Fibonacci Retracements Analysis 21.11.2019 (AUDUSD, USDCAD)

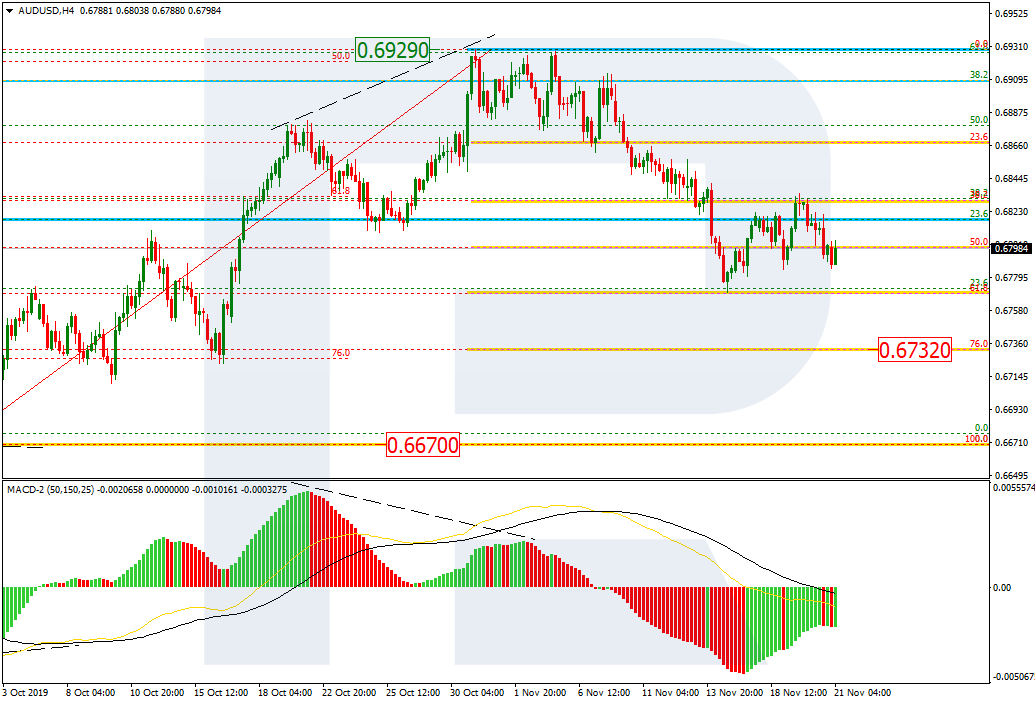

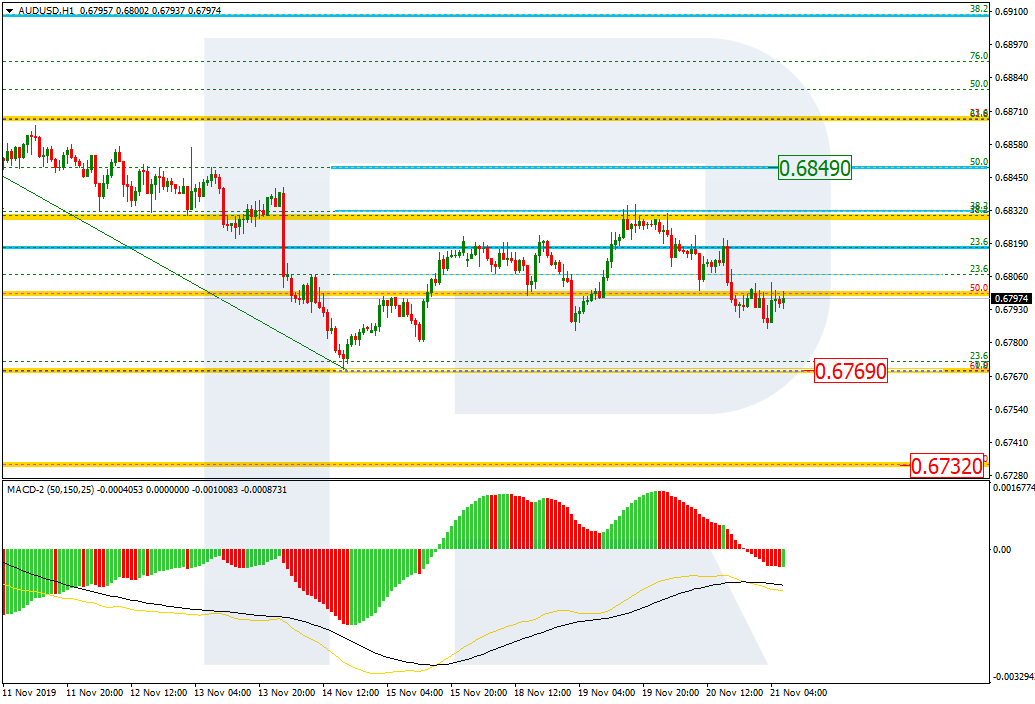

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, after completing the descending wave, AUDUSD is correcting towards 61.8%. In the future, the price is expected to finish the pullback and resume falling to reaсh 76.0% fibo at 0.6732. However, the key downside target is the fractal low at 0.6670.

The H1 chart shows more detailed structure of the current correctional uptrend, which has already reached 38.2% fibo. Despite the local decline towards the low at 0.6769, the pair may yet form a new ascending impulse to reach 50.0% fibo at 0.6849.

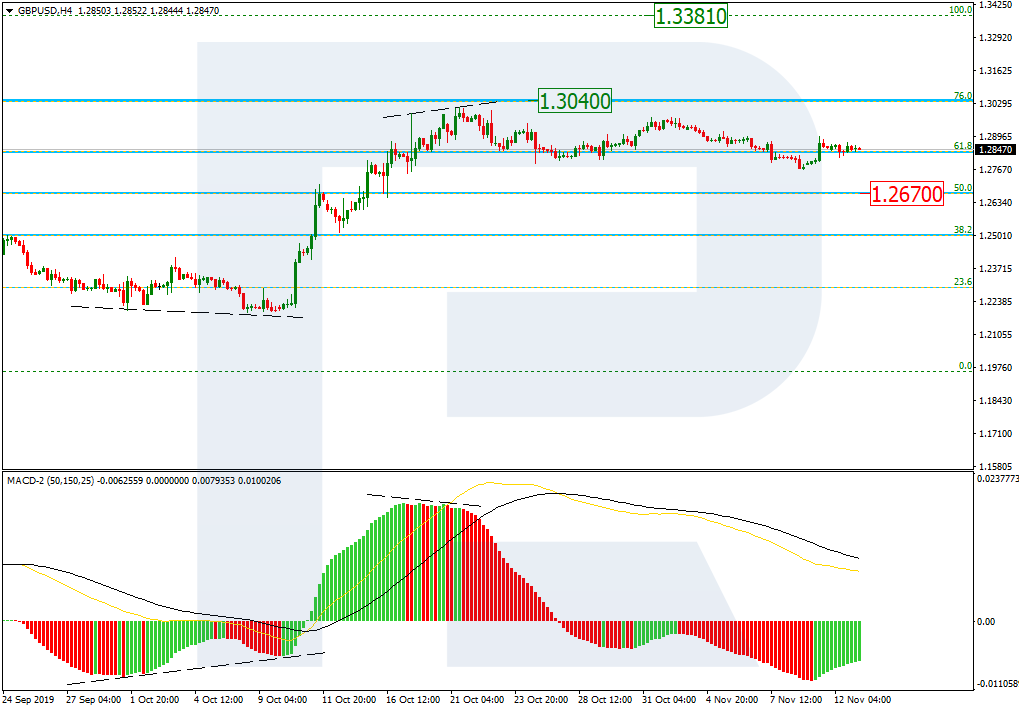

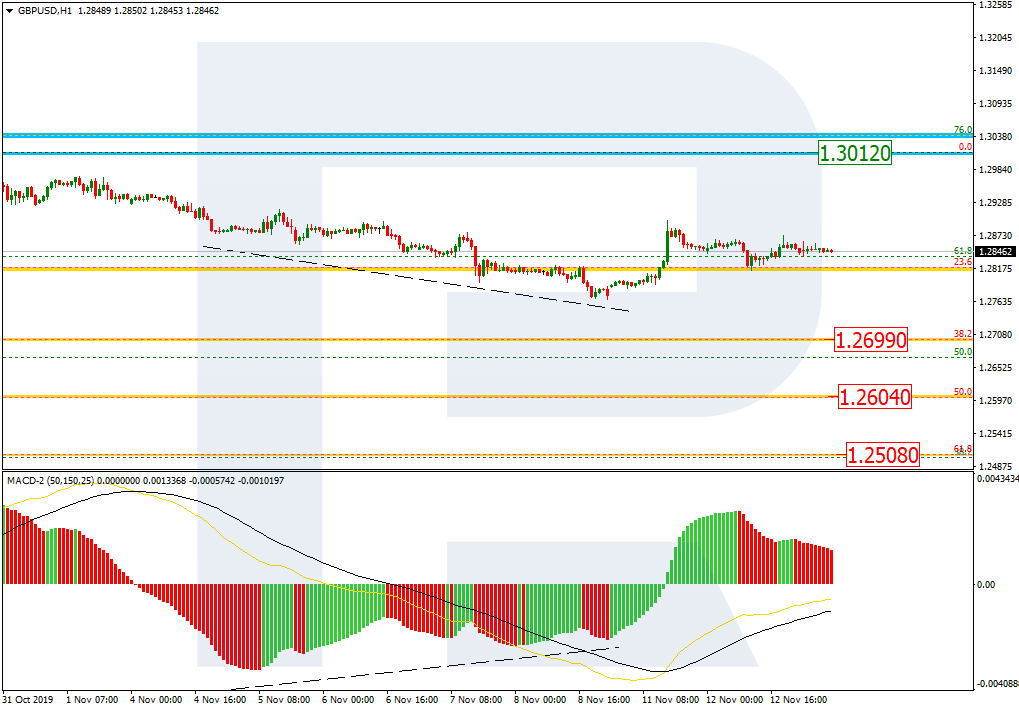

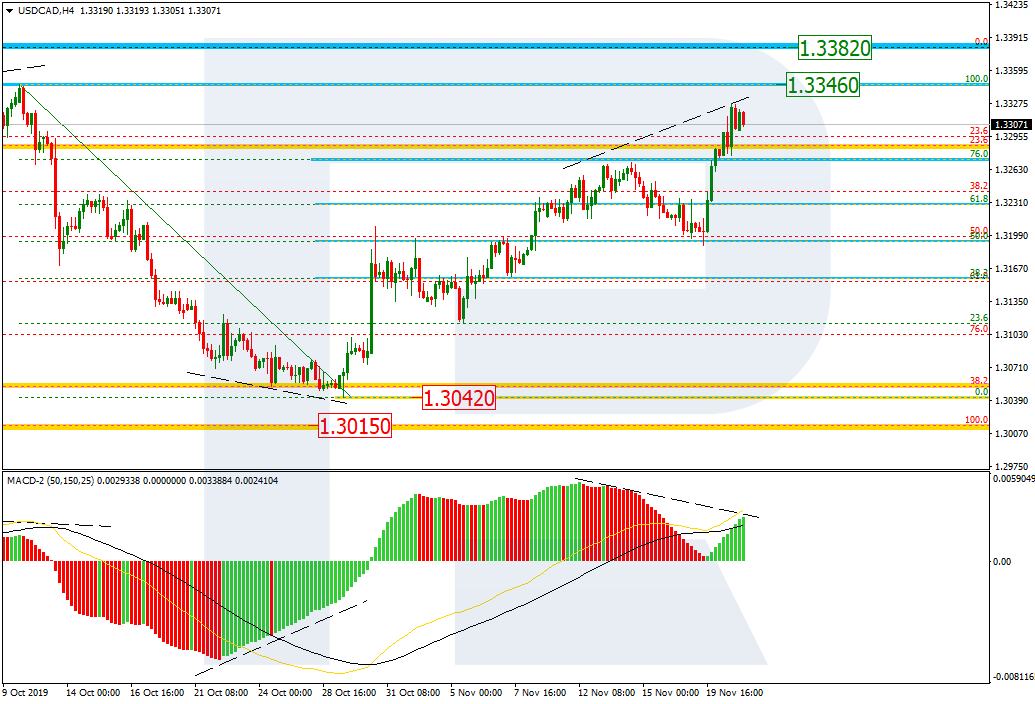

USDCAD, “US Dollar vs Canadian Dollar”

As we can see in the H4 chart, USDCAD continues forming the ascending tendency towards fractal highs at 1.3346 and 1.3386. After breaking 76.0% fibo at 1.3274, the pair has formed a local support there. At the same time, while the pair is moving towards the highs, there is a divergence on MACD, which may indicate a possible pullback soon.

In the H1 chart, the pair is starting a new correction to the downside with the targets at 23.6%, 38.2%, and 50.0% fibo at 1.3295, 1.3275, and 1.3259 respectively.