GBPUSD SELL-1.26315

SL-1.26741

TP1-1.26103

TP2-1.25907

USDJPY SELL-109.134

SL-109.519

TP1-108.920

TP2-108.723

USDCHF SELL-1.00595

SL-1.00924

TP1-1.00403

TP2-1.00252

AUDUSD SELL-0.69132

SL-0.69491

TP1-0.68954

TP2-0.68779

NZDUSD SELL-0.65176

SL-0.65616

TP1-0.64940

TP2-0.64692

GBPCHF SELL-1.27046

SL-1.27444

TP1-1.26816

TP2-1.26600

NZDJPY SELL-71.209

SL-71.560

TP1-70.926

TP2-70.684

AUDNZD BUY -1.06090

SL-1.05744

TP1-1.06240

TP2-1.06372

CADJPY SELL-80.818

SL-81.177

TP1-80.603

TP2-80.391

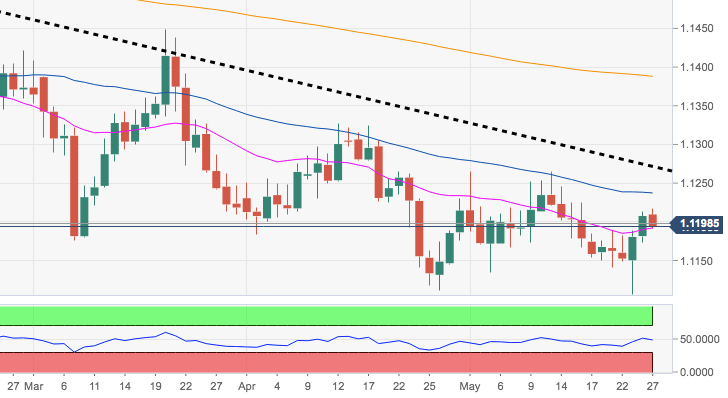

EURUSD SELL-1.11521

SL-1.11812

TP1-1.11381

TP2-1.11230

cryptocurrency #bitcoin #news #fx #education

business #today #btc #blockchain #ethereum #ico

love #tech #rating #oil #daytrading #rfxsignals

RESULT

Yesterday GBPUSD SELL SIGNAL Reaches Target 1 and we got 20 pips profit now 🙂

Yesterday EURUSD SELL SIGNAL Reaches Target 2 and we got 30 pips profit now 🙂