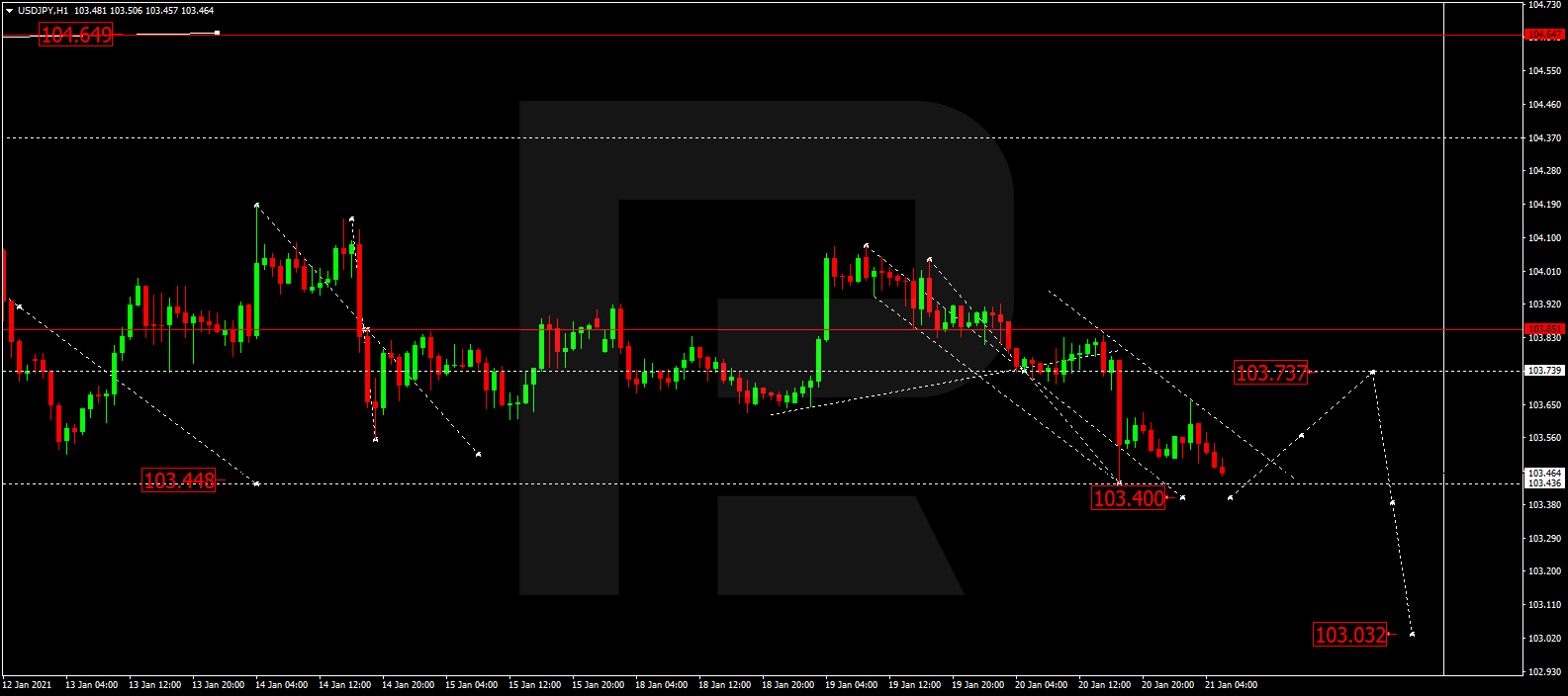

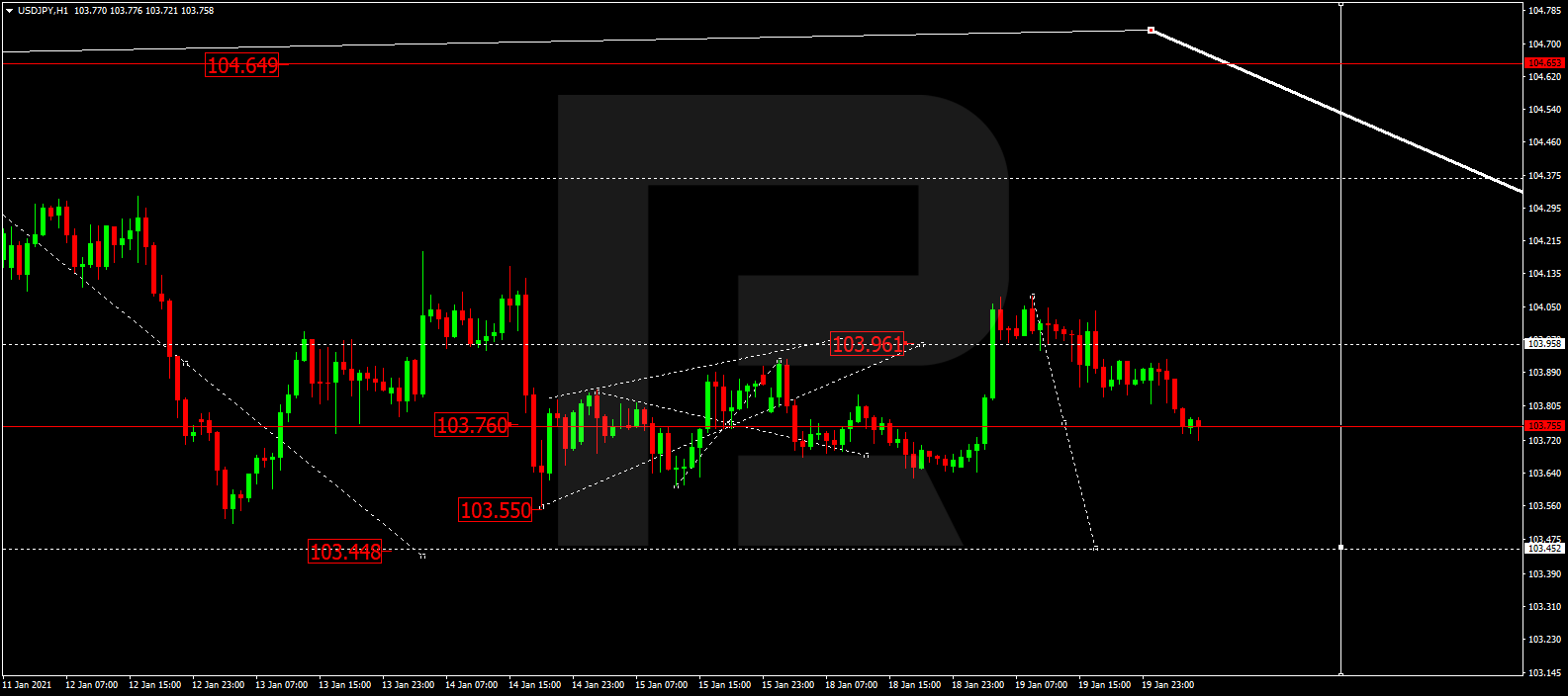

The Yen is back to growing. Overview for 21.01.2021

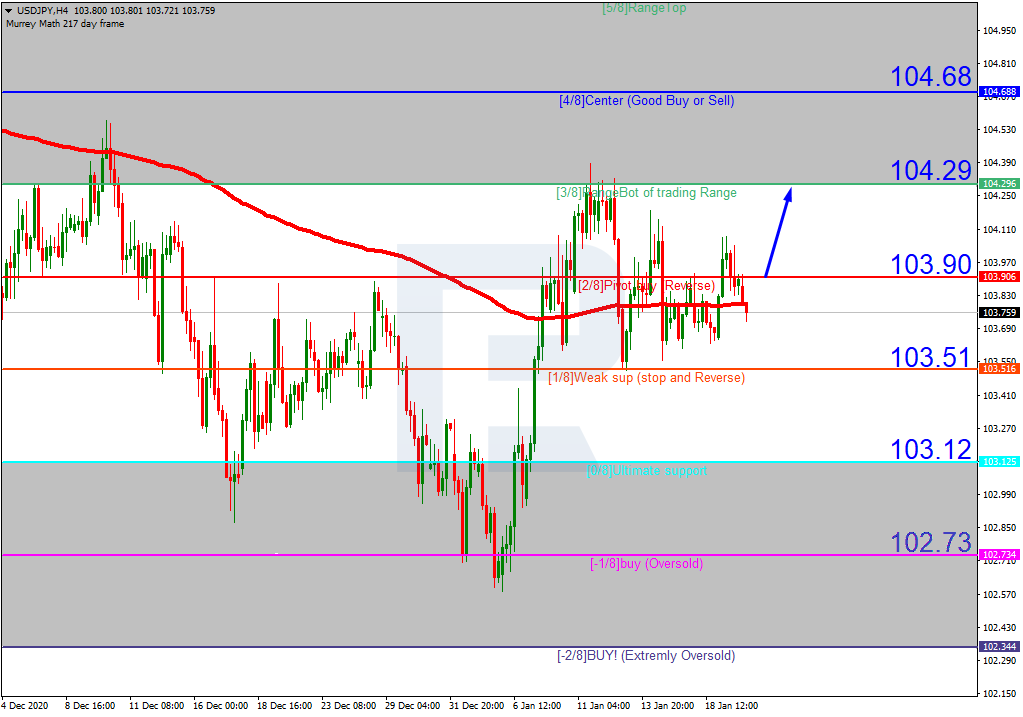

USDJPY started moving downwards yesterday and this decline is looking quite confident today.

The Japanese Yen is significantly rising against the USD on Thursday afternoon. The current quote for the instrument is 103.41.

As a rule, the demand for the Japanese currency grows when financial markets require “safe haven” assets. Probably, this is what happening right now – the pandemic isn’t over, the coronavirus continues spreading.

On Thursday, the Bank of Japan had its first meeting this year and kept the interesting rate unchanged at -0.1%. No one expected any revisions – the Japanese regulator is very conservative in its monetary moves and believes that the country’s economy has some underlying strength.

At the same time, the BoJ revised its expectations relating to the GDP in 2020, from 3.6% to 3.9%. the regulator is obviously waiting for a positive effect of the stimulus program implemented by the government.

On the other hand, the regulator sees a possibility of risk aggravation for the Japanese economy. First of all, it’s about the implementation of new quarantine restrictions aimed at fighting the coronavirus pandemic in the future. They may wreck the economic recovery plan and lead the economic system deeper into a recession.

The Yen usually doesn’t respond to politics, statistics, or fiscal news but the current strengthening may somehow be connected to the specific tone of the BoJ.