Fibonacci Retracements Analysis 01.02.2021 (GOLD, USDCHF)

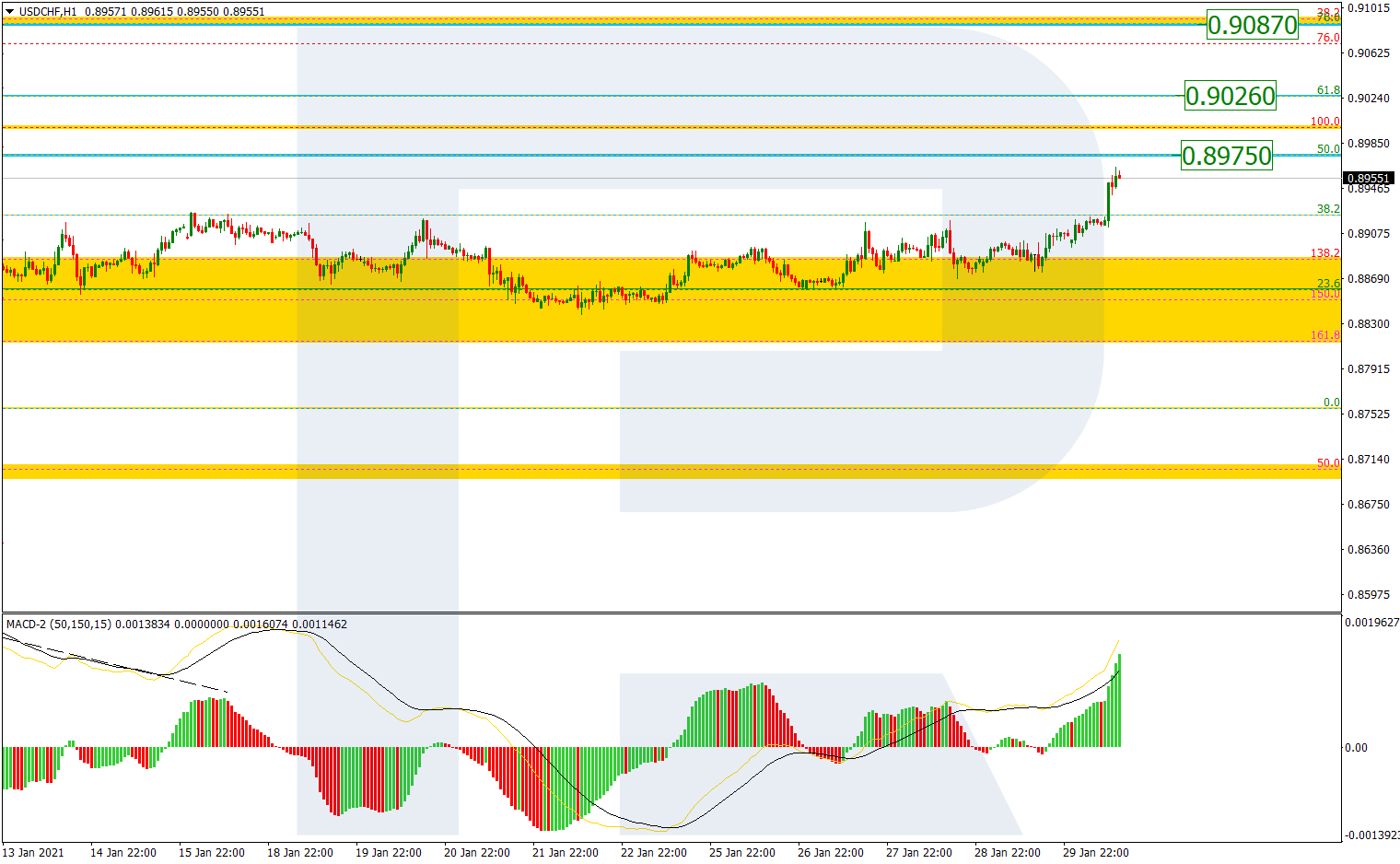

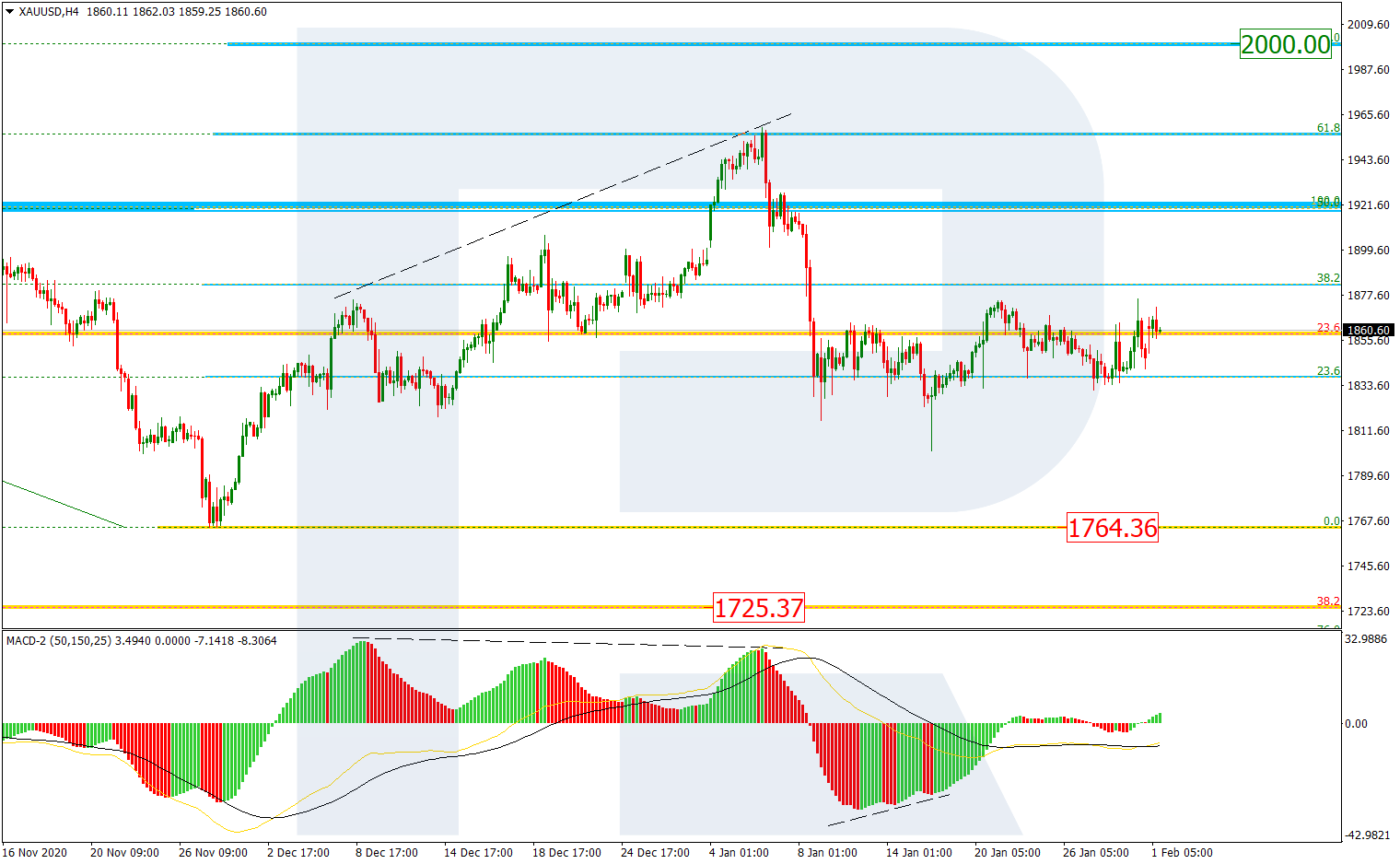

XAUUSD, “Gold vs US Dollar”

In the H4 chart, a local convergence on MACD made the pair corrected and then started consolidating. This consolidation may warn about a new impulse movement. If the price breaks this consolidation channel to the upside, the asset may form a proper rising wave towards 76.0% fibo at 2000.00. Another scenario implies that the asset may break the channel downwards to reach the low at 1764.36, a breakout of which will lead to a further long-term downtrend towards 38.2% at 1725.37.

The H1 chart shows a more detailed structure of the consolidation range. At the moment, the price is moving between 23.6% and 38.2% fibo. In the short-term, the asset may continue growing towards 50.0% and 61.8% fibo at 1880.55 and 1899.10 respectively. the local support is the low at 1801.79.

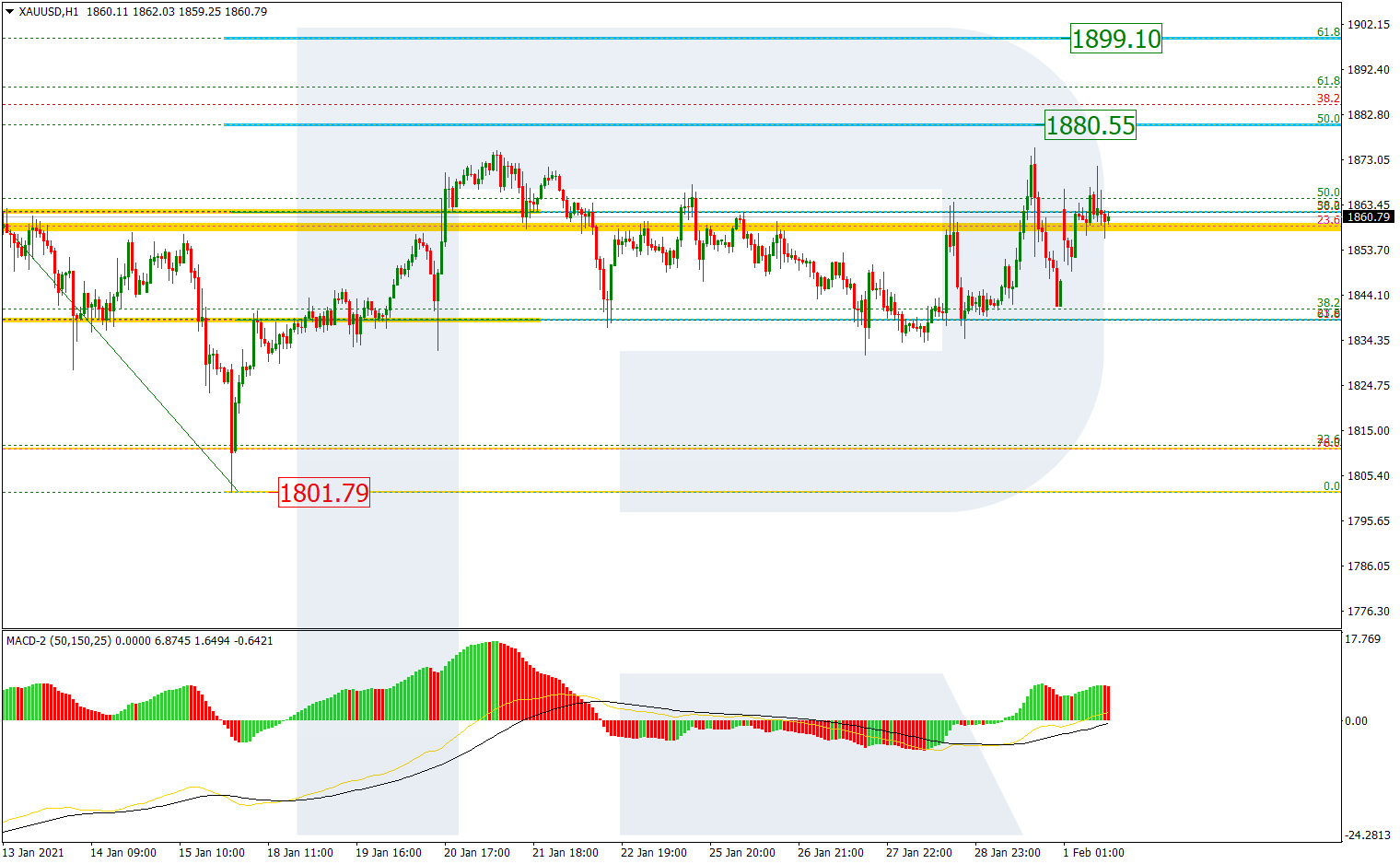

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the daily chart, after testing the post-correctional extension area between 138.2% and 161.8% fibo at 0.8886 and 0.8816 respectively, USDCHF is forming a new rising wave that may transform into a proper uptrend. In the mid-term, this growth may be heading towards 23.6%, 38.2%, and 50.0% fibo at 0.9106, 0.9322, and 0.9495 respectively.

The H1 chart shows a more detailed structure of the correctional trend. The asset is approaching 50.0% fibo at 0.8975 and may later continue growing 61.8% and 76.0% fibo at 0.9026 and 0.9087 respectively. The support is the low at 0.8757.