Yen Eyes Strength: A Potential Short Trade on CHFJPY (January 03,2024)

The Japanese Yen (JPY) has shown signs of potential appreciation against the Swiss Franc (CHF), presenting a possible shorting opportunity on the CHFJPY currency pair. This article will delve into the technical and fundamental factors supporting this bearish bias, outlining the trade setup with entry, stop-loss, and take-profit levels, and emphasizing crucial risk management considerations.

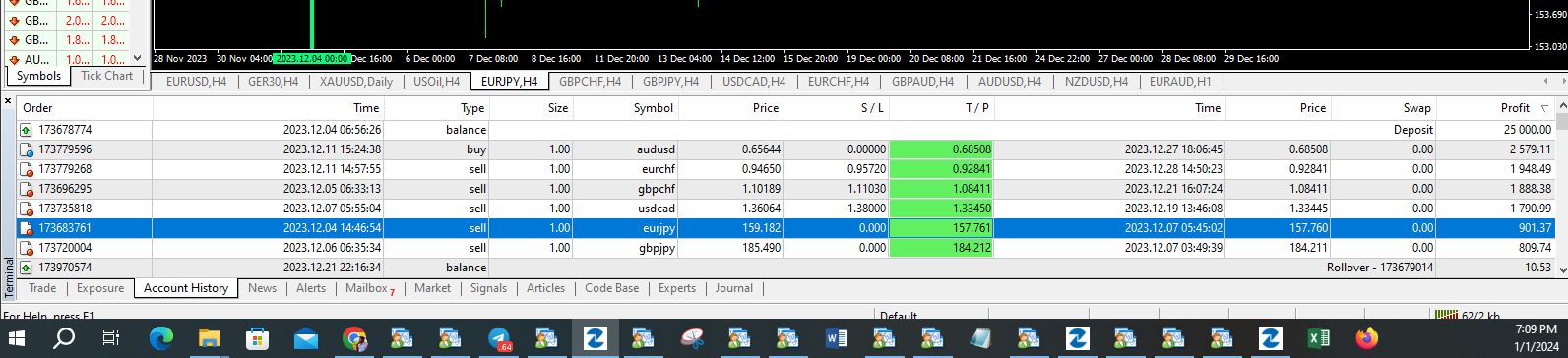

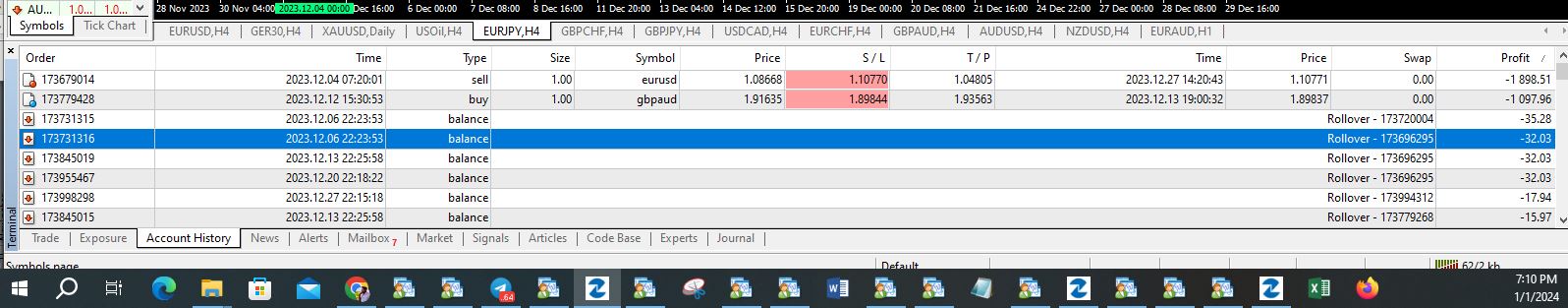

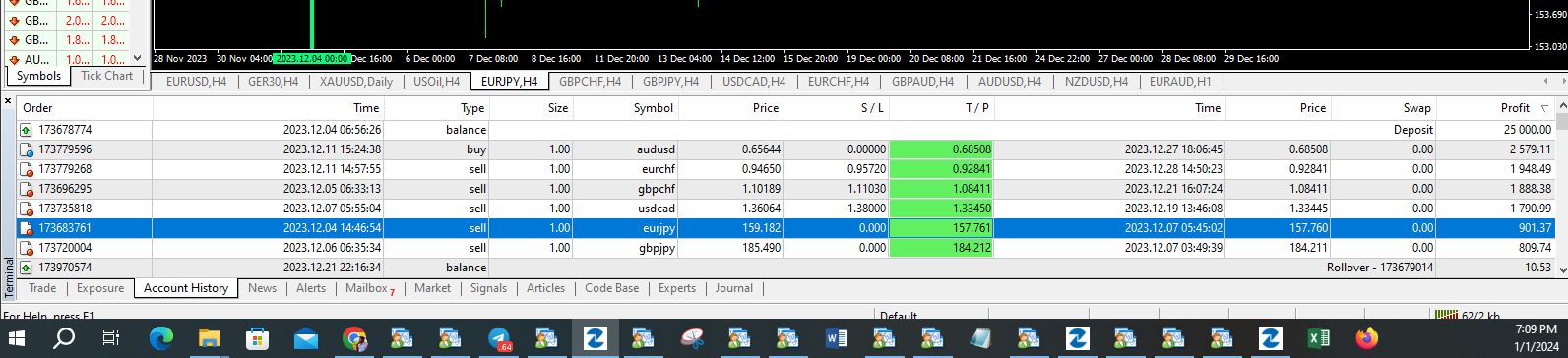

Entry Price: 167.030 Stop Loss: 169.087 Take Profit: 165.168

Technical Analysis:

- Downtrend Confirmation: CHFJPY has been trading in a descending channel since early November, suggesting waning bullish momentum.

- Relative Strength Index (RSI): The RSI indicator recently dipped below 50, entering the “neutral” zone and potentially signaling a bearish reversal.

- Moving Average Convergence Divergence (MACD): The MACD histogram is shrinking, hinting at weakening upward momentum.

Fundamental Factors:

- Bank of Japan’s Dovish Stance: The Bank of Japan (BOJ) maintains an ultra-loose monetary policy, keeping interest rates at historically low levels. This dovish stance could weaken the Yen in the long run.

- Swiss National Bank’s Hawkish Tilt: In contrast, the Swiss National Bank (SNB) has signaled a shift towards a more hawkish stance, hinting at possible future interest rate hikes, which could strengthen the CHF.

- Risk Aversion: Geopolitical tensions and global economic uncertainties might prompt investors to seek safe-haven assets like the JPY, potentially causing it to appreciate against riskier currencies like the CHF.

Risk Management:

- Stop-Loss Placement: The stop-loss is placed 2 pips above the recent swing high, safeguarding against unexpected upward spikes.

- Take-Profit Target: The take-profit target is set 2 pips below the recent swing low, aiming to capture a portion of the potential downside move.

- Position Sizing: Maintain a conservative position size, allocating only a small percentage of your capital to this trade.

Conclusion:

While the technical and fundamental factors suggest a potential downside move for CHFJPY, remember that the forex market is dynamic and unforeseen events can occur. Practice proper risk management, monitor the market closely, and adjust your trading strategy as needed.

Disclaimer:

This article is for informational purposes only and should not be considered financial advice. Please consult with a professional financial advisor before making any investment decisions