07.10.2019

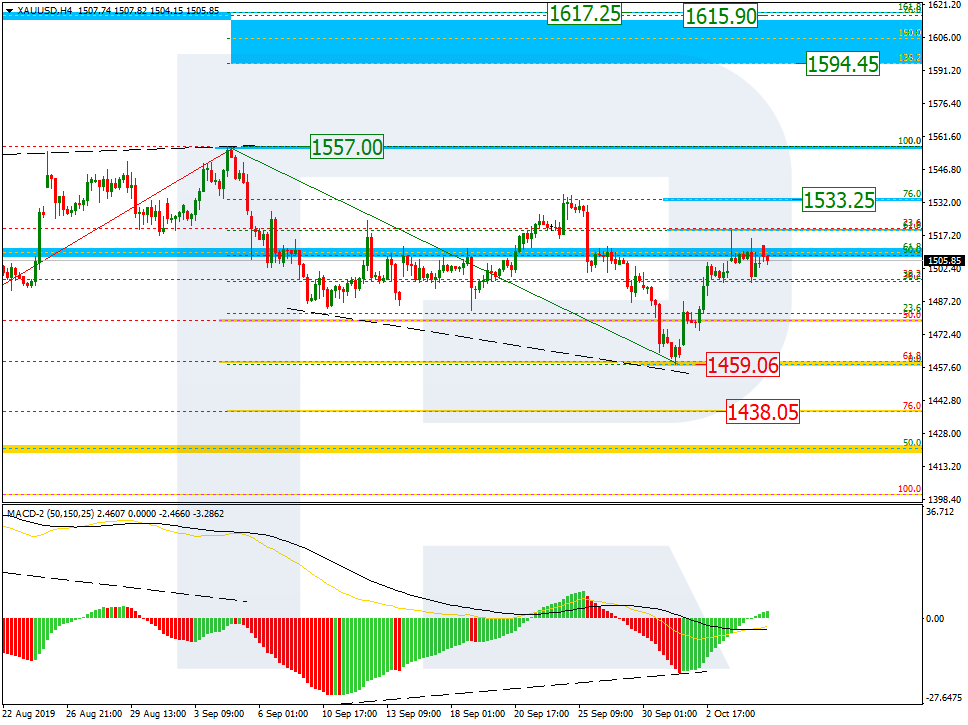

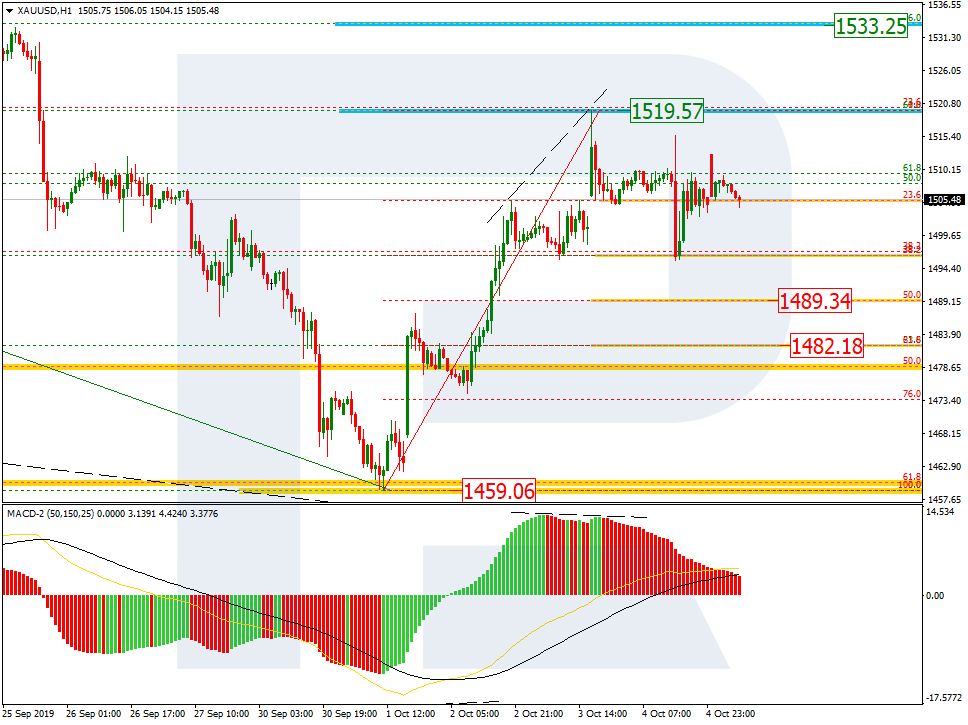

XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, the convergence made the pair complete the descending correction at 61.8% fibo and start a new growth, which has already reached 61.8% fibo. The next upside targets may be 76.0% fibo at 1533.25 and the high at 1557.00. If XAUUSD breaks the high, the instrument may continue growing towards the post-correctional extension area between 138.2% and 161.8% fibo at 1594.45 and 1617.25 respectively.

In the H1 chart, we can see a short-term pullback, which has already reached 38.2% fibo and may yet continue towards 50.0% and 61.8% fibo at 1489.34 and 1482.18 respectively. The resistance is the high at 1519.57.

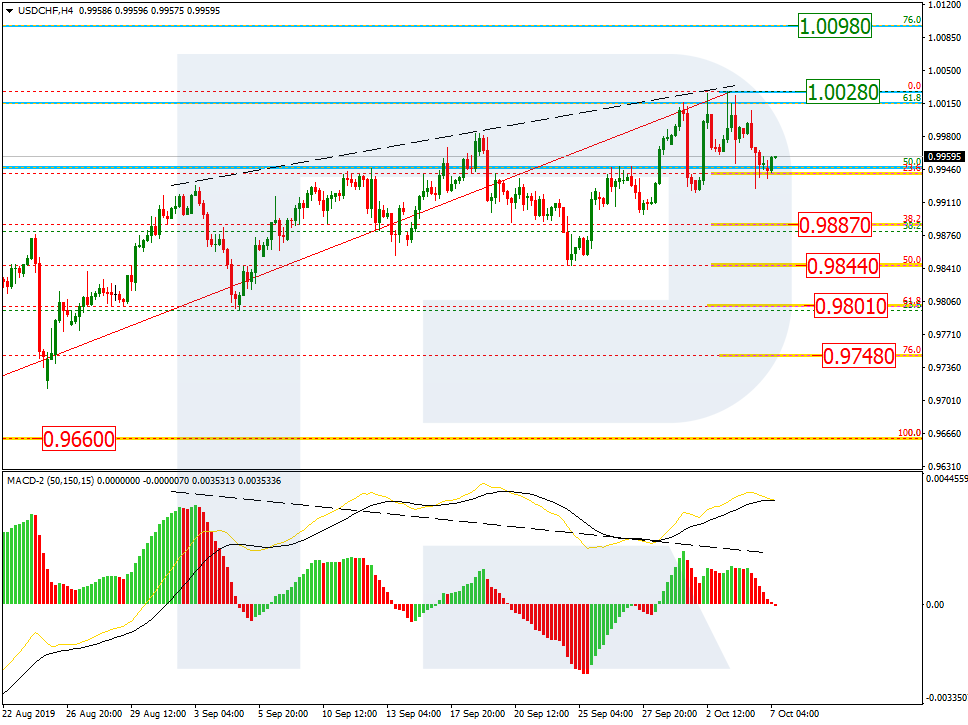

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the H4 chart, the divergence made the pair finish the ascending tendency at 61.8% fibo. However, if the price breaks the high at 1.0028, the tendency may yet continue to reach 76.0% fibo at 1.0098. Still, the divergence indicates a new decline in the first place, which has already reached 23.6% fibo. The next downside targets may be 38.2%, 50.0%, 61.8%, and 76.0% fibo at 0.9887, 0.9844, 0.9801, and 0.9748 respectively.

In the H1 chart, after completing the descending impulse, the pair is still testing 23.6% fibo. The next downside target is 38.2% fibo at 0.9887.