Fibonacci Retracements Analysis 03.02.2021 (GBPUSD, EURJPY)

GBPUSD, “Great Britain Pound vs US Dollar”

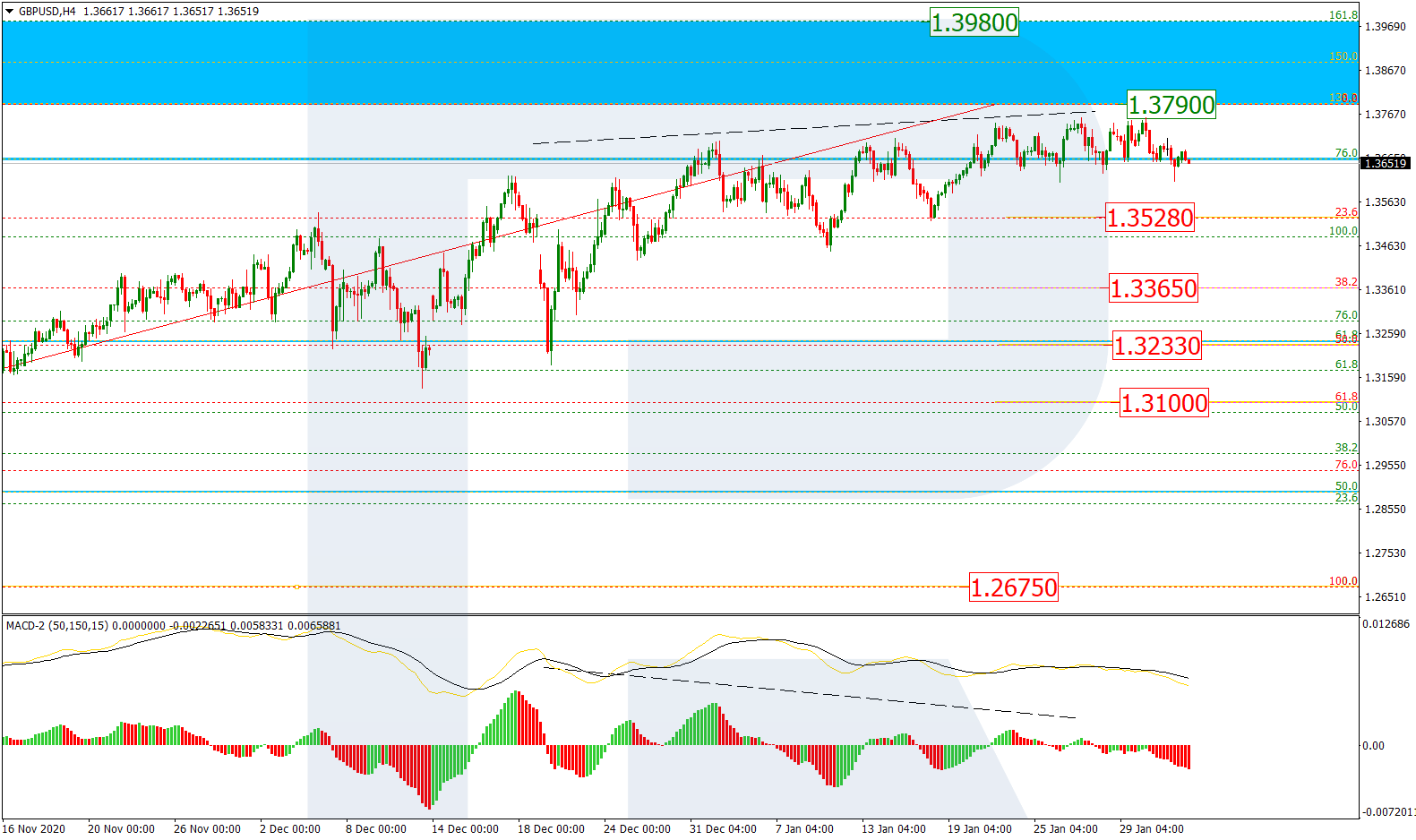

As we can see in the H4 chart, after testing 76.0% fibo for a long time, GBPUSD has failed to reach he post-correctional extension area between 138.2% and 161.8% fibo at 1.3790 and 1.3980 respectively. Another reason for a new decline, which is now testing the lows, was a divergence on MACD. The predicted correctional targets are 23.6%, 38.2%, 50.0%, and 61.8% fibo at 1.3528, 1.3365, 1.3233, and 1.3100 respectively.

In the H1 chart, after finishing the previous ascending wave, GBPUSD is correcting downwards and has already reached 23.6% fibo. Later, the market may start a slight growth, which may be followed by a further decline towards 38.2% and 50.0% fibo at 1.3541 and 1.3474 respectively. The resistance is the high at 1.3759.

EURJPY, “Euro vs. Japanese Yen”

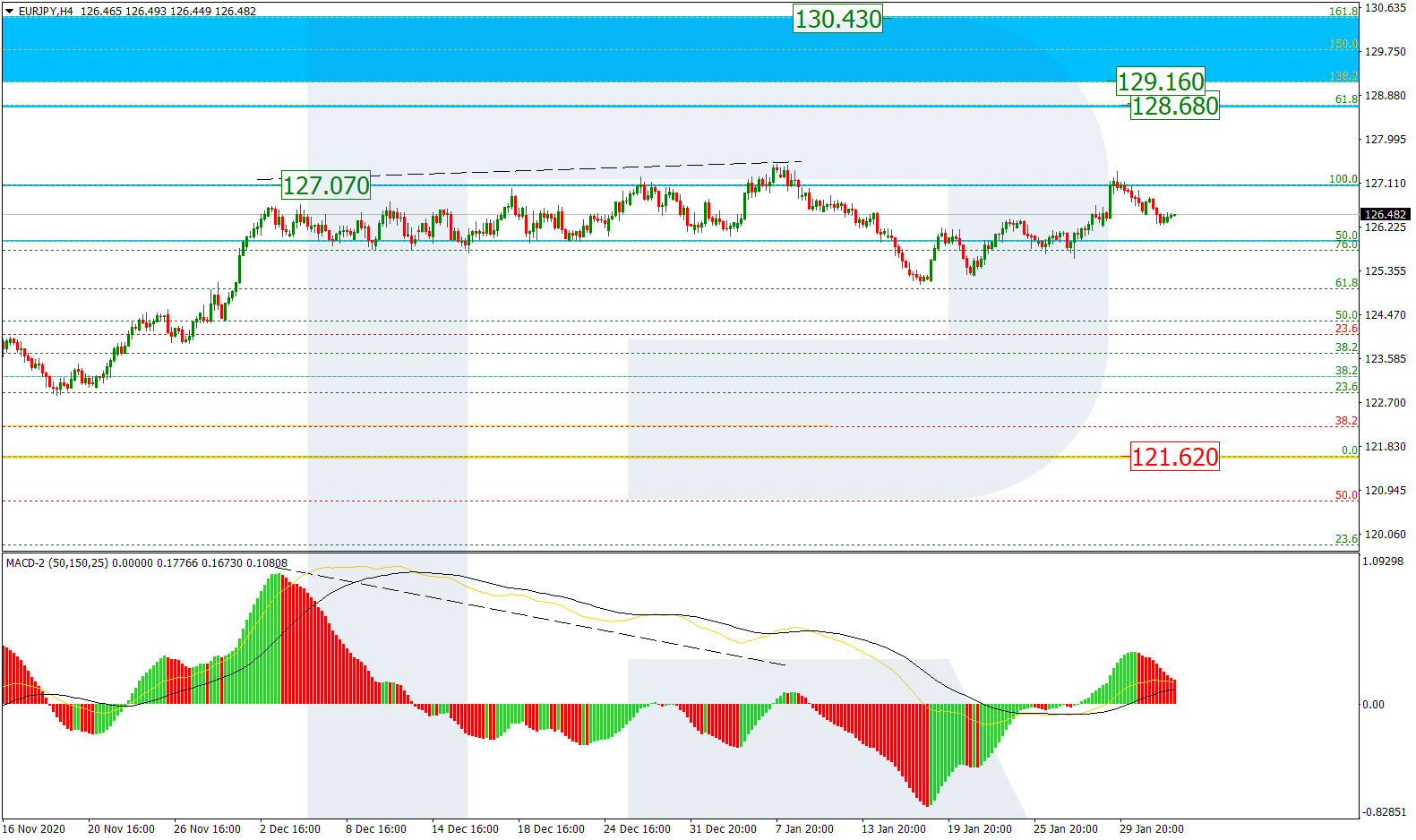

In the H4 chart, EURJPY completed the correctional decline; right now, it is moving upwards. At the same time, after testing the previous high at 127.07, the pair has finished another pullback. If the price resumes its ascending tendency, it may reach and break the mid-term 61.8% fibo at 128.65 and then continue moving to reach the post-correctional extension area between 138.2% and 161.8% fibo at 129.16 and 130.43 respectively.

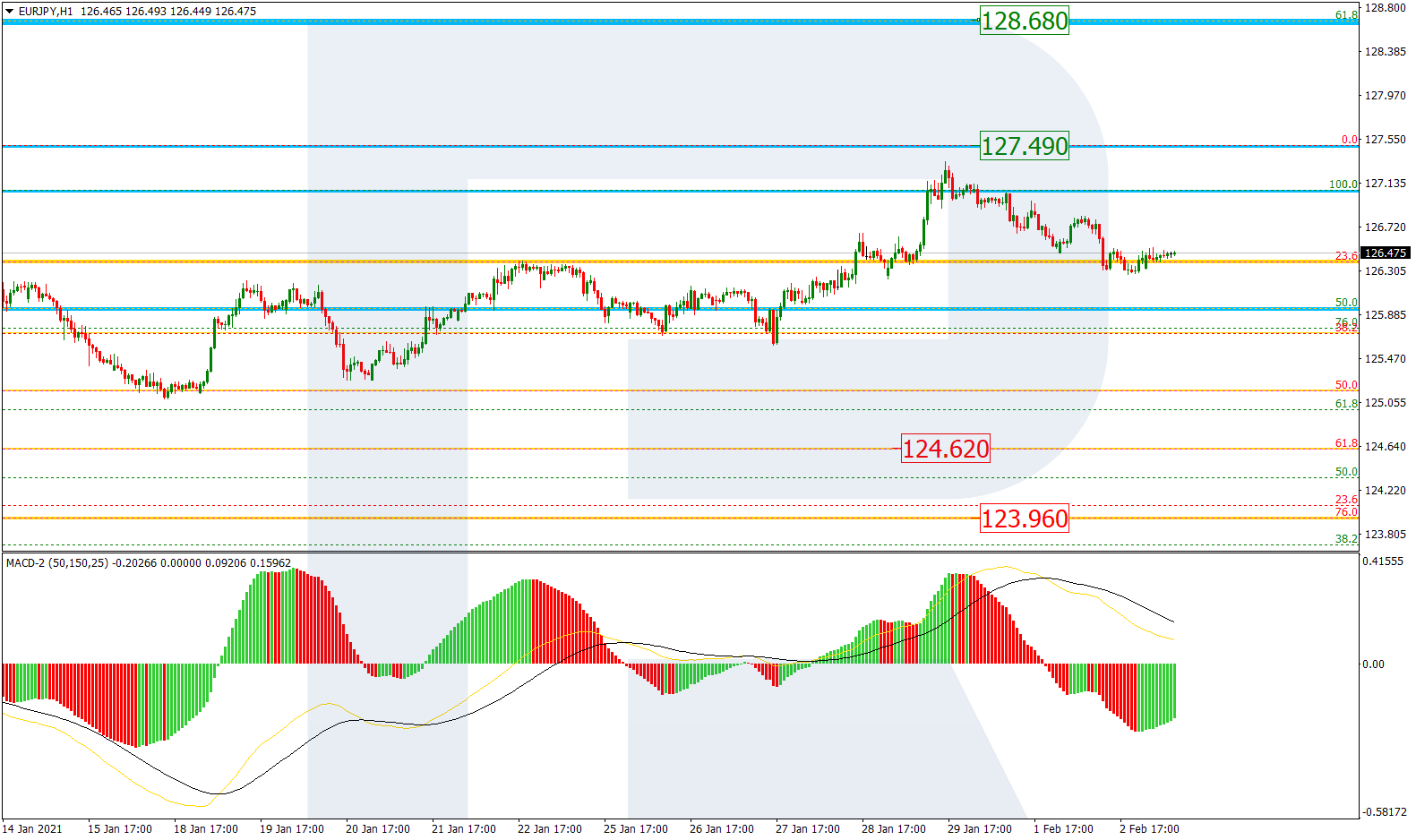

As we can see In the H1 chart, after attempting to reach the high at 127.49, the pair is moving downwards. The previous decline has reached 50.0% fibo, so the next one may be heading towards 61.8% and 76.0% fibo at 124.62 and 123.96 respectively. A breakout of the resistance at 127.49 will result in a further uptrend towards the mid-term 61.8% fibo at 128.68.