The ability to properly draw support and resistance levels is one of the most basic skills every price action trader must have. It’s also the building block for everything that comes after it, including price action trading strategies like pin bars and inside bars as well as a proper risk to reward ratio.

Get it right and trading starts to become effortless. Get it wrong and your trading experience will most likely be a frustrating one.

In this lesson we’re going to define what a support and resistance level is, as well as why they form. We’ll also dive into how to properly identify these levels, and then we’ll finish things off with a few basic rules to trade by.

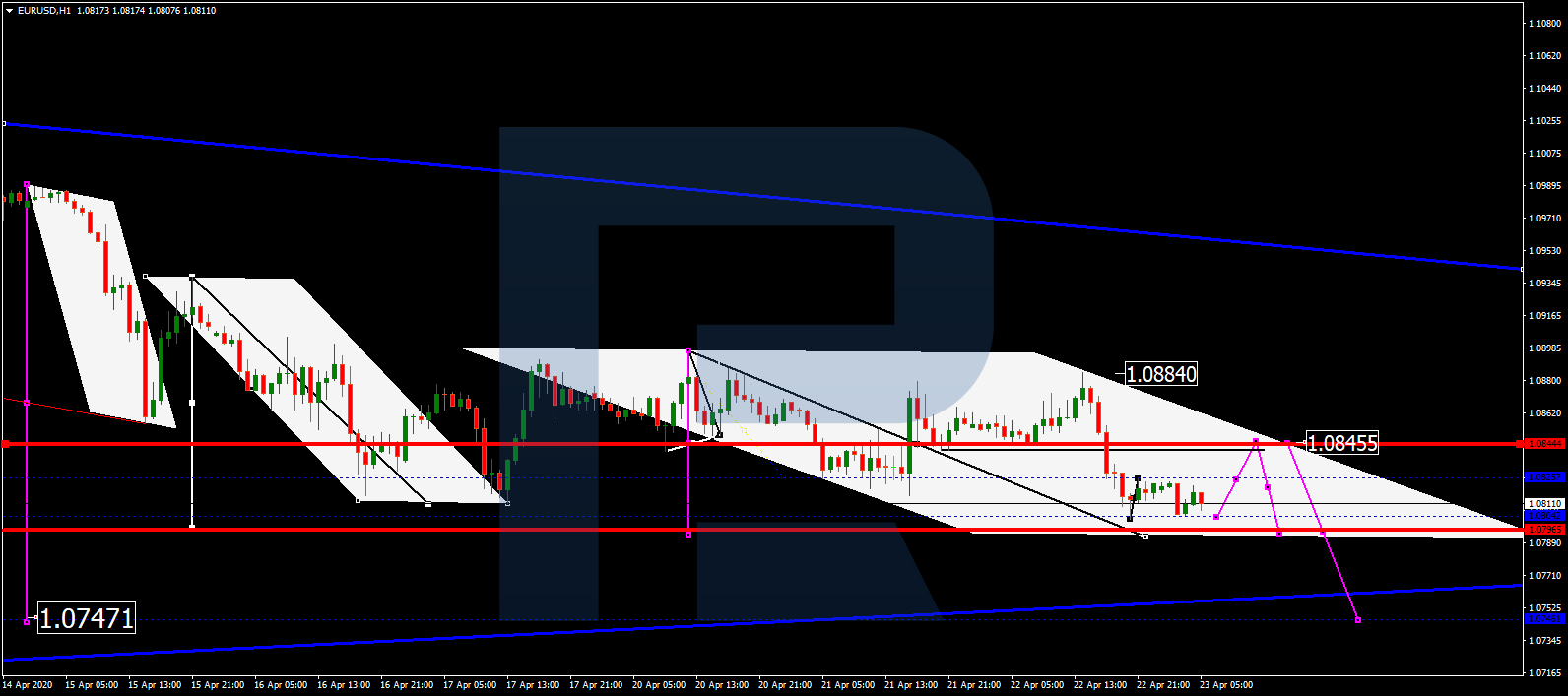

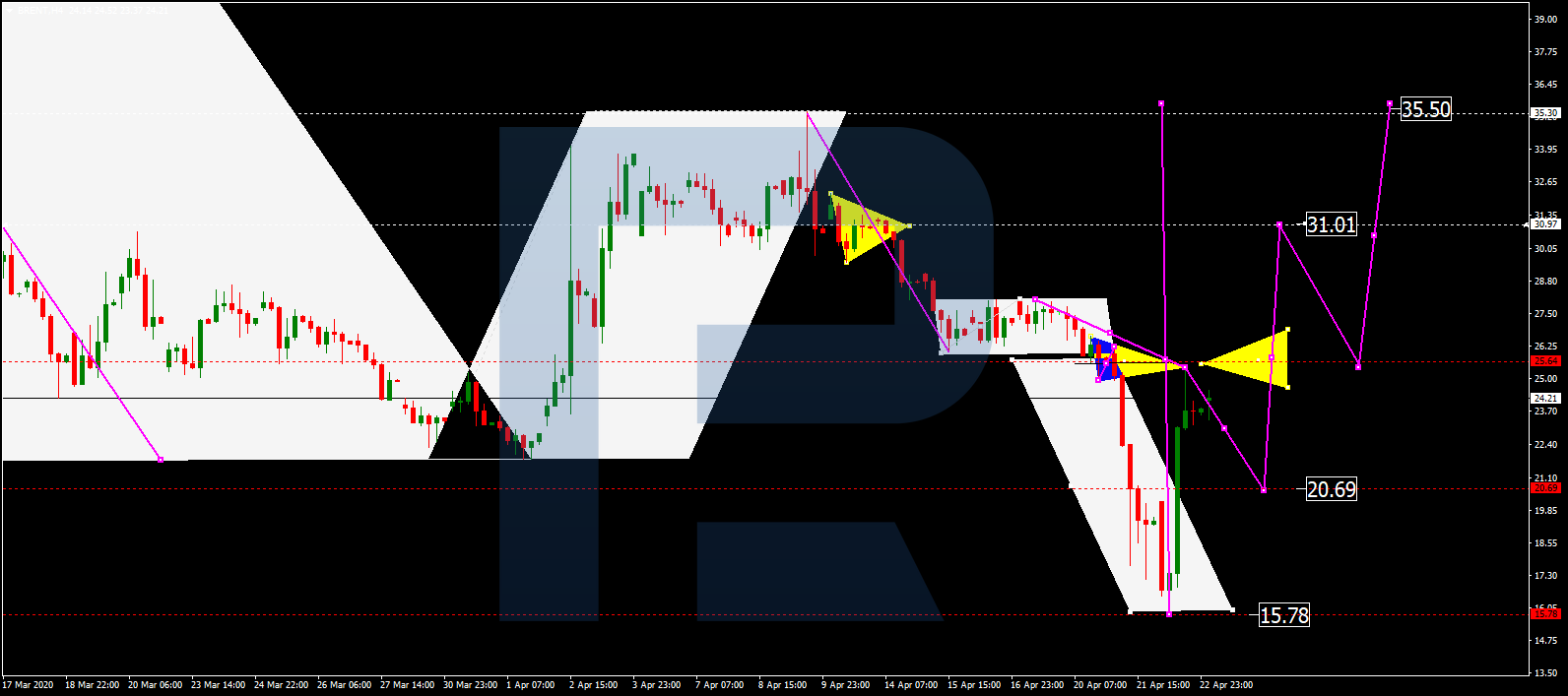

In short this lesson will help you keep your charts from looking like this…

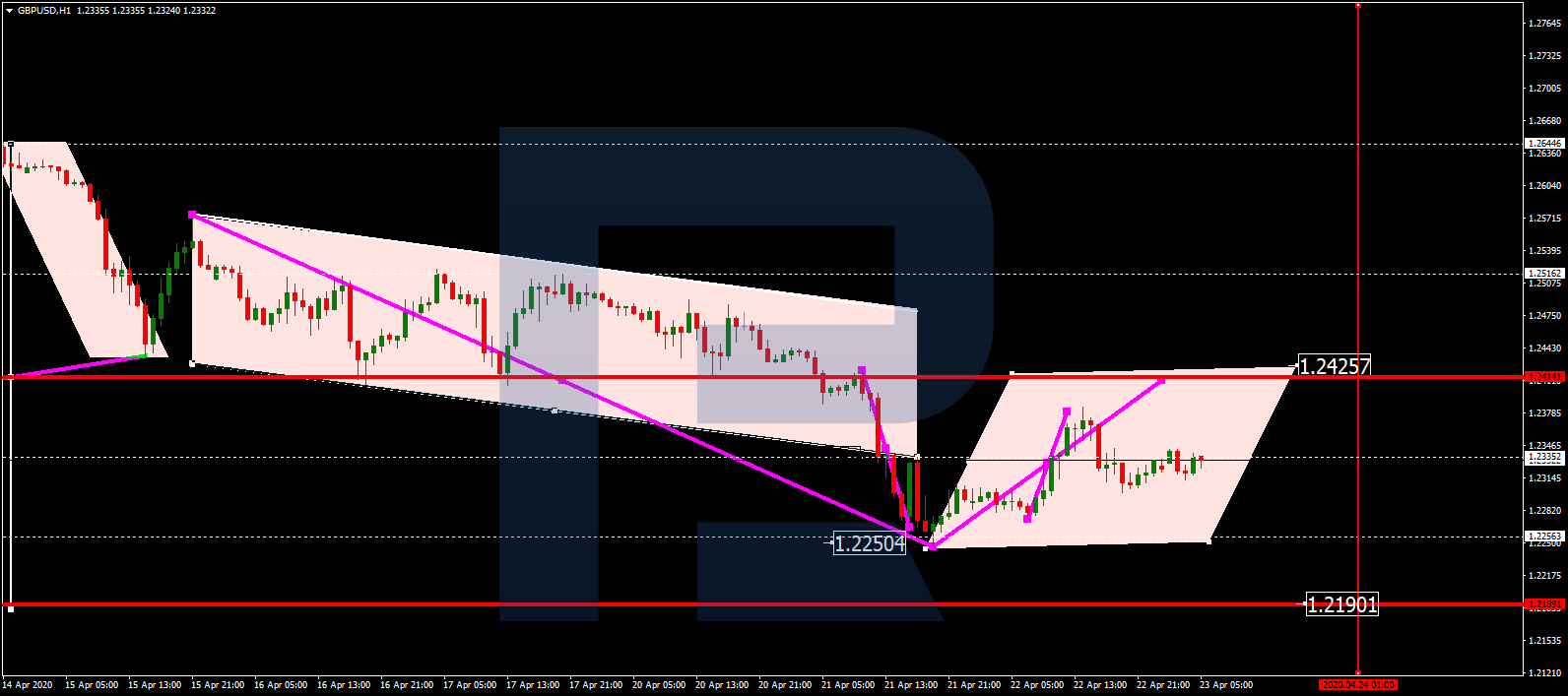

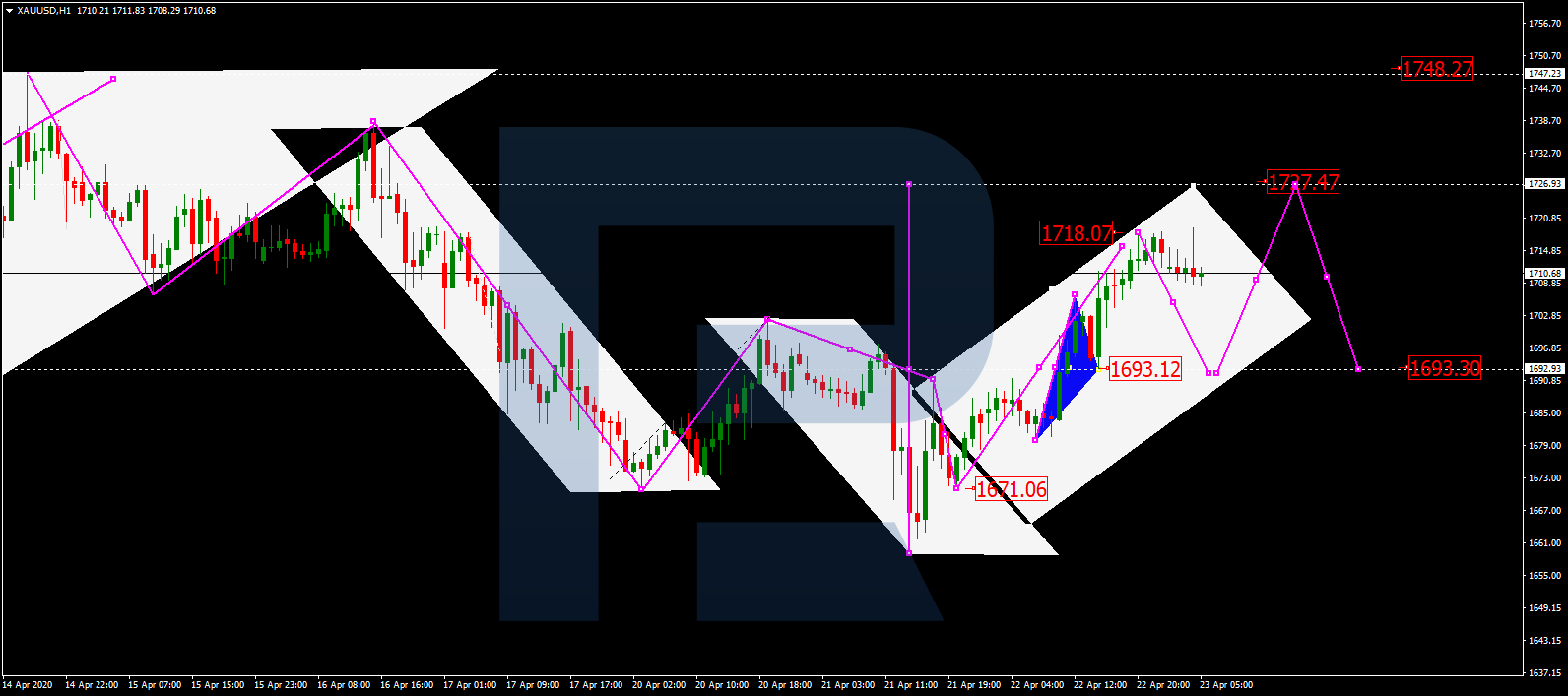

And more like this…

A quick note before we get started. This lesson will only focus on horizontal support and resistance as I believe it to be the cornerstone on the topic of key levels.

Get Instant Access to the Same “New York Close” Forex Charts Used by Justin Bennett!

I’ll save trend lines for a later lesson as they have many different facets that deserve more attention.

What is a Support and Resistance Level?

A support and resistance level is simply a level in a market at which traders find a price to be overvalued or undervalued depending on current market dynamics. This creates a level in the market that can act as support or resistance depending on various factors surrounding each currency.

So that’s the “fancy” definition of a support and resistance level. Now for the price action trader’s definition…

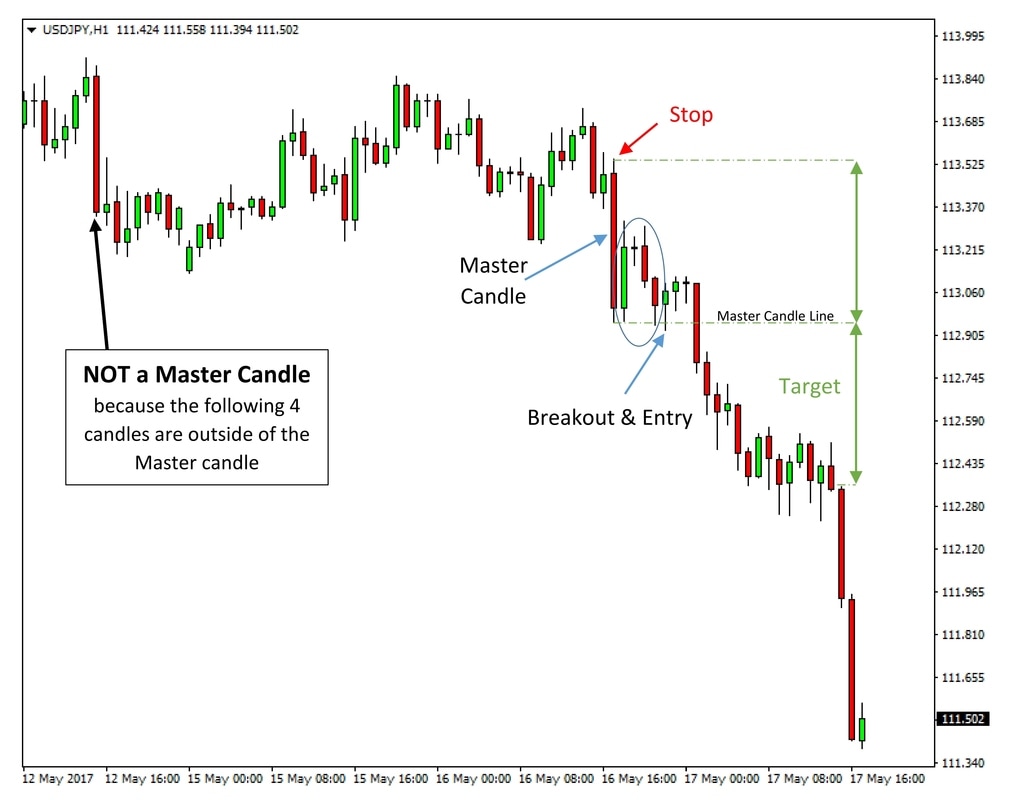

A level at which we can look for price action buy or sell signals such as the pin bar. That’s really all we need to know. We aren’t concerned about why a level has formed. Instead, we’re focused on how important that level is relative to the surrounding price action. If it’s deemed to be an important (key) level that we want on our chart, we simply wait and watch for a price action buy or sell signal to develop.

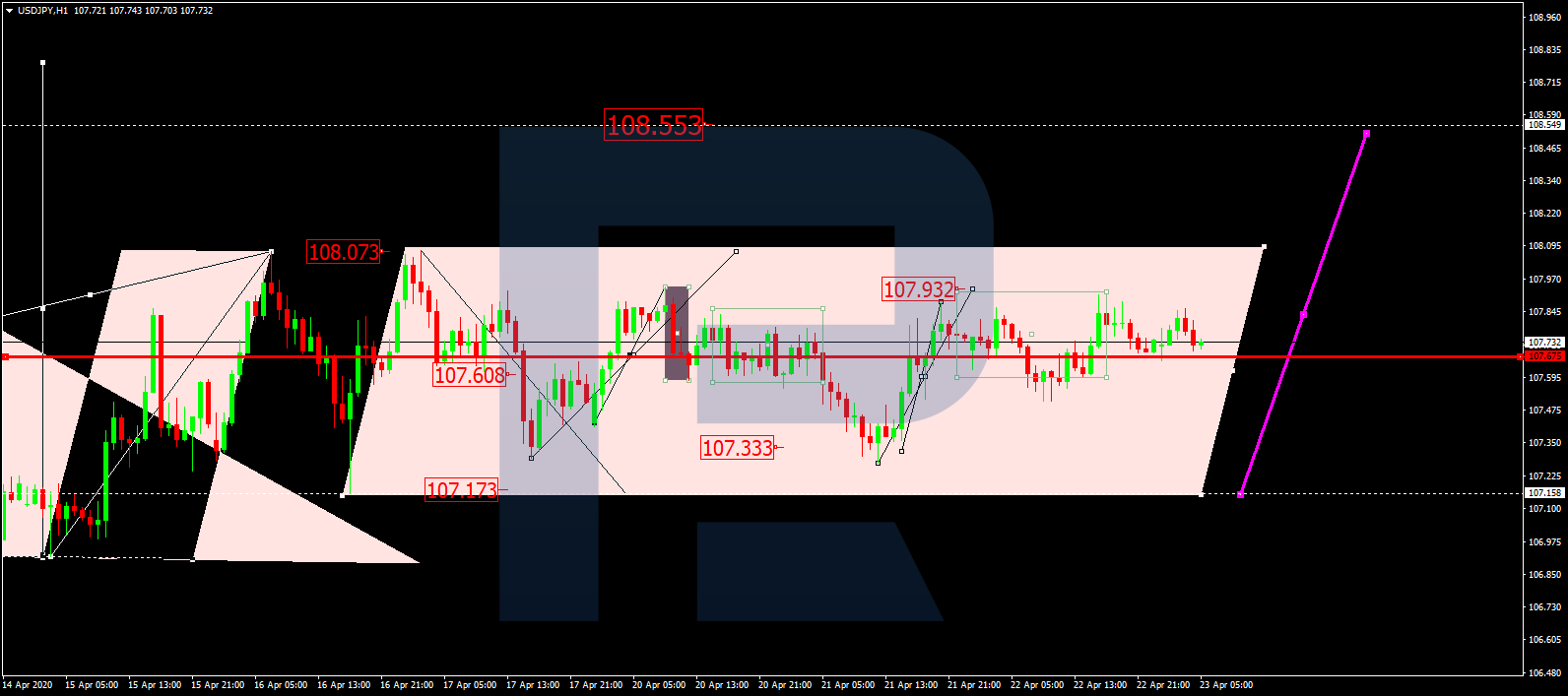

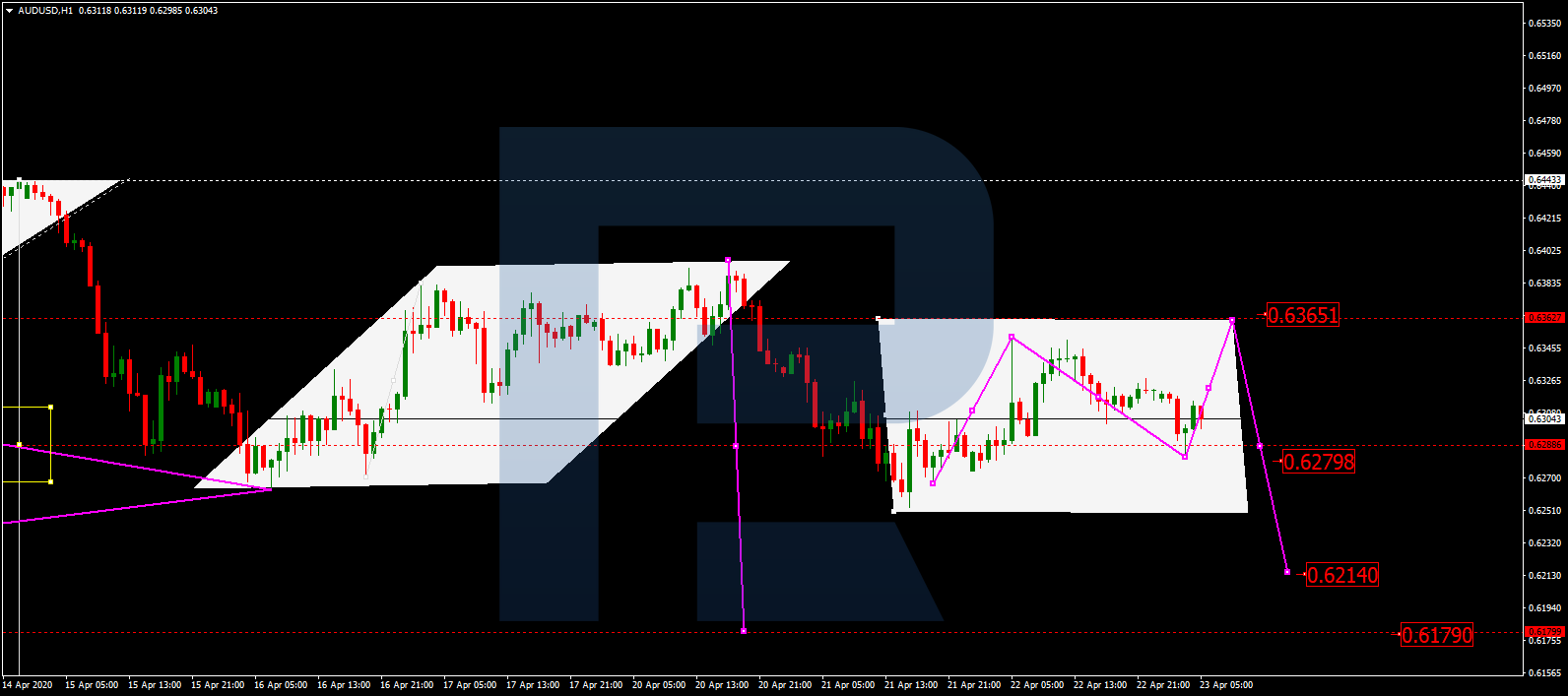

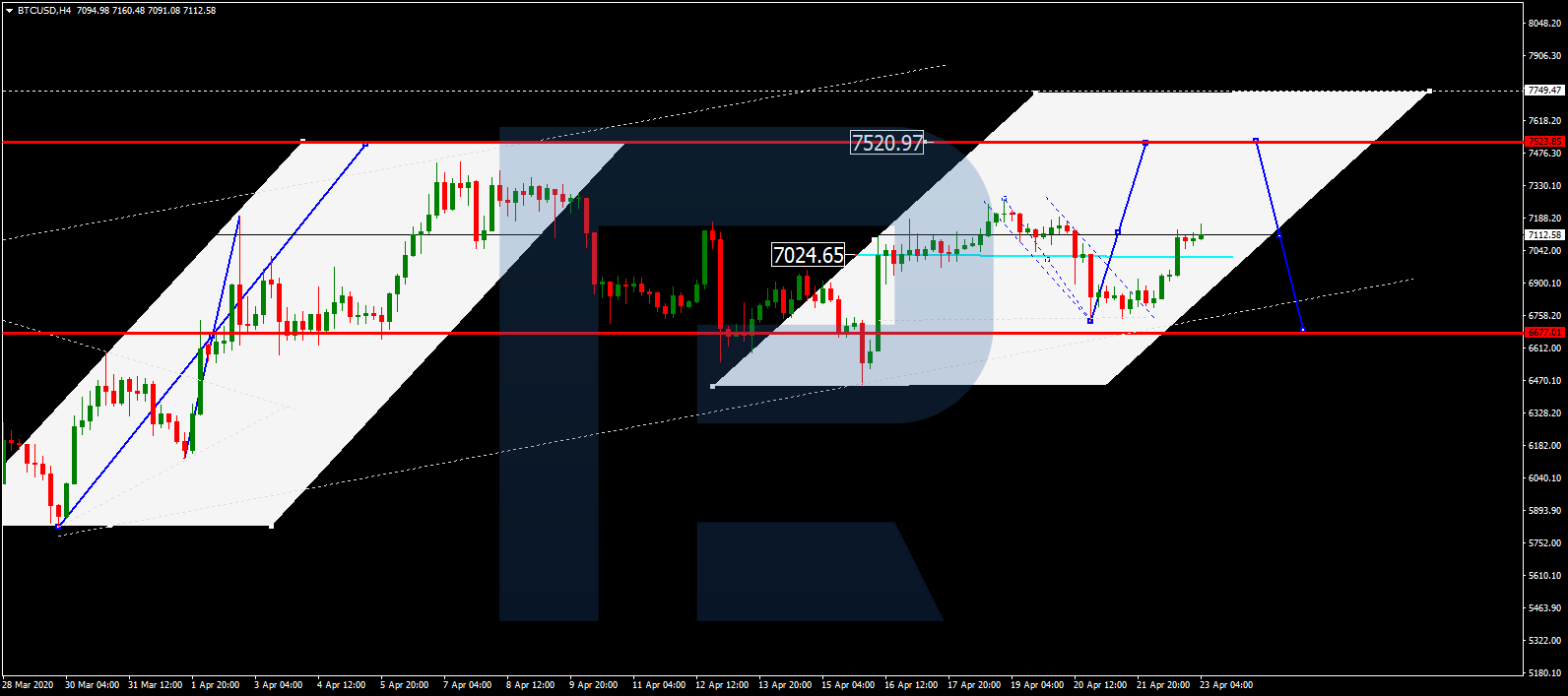

Here is a great example of a support and resistance level in action.

What Causes These Areas to Form?

To understand why these levels form we have to go back to the supply and demand curve. I won’t spend too much time on this as the real benefit to support and resistance comes once you learn how to properly identify the levels.

Notice how in the supply curve below, the number of units for sale increases as price increases. To put this in trading terms – the higher the price, the more willing traders are to sell their positions.

The demand curve, on the other hand, is the exact opposite. As price increases the number of units desired decreases. This is because traders are less willing to buy in a more expensive market.

We can, therefore, label a support and resistance level as a point in the market where traders are more willing to buy or sell, depending on market conditions. This creates an area of tension between buyers and sellers, which often causes the market to change direction.

Here’s how that looks when it’s applied to a market such as GBPNZD.

Now that we have a good understanding of how and why these areas form, let’s take a look at how to properly identify them.

How to Draw Support and Resistance Levels

The first thing I want to mention about support and resistance levels is that they aren’t always exact levels. In fact, most often these “levels” are better thought of as areas on your chart.

It’s a common misconception that a key level has to line up perfectly with highs and lows. This couldn’t be further from the truth as most support and resistance levels have areas where the market failed to respect it as either support or resistance. This is the reason we use price action strategies like the pin bar as confirmation that a level is likely to hold.

I don’t know about you, but I learn best when I can see something in action. Which is why I created a video to show you how I go about drawing support and resistance on my own charts.

If you’ll notice, the support and resistance levels I drew in the video didn’t always line up exactly with highs and lows, nor did the market always respect them. But that’s okay.

It’s important to understand that although properly drawn support and resistance levels can be a powerful asset, they aren’t without flaw. But as I mentioned earlier, that’s where price action signals come in to help us determine the strength of a level prior to placing a trade.

One last point about drawing your support and resistance levels. You should always aim to achieve the most touches possible on either side of the level. This usually requires you to move the level up and down a few times until you can find the place where the market touches that level the most from both sides (as support and also as resistance).

Remember that these levels represent areas in the market where traders are more willing to buy or sell, which can mean a change of direction in the market. So by moving a level to a place that achieves the most touches on either side, you stand the greatest chance of catching the move if and when it happens.

Rules to Trade By

Here are a few simple rules to follow that will vastly improve your ability to identify key areas of support or resistance.

Use swing highs and swing lows in the market to your advantage

By using the highs and lows as a guideline to start drawing your support and resistance levels, you’re more likely to capture the “key” levels. These are the levels that you should be interested in as they are the most likely to produce a valid price action buy or sell signal.

Don’t worry if the highs and lows don’t line up perfectly

Remember that most levels are not going to line up perfectly with highs and lows. Instead of worrying about a level lining up perfectly with highs and lows, you should spend some time making sure the level is at a place in the market that achieves the most touches on either side of the level.

Focus on the major (key) levels in the market

These are the most obvious support and resistance levels and should be immediately visible. If you have to search long and hard for a level, it probably isn’t worth placing on your chart. By only focusing on key levels you’ll be in a much better place to actually trade a price action signal when one shows up.

Stay within a six-month window

You don’t need to go back five years to find support and resistance levels. Most of the levels that you will need are going to come from highs and lows that have occurred within the last six months. Feel free to travel back in time once you have the level drawn, but don’t think it necessary to look back more than six months to find great levels to trade.

That wraps up this lesson on how to draw support and resistance levels. I hope you now have a better understanding of how to approach these levels and also which levels are most important.

Just remember to not over-complicate things. Drawing support and resistance levels should be one of the easier and stress-free things you do as a price action trader. In fact, I’ll go so far as to say that if you find yourself expending a lot of energy to find these levels, you’re probably drawing more levels than you actually need.

Keep it simple and most importantly, have confidence in your abilities! One of the bigger mistakes you can make is to second guess whether or not you’ve drawn a level correctly. It’s okay to double check your work, but just remember that your first instinct is usually the right one.