09.10.2019

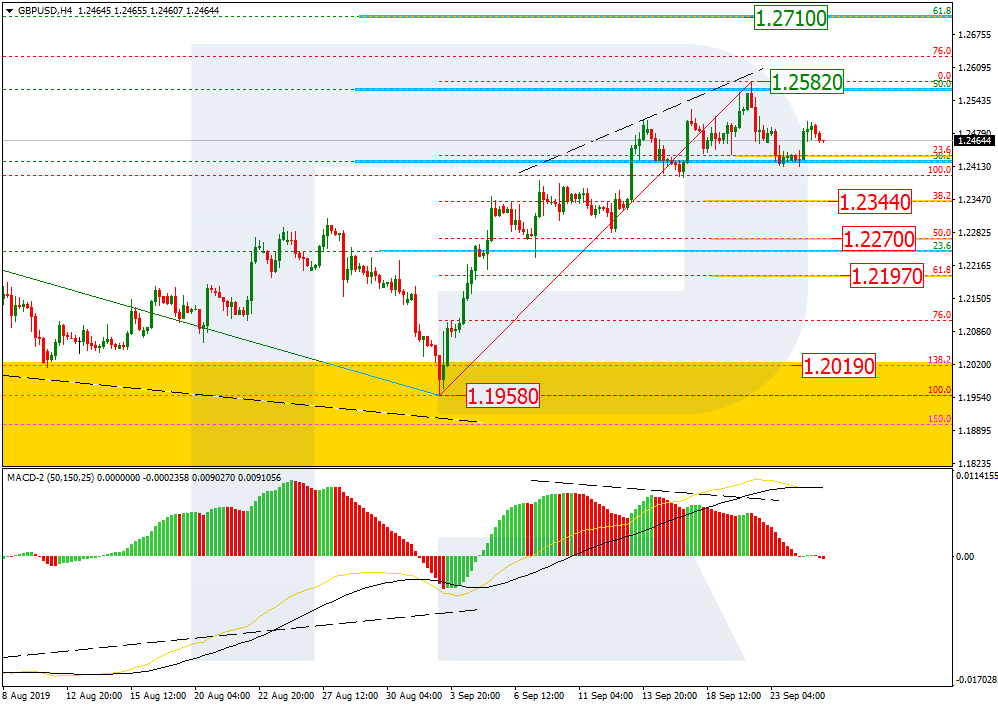

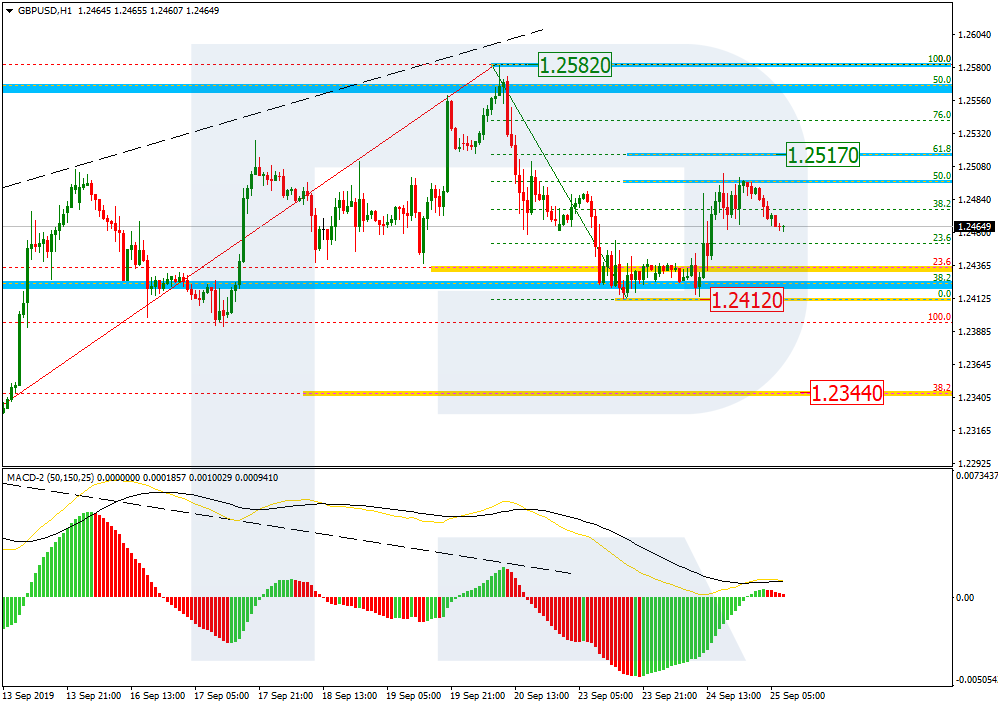

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, after finishing the short-term correction and updating the local low, GBPUSD has reached 61.8% fibo. The next downside target is 76.0% fibo at 1.2108. If the pair is able to break this level, it may try to test the low at 1.1958 and once again enter the post-correctional extension area between 138.2% and 161.8% fibo at 1.2019 and 1.1788 respectively.

In the H1 chart, the pair is testing 61.8% fibo. Later, the price is expected to fall towards 76.0% fibo at 1.2108.

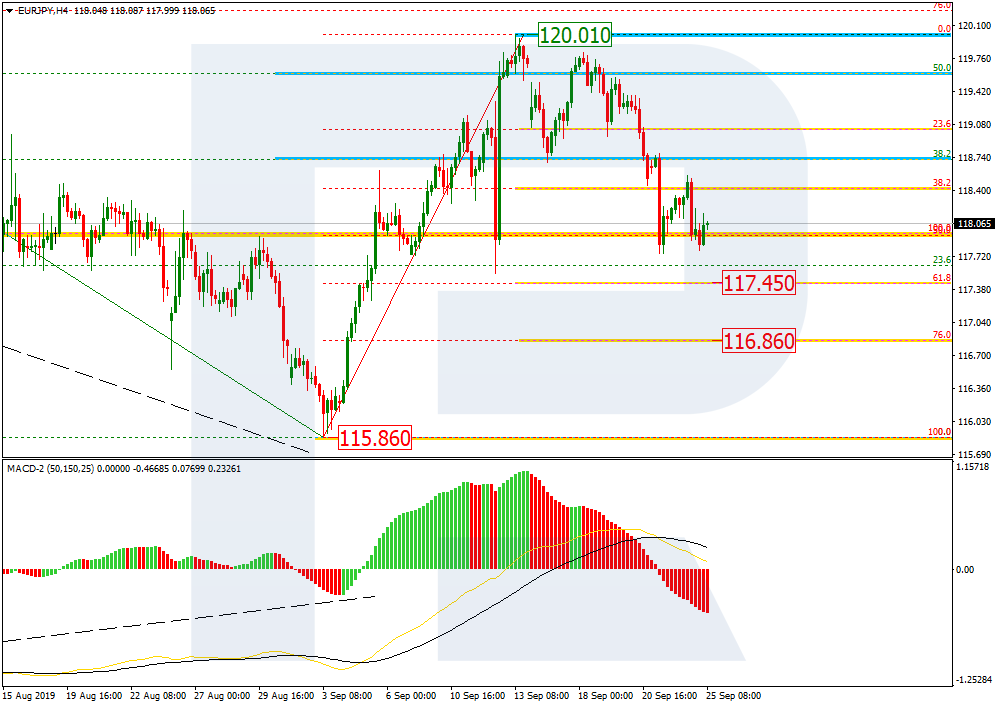

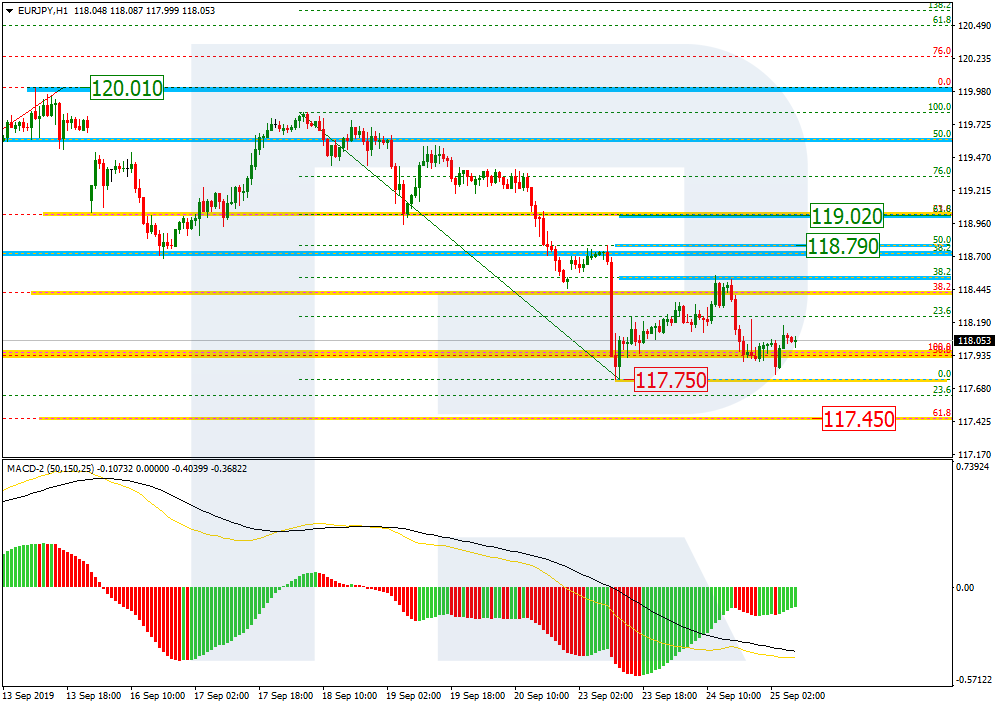

EURJPY, “Euro vs. Japanese Yen”

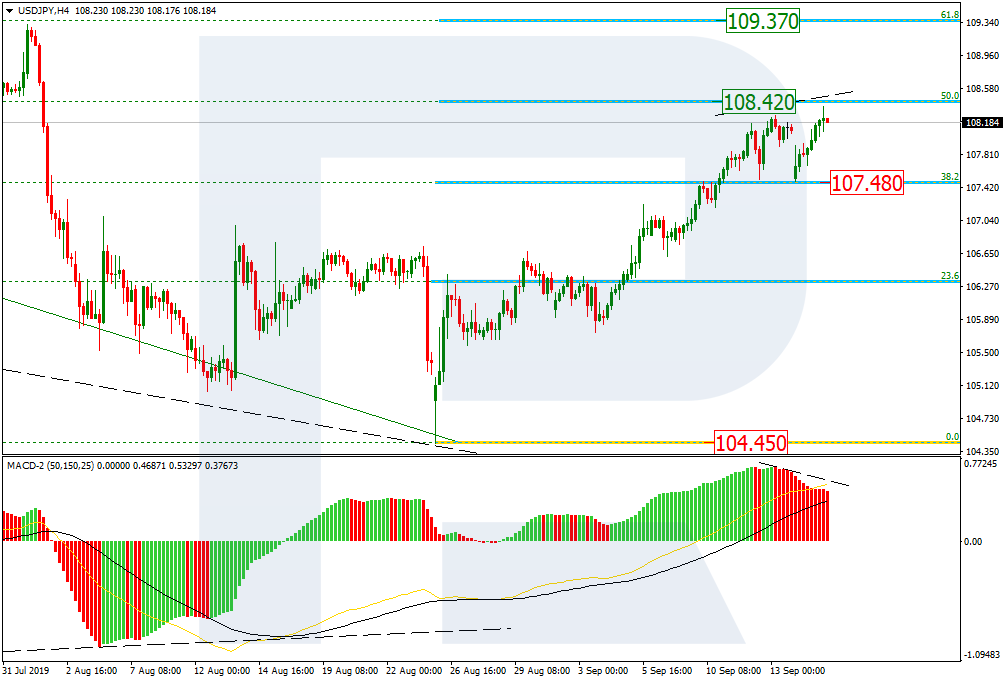

As we can see in the H4 chart, the convergence made EURJPY complete the descending wave at 61.8% fibo. The current situation may be considered as the start of another mid-term rising wave. However, one shouldn’t exclude a possibility of further decline towards 76.0% fibo at 116.86 in the short-term, but the main scenario implies that the price is expected to move upwards. The first rising impulse has already reached 23.6% fibo. After a slight pullback, the impulse may continue towards 38.2%, 50.0%, 61.8%, and 76.0% fibo at 118.19, 118.54, 118.89, and 119.30 respectively. The key target is the high at 120.01.

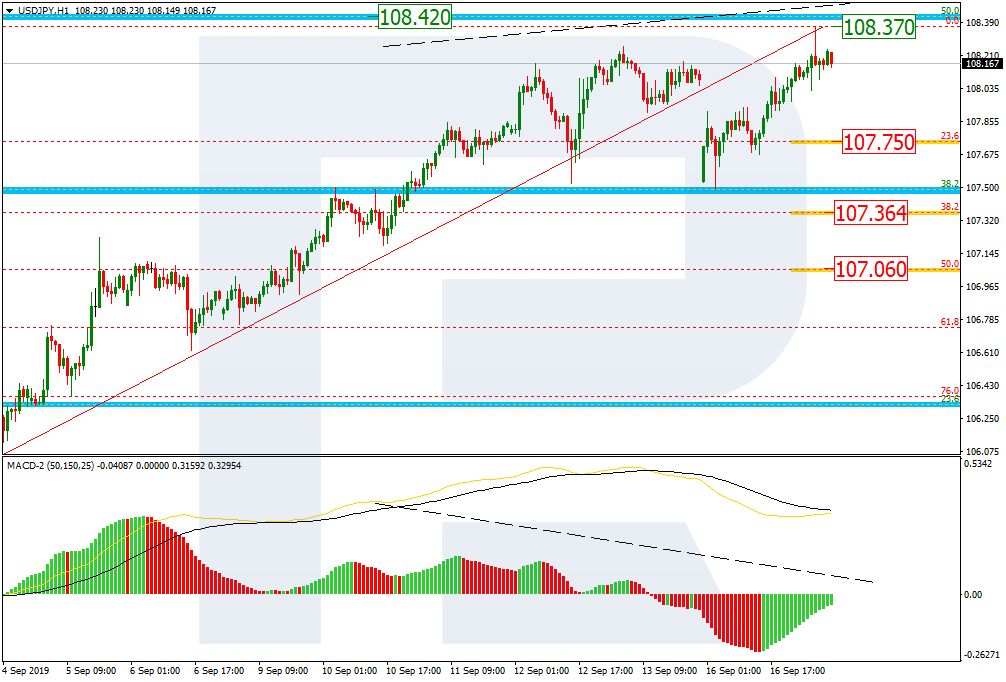

In the H1 chart, the price is falling to reach 23.6% fibo. After breaking the local low at 117.07, the mid-term descending tendency may continue towards 76.0% fibo at 116.86.