Fibonacci Retracements Analysis 02.04.2020 (AUDUSD, USDCAD)

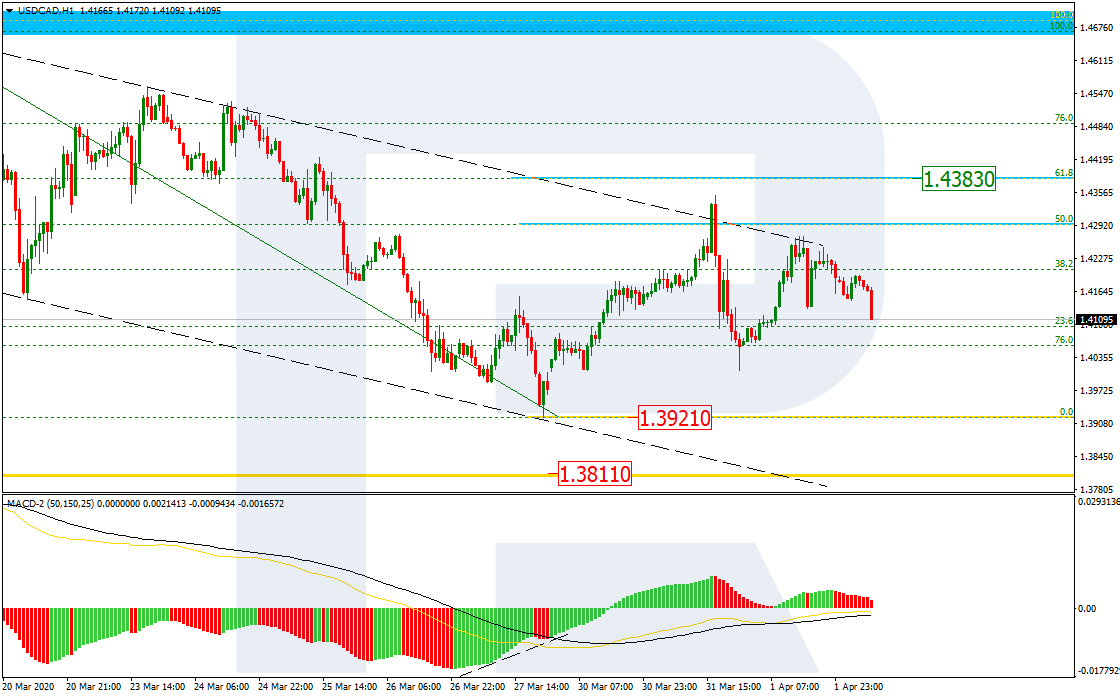

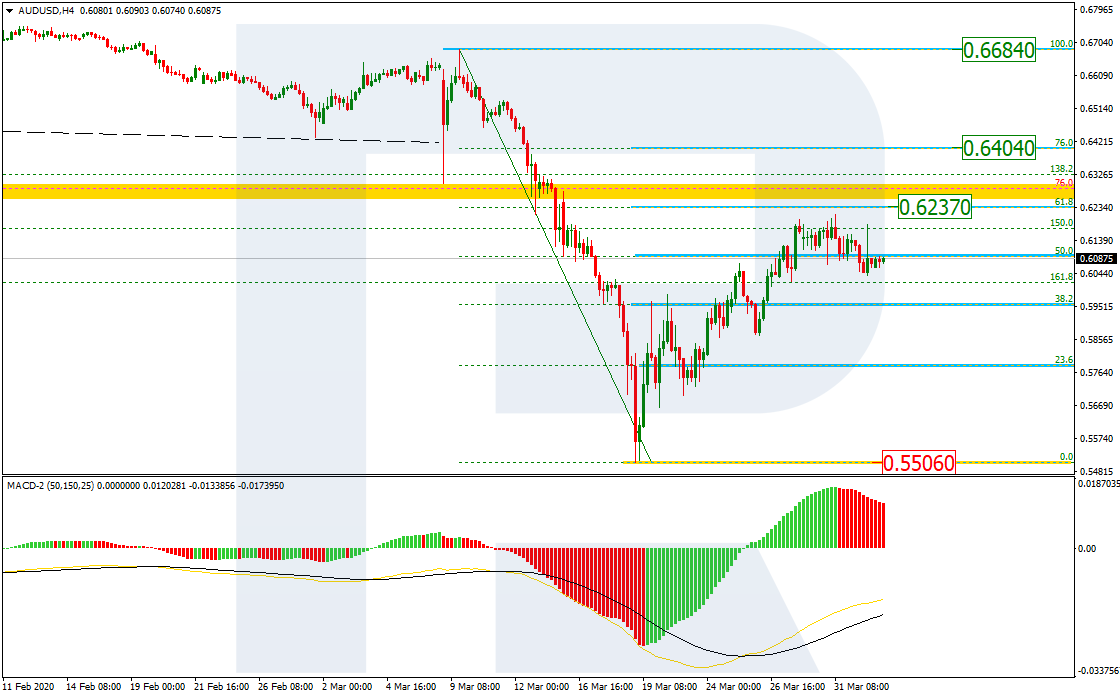

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, the ascending tendency is getting close to 61.8% fibo at 0.6237. Under the current circumstances, this level may be considered a defining point, because the pair has equal chances of both breakout and reversal. As a result, if this level is broken, the price may grow towards 76.0% fibo at 0.6404 or even the fractal high at 0.6684. Otherwise, AUDUSD may start a new descending wave to reach the low at 0.5506.

In the H1 chart, the divergence made the pair reverse and start a new descending correction, which has already reached 23.6% and may later continue falling towards 38.2% and 50.0% fibo at 0.5943 and 0.5859 respectively. The resistance is the high at 0.6213.

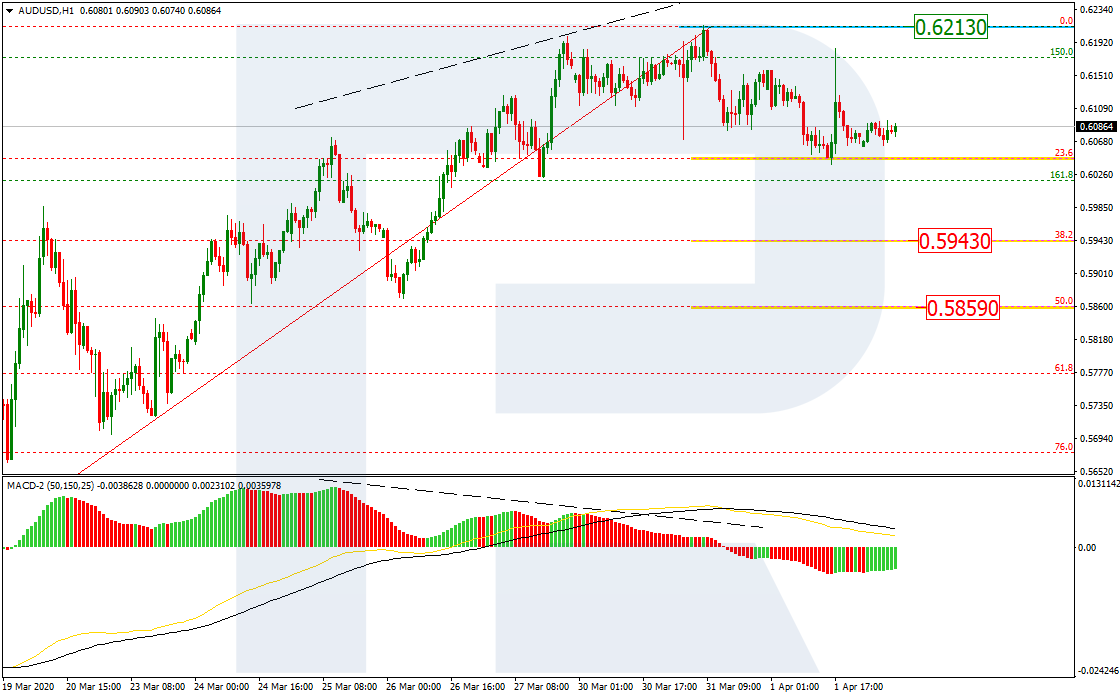

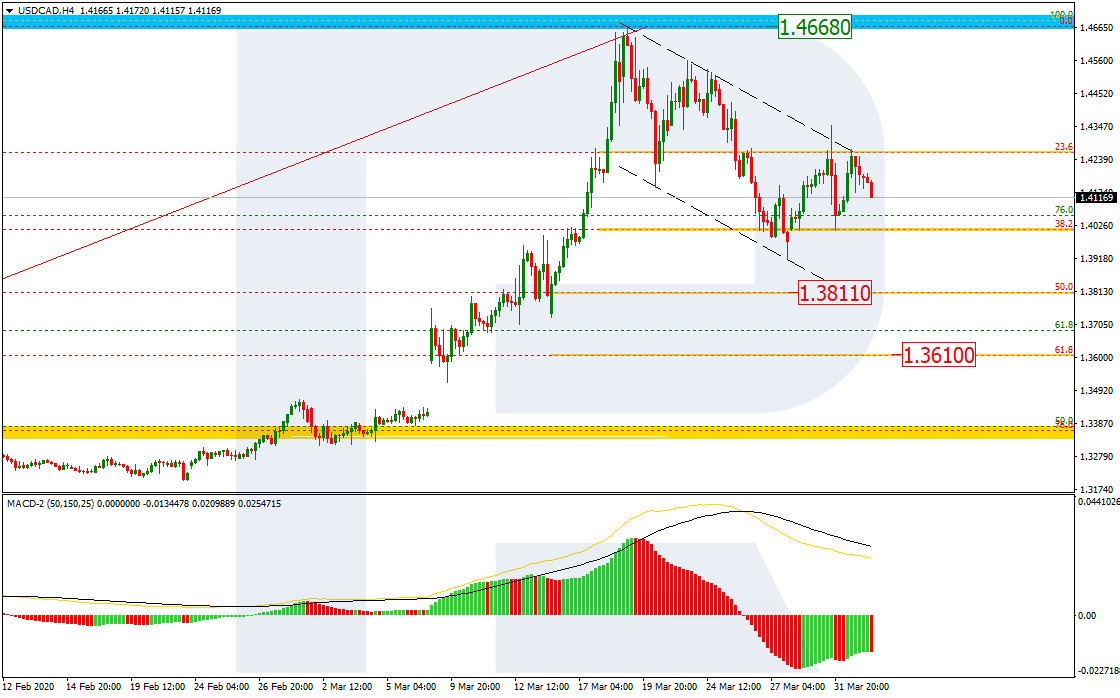

USDCAD, “US Dollar vs Canadian Dollar”

In the H4 chart, USDCAD is forming the descending correctional channel, which has already reached 38.2% fibo. MACD lines are also directed downwards, thus indicating further decline towards 50.0% and 61.8% fibo at 1.3811 and 1.3610 respectively. The resistance is the high at 1.4668.

As we can see in the H1 chart, the convergence made the pair start a new local ascending correction, which has already reached 50.0% fibo. At the moment, the price is expected to fall to break the low at 1.3921 and then continue trading downwards to reach 1.3811. However, if the instrument rebounds from the low, a new rising wave may expand the correctional range up to 61.8% fibo at 1.4383.