The ABCD is a basic harmonic pattern. All other patterns derive from it. The pattern consists of 3 price swings. The lines AB and CD are called “legs”, while the line BC is referred to as a correction or a retracement. AB and CD tend to have approximately the same size.

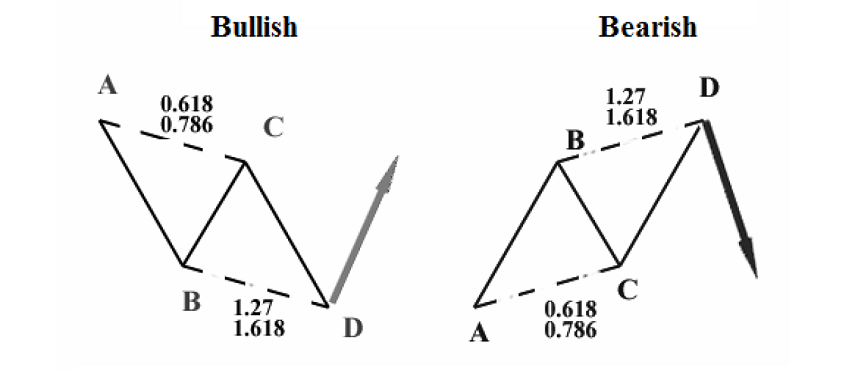

A bullish ABCD pattern follows a downtrend and means that a reversal to the upside is likely. A bearish ABCD pattern is formed after an uptrend and signals a potential bearish reversal at a certain level. The rules for trading bullish and bearish ABCD patterns are the same, you will just need to take into account the direction of the pattern you trade and the movement of the market it predicts.

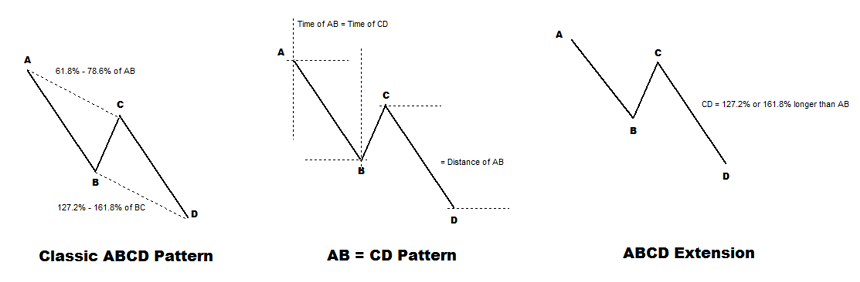

There are several types of ABCD pattern (all the 3 patterns at the picture are bullish).

In the classic one, the point C should be at 61.8%-78.6% of AB (Use Fibonacci retracement tool on AB: the point C should be close to 61.8%). The point D, in its turn, should be at the 127.2%-161.8% Fibonacci expansion of BC.

Notice that a 61.8% retracement at the point C tends to result in the 161.8% projection of BC, while a 78.6% retracement at the C point will lead to the 127% projection.

There is also the so-called AB=CD pattern. Here CD has exactly the same length as AB. In addition, it takes the market the equal time to travel from A to B as from C to D. As a Result, AB and CD have the same angle. This type of ABCD pattern is seen quite often and is popular among traders.

The third type is when CD is the 127.2%-161.8% extension of AB. CD can be even 2 times (or more) bigger than AB. There actually are some signs that can hint that CD will be much longer than AB. They are a gap after point C or big candlesticks near point C.

How to trade ABCD pattern

The key thing you should remember is that you can enter the trade only after the price reached the point D.

Study the chart looking at the price’s highs and lows. It may be helpful to use ZigZag indicator (Insert – Indicators – Custom – ZigZag) that marks the chart’s swings.

Watch the price as it forms AB and BC. In a bullish ABCD, C must be lower than A and should be the intermediate high after the low at B. Point D must be a new low below B.

When the market arrives at a point, where D may be situated, don’t rush into a trade. Use some techniques to make sure that the price reversed up (or down if it’s a bearish ABCD). The best scenario is a reversal candlestick pattern. A buy order may be set at or above the high of the candle at point D.

Take profit levels

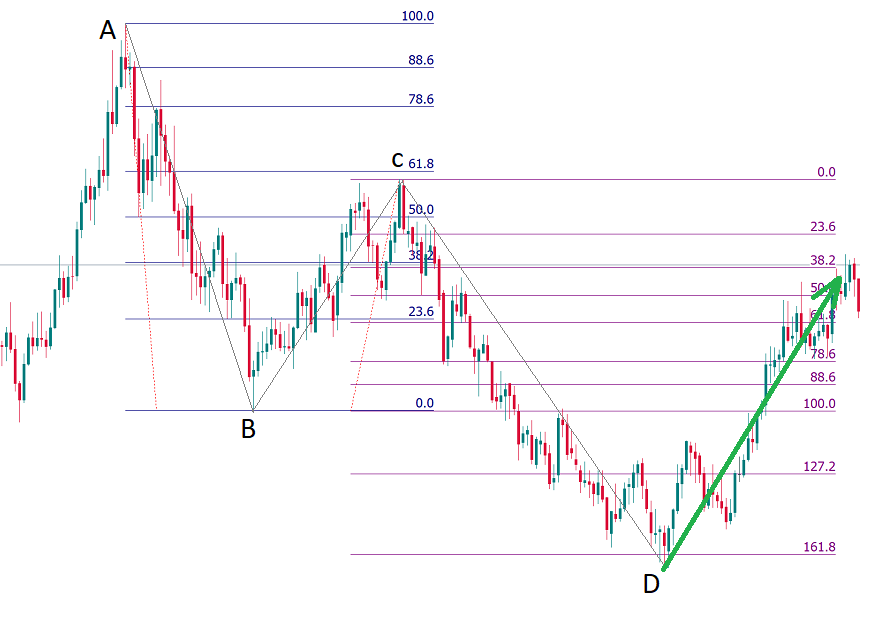

Here are the target levels for trading the ABCD pattern.

TP1: 38.2% retracement of AD

TP2: 61.8% retracement of AD

TP3: point A

We recommend using these levels together with support and resistance you identify at the chart using various tools of technical analysis. Don’t forget to have a look at senior timeframes when you hunt for support and resistance levels.

If the price moved to TP1 fast, the odds are that it will continue towards TP2. On the contrary, if the price is slow to get to TP1, this might mean that it will be the only TP level you’ll get.

There are many cases when the market reversed after AC=CD pattern going beyond point A.

As for Stop Loss, there are no special recommendations. You can put a Stop Loss in line with your risk management rules.

Here’s an example of the ABCD patterns on the chart:

Conclusion

You can find many ABCD pattern on one chart. The rules for trading each of them are as explained above. Make sure that you know how to apply Fibonacci tools correctly an follow all our tips.