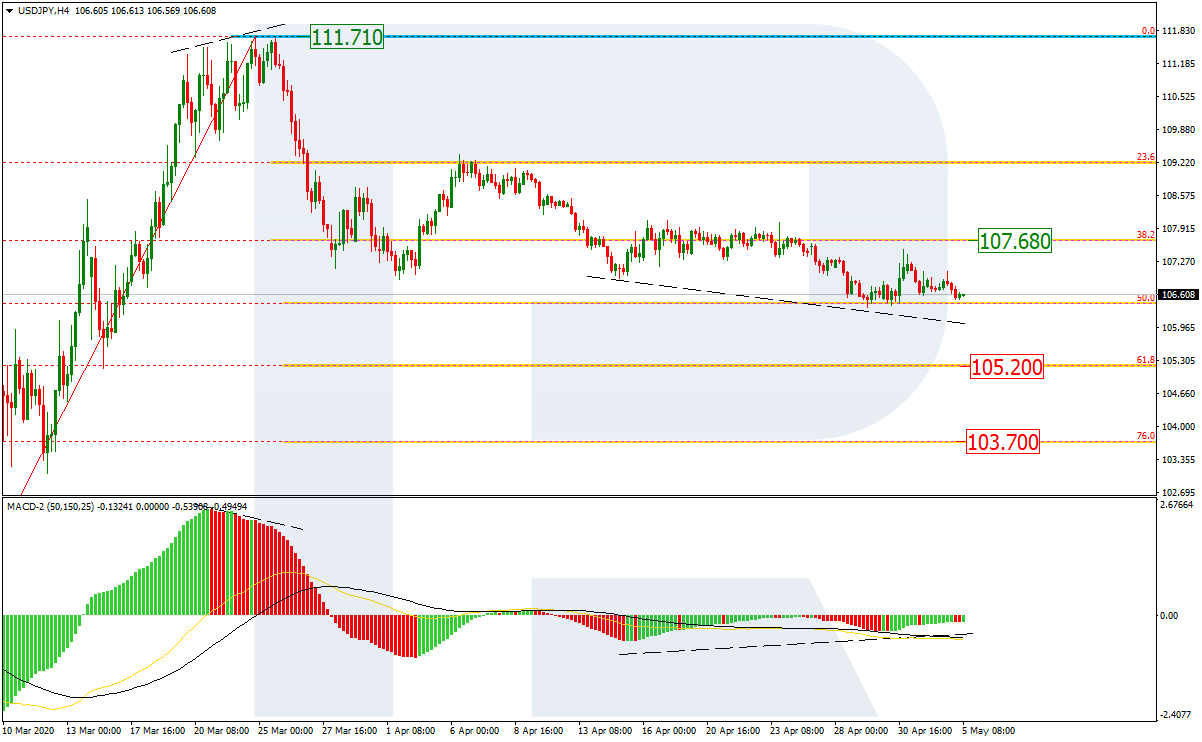

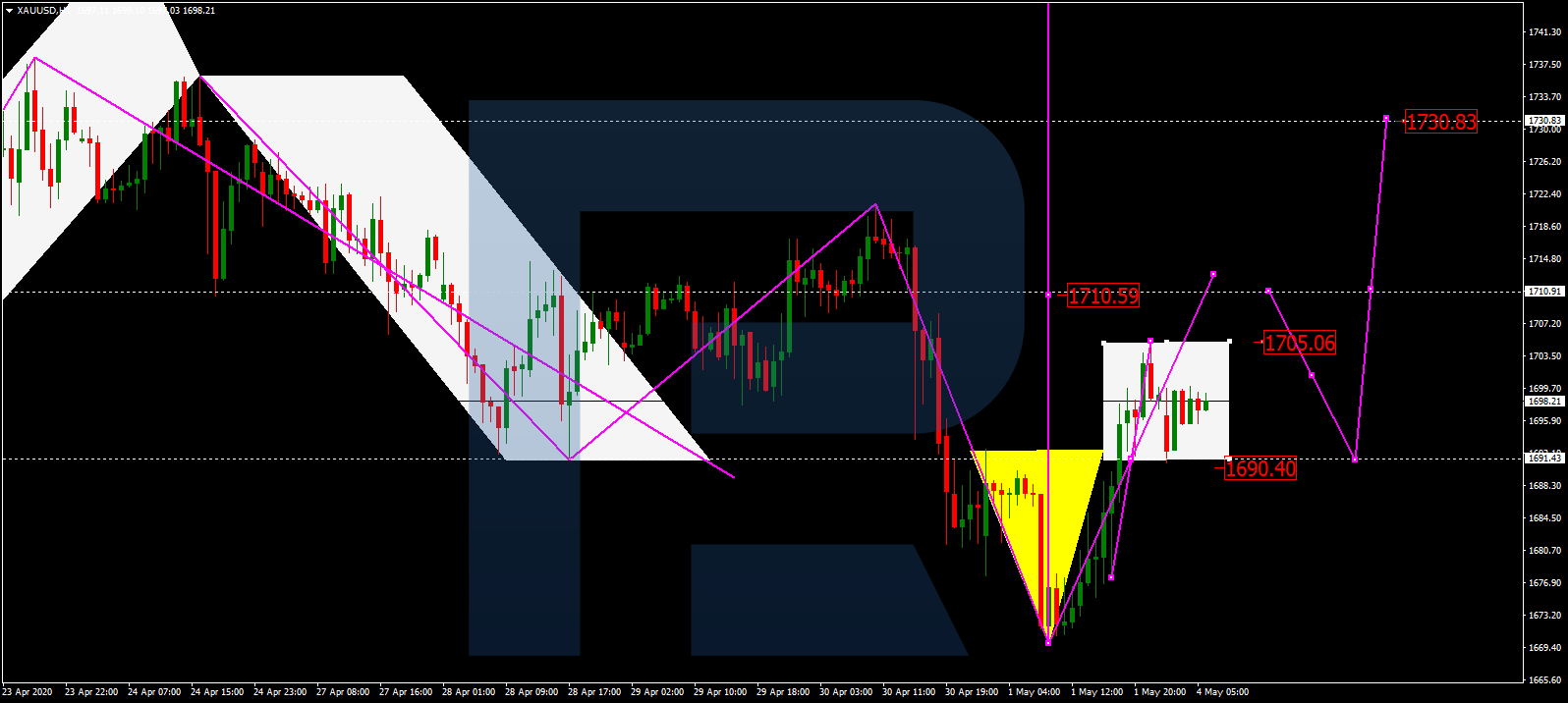

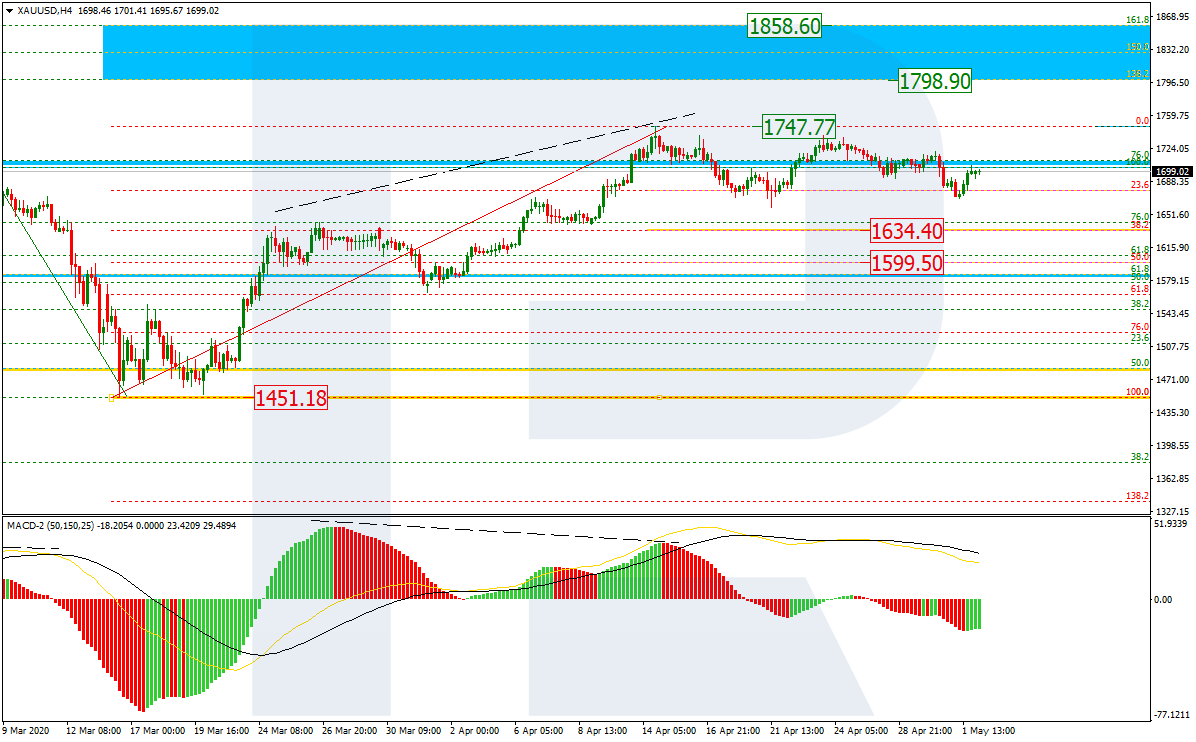

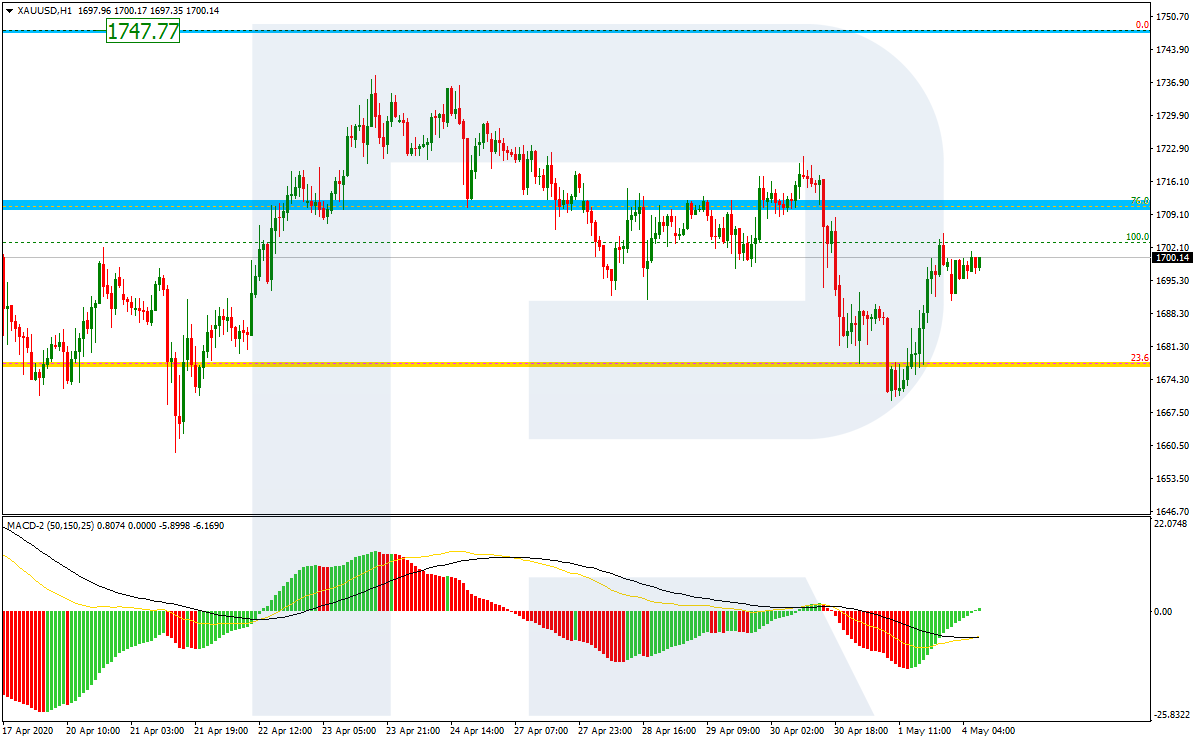

XAUUSD, “Gold vs US Dollar”

Gold is trading at 1701 above the Ichimoku Cloud, suggesting an uptrend. A test of the lower border of the indicator Cloud near 1690 is expected, followed by growth to 1755. An additional signal confirming the growth will be a bounce off the support level. The growth will be canceled in the case of a breakaway of the lower border of the Cloud and closing below 1679, which will mean further falling to 1645. The growth will be confirmed by a breakaway of the resistance area and closing above 1712, which will mean the completion of a Head and Shoulders pattern.

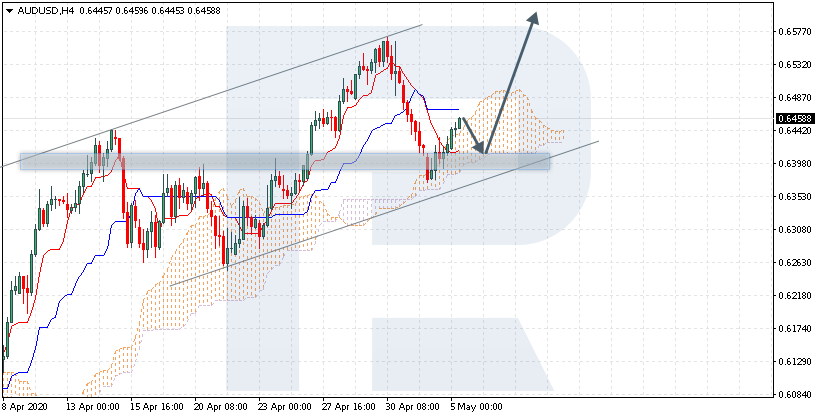

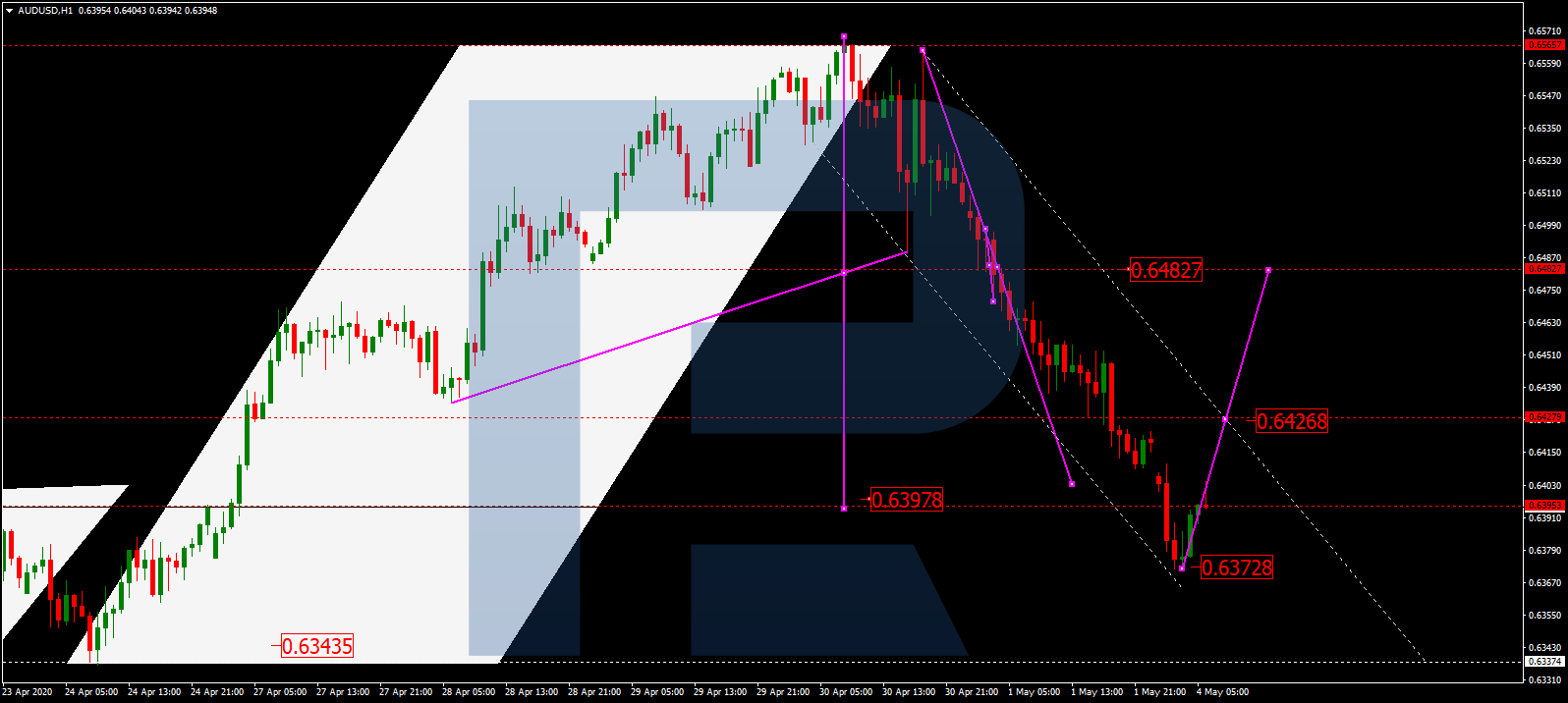

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair is trading at 0.6458 above the Ichimoku Cloud, suggesting an uptrend. A test of the lower border of the indicator Cloud near 0.6400 is expected, followed by growth to 0.6585. An additional signal confirming the growth will be a bounce off the support level. The growth will be canceled in the case of a breakaway of the lower border of the Cloud and closing below 0.6365, which will mean further falling to 0.6285.