NZDUSD SELL-0.65851

SL-0.66257

TP1-0.65692

TP2-0.65528

GBPUSD SELL-1.26648

SL-1.26953

TP1-1.26453

TP2-1.26260

NZDJPY SELL-71.055

SL-71.410

TP1-70.844

TP2-70.617

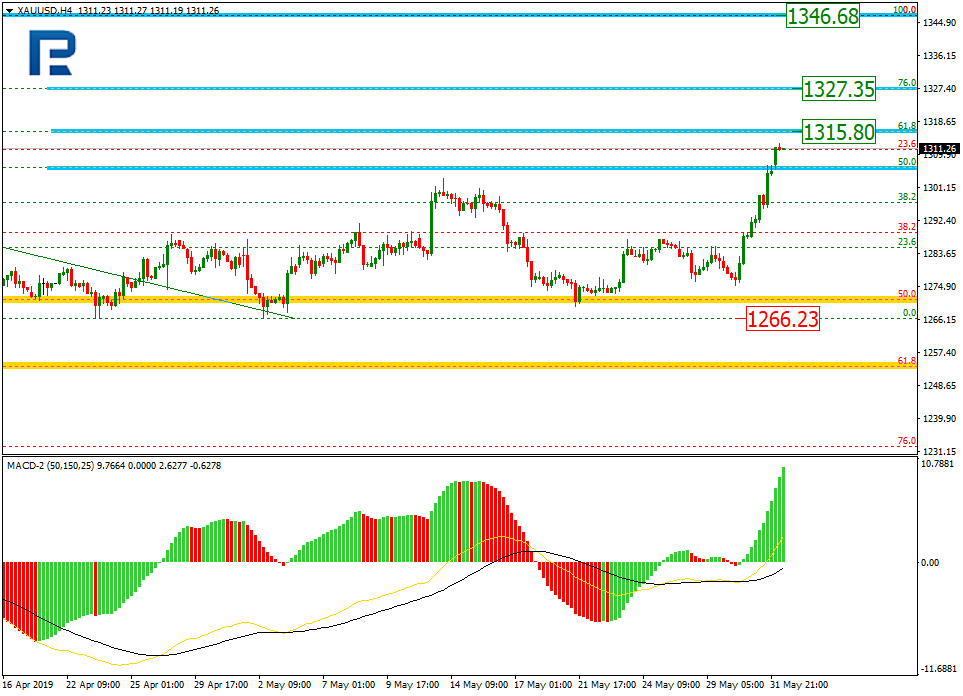

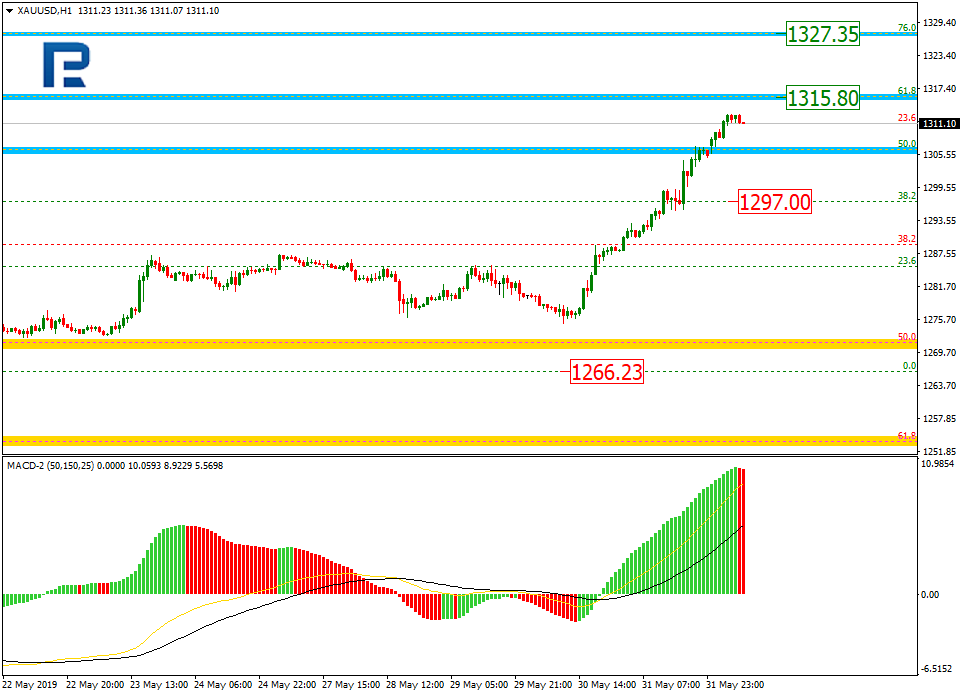

GOLD SELL-1323.45

SL-1329.79

TP1-1320.87

TP2-1317.65

GBPAUD SELL-1.81428

SL-1.81812

TP1-1.81209

TP2-1.80945

GBPCAD SELL-1.69968

SL-1.70387

TP1-1.69729

TP2-1.69439

GBPNZD SELL-1.92014

SL-1.92436

TP1-1.91776

TP2-1.91537

GBPJPY SELL-136.675

SL-137.019

TP1-136.518

TP2-136.381

GBPCHF SELL-1.25613

SL-1.25999

TP1-1.25432

TP2-1.25212

USDJPY BUY -108.084

SL-107.719

TP1-108.312

TP2-108.530

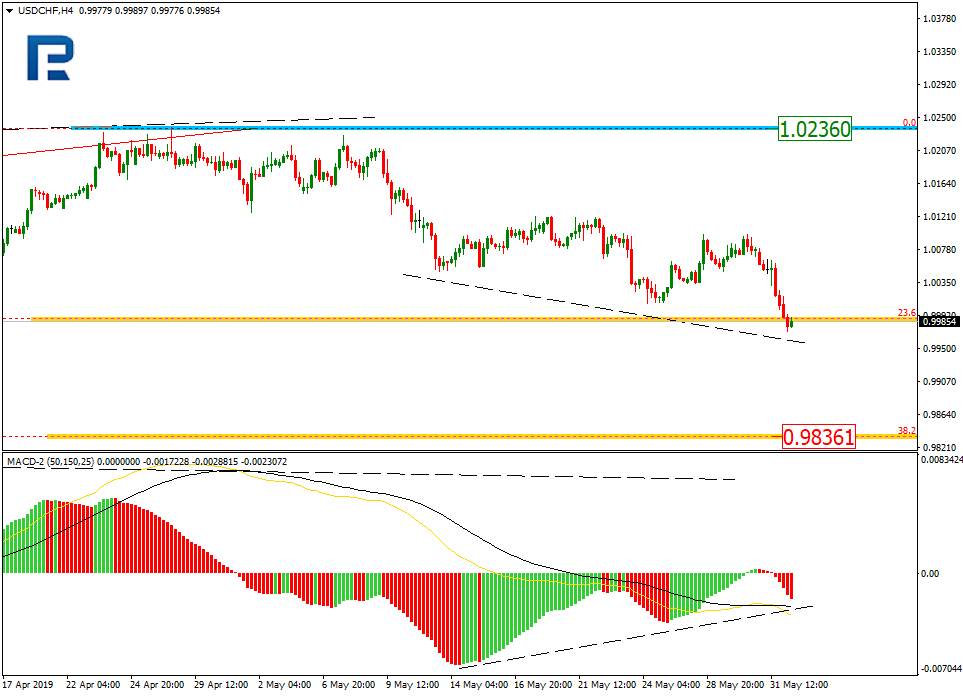

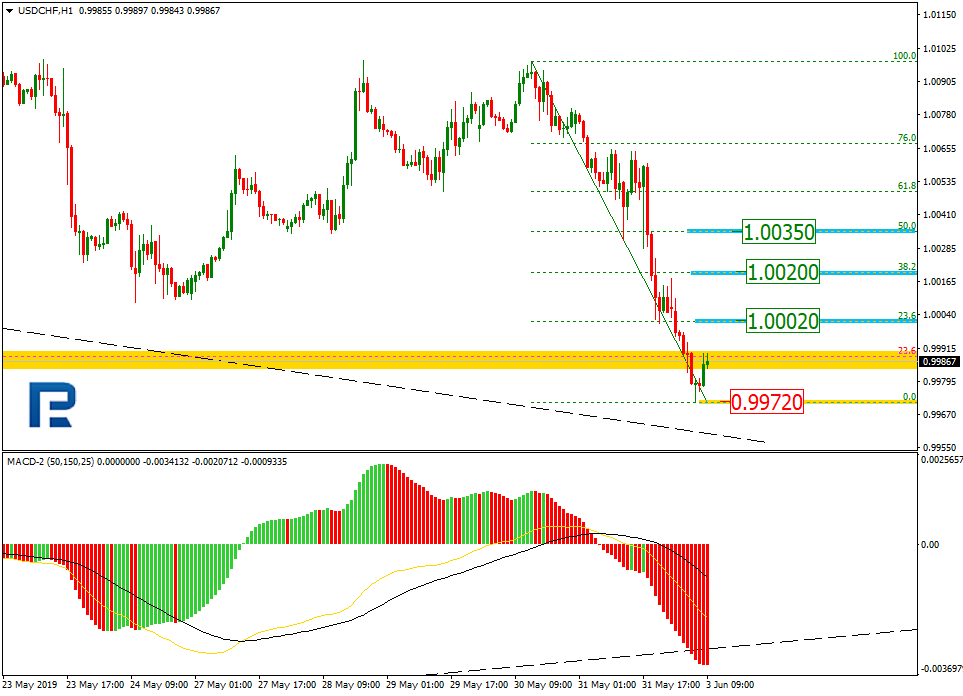

USDCHF BUY -0.99377

SL-0.99054

TP1-0.99604

TP2-0.99847