Murrey Math Lines 24.12.2020 (USDCHF, GOLD)

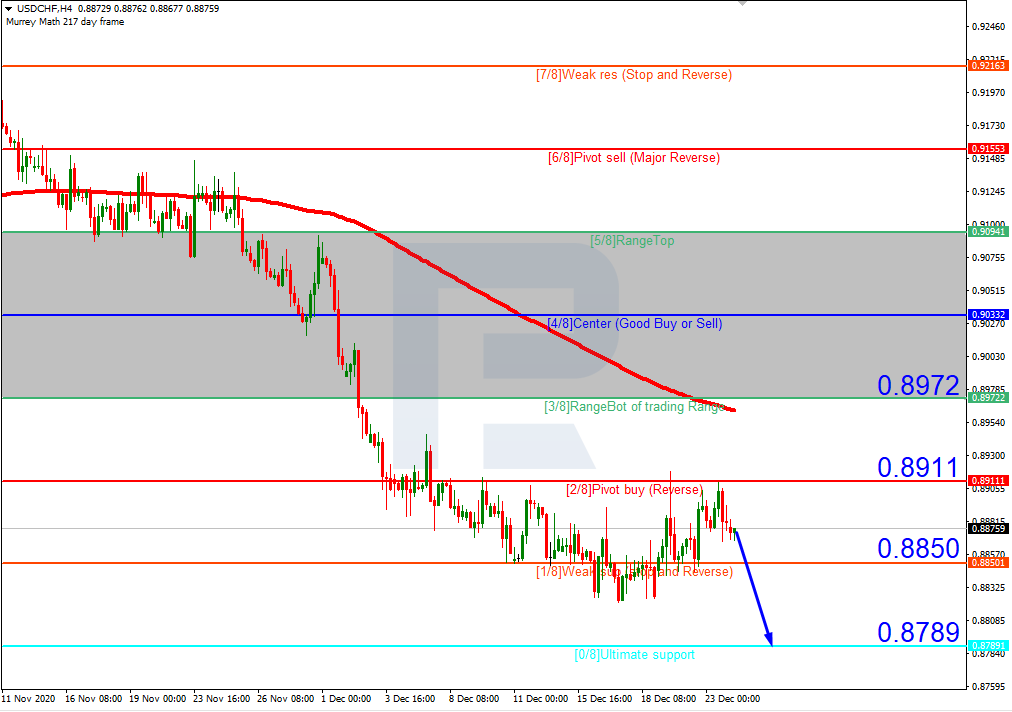

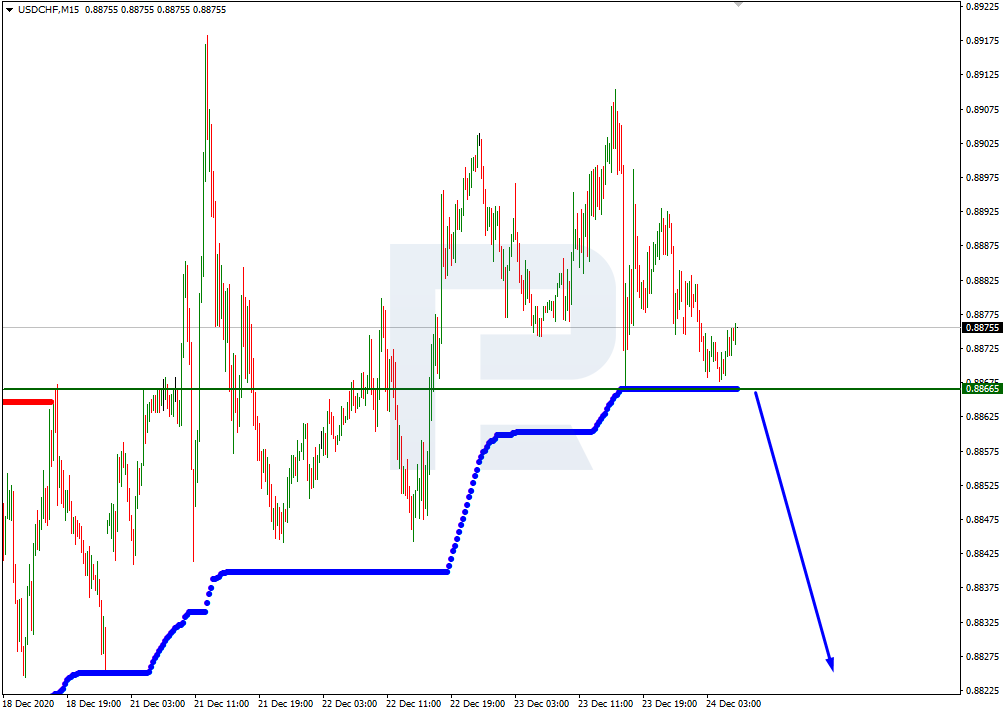

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the H4 chart, USDCHF is moving below the 200-day Moving Average, thus indicating a descending tendency; a rebound from 2/8 earlier is another signal in favor of further decline. In this case, the price is expected to continue falling to reach the support at 0/8. Still, this scenario may no longer be valid if the price breaks 2/8 to the upside. After that, the instrument may reverse and correct towards the resistance at 3/8.

In the M15 chart, the pair may break the downside line of the VoltyChannel indicator and, as a result, continue the descending tendency.

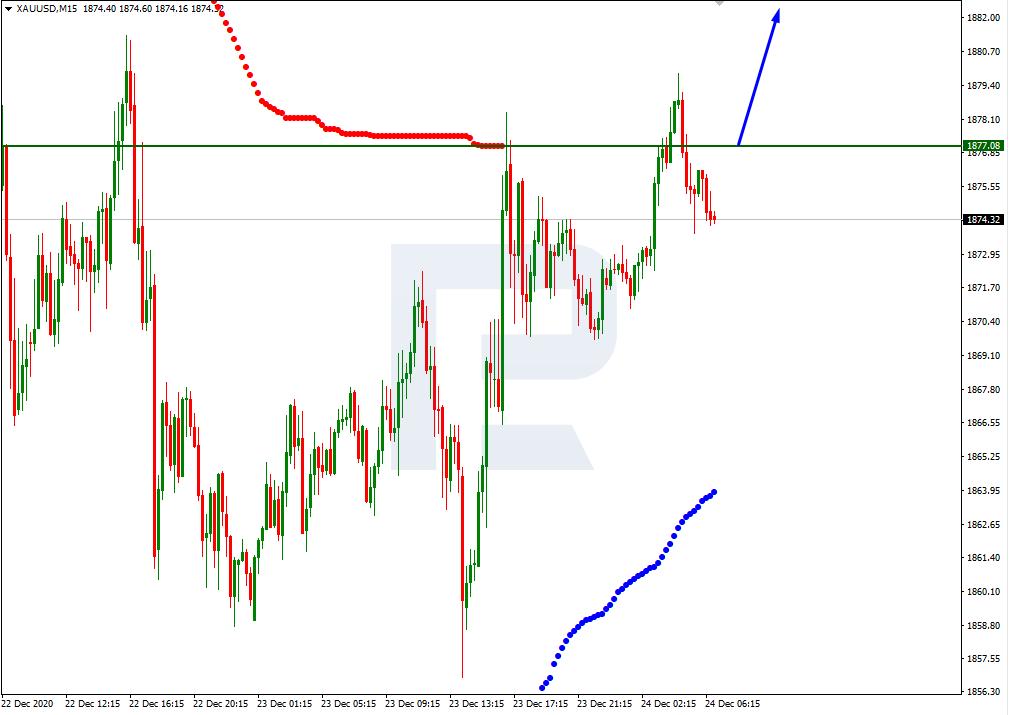

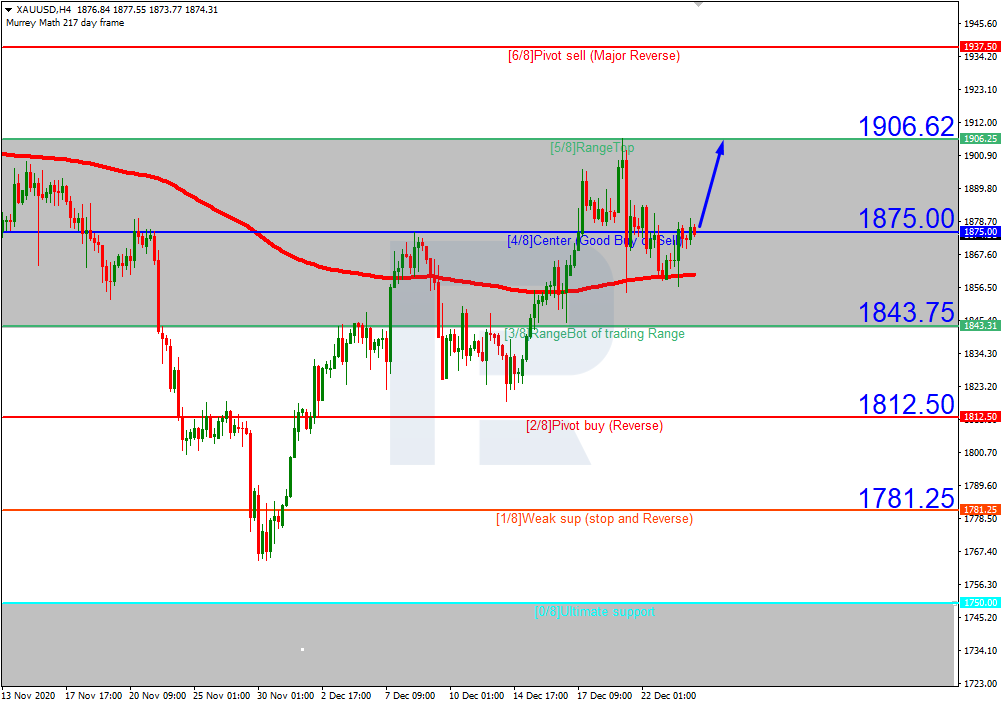

XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, the 200-day Moving Average has been broken, thus reversing the tendency to the upside. In this case, the price is expected to continue growing to reach the resistance at 5/8. However, this scenario may no longer be valid if the price breaks the support at 3/8 to the downside. After that, the instrument may continue falling towards 2/8.

In the M15 chart, the price may break the upside line of the VoltyChannel indicator again and, as a result, may continue growing to reach 5/8 from the H4 chart.