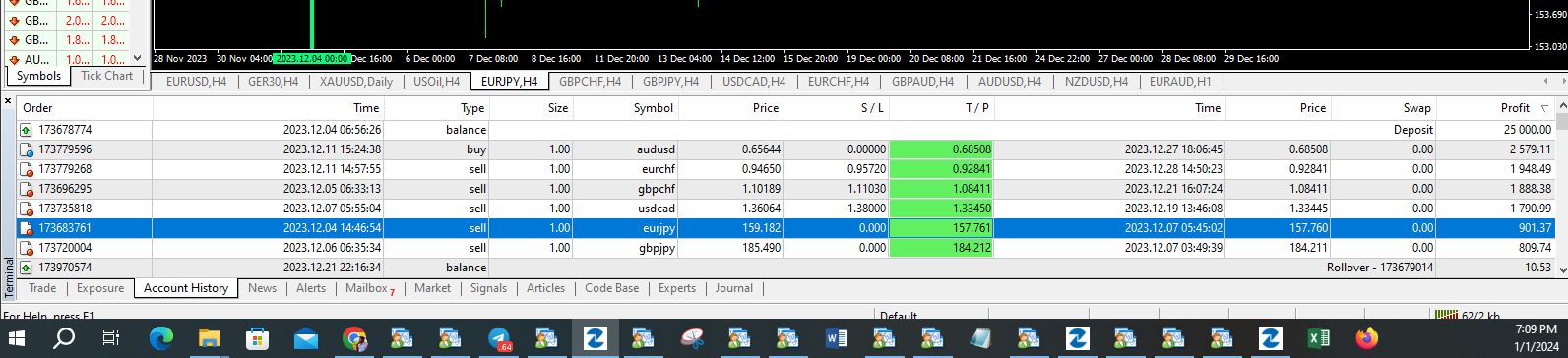

Sthree Sakthi (SS-153) 16/04/2019- Kerala Lottery Result

KERALA STATE LOTTERIES – RESULT

www.keralalotteries.com PHONE:- DIRECTOR OFFICE FAX

www.kerala.gov.in 0471-2305230 0471-2305193 0471-2301740

Sthree Sakthi LOTTERY NO. SS-153rd DRAW held on 16/04/2019 AT GORKY BHAVAN NEAR BAKERY

JUNCTION THIRUVANANTHAPURAM

1st Prize- Rs :6,000,000/- SH 710595 (KOLLAM)

Consolation Prize- Rs. 8,000/- SA 710595 SB 710595 SC 710595 SD 710595

SE 710595 SF 710595 SG 710595 SJ 710595

SK 710595 SL 710595 SM 710595

2nd Prize- Rs :500,000/- SJ 679245 (PALAKKAD)

FOR THE TICKETS ENDING WITH THE FOLLOWING NUMBERS

3rd Prize- Rs. 5,000/- 0450 0948 1094 1695 1736

2930 4479 6298 6570 7403

8759 8899

4th Prize- Rs. 2,000/- 0966 1242 4510 5173 5922

6105 6278 9995

5th Prize- Rs. 1,000/- 0554 0810 1412 1764 2398

3416 4171 4216 4463 4819

5808 6994 7088 8508 8526

8681 8797 8868 9513 9845

6th Prize- Rs. 500/- 0083 0265 0446 1278 1323

2071 2431 2447 2448 3002

3149 3468 3851 4293 4535

4568 4893 4987 5606 5745

6094 6378 6517 6638 7242

7602 7623 8416 8466 8621

8973 8986 9201 9476 9727

9949

7th Prize- Rs. 200/- 0254 0461 0692 1042 1152

1380 1503 1637 1646 1942

2008 2665 2728 2771 2934

3348 3816 4077 4274 4497

4683 4851 4904 5563 5937

6034 6301 6651 6990 7101

7135 7175 7180 7510 7636

7684 7946 8129 8317 8406

8548 8601 8615 8872 9718

8th Prize- Rs. 100/- 0085 0288 0343 0396 0456

0638 0783 0802 0823 0921

0925 0949 0981 1357 1469

1535 1610 1735 1738 1774

2640 2682 2702 2755 2776

2829 2883 2925 2937 3012

3157 3202 3227 3234 3245

3286 3299 3473 3604 3632

3698 3868 3891 3948 3960

3985 4011 4119 4195 4374

4464 4626 4643 4711 4811

4828 5128 5184 5215 5728

5737 5876 6367 6509 6511

6724 7070 7125 7147 7252

7260 7332 7565 7625 7657

7799 7878 8048 8081 8131

8169 8201 8207 8278 8301

8351 8402 8603 8651 8829

8859 8915 9295 9442 9517

9548 9594 9669 9912 9955

The prize winners are advised to verify the winning numbers with the results published in the Kerala Government

Gazatte and surrender the winning tickets within 30 days.

Next Sthree Sakthi Lottery Draw will be held on 23/04/2019 at

GORKY BHAVAN, THIRUVANANTHAPURAM

Sd/-

SG Sarma

Deputy Director

Directorate Of State Lotteries , Vikas Bhavan,tvm