Fibonacci Retracements Analysis 05.03.2020 (AUDUSD, USDCAD)

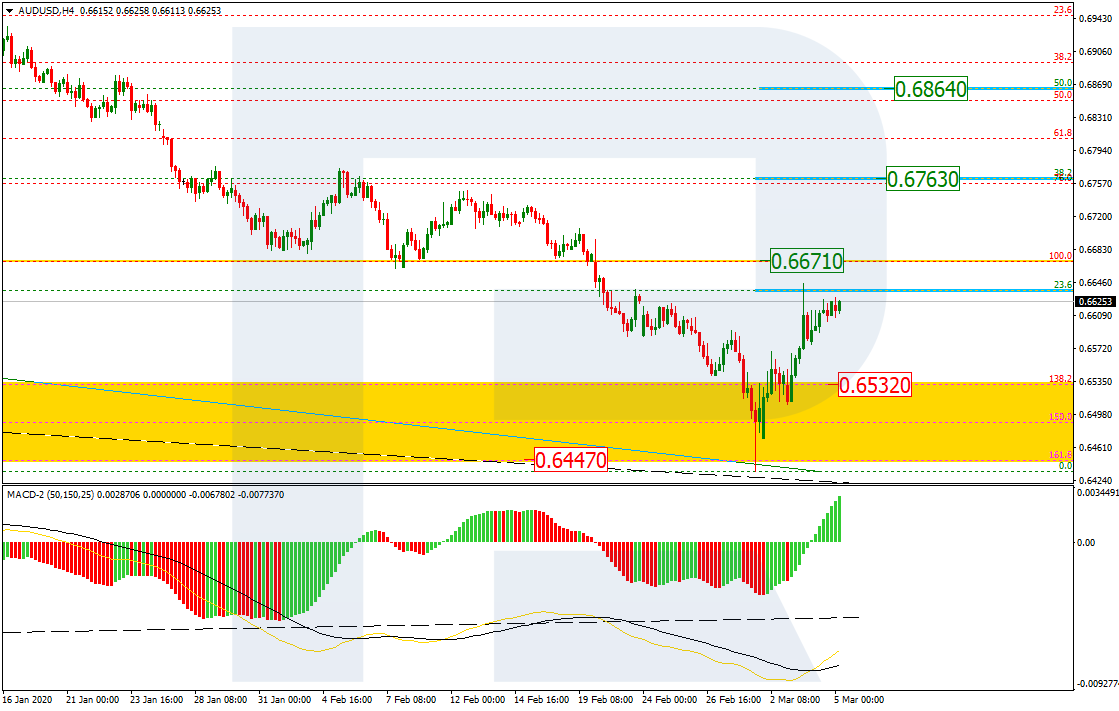

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, after reaching the post-correctional extension area between 138.2% and 161.8% fibo at 0.6532 and 0.6447 respectively, the pair started a new correctional uptrend, which has already reached 23.6% fibo and is trying to test the resistance at 0.6671. the next upside targets may be 38.2% and 50.0% fibo at 0.6763 and 0.6864 respectively.

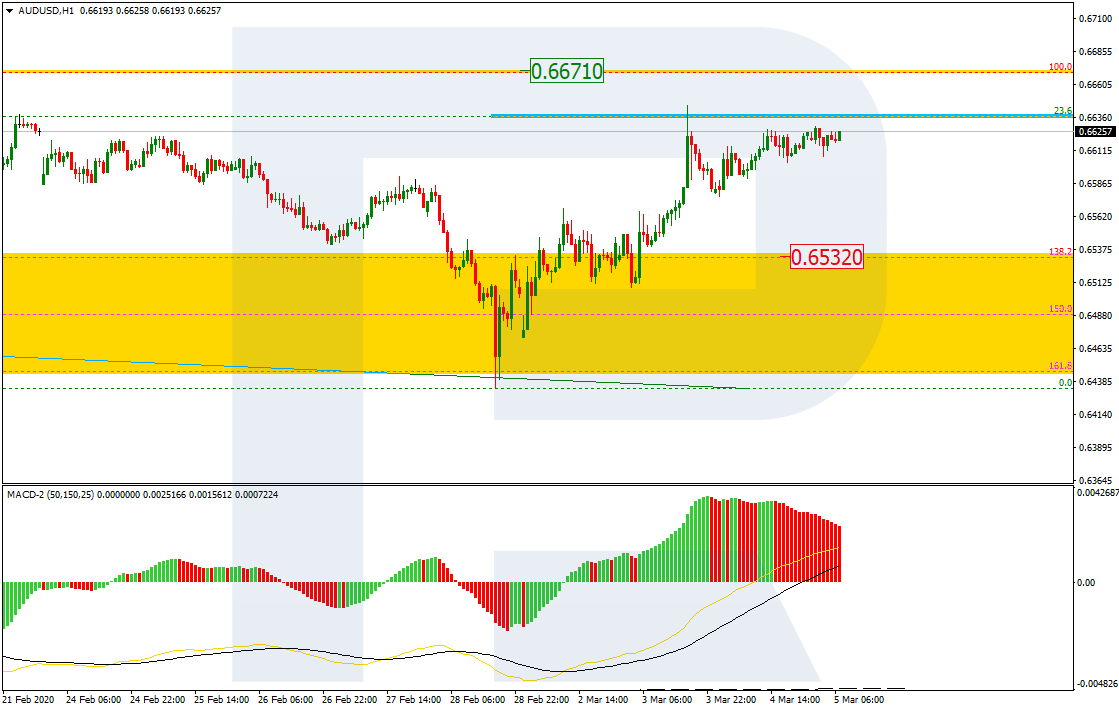

In the H1 chart, AUDUSD is forming a short-term correction in the form of a Triangle pattern below 23.6% fibo.

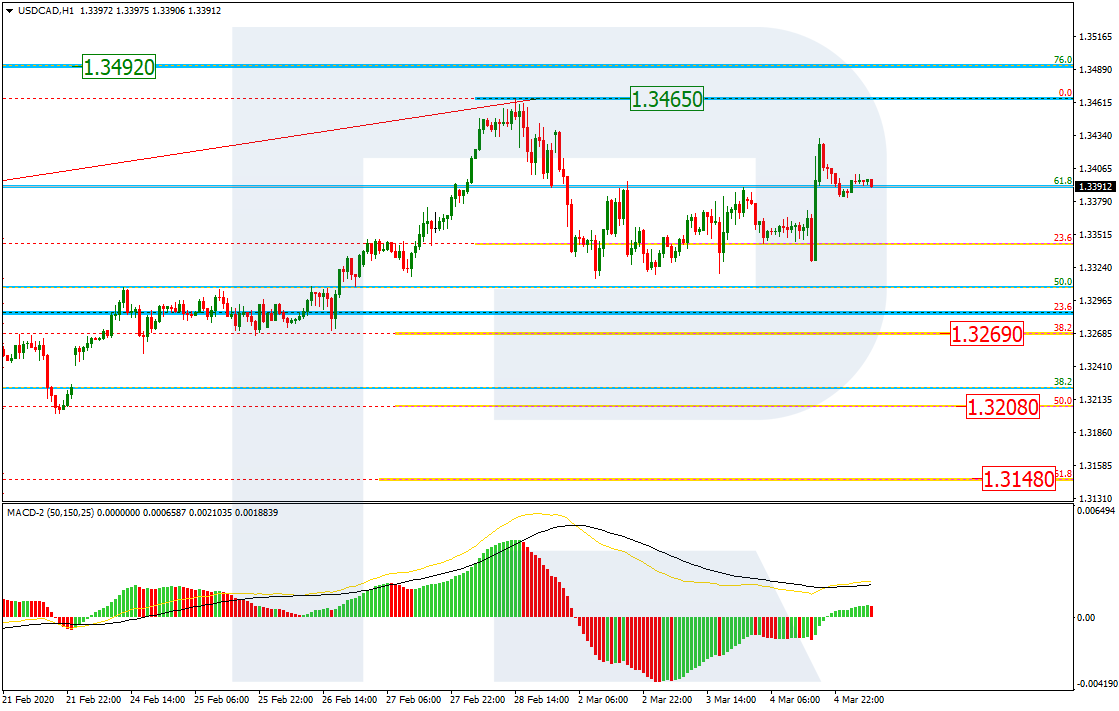

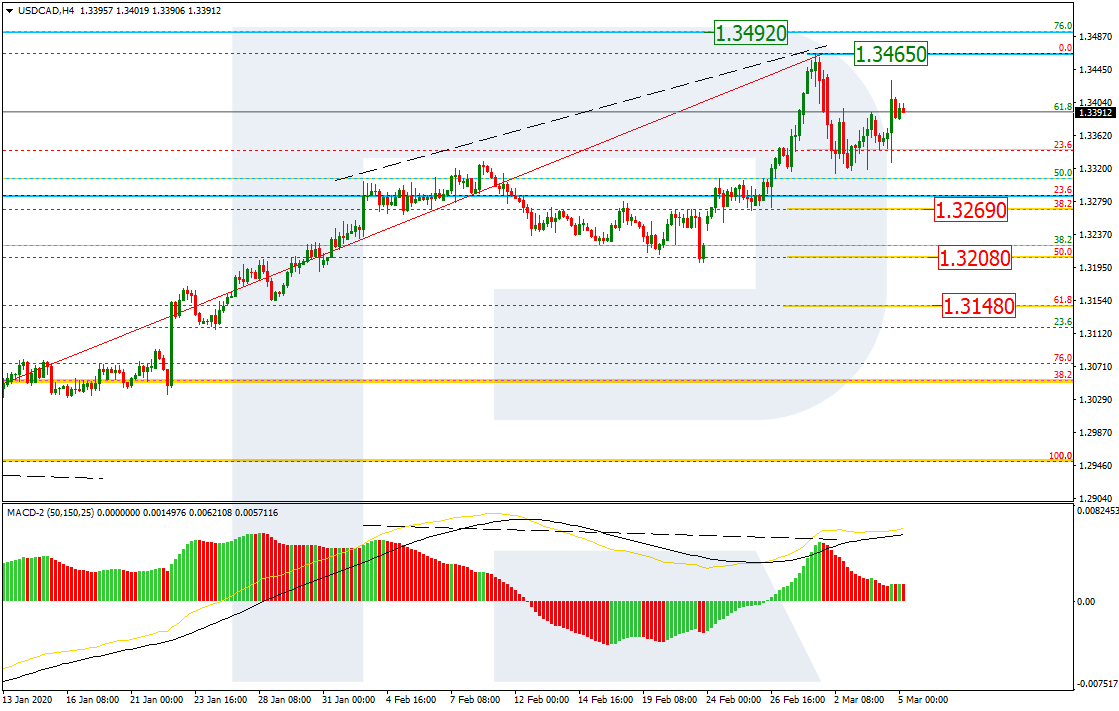

USDCAD, “US Dollar vs Canadian Dollar”

As we can see in the H4 chart, the divergence made the pair start a new decline, which, after reaching 23.6%, has rebounded and right now is trying to move sideways. If this rebound transforms into a new growth, the price may break the high at 1.3465 and grow towards 76.0% fibo at 1.3492. However, if the descending tendency continues, the targets will be 38.2%, 50.0%, and 61.8% fibo at 1.3269, 1.3208, and 1.3148 respectively.

In the H1 chart, there have been several tests of 23.6% fibo. Right now, the pair is trying to trade towards the high at 1.3465.