By forex21.com

Indicators :

ProFx Bar Close Time

Provides you with information when the actual bar will be closed. Font size and text color can be changed in the settings.

ProFx Moving Average

It’s a customized version of the well known Moving Average indicator. The MA is used to determine the short term momentum and best time to exit trades. Parameters which can be adjusted are Period, Shift, Method (Calculation Method), Applied Price (which price is used for calculation) and Bars Count.

ProFx Heiken Ashi

Instead of regular candle sticks we use Heiken Ashi candles in ProFx because it helps to reduce the ’noise’ on the chart. ‘Bar Count’ can be changed in the settings.

ProFx Strength Oscillator

A proprietary indicator which shows how strong or weak the current up/down price move is. The following parameters can be changed: Period (1-3), Applied price (which price is used for calculation) and Bars Count.

ProFx Multi Analyzes

A proprietary indicator which combines GHL, Woodie CCI, TVI and T3 Slope in one indicator. The indicator is mainly used as confirmation indicator. The indicator is used for signal generation but is not part of the standard template.

ProFx Probability Cloud

A proprietary indicator which provides visual information about market direction. The indicator is used for signal generation and is also part of the ProFx Standard template.

ProFx Better Stochastic

A proprietary indicator which is based on the very popular work of Mr. Lane. The indicator is used to determine possible turning points and to optimize trade entries.

Trading Instruments

ProFx 4.0 is a very flexible trading system and can be used on many different instruments. This includes not only currency pairs but also Indices, Commodities, Virtual Currencies (Bit Coins, Lite Coins, etc.), Stocks and, of course, all sort of derivate instruments such as CFD’S and options. However, if you are new to trading or just started to use ProFx 4.0, it is highly recommended that you use GBPUSD or EURUSD for the first 30 – 90 days. It’s because these are major currency pairs which tend to trend very well. Besides, they offer very high liquidity and the low execution costs.

Money Management Rules

We recommend starting with a risk of 1% per trade. The advantage of using very low risk per trade is that even when to make a few wrong trading decisions, your draw down will be very low. As soon you are 100% familiar with the trading rules you can use a higher risk for trading to boost your profits.

Entry Rules

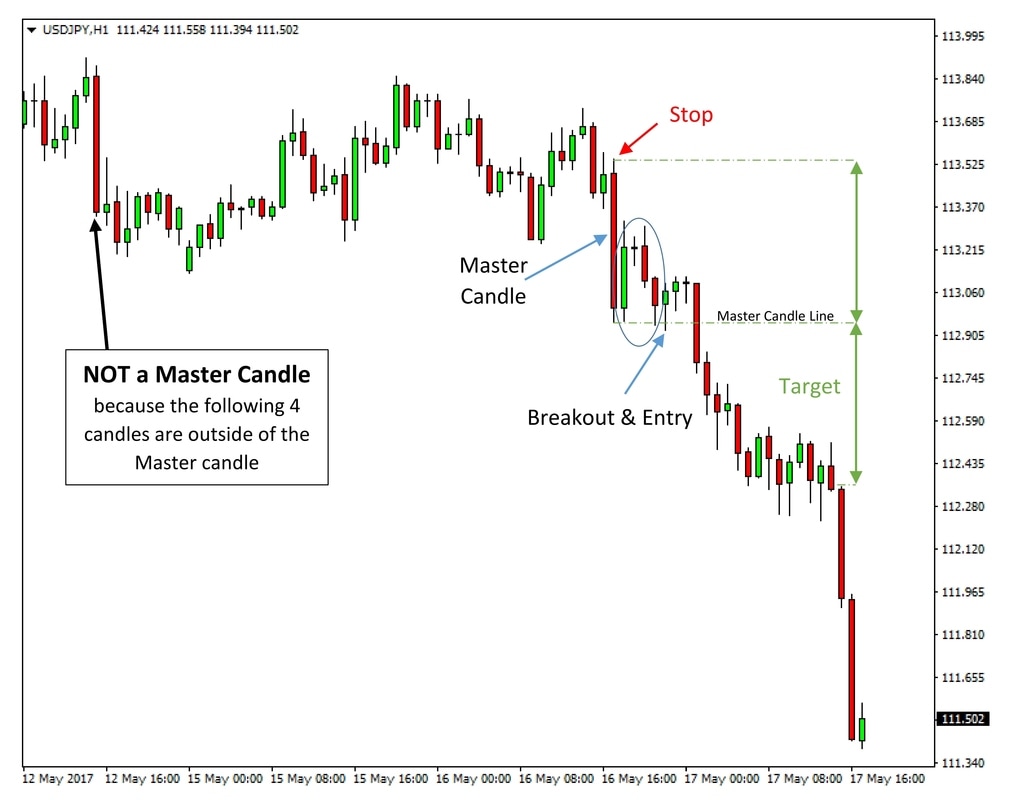

1) ProFx 4.0 signal arrow needs to be shown on the chart.

2) The signal needs to be confirmed by the ProFx 4.0 probability cloud.

3) The signal bar opened below/above the custom moving average.

4) Momentum increases.

5) Direction should be confirmed by higher timeframe chart. (H4 or D1)

6) Signals during the EU/US session are preferred.

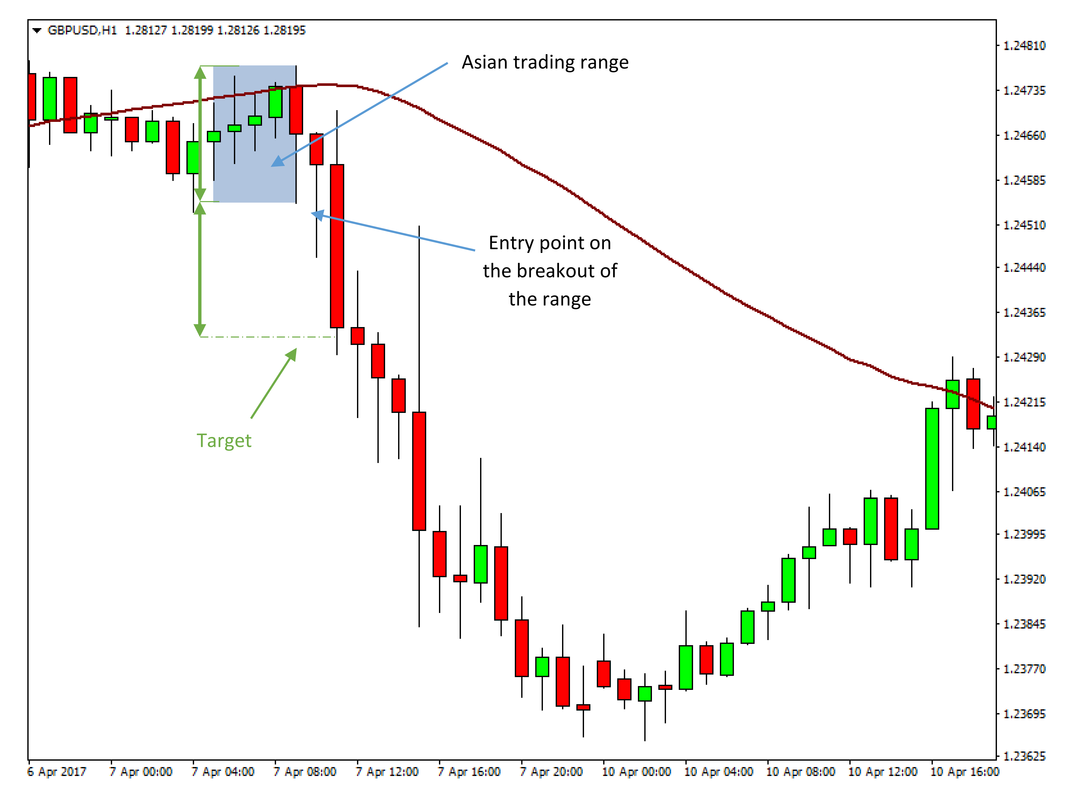

7) Signals which occur during a tight price range should be ignored.

Exit Rules

1) Trades should be kept open as long all indicators confirm that the price will keep rising/falling.

2) When the signal lines of the Strength indicators are crossing (gray), and the heiken ashi candles change from blue to white or vice versa, the trade should be closed.

3) When the price turns quickly because of high impact news, indicators should be ignored, and the trade should be closed immediately.

Timeframe Rules

ProFx 4.0 can be used on any time frames and with many different instruments. However, our experience is that the M30 TF in combination with the H4 TF (trend confirmation) is the best choice.

General Rules :

Do not place more than 1-2 trade per day.

This is also known as “One/Two strike(s) out rule.” It helps to reduce the monitoring time, keeps the psycho-logical pressure at very low level and acts as time filter during market periods with choppy market conditions.

Do not trade during holiday session.

During holidays markets are much more unpredictable. Therefore it is highly recommended not to trade dur-ing holiday sessions such as US, EU national holidays and shortly/after the new year.

Write a trade log for every trade.

Writing down why you entered and exited a trade will help you to increase your trading skills and help you to make the same mistake multiple times.

Decrease SL value before major news to protect your trading account.

Major news are often unpredictable. They can work for and against you. Whenever major news are about to be released, make sure you adjust your SL.

Accept that you cannot be always right.

We have no doubts that when you follow the trading rules that you will be able to generate constant profits using ProFx 4.0. However, in order to succeed you have to accept that you will be not always right and that

there will be periods where you have to deal with draw downs. Only when you accept that and stick to the trading rules during difficult market conditions you will succeed as currency trader.

Trade with the Trend

Every trader knows the saying “The trend is your friend.”. Keep it in mind when placing a trade.

Free Download