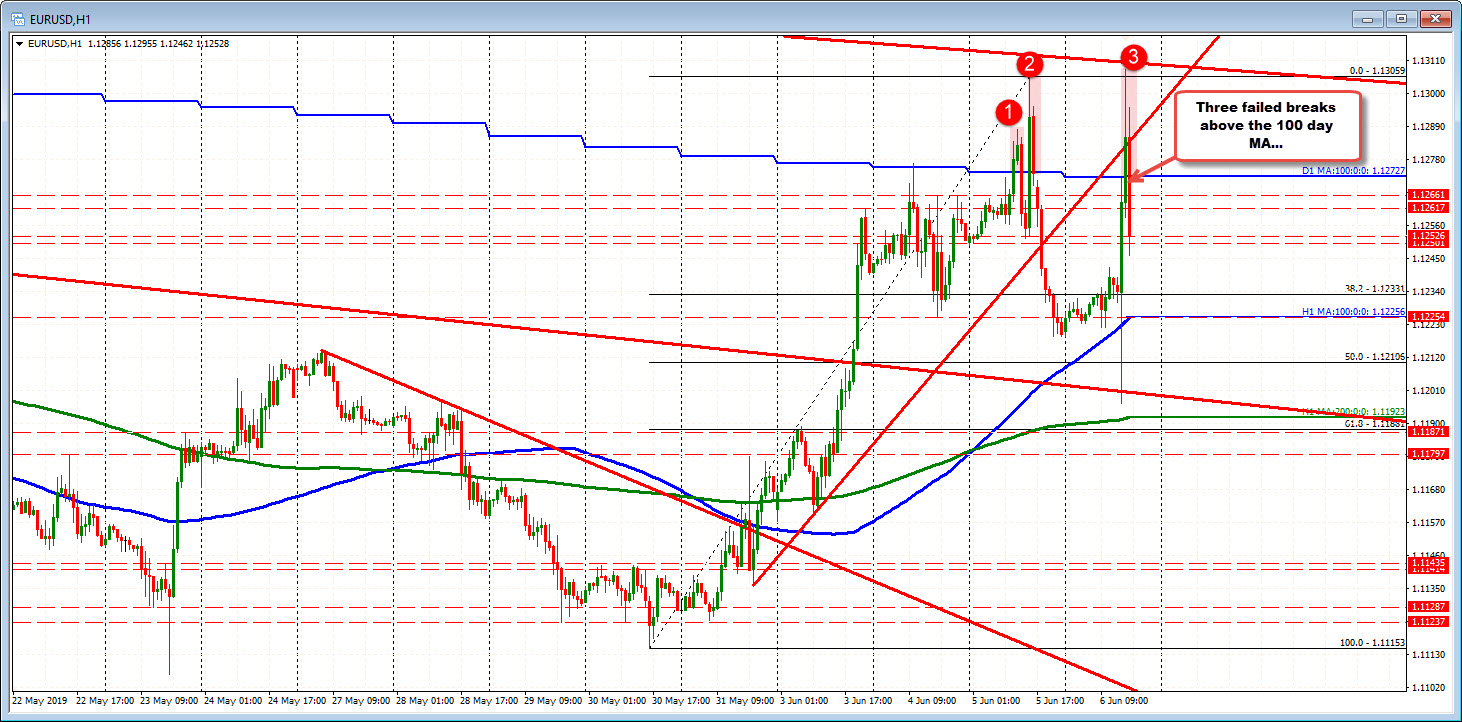

Another failed run above the 100 day MA?

The EURUSD moved above the 100 day MA on disappointment that the TLTRO rate was not as low as it could have been (I guess). However, comments in the presser had a little for bulls, but also bears.

The price is digesting the comments and have now moved back below the 100 day MA (again). Recall yesterday, there were two runs above, but each failed.

On the daily chart, the pair also tested a topside trend line and that line held at 1.1308 area (see chart below).

The stall at the trend line. The fall back below the 100 day MA are both bearish. Until the price action can get – and stay above – the 100 day MA AND break that trend line after that, can the buyers be taking control? No. Sellers are still in control.

The couple things working in the buyers favor is that the market is short EUR. That could lead to a squeeze higher. Also, USD may weaken too on expectations of Fed easing.

Also technically, the low today did test the underside of a broken trend line at 1.1202 (call it 1.1200 -see daily chart). So there is some hope that buyers hold that 1.1200 area (risk for bulls), and the 100 day MA is broken for good (or at least for a little while).