✍️ Meta Description:

Discover the ideal risk-reward ratio in forex trading for 2025. Learn how to balance risk and reward to improve trading results with practical tips and tools.

📝 SEO-Optimized Article Content:

What is a Good Risk-Reward Ratio in Forex Trading?

Risk management is a cornerstone of successful forex trading. Among the most important concepts is the risk-reward ratio (RRR) — a simple but powerful formula that defines your trading strategy’s profitability.

📊 What is Risk-Reward Ratio?

The Risk-Reward Ratio compares the amount of money you’re risking on a trade to the potential reward.

Formula:Risk-Reward Ratio = Potential Loss / Potential Profit

For example, if you’re risking $50 to potentially gain $150, the RRR is 1:3.

🎯 What is a “Good” Risk-Reward Ratio?

1:2 is considered a minimum acceptable ratio for most traders.

1:3 or higher is preferred for long-term profitability.

Lower ratios like 1:1 are riskier unless you win more than 60% of your trades consistently.

✅ Benefits of High Risk-Reward Ratios

You don’t need to win every trade.

Improves your overall trading discipline.

Helps you withstand losses without draining your capital.

⚠️ Common Mistakes Traders Make

Chasing big profits with poor stop-loss planning.

Ignoring the ratio and focusing only on entry signals.

Over-leveraging without knowing the downside risk.

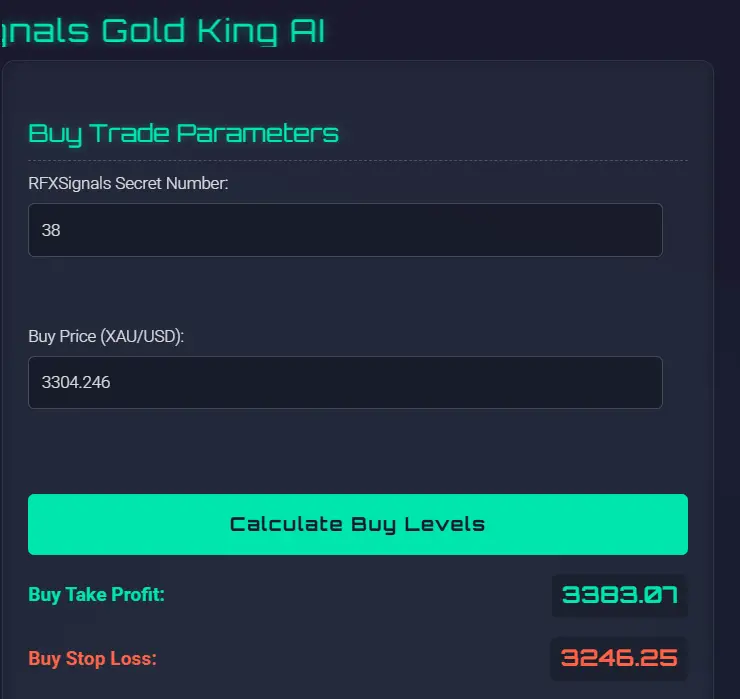

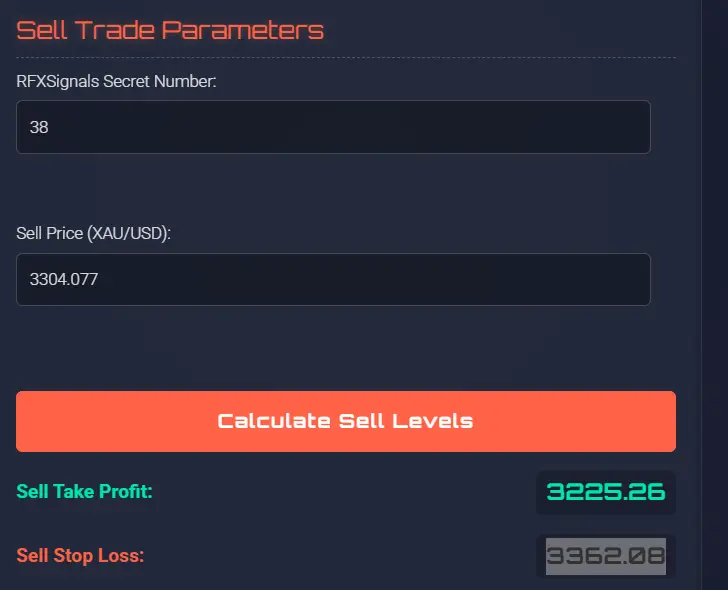

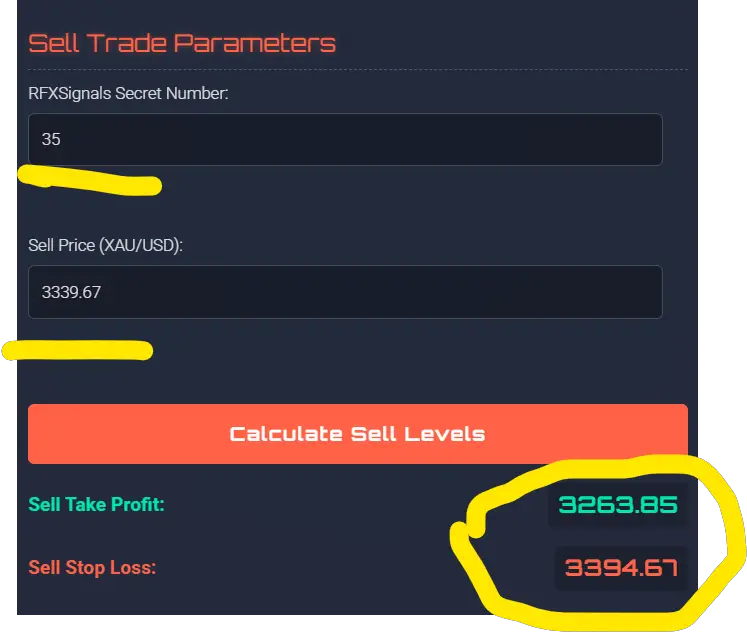

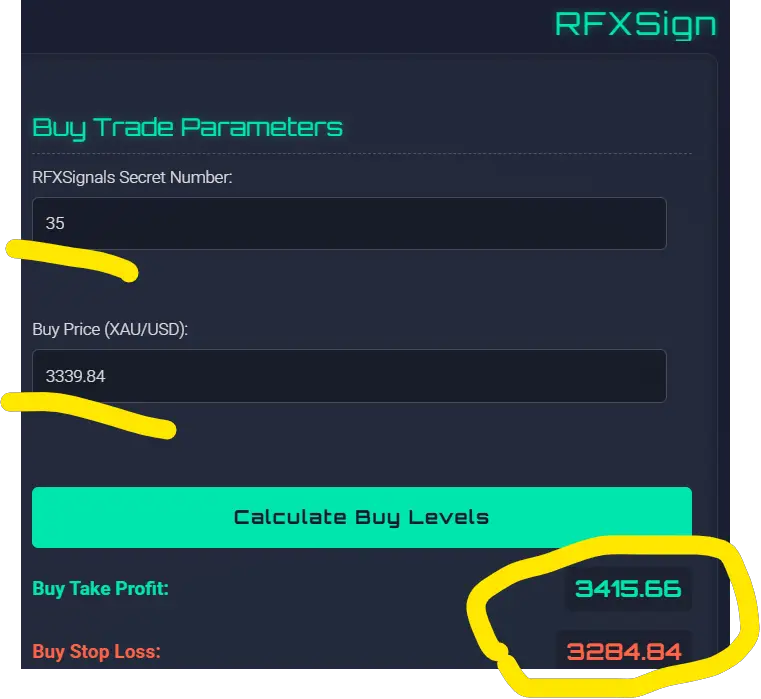

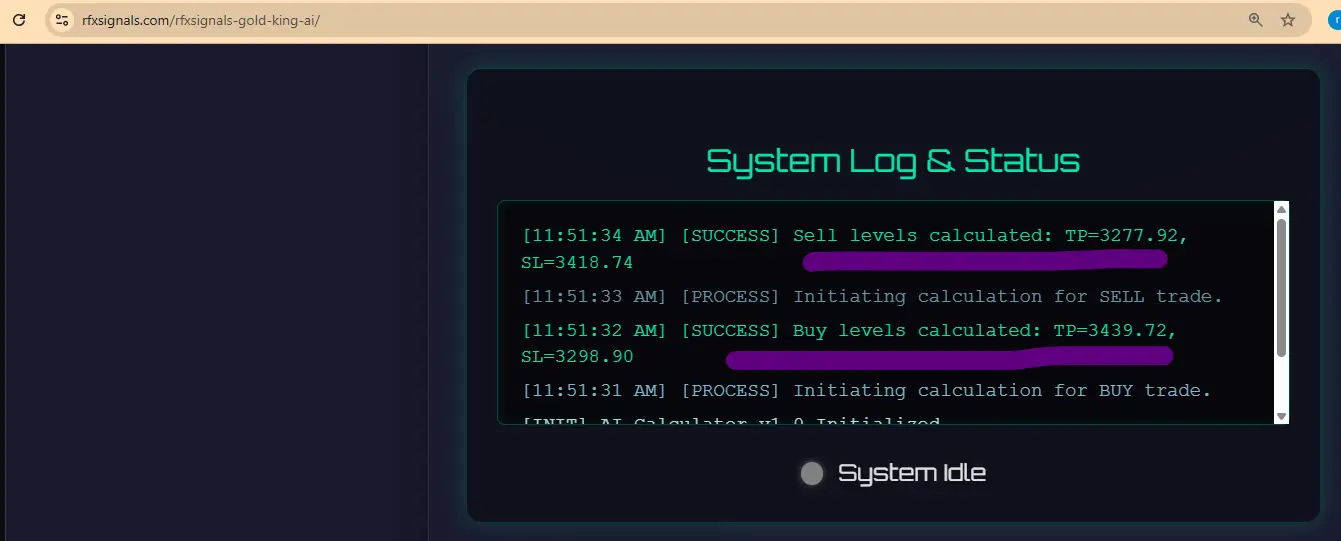

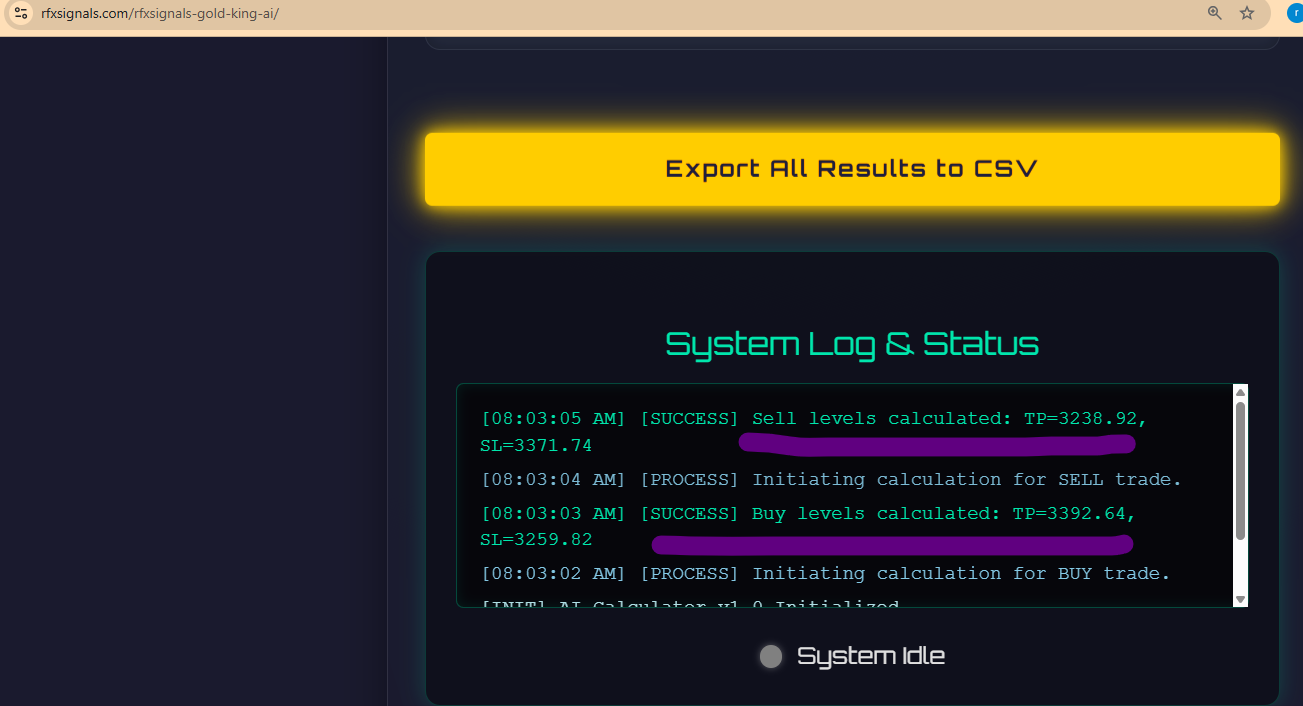

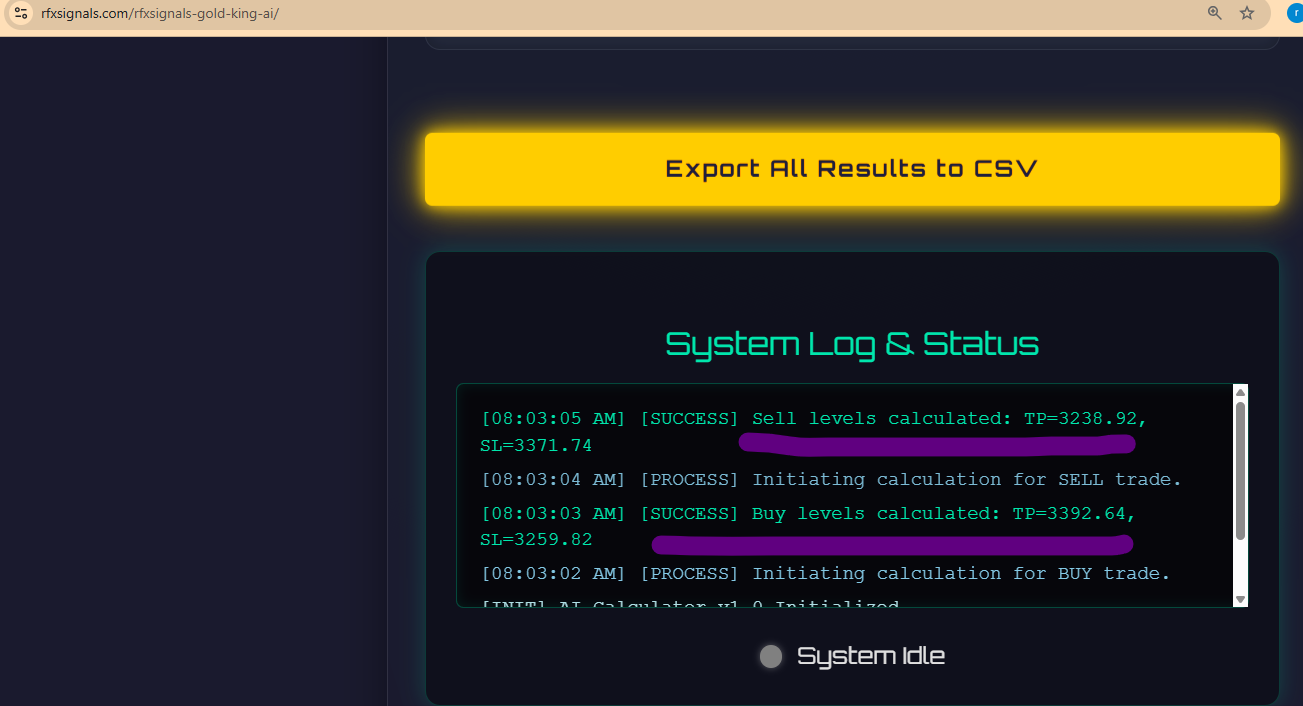

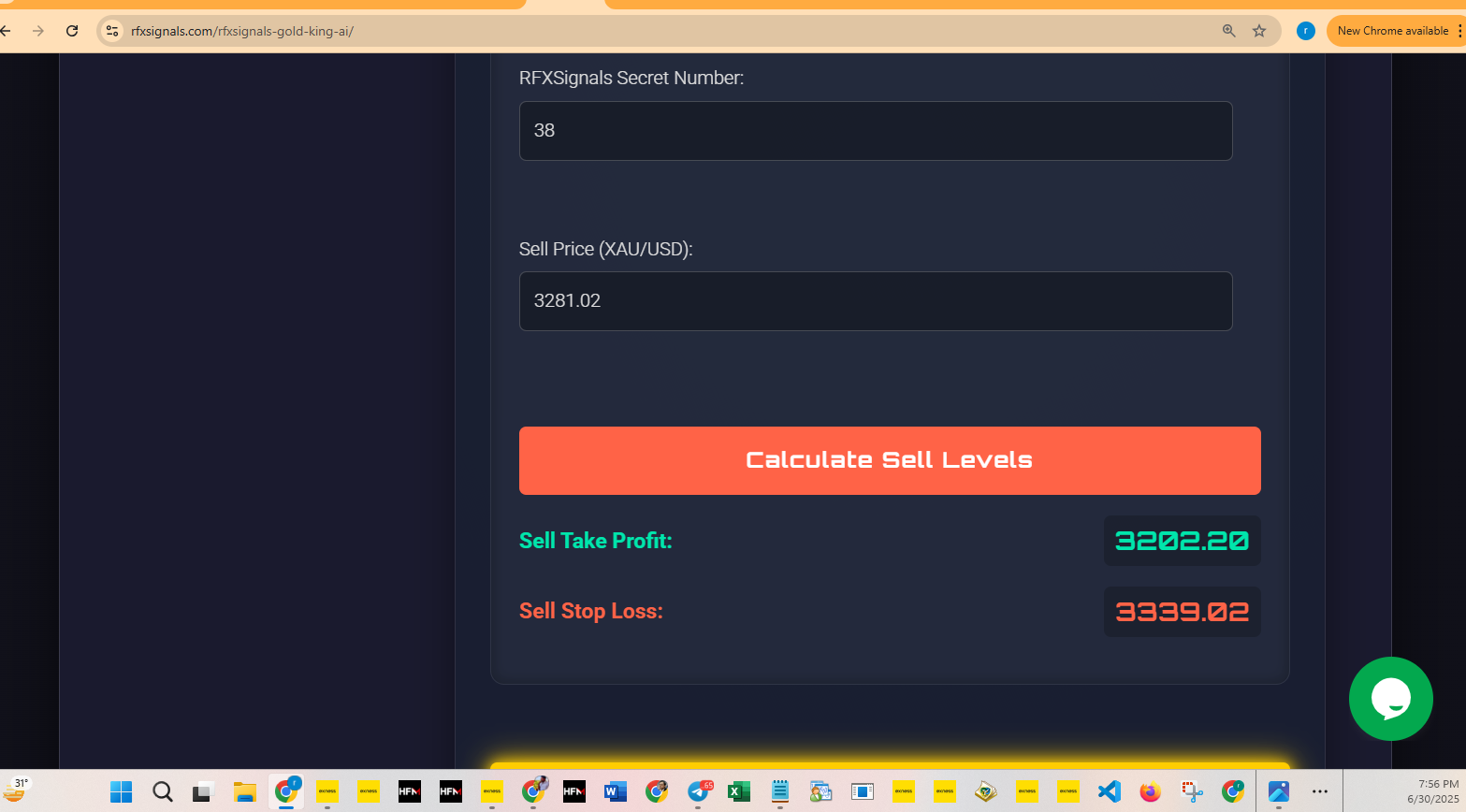

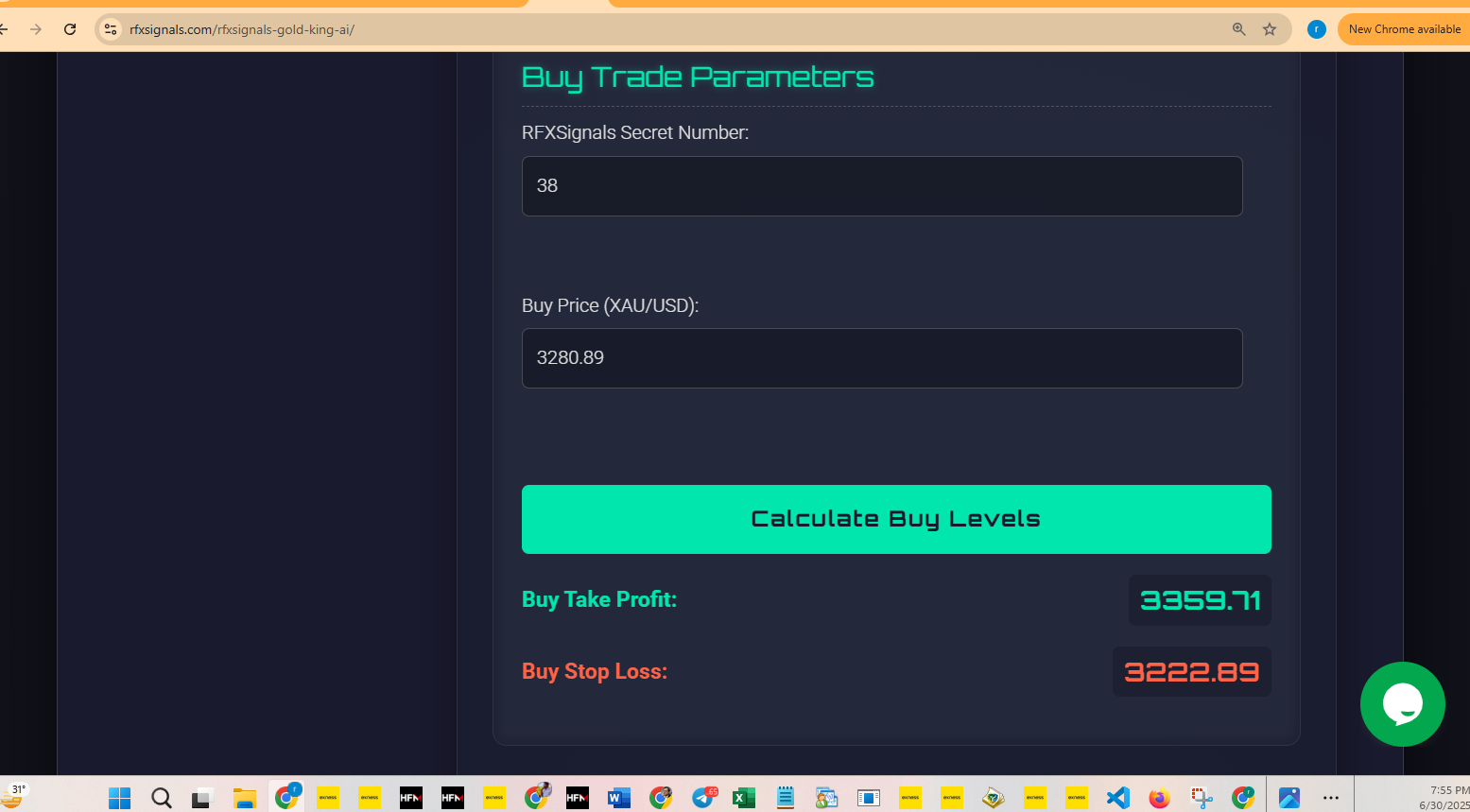

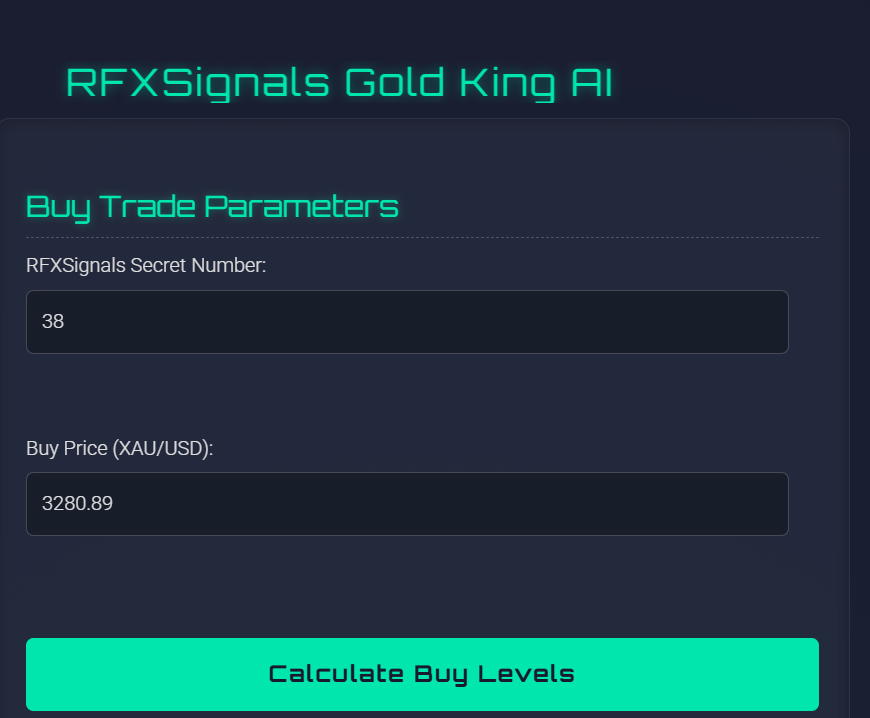

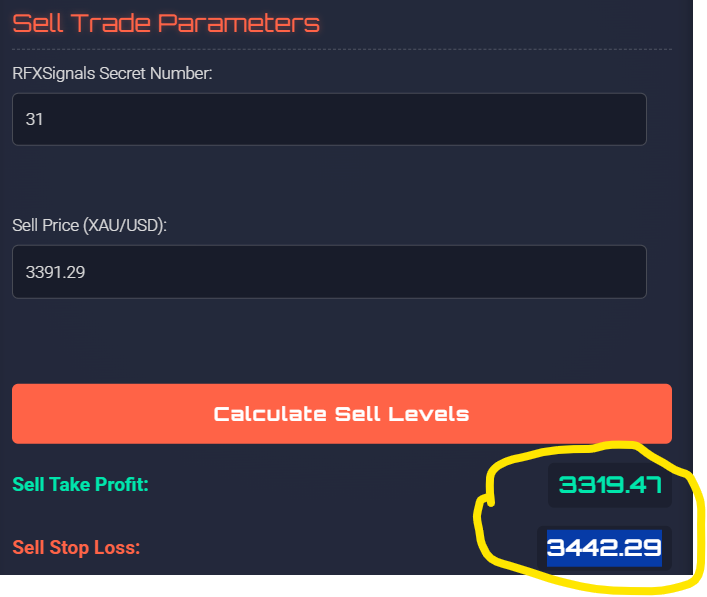

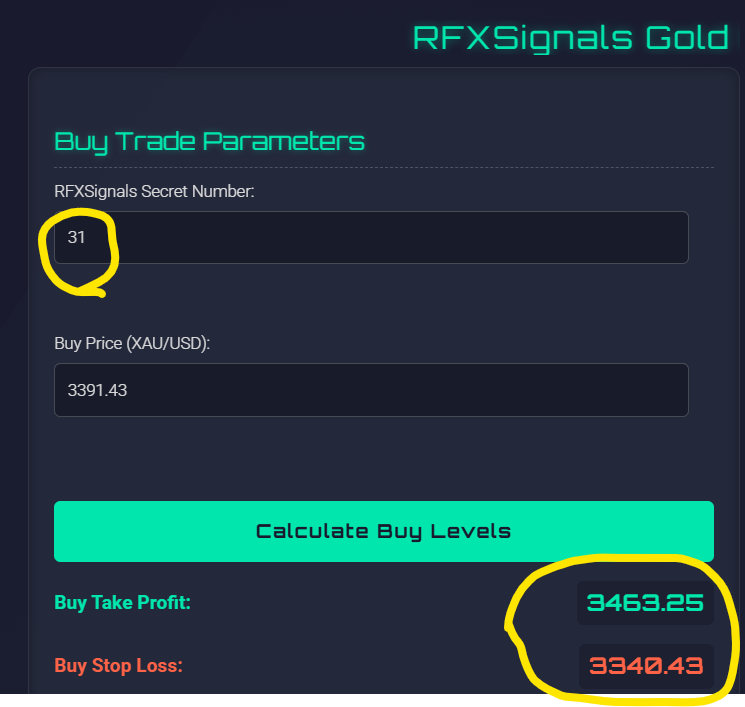

🛠️ Tools to Calculate Risk-Reward Ratio

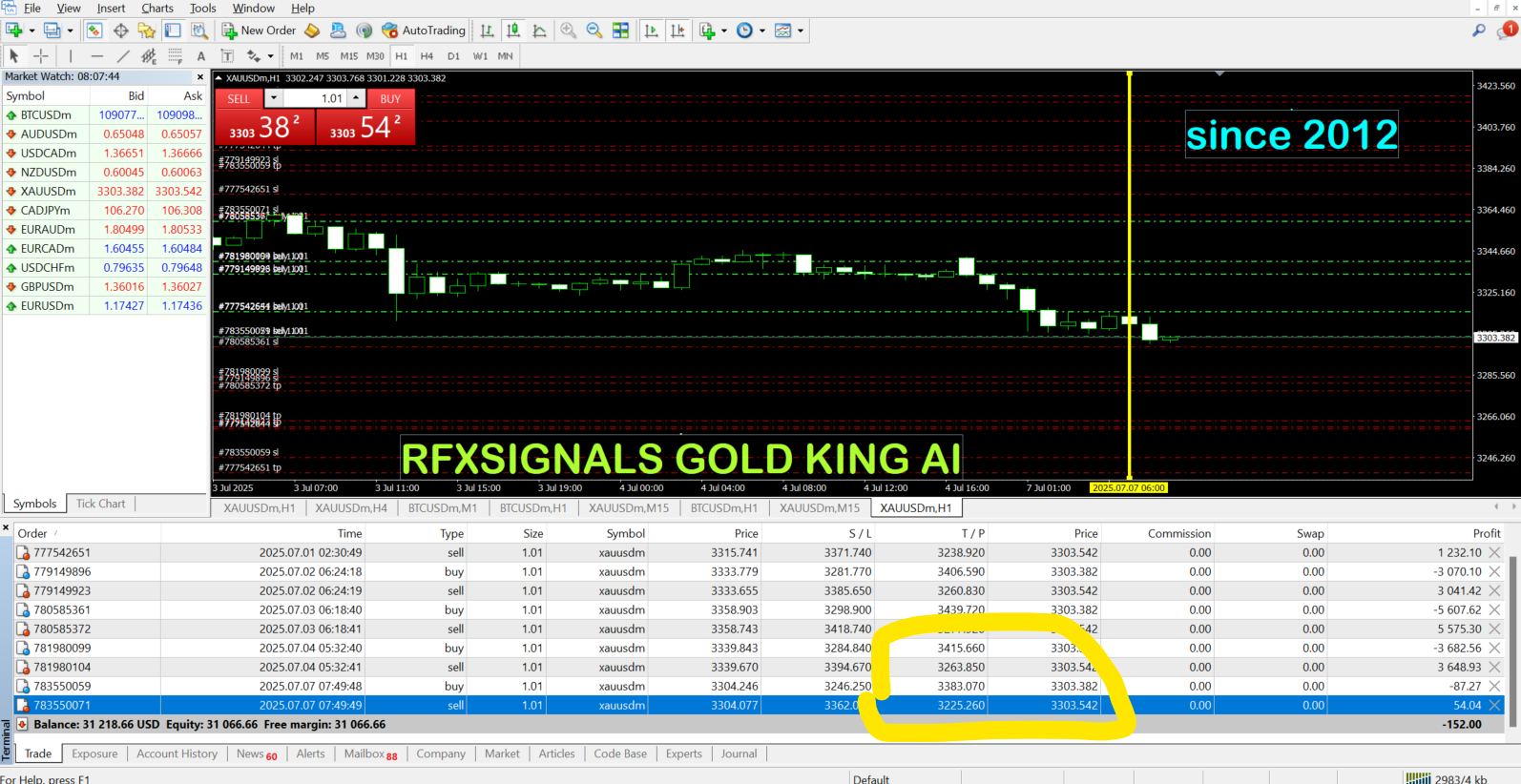

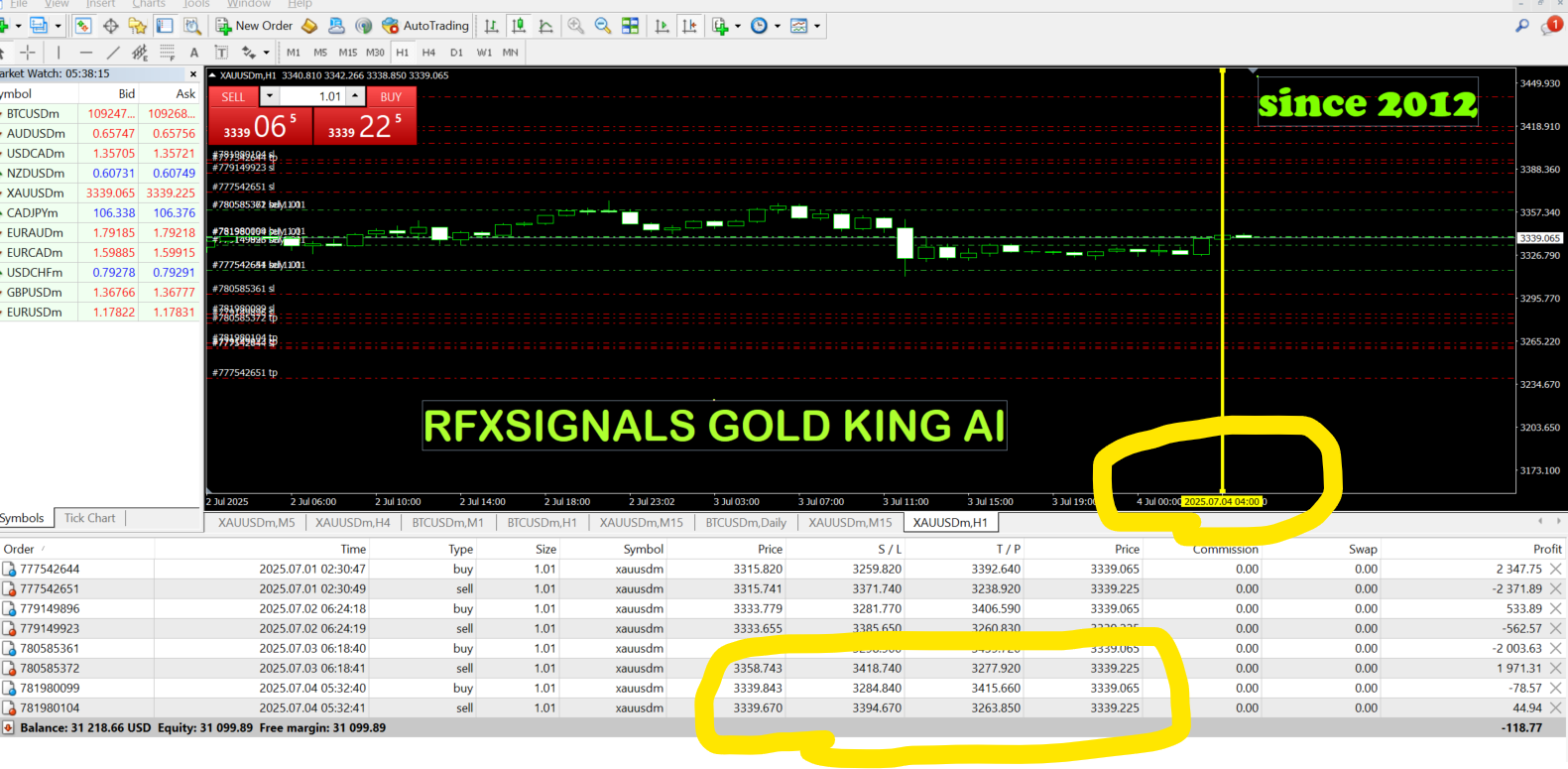

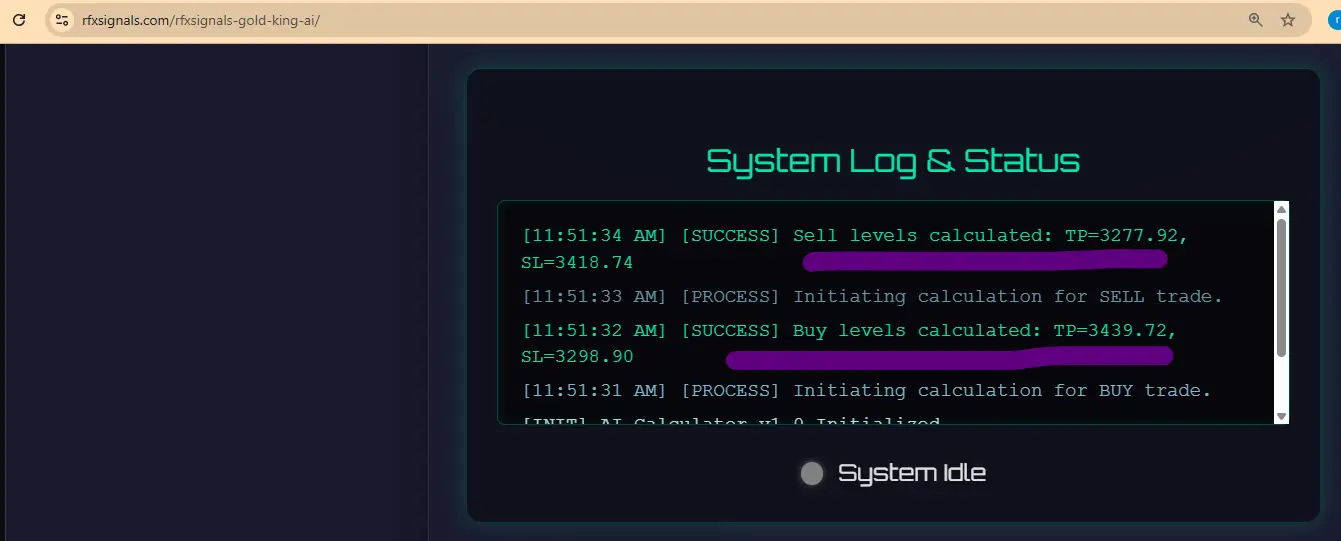

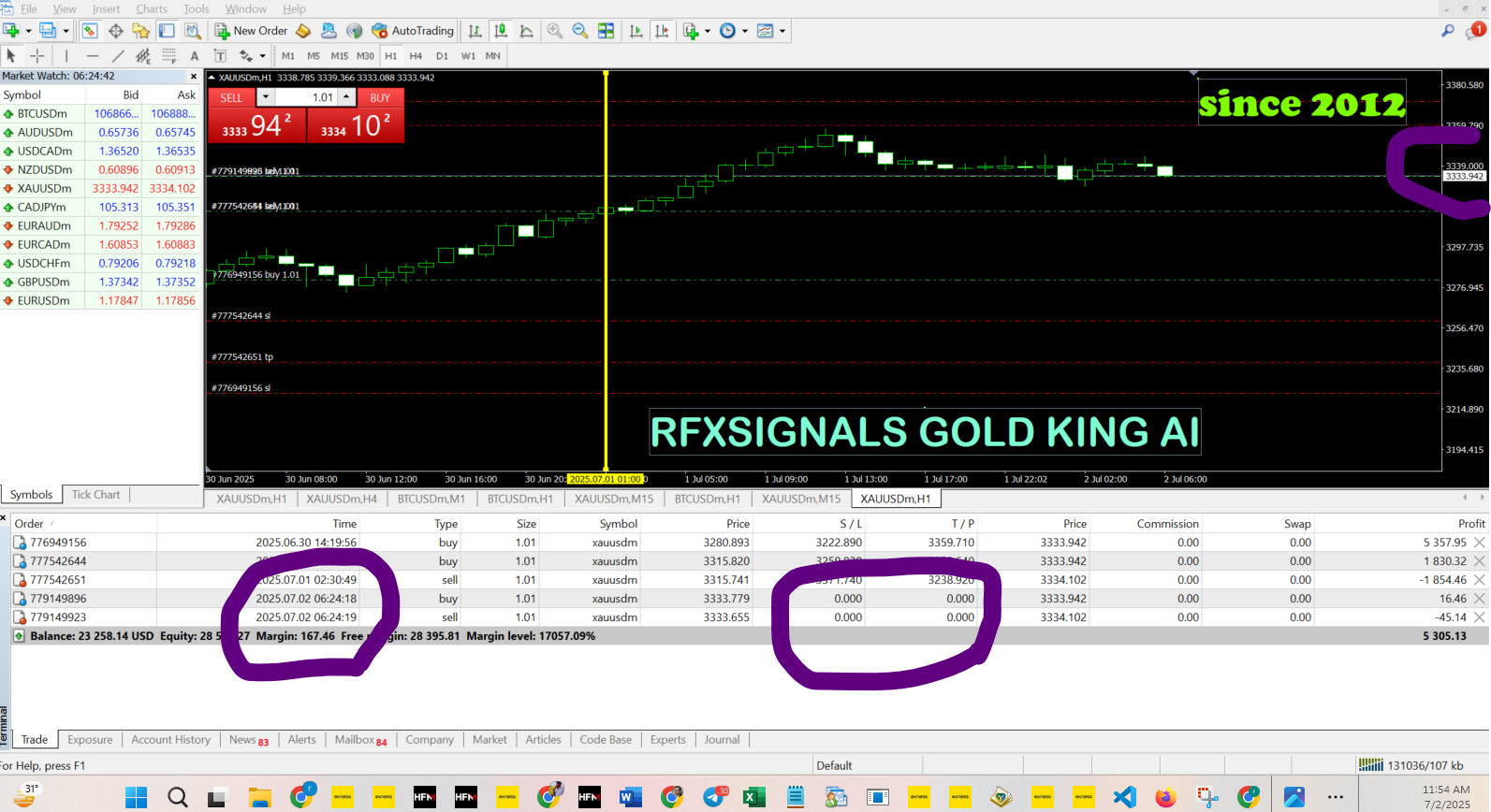

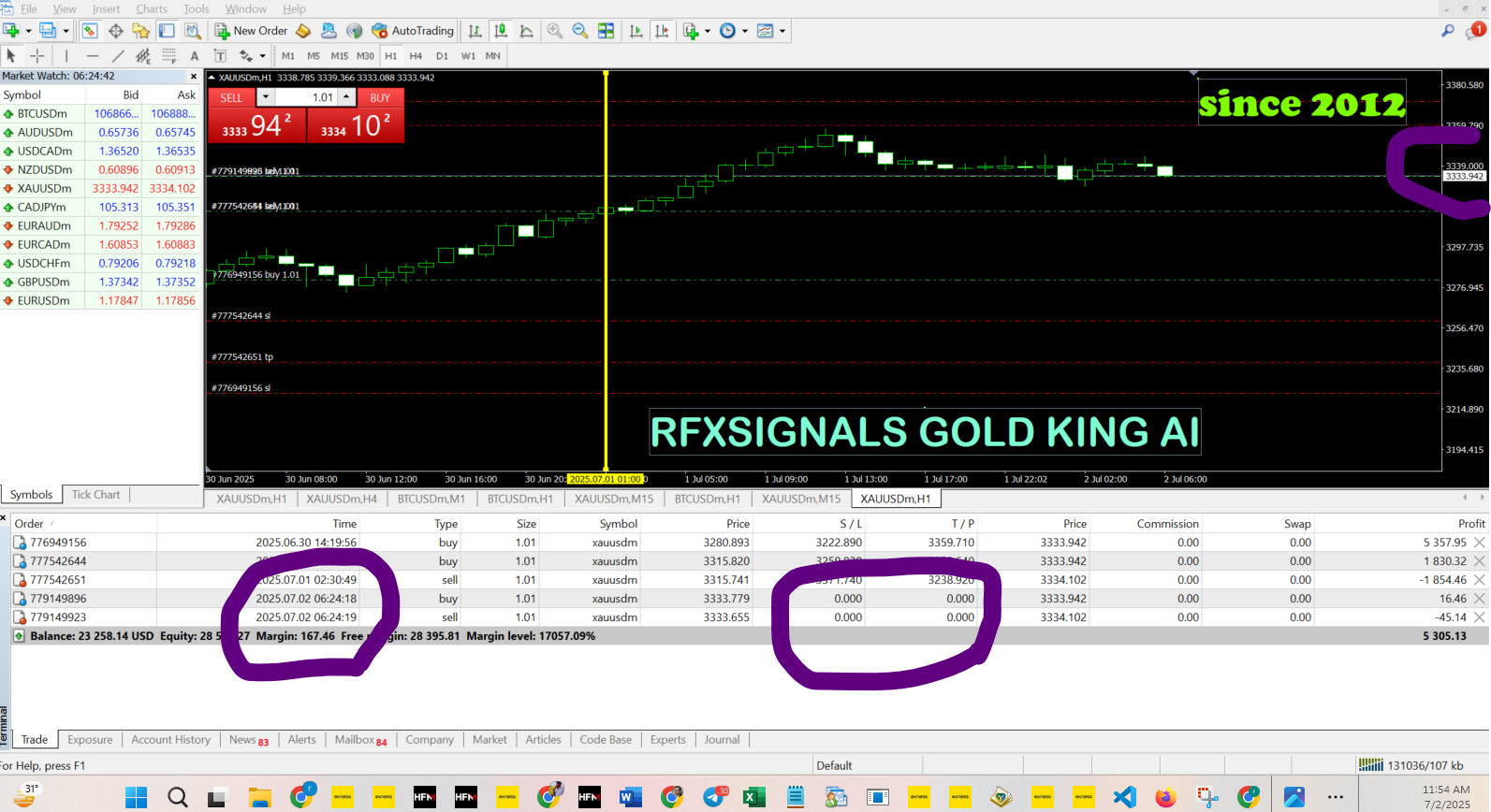

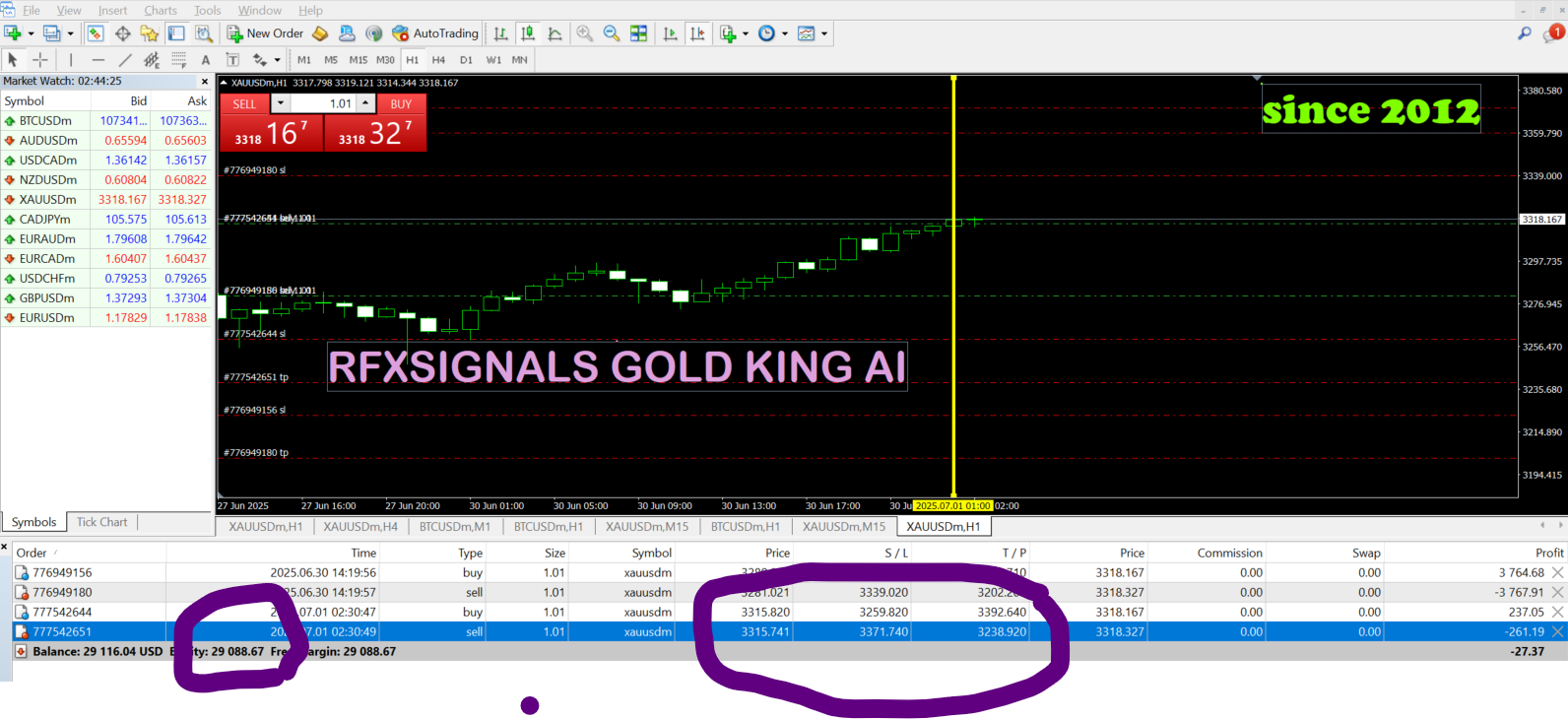

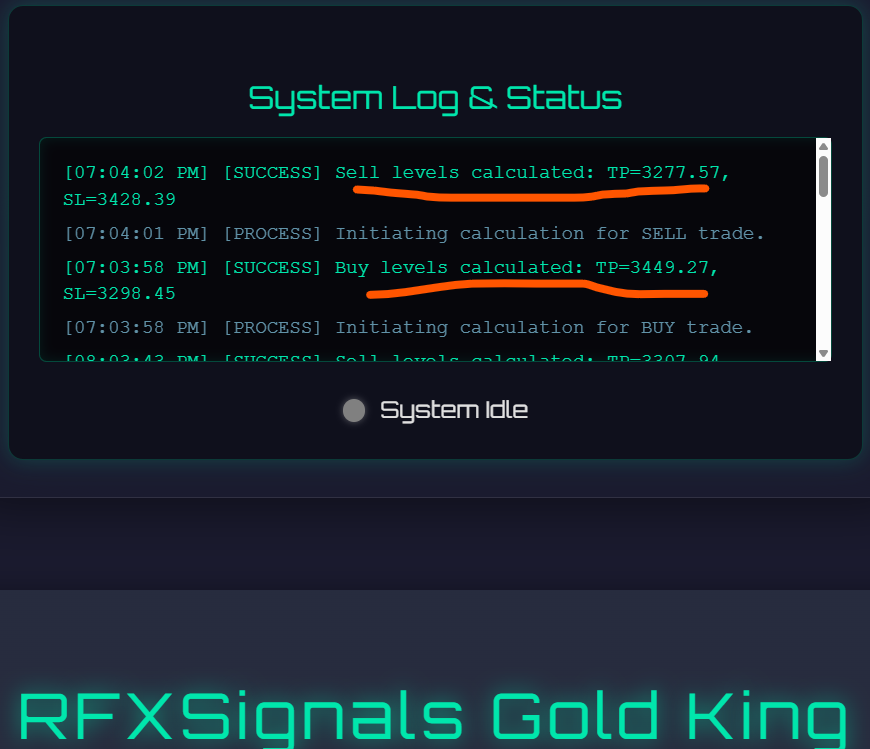

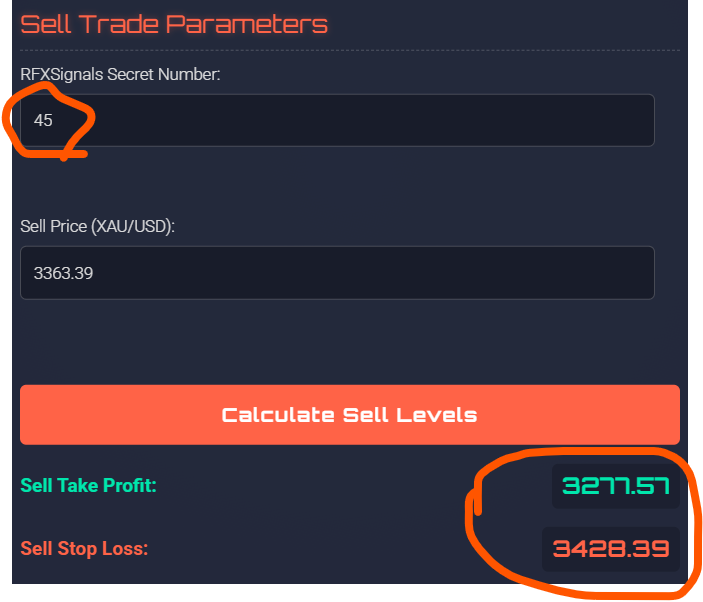

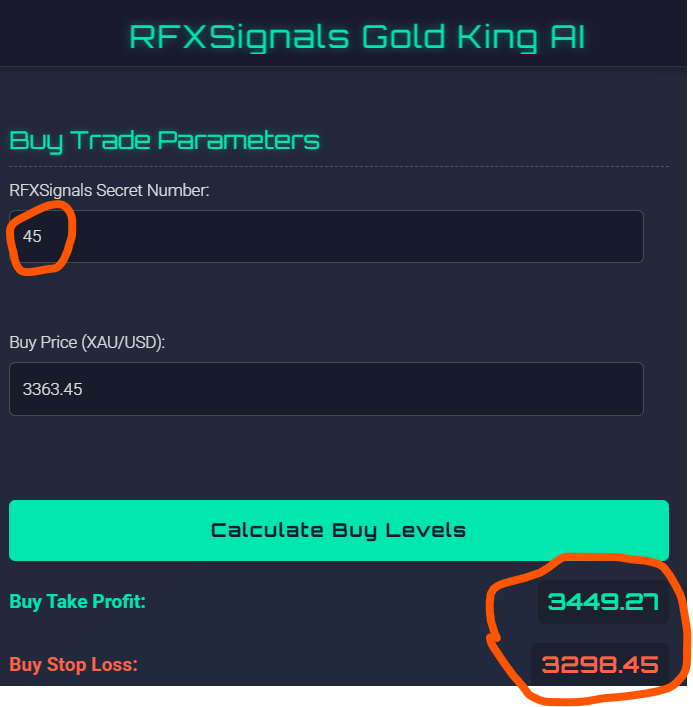

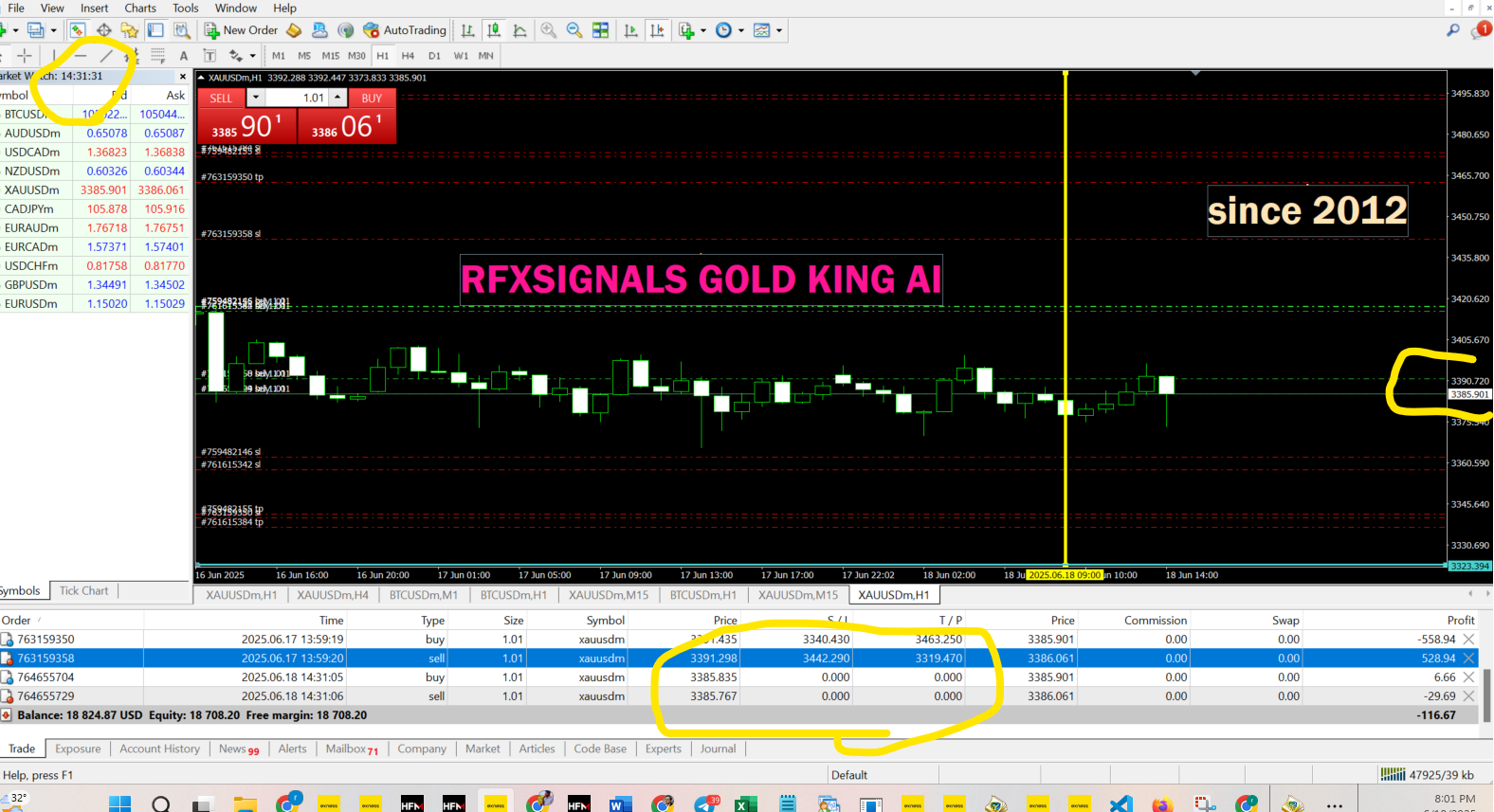

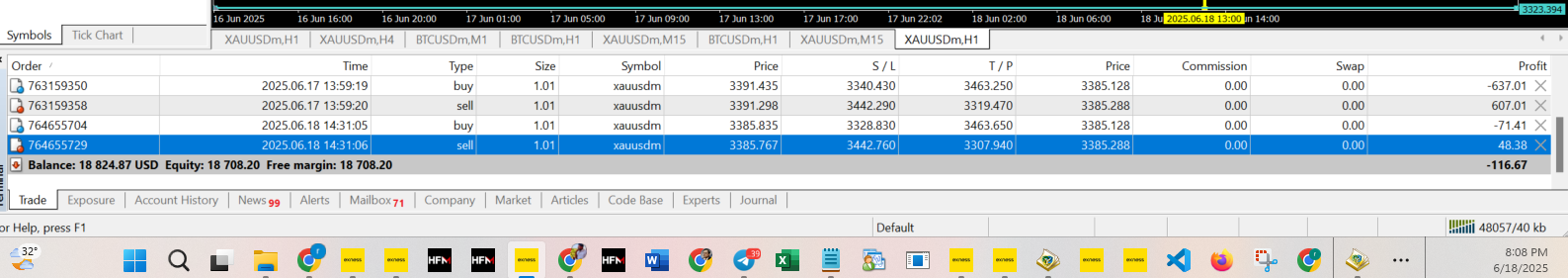

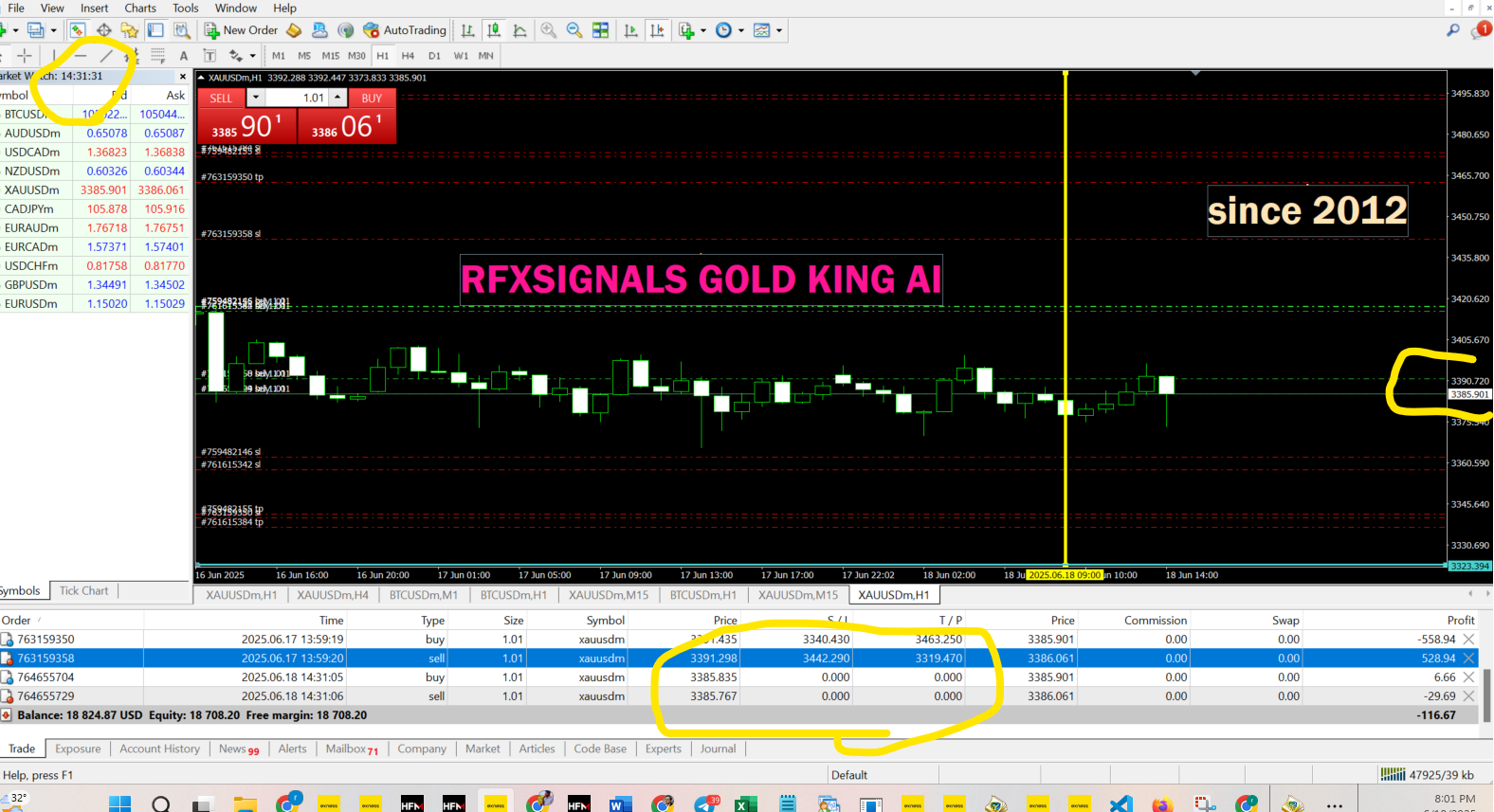

MT4/MT5 Risk Tools

Online Risk Calculators

TradingView built-in tools

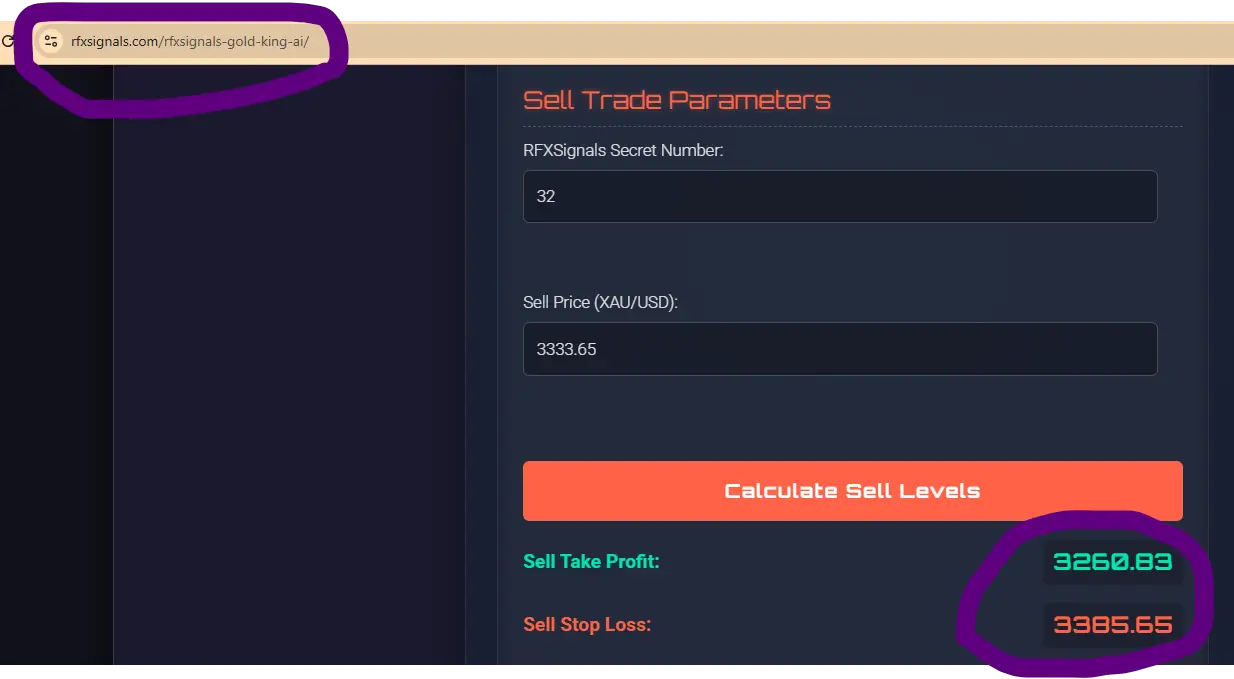

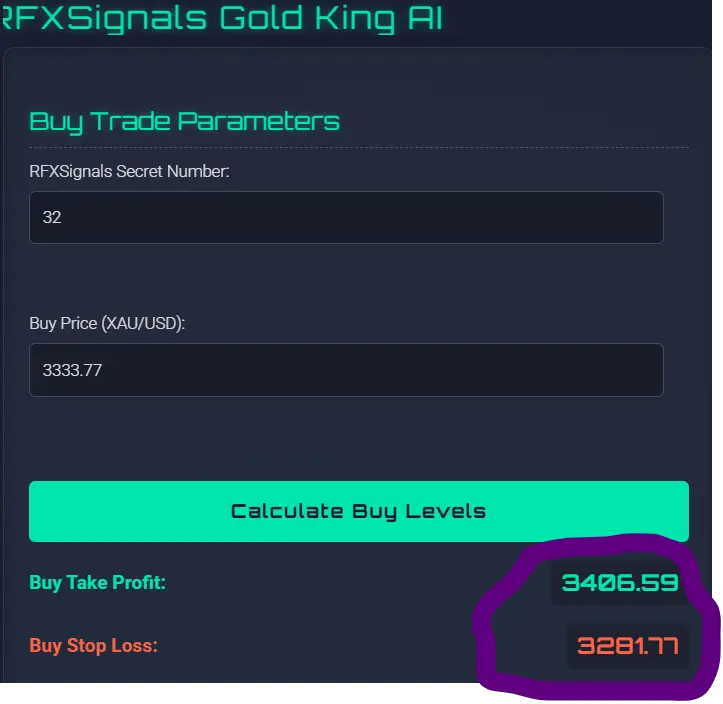

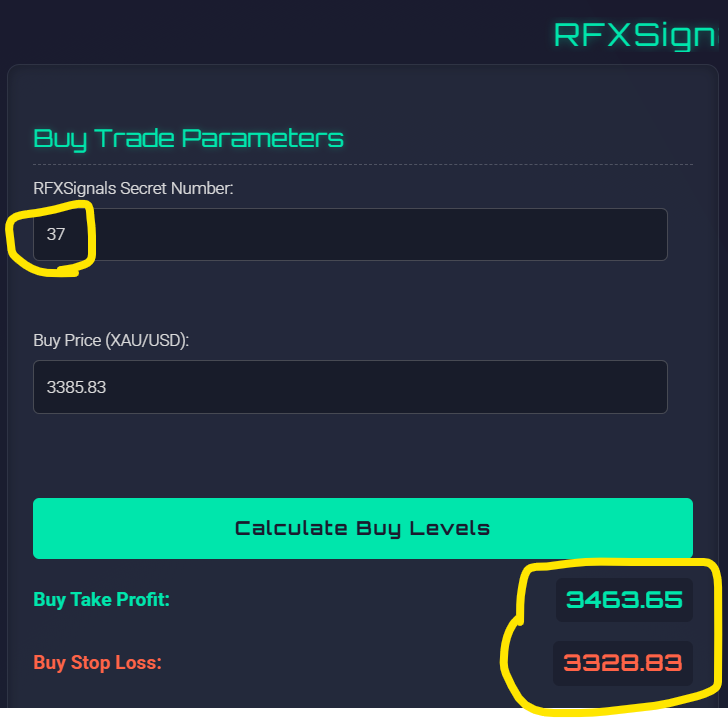

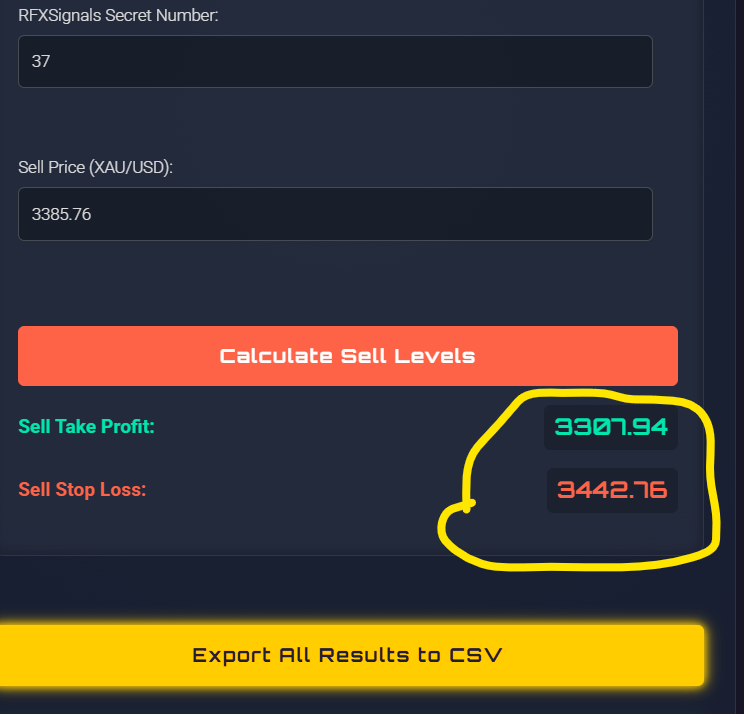

RFXSignals’ proprietary Risk Manager Tool (coming soon)

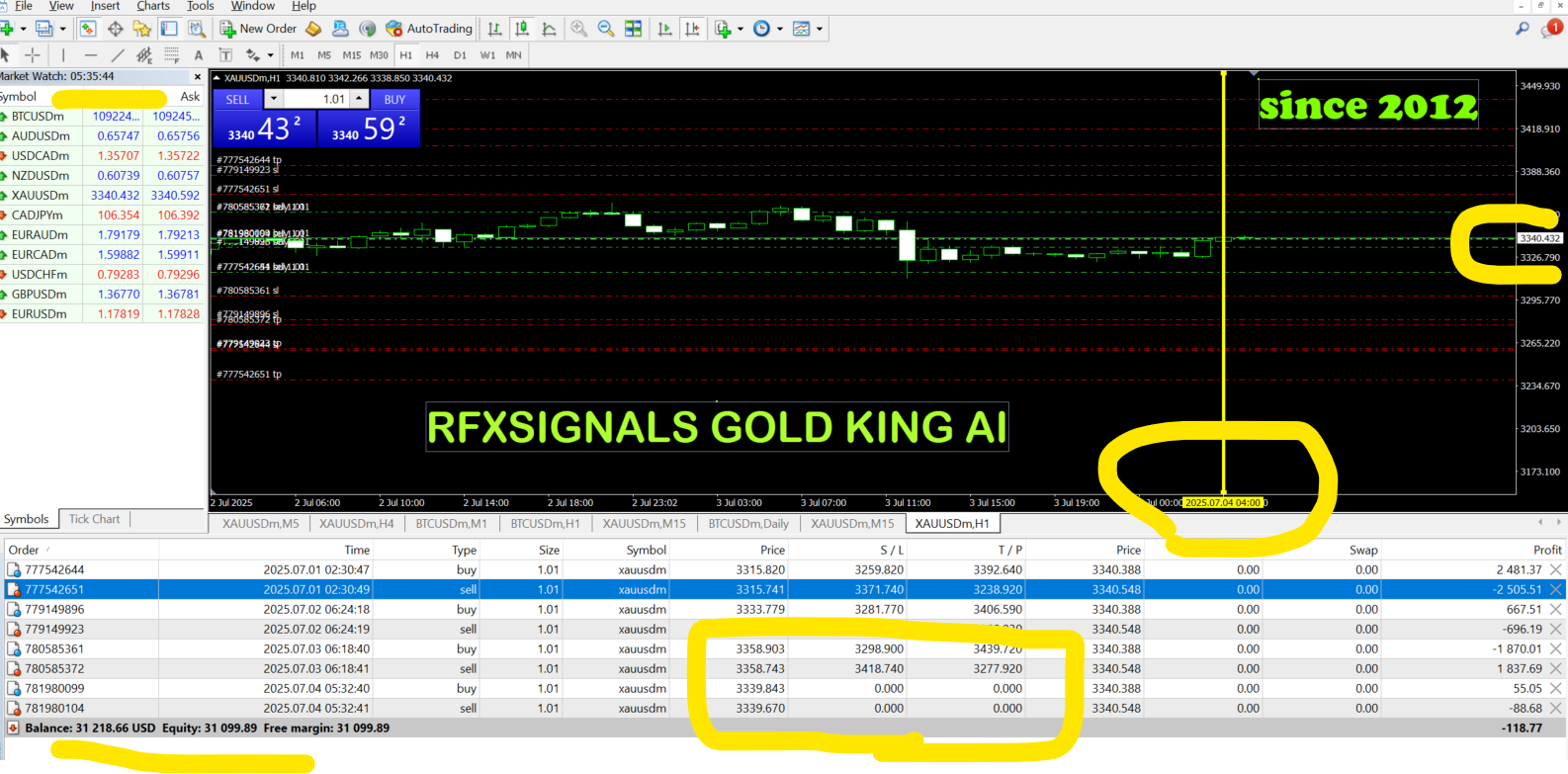

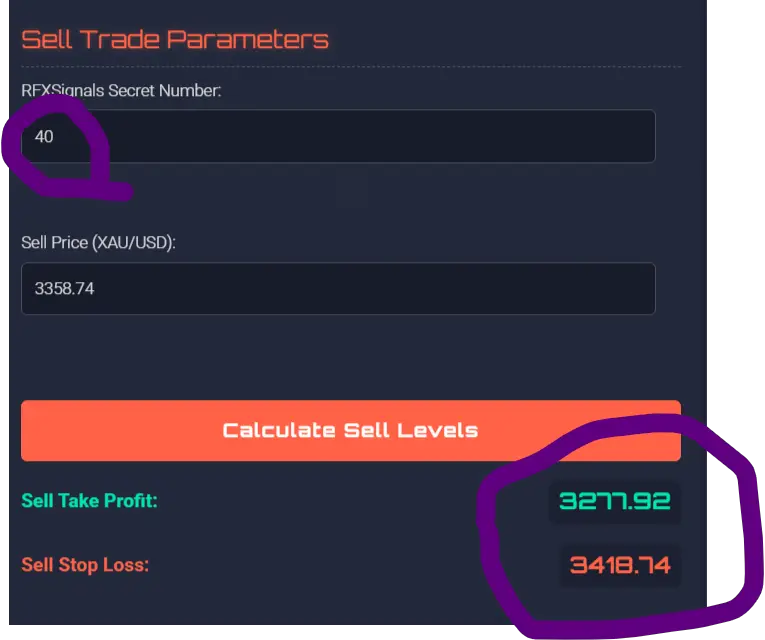

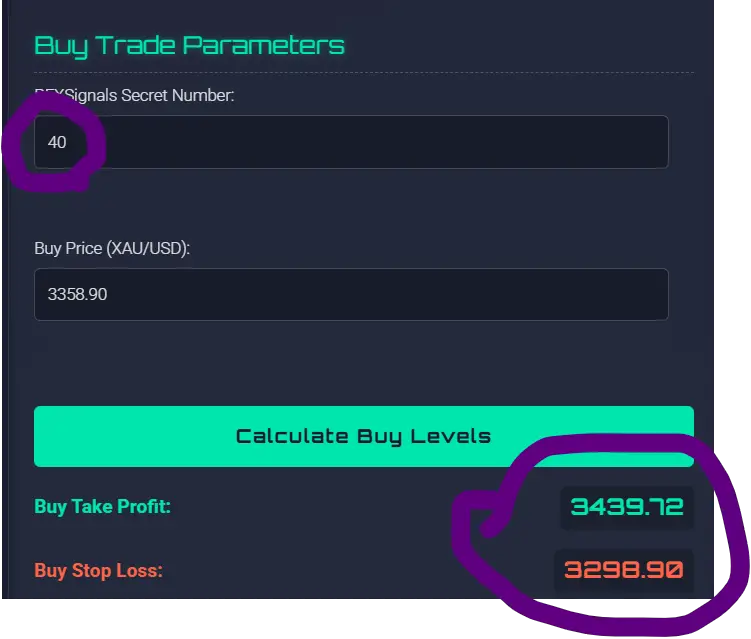

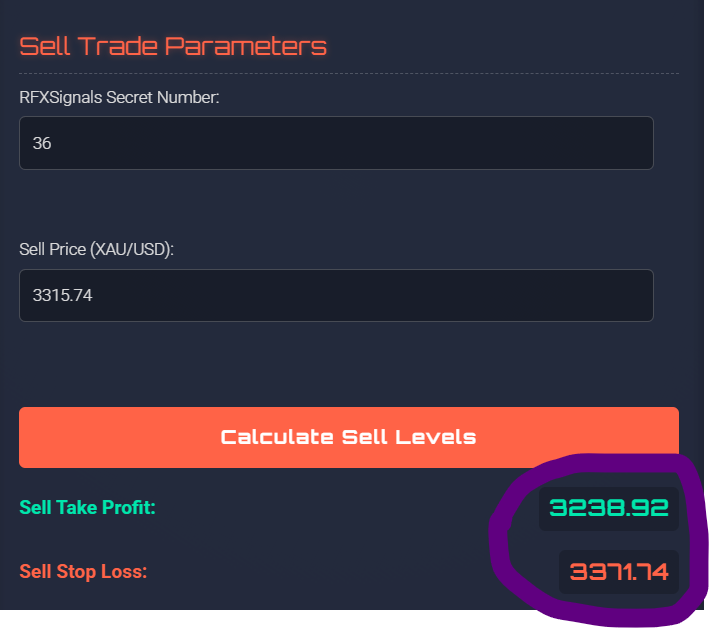

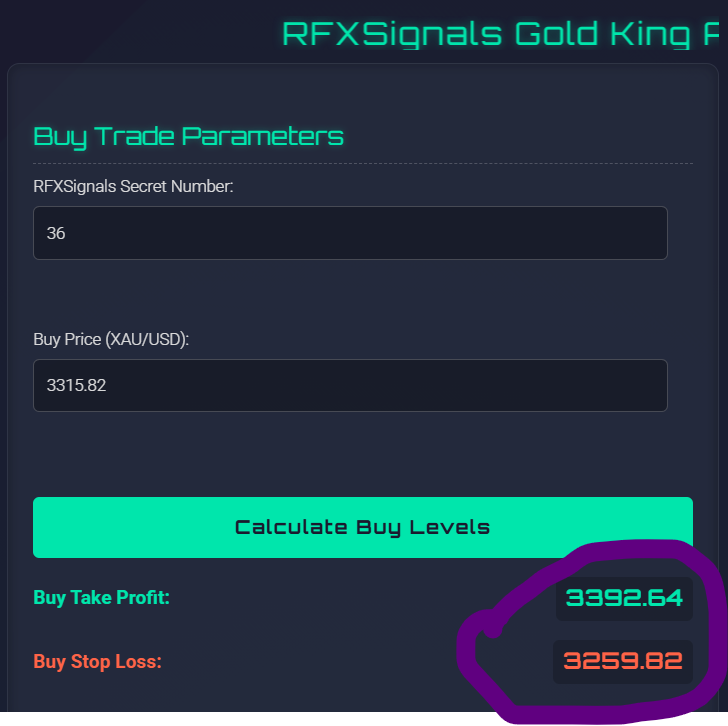

📈 Practical Example

If you enter a BUY trade at 1900 (XAUUSD), set stop-loss at 1890 and take-profit at 1920:

Risk: 10 pips

Reward: 20 pips

RRR = 1:2

This is a strong risk-managed trade setup.

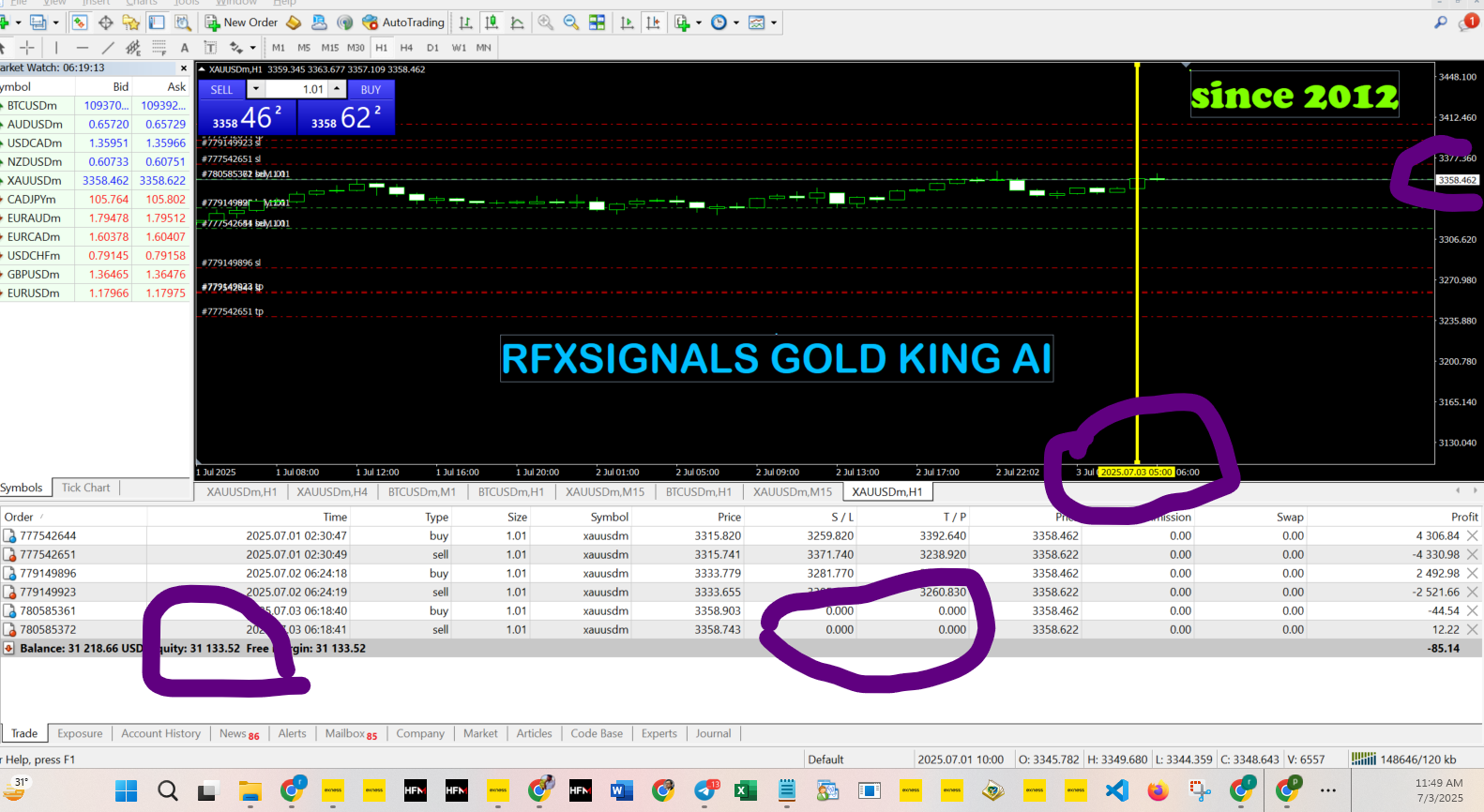

🚀 Get High-Accuracy Forex Signals with RFXSignals

Want to trade with expert-level risk management? Join RFXSignals for real-time XAUUSD strategies with defined RRR on every alert.

🔔 Join Free Telegram Channel Now✅ Final Thoughts

Choosing the right risk-reward ratio helps you avoid emotional trading and build a disciplined approach. Use this guide as your foundation in 2025 and beyond.