Murrey Math Lines 12.02.2021 (Brent, S&P 500)

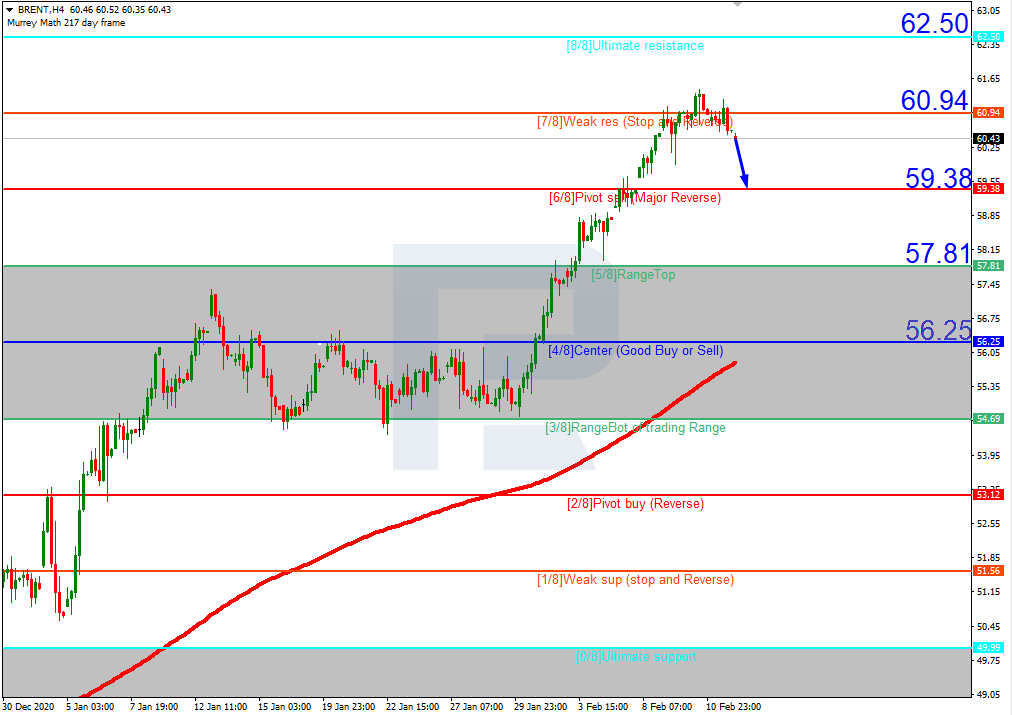

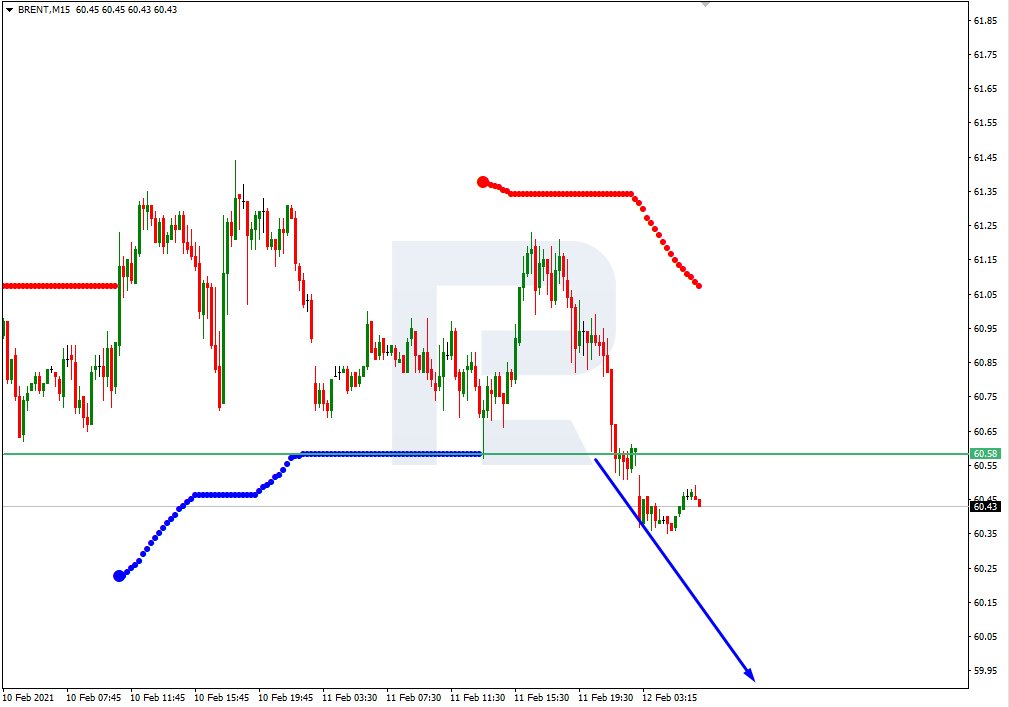

BRENT

In the H4 chart, Brent is trading above the 200-day Moving Average, thus indicating an ascending tendency. However, the asset has failed to fix above 7/8. In this case, the pair is expected to continue the correction to reach the closest support at 6/8. However, this scenario may no longer be valid if the price breaks the resistance at 7/8 to the upside again. After that, the instrument may continue growing towards 8/8.

As we can see in the M15 chart, the price has broken the downside line of the VoltyChannel indicator and, as a result, may continue the descending tendency.

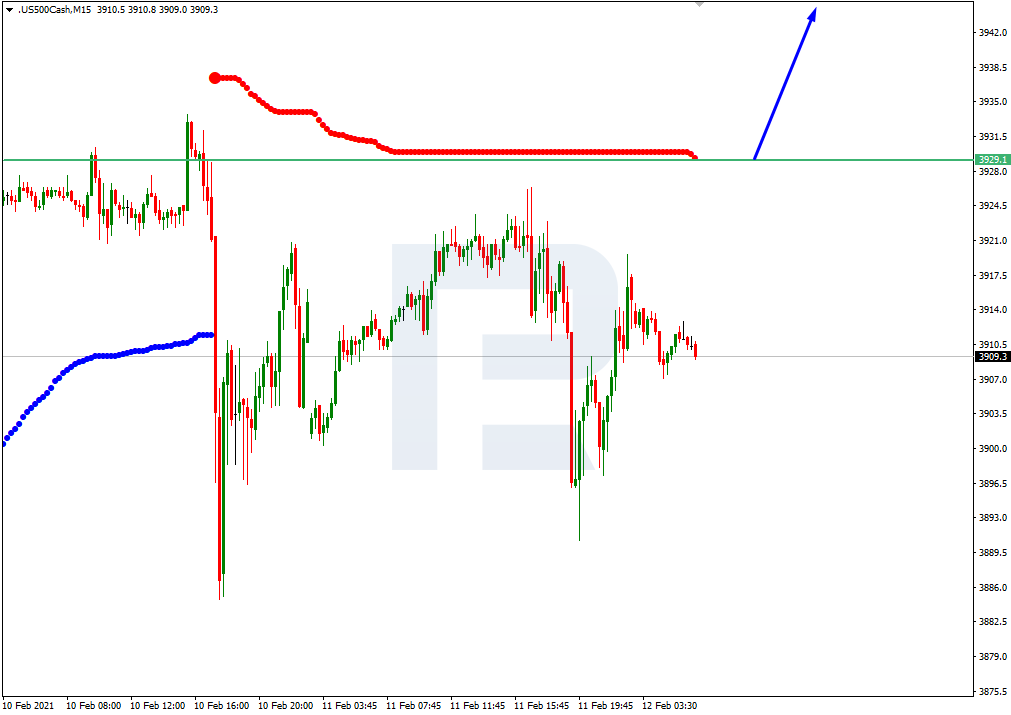

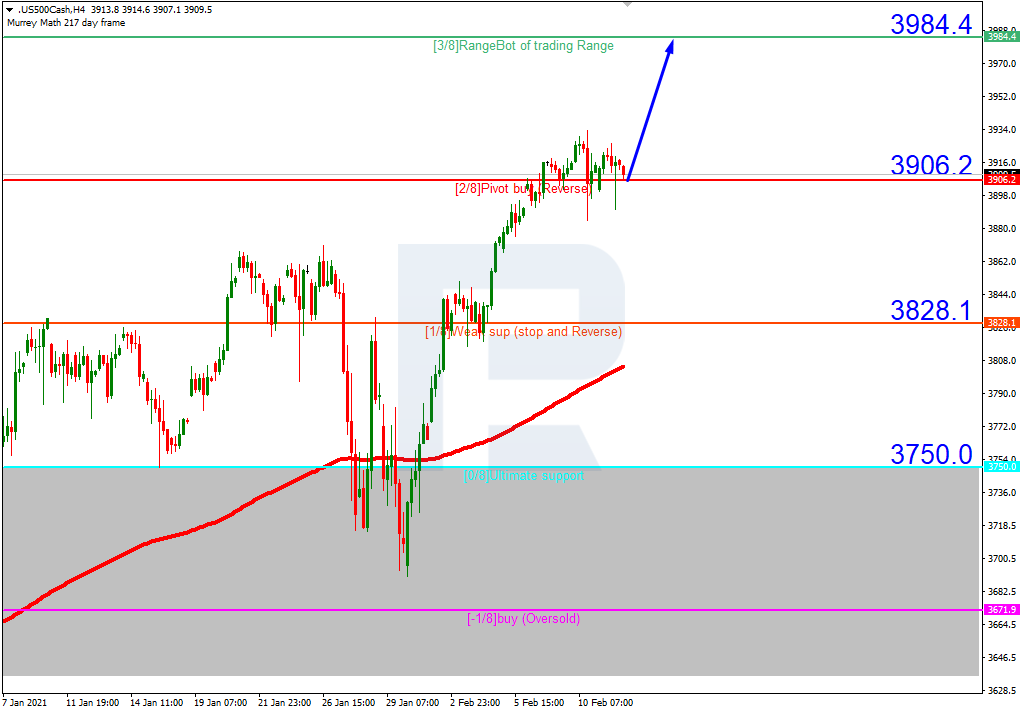

S&P 500

As we can see in the H4, the S&P Index is trading above the 200-day Moving Average and has already fixed above 2/8. In this case, the asset is expected to continue growing towards the next resistance at 3/8. However, this scenario may no longer be valid if the price break 2/8 to the downside. After that, the instrument may fall to reach the support at 1/8.

In the M15 chart, the price may break the upside line of the VoltyChannel indicator and, as a result, continue its growth.