13.09.2019

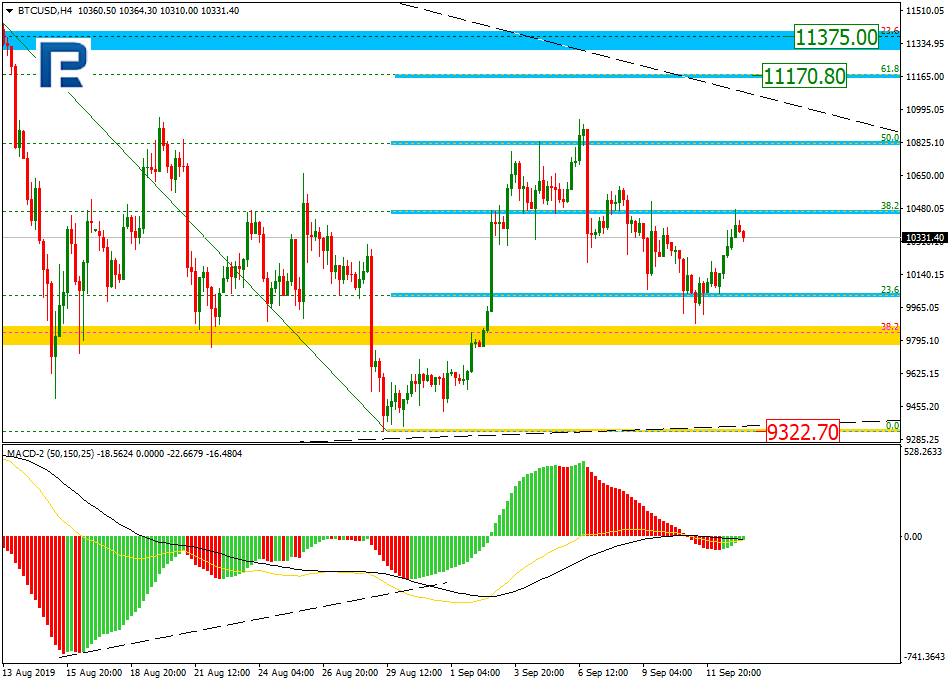

BTCUSD, “Bitcoin vs US Dollar”

As we can see in the daily chart, the correctional Triangle continues close to 38.2% fibo. If the price breaks the current resistance level and 23.6% fibo at 11375.00, BTCUSD will continue growing towards the high at 13857.20. At the same time, MACD lines are heading downwards, which means that the decline may yet continue towards 50.0% and 61.8% fibo at 8580.00 and 7350.00 respectively.

In the H4 chart, the pair is correcting to the upside after the convergence and has already reached 50.0% fibo. In the future, the correction may continue towards 61.8% fibo at 11170.00. The support is the low at 9322.70.

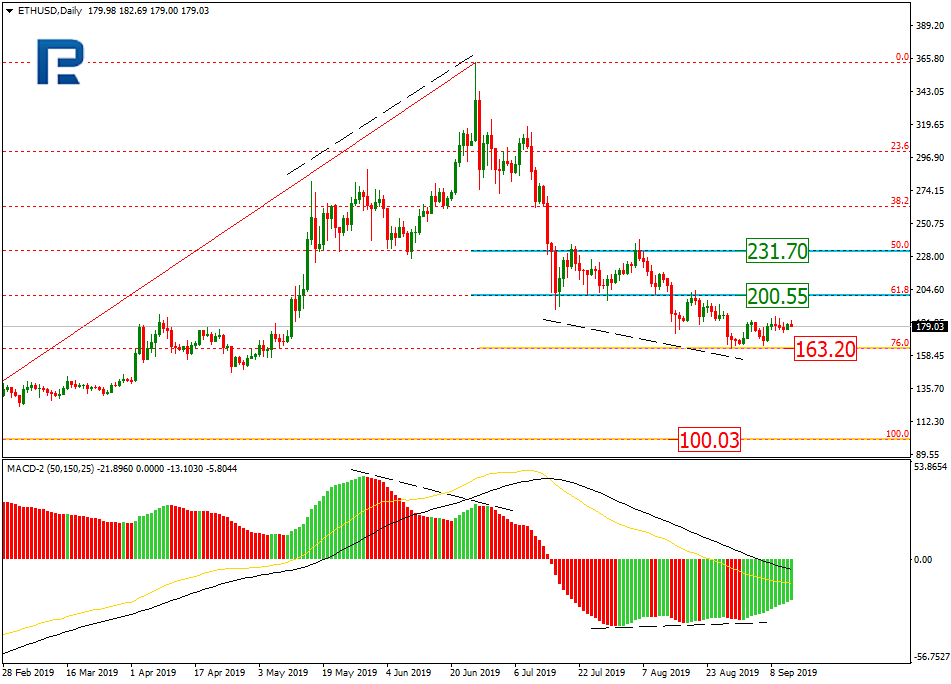

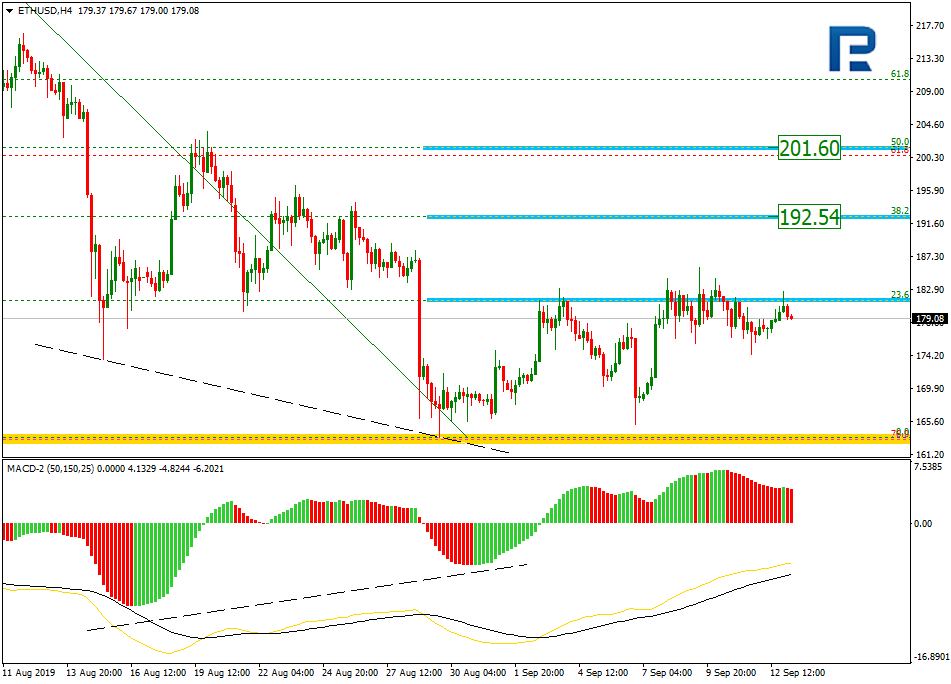

ETHUSD, “Ethereum vs. US Dollar”

As we can see in the daily chart, the descending tendency reached 76.0% fibo and then there was a convergence on MACD. However, the pullback that started later can’t be called very significant. Still, the pullback may yet continue towards 61.8% and 50.0% fibo at 200.55 and 231.70 respectively. After breaking 163.20, the instrument may plummet to reach 100.03.

The H4 chart shows more detailed structure of the current correction. By now, the pair has already reached 23.6% fibo. Later, the price may continue growing towards 38.2% and 50.0% fibo 192.54 and 201.60 respectively.

Back to listAttention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.