Japanese Candlesticks Analysis 25.05.2020 (EURUSD, USDJPY, EURGBP)

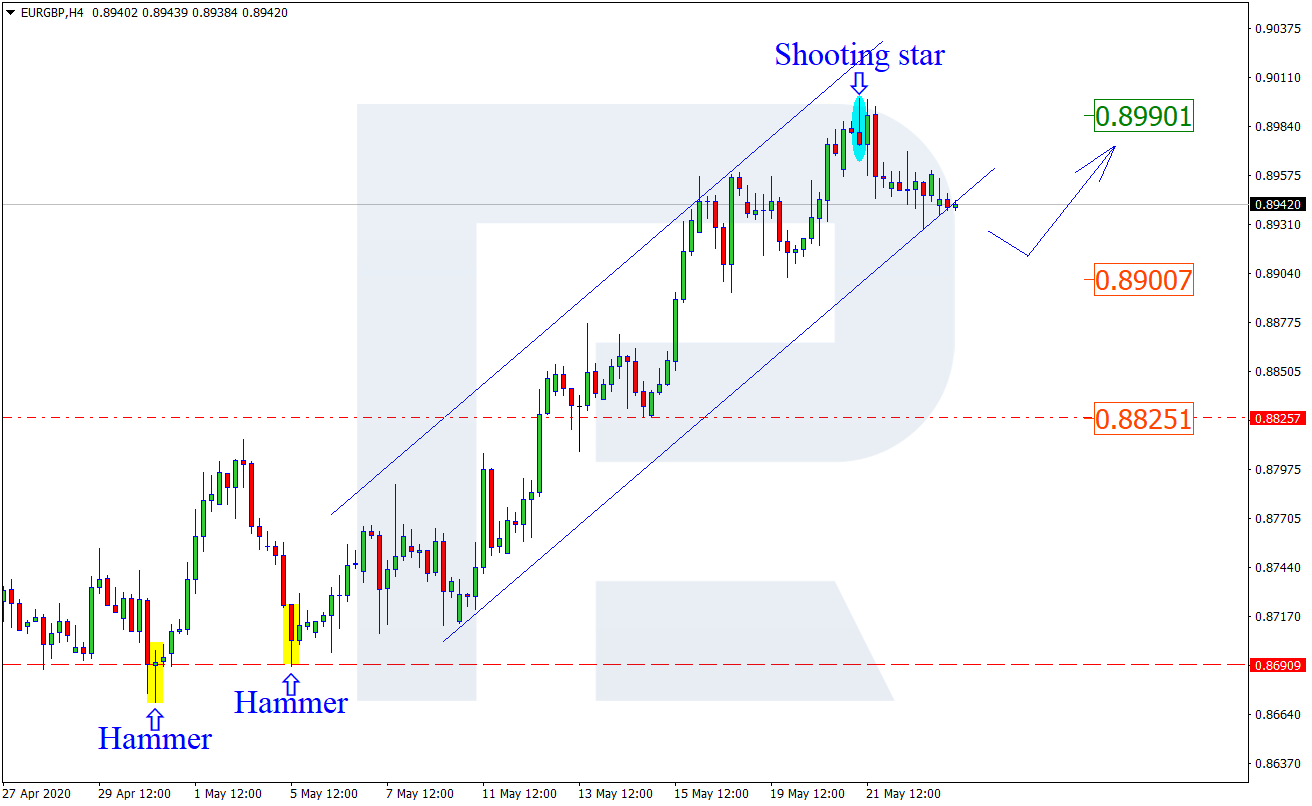

EURUSD, “Euro vs. US Dollar”

As we can see in the H4 chart, after growing towards the resistance level and forming a Shooting Star pattern, EURUSD has reversed. We may assume that after a slight correction the price may continue falling towards the channel’s downside border at 1.0850. At the same time, there is another scenario, which implies that the price may grow to reach 1.0995 without testing 1.0850.

USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the H4 chart, after testing the rising channel’s downside border and forming a Hammer pattern, USDJPY has started to reverse. The current situation implies that after breaking the resistance level the asset may continue moving upwards. In this case, the upside target may be 108.40. However, there might be another scenario according to which the instrument may fall and return to 107.20.

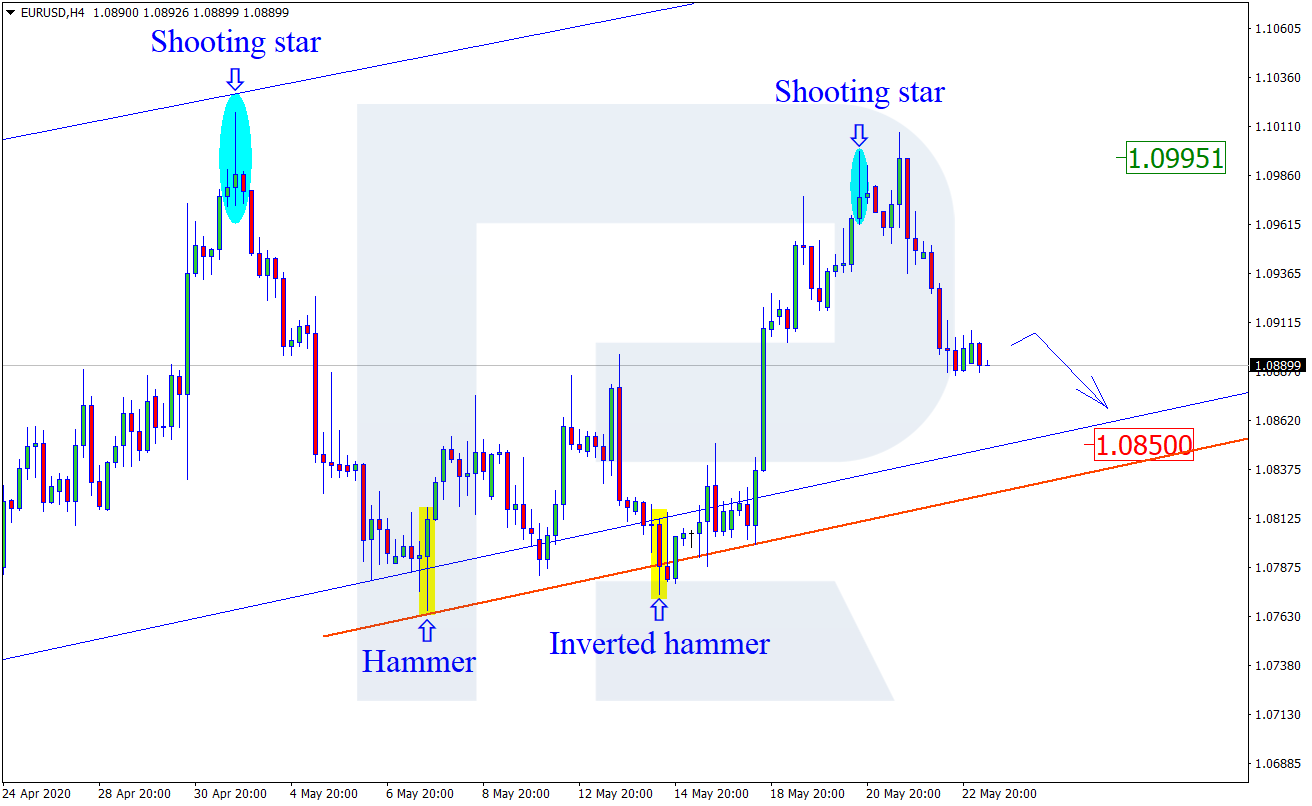

EURGBP, “Euro vs. Great Britain Pound”

As we can see in the H4 chart, after testing the resistance level and forming a Shooting Star pattern, EURGBP is reversing and may later correct towards 0.8900. After that, the instrument may continue the ascending tendency. In this case, the upside target may be at 0.8990. Still, one shouldn’t exclude an opposite scenario, which implies that the instrument may break 0.8900 and continue falling towards 0.8825.