29.10.2019

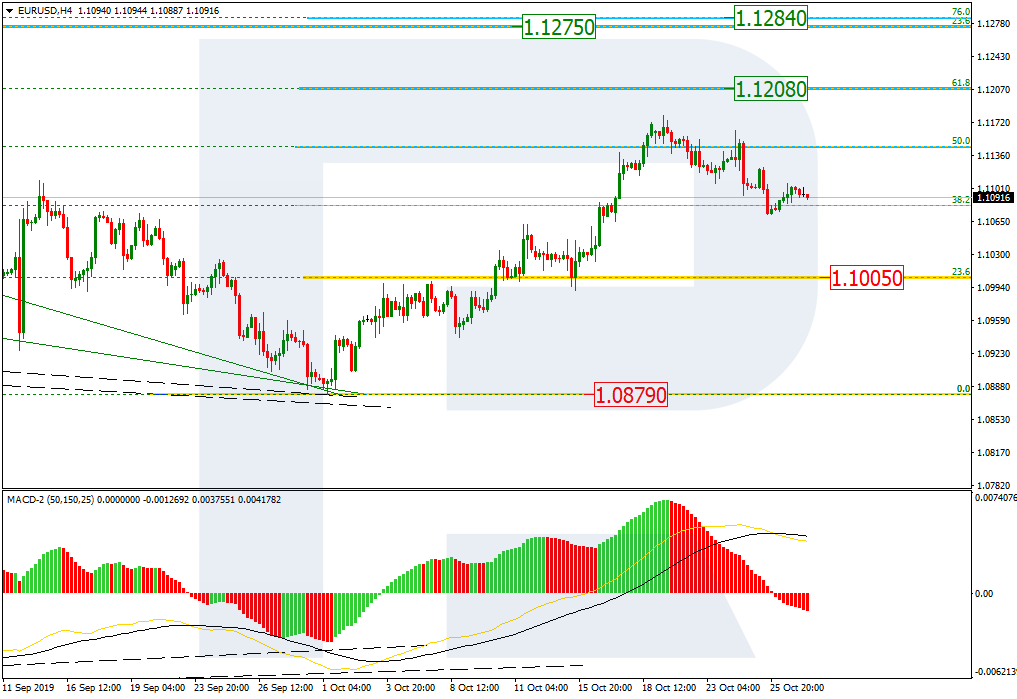

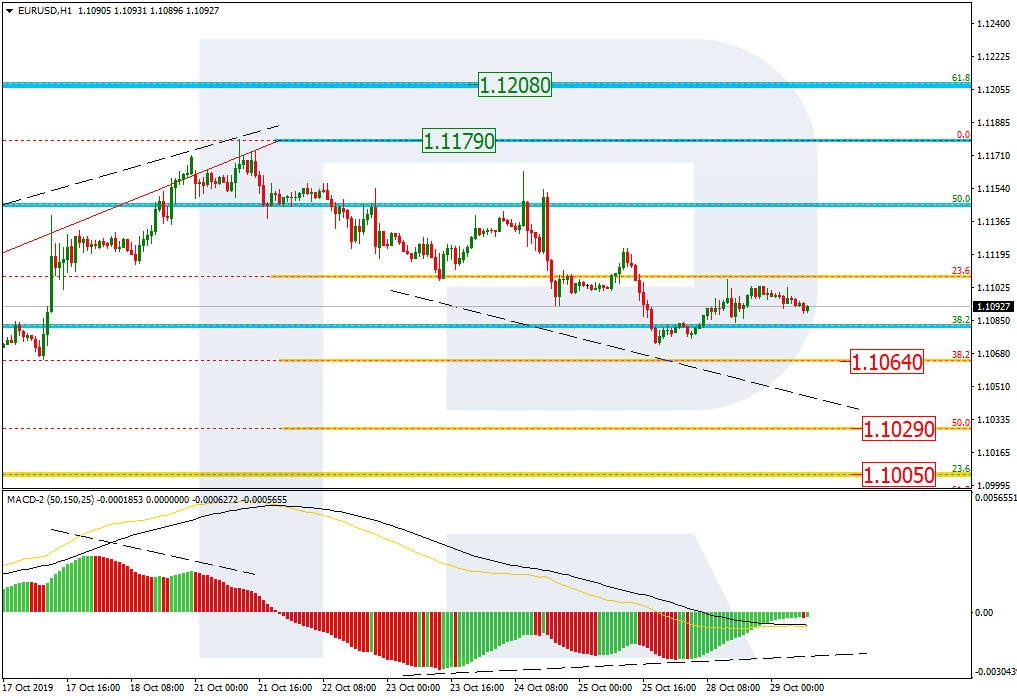

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, after reaching 50.0% fibo, EURUSD is correcting to reach the local support, which is 23.6% fibo at 1.1005. After finishing this descending correction, the pair may start a new wave to the upside to reach 61.8% and 76.0% fibo at 1.1208 and 1.1248 respectively. however, one should pay attention to long-term 23.6% fibo at 1.1275. If the price reaches this level, the instrument may reverse the current long-term tendency..

The H1 chart shows the more detailed structure of the current descending correction tendency that started after the divergence. Right now, the pair is getting closer to 38.2% fibo at 1.1064, while the next downside target may be 50.0% fibo at 1.1029. At the same time, there is a convergence on MACD. The resistance is the high at 1.1179.

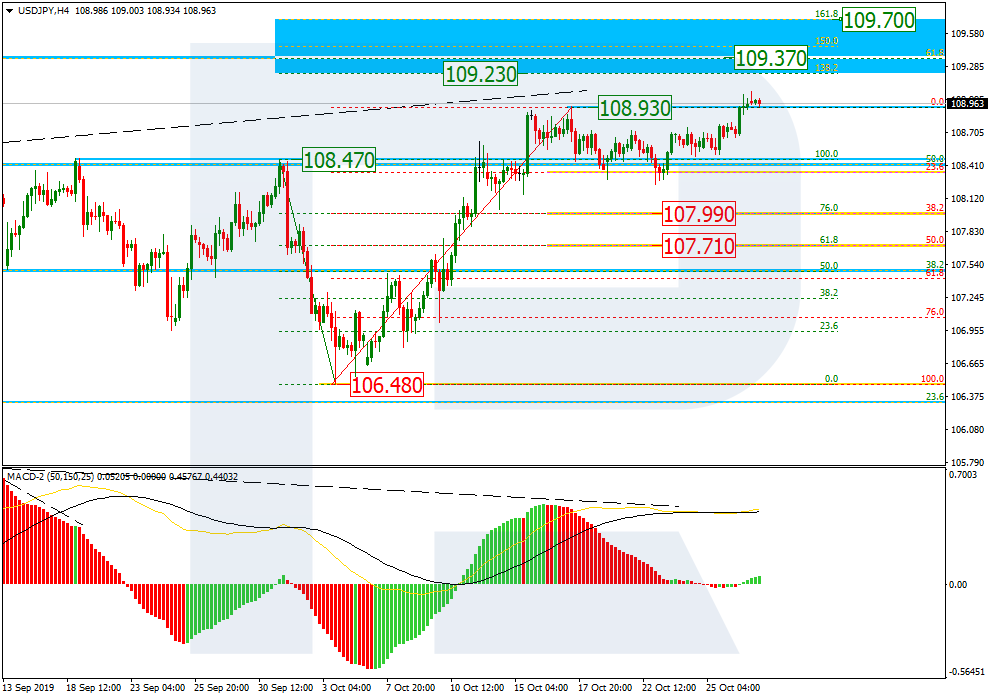

USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the H4 chart, after completing the correction at 23.6% fibo and breaking the previous high, USDJPY is trying to fix above it to continue forming the rising tendency. The next upside targets are inside the post-correctional extension area between 138.2% and 161.8% fibo at 109.23 and 109.70 respectively; mid-term 61.8% fibo at 109.37 is also there. The key support is still at 106.48.

In the H1 chart, after breaking the high, the pair is slowing down. The target may be the downside border of the post-correctional extension area between 138.2% and 161.8% fibo at 109.23 and 109.70 respectively.