Top 10 Forex Signal Providers in 2025 (Ranked & Reviewed)

Last Updated: July 2025

With thousands of traders joining the forex market daily, reliable forex signals can give a massive edge — especially for beginners or those short on time. In this post, we rank the top 10 forex signal providers in 2025, based on:

- ✅ Accuracy of signals (win rate)

- ✅ Global user reviews

- ✅ Transparency

- ✅ Support & education

- ✅ Signal delivery (Telegram, Email, MT4)

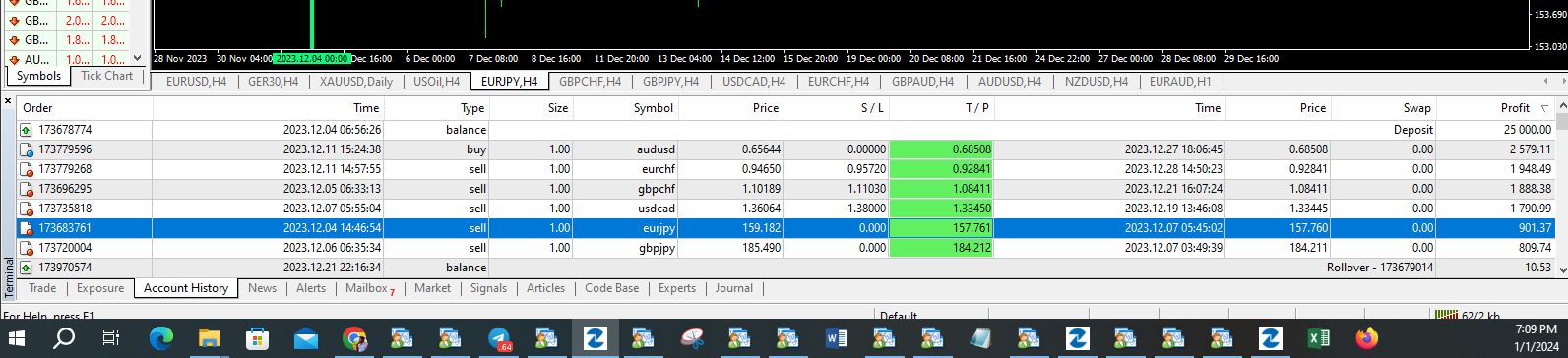

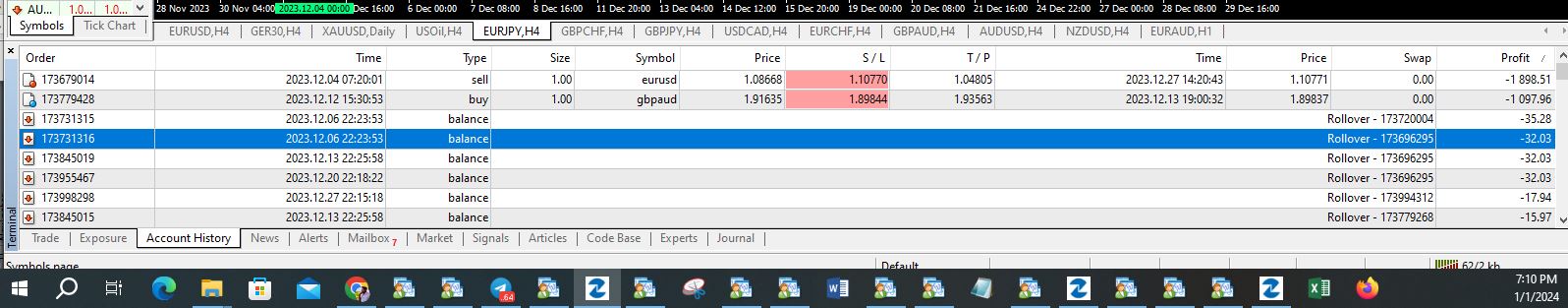

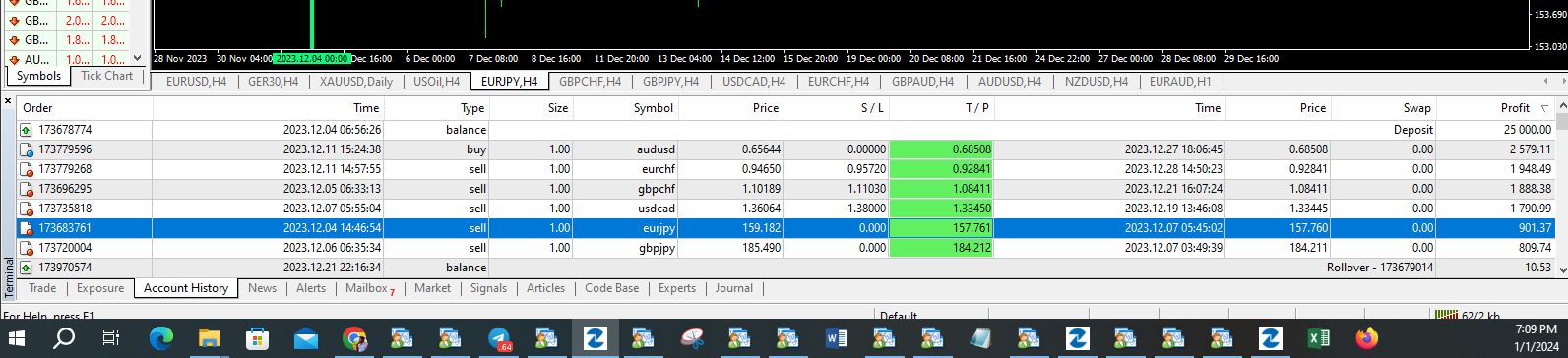

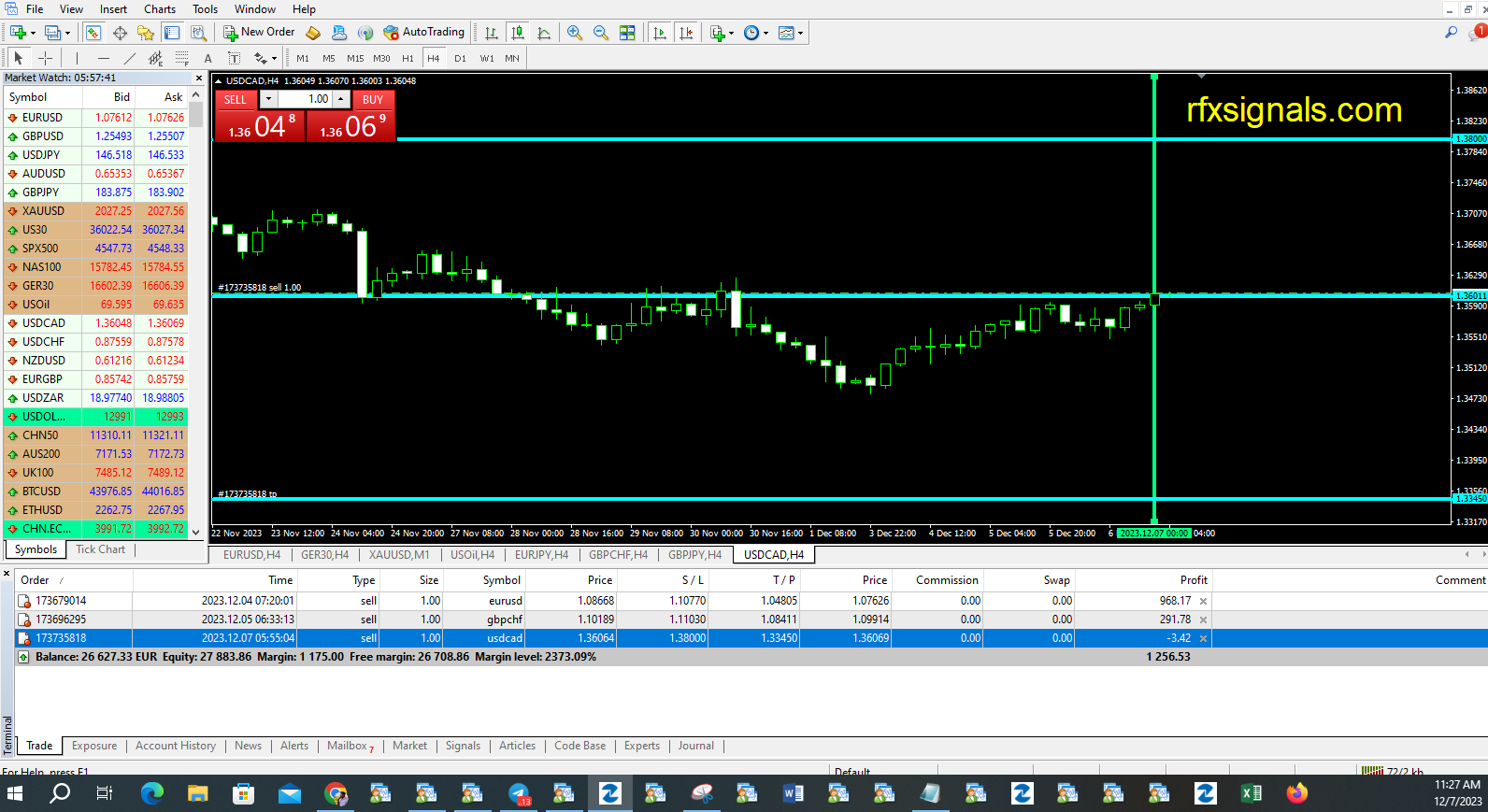

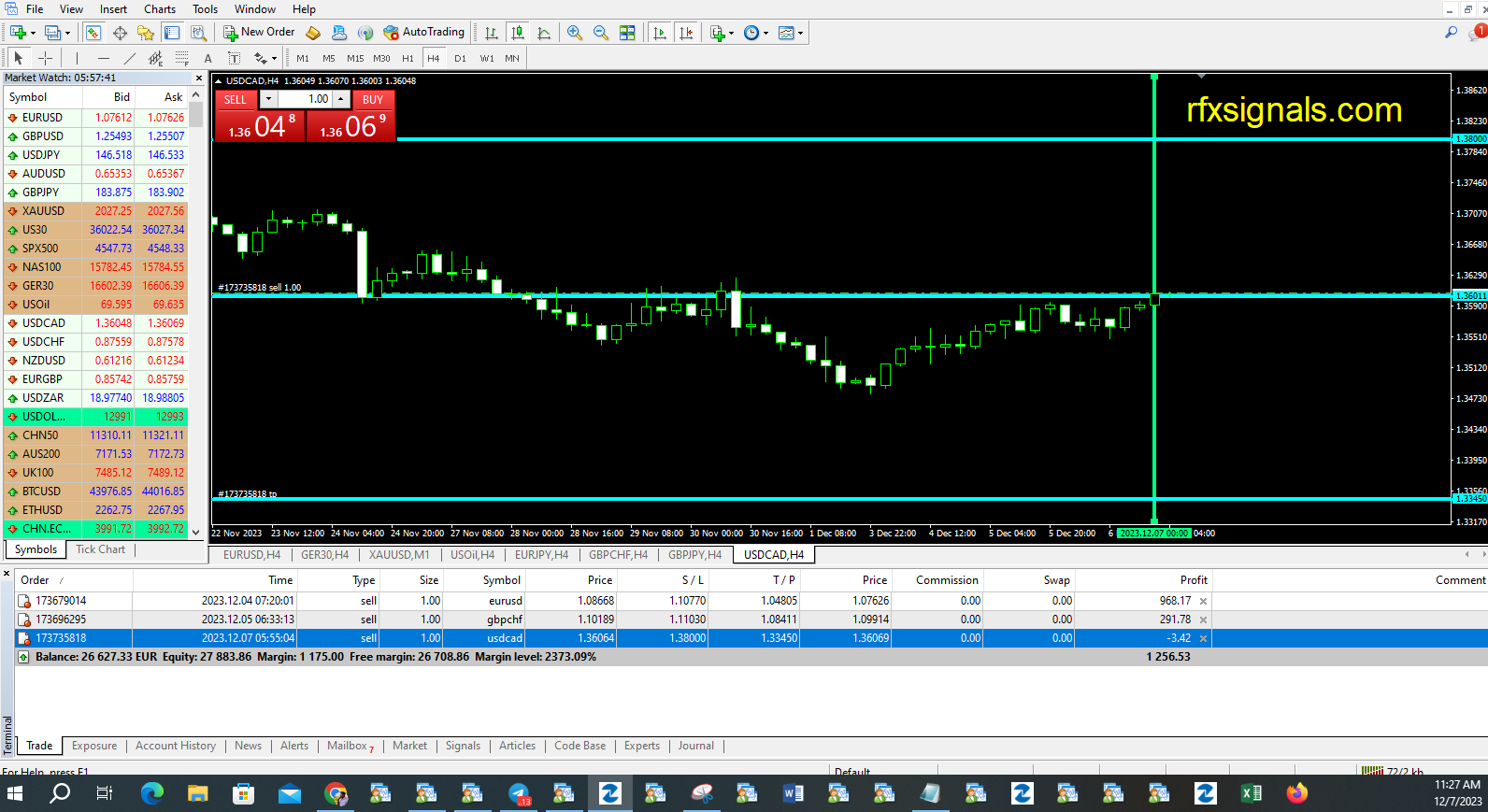

1. RFXSignals.com – Most Accurate XAUUSD (Gold) Signals

- Accuracy: 85–90% (XAUUSD focused)

- Delivery: Telegram + Web + EA integration

- Best For: Traders who want gold-specific scalping/swing signals

- Free Trial: ✅ Yes – Telegram group

- VIP Plans: Starting at $29/month

Why RFXSignals Stands Out: Focuses only on XAUUSD – arguably the most volatile, profitable pair. Uses a hybrid approach: manual analysis + AI-based logic. Trade setups are shared with full TP/SL logic, charts, and recovery plans. Works well even in news conditions.

👉 Join Free Telegram Group »

👉 Visit RFXSignals.com »

2. ForexSignals.com – Best for Education + Signals

- Accuracy: 70–80%

- Delivery: App + Telegram + Web

- Free Trial: ❌

- VIP Plans: $97/month

Offers a full trading room, live analysis, and mentoring with signals.

3. Learn 2 Trade – Affordable Signals + Auto Copy

- Accuracy: 70%

- Delivery: Telegram

- Free Trial: ✅

- VIP Plans: $35/month

Popular among Nigerian and UK traders.

4. Pips Alert

- Accuracy: 65–75%

- Delivery: Telegram

- Free Trial: ❌

- VIP Plans: $50+/month

5. 1000pip Builder

- Accuracy: 70–85%

- Delivery: Email

- Free Trial: ❌

- VIP Plans: $97/month

6. FXPremiere

- Accuracy: 65–70%

- Delivery: Telegram

- VIP Plans: $37/month

7. GoldSignals.io

- Accuracy: 75–85%

- Delivery: Telegram

- VIP Plans: $40/month

8. Daily Forex

Offers free signals and educational content through the website. Accuracy varies depending on contributor.

9. Signals Factory

Community-driven free signals on Telegram. Suitable for beginners but lacks consistency and risk control.

10. MegaFX Signals

- Accuracy: 70%

- Delivery: Telegram

- Best For: Asian session trades

🧠 Final Thoughts: Which Forex Signal Provider is Best?

| Provider | Accuracy | Focus | Free Trial | Best For |

|---|---|---|---|---|

| RFXSignals | ✅ 85–90% | XAUUSD | ✅ | Gold traders |

| ForexSignals.com | 70–80% | All pairs | ❌ | Beginners |

| Learn 2 Trade | ~70% | Mixed | ✅ | Budget users |

| GoldSignals.io | ~85% | Gold | ❌ | Swing traders |

🚀 Ready to Start?

📢 Join RFXSignals’ Free Telegram Group for live updates, trade setups, and VIP previews:

👉 Click to Join Now »

🔐 Want full access to VIP signals with high precision, automated backup strategy, and visual charts?

👉 Visit RFXSignals.com »