Powerful 123 Forex Trading Strategy

The 123 Forex trading strategy is based on price action and normal Forex market structure that any trader should know. The 1 2 3 trading strategy is used as a continuation trading setup that is designed to take advantage of the trend of the market.

The failure of the 123 trading strategy is also a trade setup but can also warn you of potential price consolidation in the market or even a trend reversal in whatever Forex pair you are watching.

Keep in mind that even though it is a continuation pattern upon confirmation, it is also a reversal pattern from the short term trend direction.

1 2 3 Trading Pattern Formation

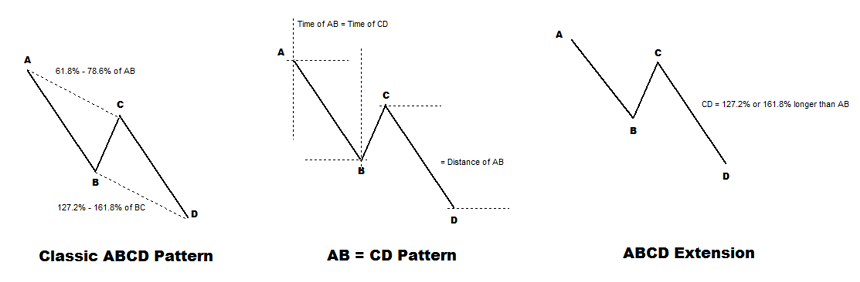

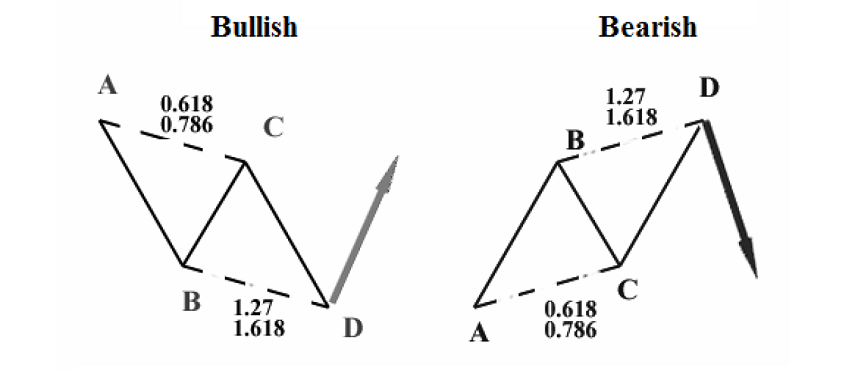

In any trending market, there is a pattern of higher highs and higher lows. In order for the trend to the upside to remain active, each successive impulse swing must take out the point 2 in the formation. When price surpasses the price at #2, the trader can use that as confirmation that the 1 2 3 chart pattern is present.

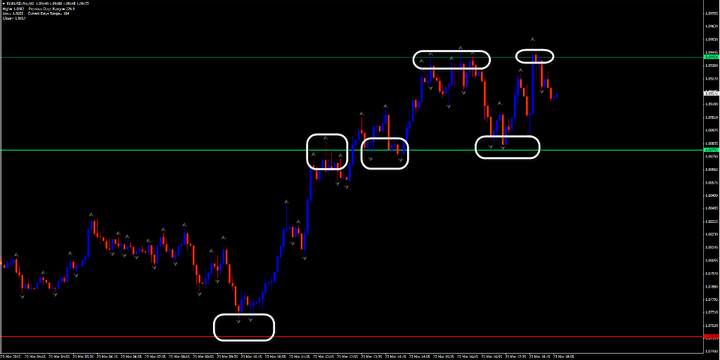

This is a line chart that explains the concept of the 1 2 3 trading pattern and in this case, we are assuming an up trending market

1 2 3 Trading Strategy

Let’s walk through each number and this pattern should be familiar to any trader who’s been looking at charts for a while.

- When an uptrend pulls back, it will put in a low and from that low, price continues to rally.

- This acts as short term potential resistance. Price rallies to this point and then begins to retrace back in the direction of the price at #1. We DO NOT want to see price retrace all the way to the price at #1. If it does, we will consider that to be the formation of a double bottom chart pattern and would trade that according to the trading plan you have set up for that price pattern.

- This level is also considered a #1 only when the price level at #2 is broken. This price point is the level at which the corrective move completes and the price reversal to the upside begins.

Please note that the 1 2 3 price pattern is only confirmed once the high at point #2 is taken out by price.

You can also see that the 1 2 3 trading strategy is taking advantage of the stair step nature of the market that is needed if a trend is going to continue. It is at the confirmation of the patter that a trader can place a conservative trading position in the market

1 2 3 Chart Pattern By The Numbers

In an uptrend market situation, price will make 3 points

- Point 1 is the lowest low point, forms a support level.

- Point 2 will be the peak or the highest point, forms a level that we consider as potential resistance

- Point 3 will be the 2nd low point, a support level ( which must be higher that the point 1 which is the lowest low point ).

- The breakout of price above point 2 signals the continuation of the uptrend.

In a downtrend market, the 1 2 3 chart pattern forms when:

- Point 1 becomes the highest peak when price finds resistance and moves down.

- Point 2 becomes the lowest low point (forms support) and price moves up

- Finds another resistance at point 3.

- when price breaks the point 2 support level,it indicates that the market is most likely to continue downward

Trading Strategy Trading Plan

Let’s take a look at a potential trading method to trade the 1 2 3 trading strategy. We will look at a conservative method for those traders that need a little extra confirmation in their trades.

Keep in mind there is a cost involved. The longer you wait to get involved in a trading position, the larger you will have to make your stop loss.

123 Trading Plan

Trade Setup 1

You should be familiar with the numbers and what they represent on the chart. We can see that price rallied from point 3, found resistance at point 2 and retraced. We now have a double bottom chart pattern and just as the 1 2 3 trading strategy needs a breach of #2 to confirm the pattern, so does the double bottom.

If you do get a double bottom after a move in price, that could signify weakness in the market. If bulls were fully in chart during the retrace at 2, we should not see two shots at the level #3.

Price breaks above #2 and you can either enter at the breakout or, my preference, take a position at the close of the candlestick to confirm a true break. You can also put an order to buy slightly above the candlestick that broke the #2 level.

Your stop loss should be below #2 with buffer room to allow for noise. You can also, my preference is coming, use a 14 period Average True Range x 2.

Trade Setup 2

Price rallies from #1 and gives us a strong reversal candlestick at #2. Once price begins to retrace, put this currency pair on your radar. Price find support at #2 (inside the previous consolidation pattern from trade #1) and shows strength as it rallied to #2

Once price shatters the #2 price zone, enter at the close of the daily candlestick (or whatever time frame you are using) and use an ATR stop. The average true range stop for this trade would actually be in the middle of the candlestick that printed just before the breakout candlestick.

Trade Setup 3

Each trader should understand this pattern by now so let’s focus on the range that is occurring. We have most variables need for the 1 2 3 trading strategy but price is forming a range near the level at #3.

That is NOT something we want to see for a clean 1 2 3 chart pattern.

When price is basing in this fashion, it shows that the side that was dominant, in this case bulls, have tired. As a trader for years, I have seen the following occur:

- Price trends nicely

- Weakness shows up in this fashion

- Traders will take another run to the upside, break #2 and then see this fail back inside

This formation of the consolidation is also a great trade entry into the potential of the 1 2 3 chart pattern continuing.

Front Running

We can position early in the 1 2 3 formation when we have basing occurring. Ideally, we would like to see some form of basing near the resistance level (red line). You can see the green dashed line and then price rockets to resistance.

That is not conducive to a sustained break of resistance.

The more favorable setup is to have either basing near the extreme or a slight pullback in price which we see with orange box. The break out then occurs after that pullback.

Those types of breaks are more effective and see if you can understand why. Some would think the first break would carry more weight because the drive started midway in the range.

But traders who positioned lower will also look for scalping Forex trades at the top of the range – is that not how you play a range?? Yes. The breakout that occurs is driven by traders who went long at the bottom of the range.

Let’s see some detail in this chart

- Price could not rally far from the low which is showing the 1 2 3 chart pattern – the stair stepping in a trend – is under attack. Price can’t break lows so traders go into range trading mode

- The formation of this smaller range allows traders to position with a tighter stop loss just under the small range.

- You can see there was a drive to this level and then a very weak candlestick shows up. This is either traders positioning short in the range or the longs taking profits.

That is the type of thinking you want to have as a trader. Do not trade blind!

What Is Your Entry Strategy?

As discussed, you can enter at the close of the break out candlestick (signal candlestick) or entering your trading position at a break of the high.

Some traders may want to use a multiple time frame approach and enter on a lower time frame. In my own trading and in my years as a trader, I look to simplify. Entering at close or breaks of support levels or resistance levels (highs and lows of breakout candlesticks) is my favored entry

Taking Your Profits

Some traders would like to see specific price targets to add to their trading plan. Other traders see the power of trailing their stop loss to take as much as the market is willing to give.

You can use structure targets such as higher resistance levels in an uptrend.

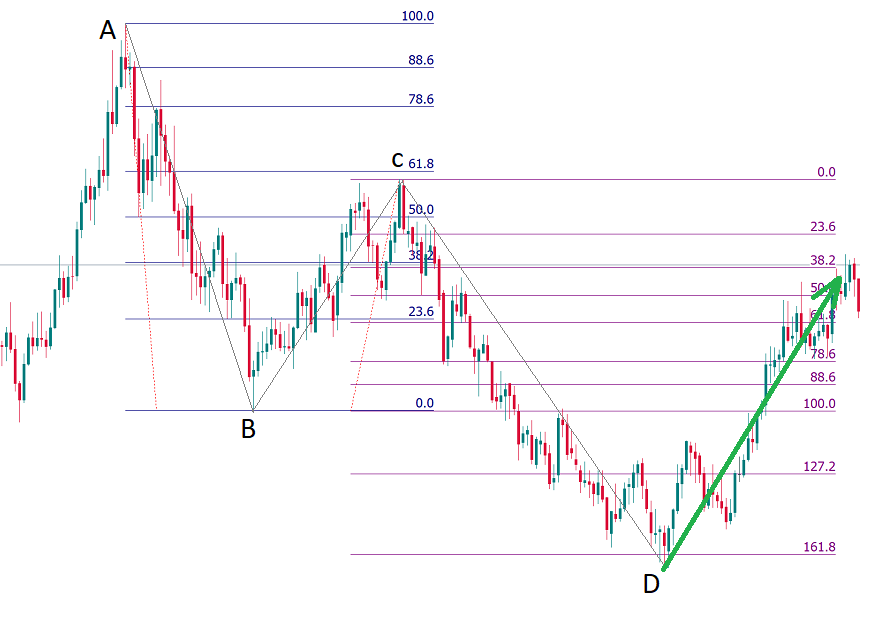

You can use legs 1-2=3-4 which suits the 1 2 3 trading strategy.

One to One Targets

I color coded each swing so you can see where I am measuring from. I use the 3 point Fibonacci tool and set it to the 100%. You can see the first two trades nailed the targets. The third trade hits the .618 Fibonacci level which is quite popular when used to portion out swing points.

Summary

The 1 2 3 trading strategy is a pure price action trading method that uses a sound approach to trading.

No trading indicators are required although I do suggest the ATR for stop loss placement.

You must have a proper risk protocol as part of your trading plan.