Fibonacci Retracements Analysis 02.03.2020 (GOLD, USDCHF)

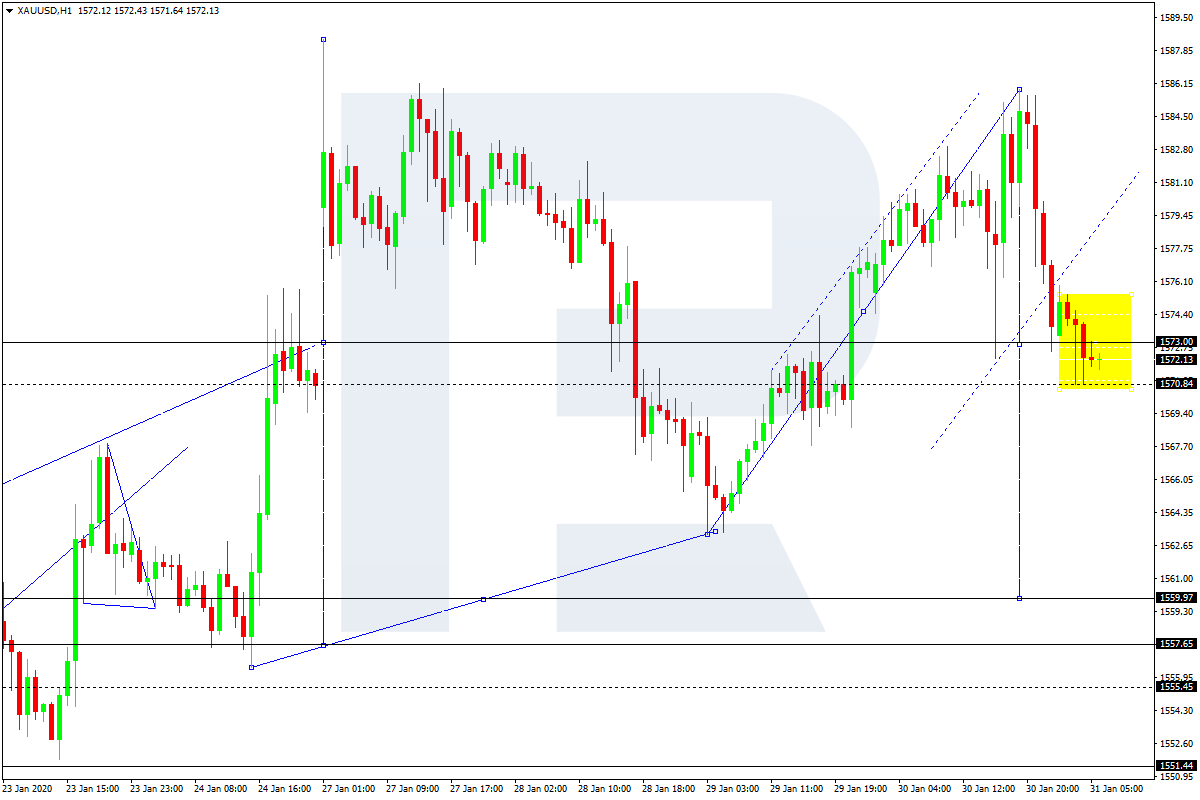

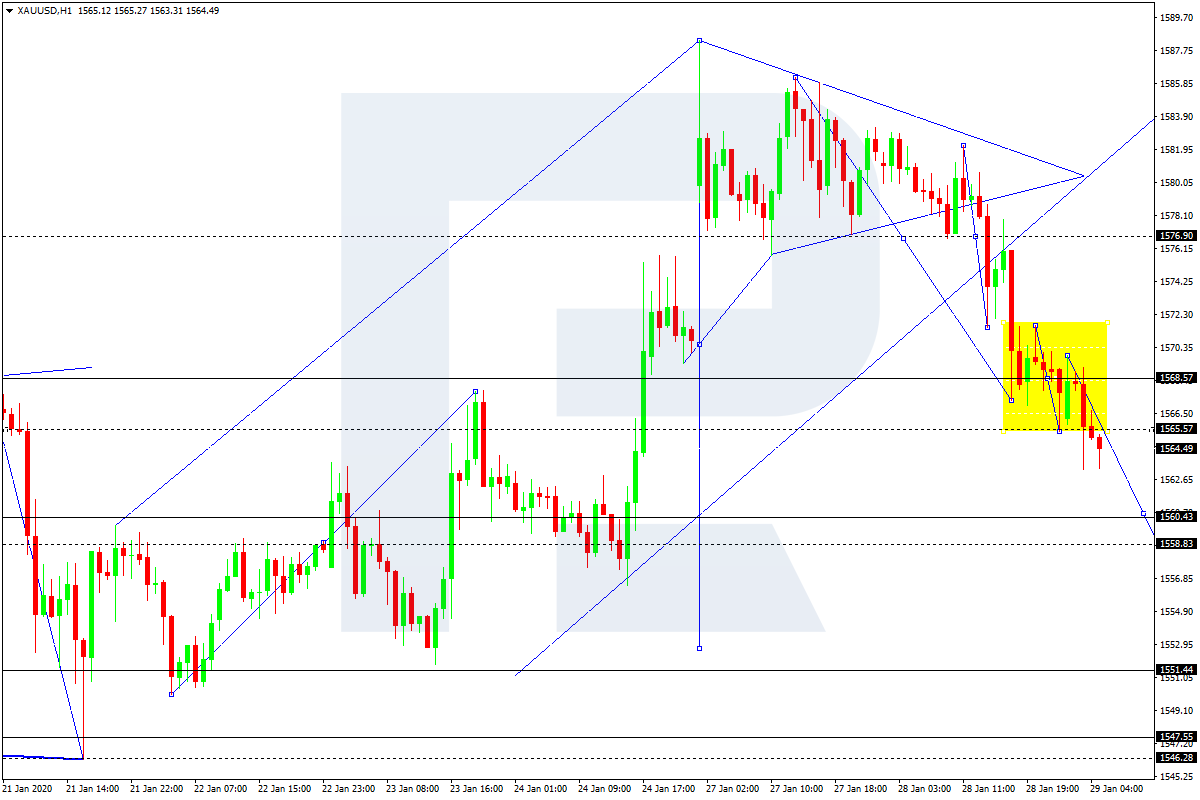

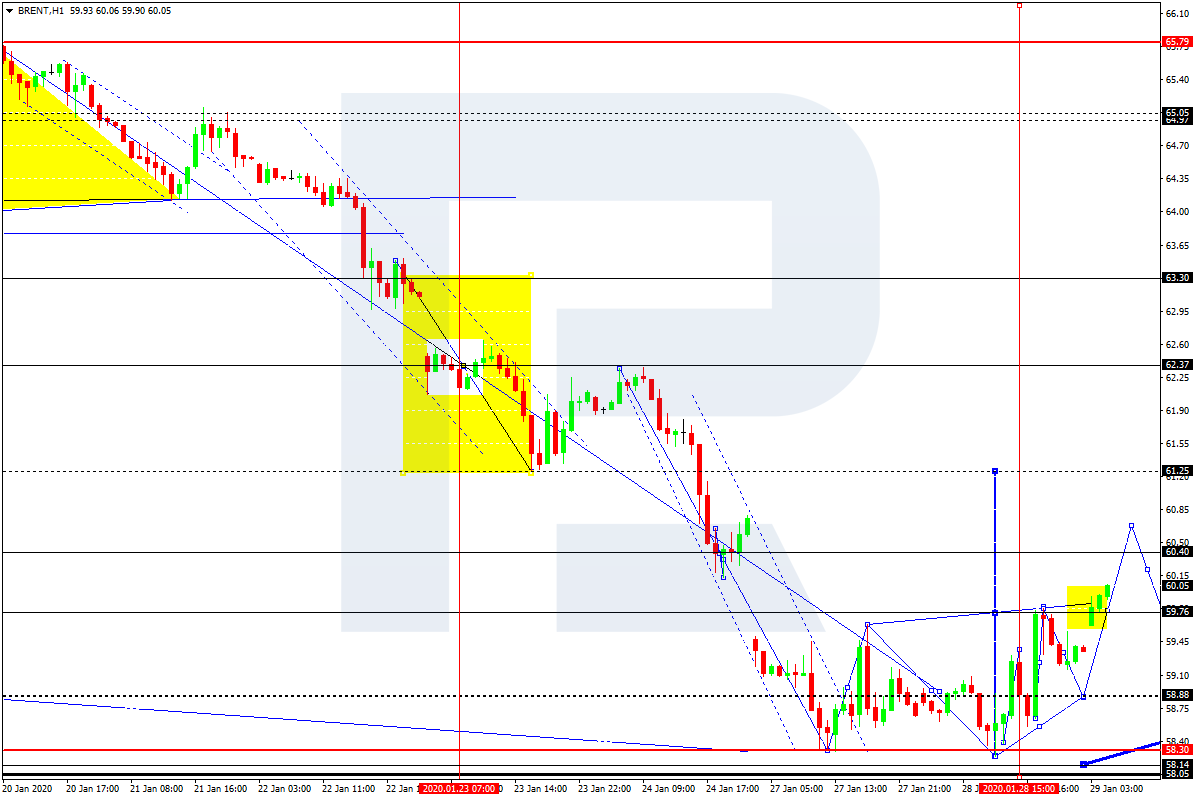

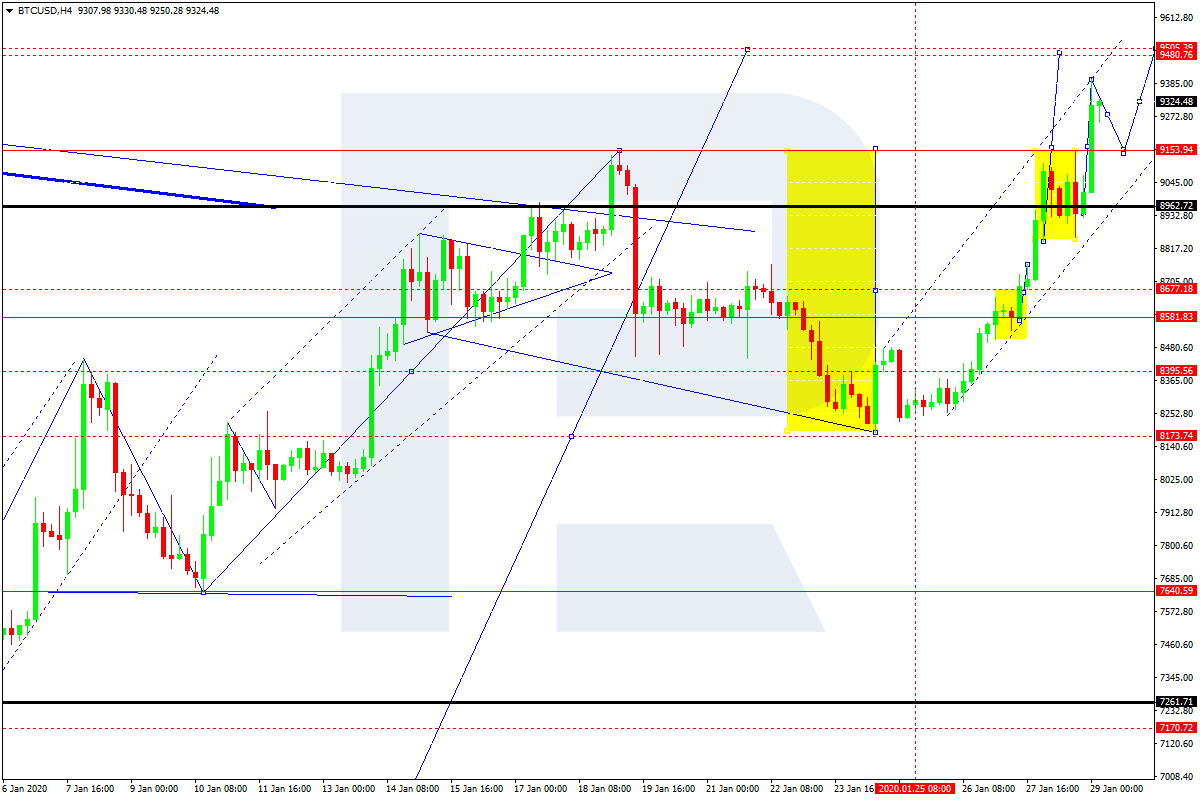

XAUUSD, “Gold vs US Dollar”

As we can see in the daily chart, XAUUSD has failed to reach the long-term high at 76.0% fibo (1708.10): there was a divergence on MACD, which made the pair reverse and start a new decline. After reaching 23.6% fibo, the descending movement may continue towards 38.2%, 50.0%, and 61.8% fibo at 1527.70, 1478.00, and 1428.40 respectively. At the same time, one should realize that if the price breaks the long-term support at 50.0% fibo (1482.50), it will confirm the long-term trend reverse. The resistance is the high at 1689.26.

In the H1 chart, the pair is correcting upwards; it has already reached 38.2% fibo, and may continue towards 50.0% and 61.8% fibo at 1611.45 and 1623.10 respectively. After the price breaks the support at 1562.74, the instrument may resume its mid-term downtrend towards 38.2%fibo at 1527.70.

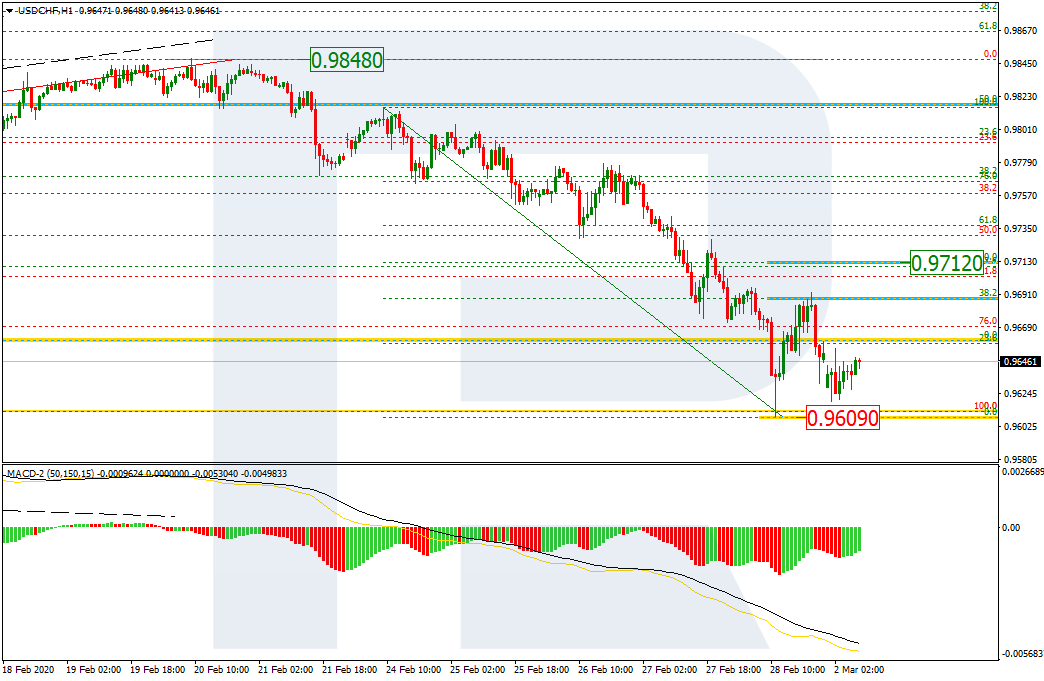

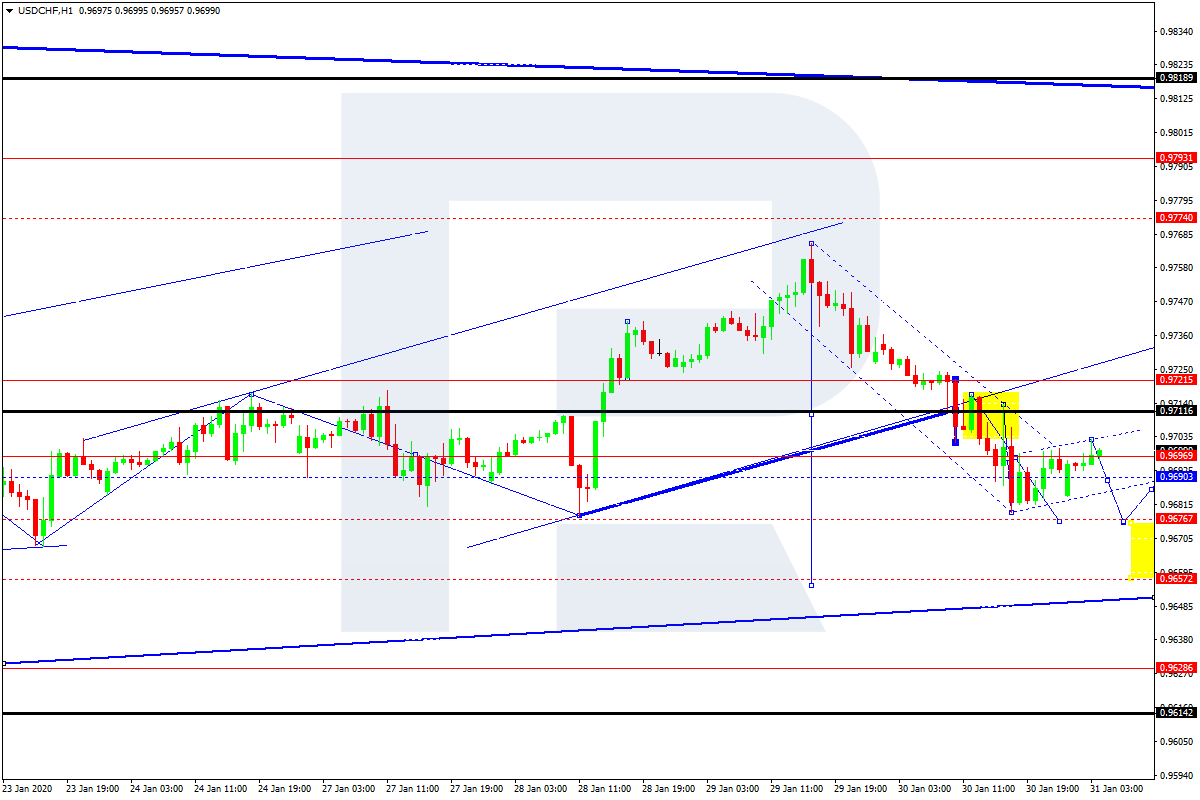

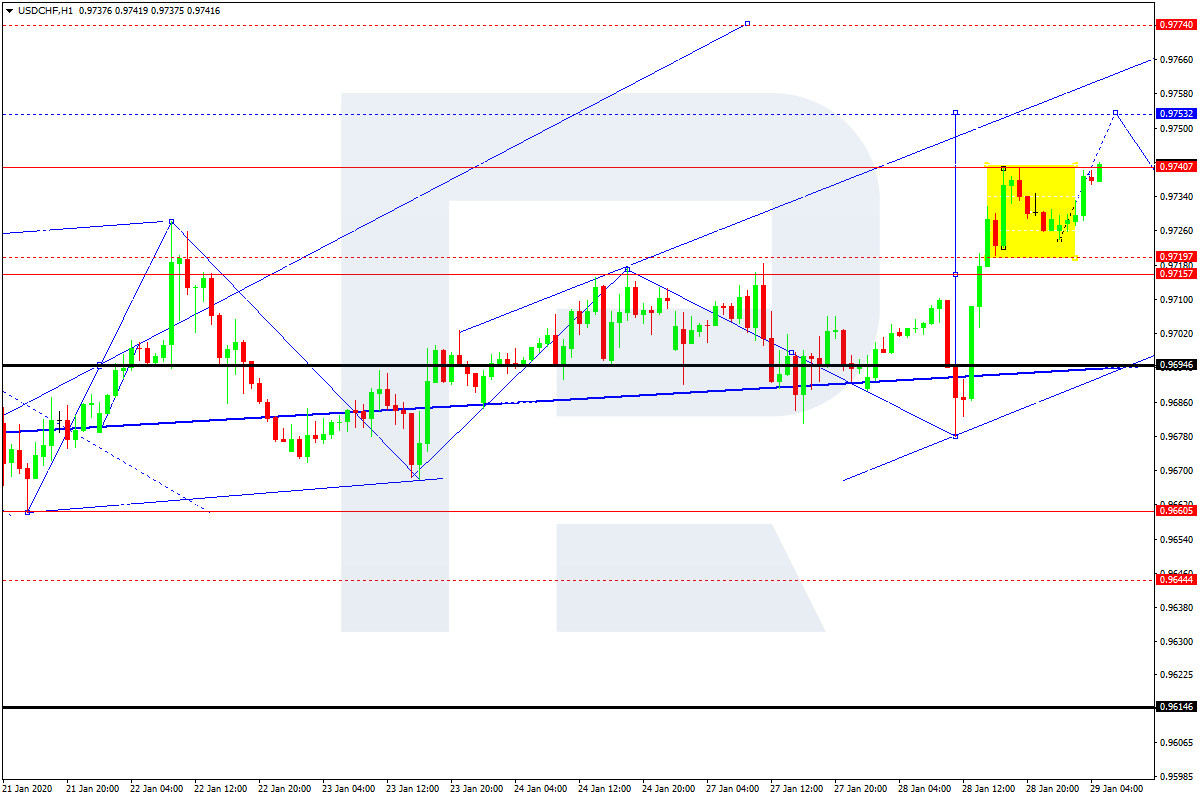

USDCHF, “US Dollar vs Swiss Franc”

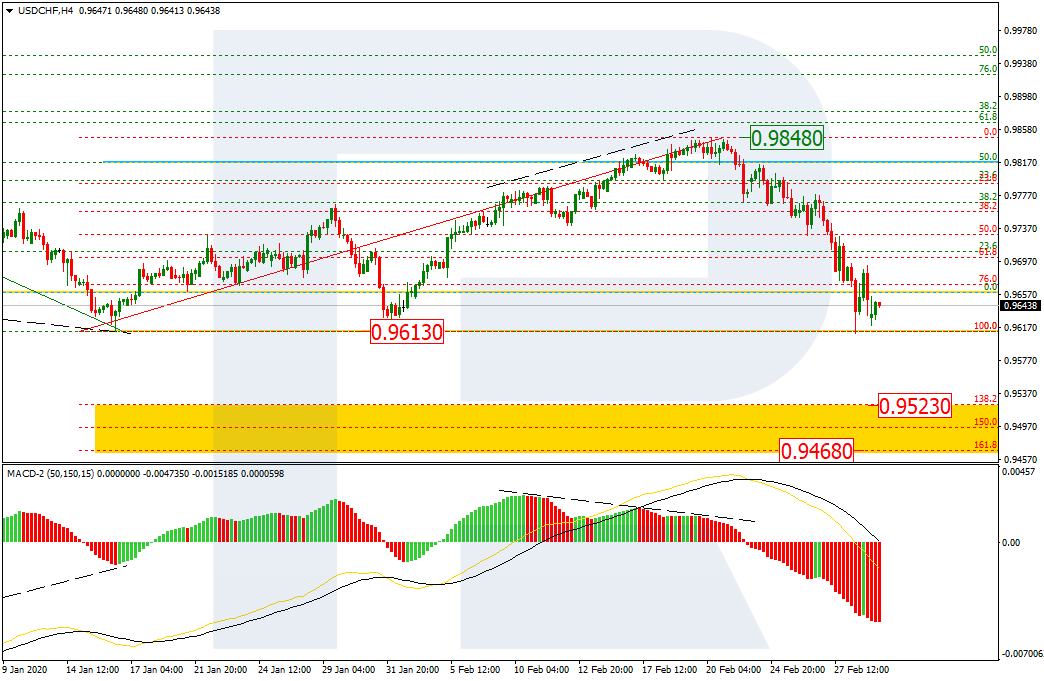

As we can see in the H4 chart, the divergence on MACD made the pair reverse after reaching 50.0% and start a new descending movement, which has already reached the long-term low at 0.9613. Right now, the price is testing the low and may break it. In this case, USDCHF may continue falling towards the post-correctional extension area between 138.2% and 161.8% fibo at 0.9523 and 0.9468 respectively.

In the H1 chart, after finishing the downtrend and testing the low, the pair is correcting upwards. By now, the first correctional wave has already reached 38.2% fibo and may continue towards 50.0% fibo at 0.9712. The support is local low at 0.9609.