Fibonacci Retracements Analysis 08.06.2020 (GOLD, USDCHF)

XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, the divergence prevented XAUUSD from updating the high at 1764.86 and made the pair start a new decline, which has already reached 23.6% fibo. The next downside targets may be 38.2%, 50.0%, and 61.8% fibo at 1645.06, 1607.83, and 1570.90 respectively.

![]()

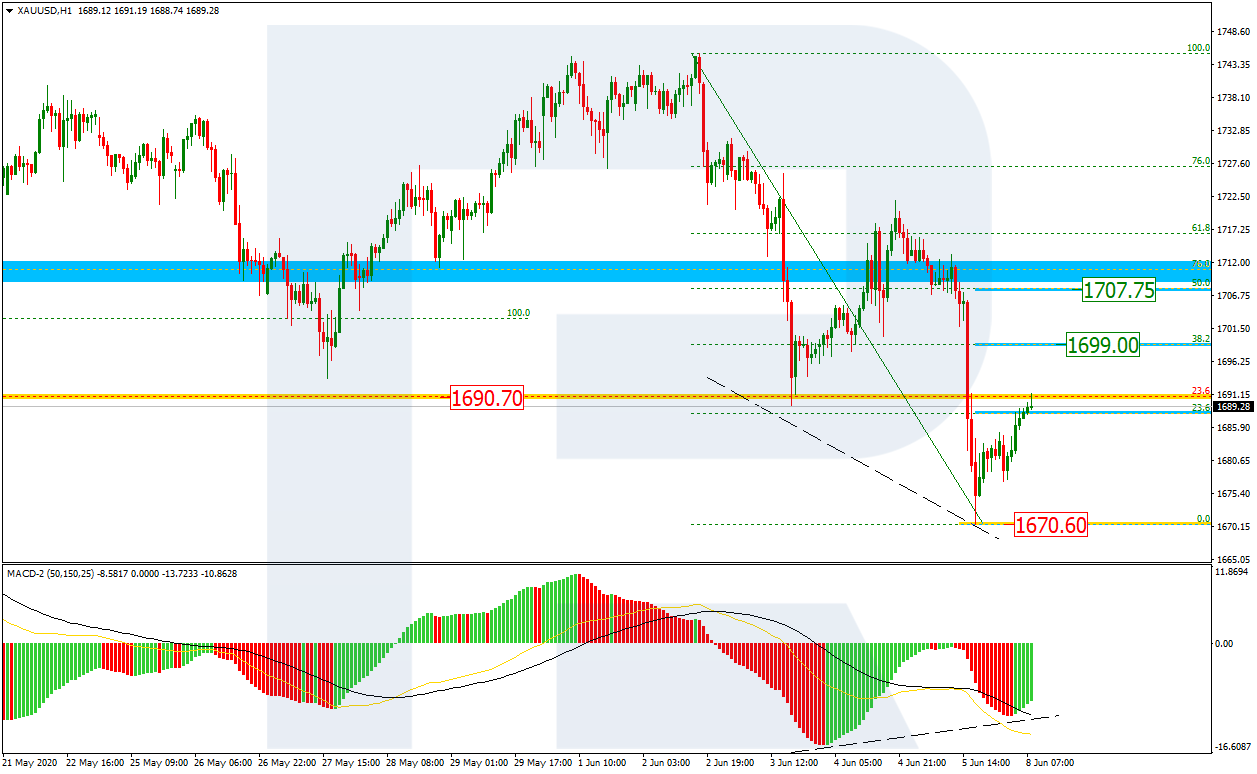

In the H1 chart, the local convergence made the pair start a new growth, which has already reached 23.6% fibo. The next upside targets may be 38.2% and 50.0% fibo at 1699.00 and 1707.75 respectively. The support is the low at 1670.60.

![]()

USDCHF, “US Dollar vs Swiss Franc”

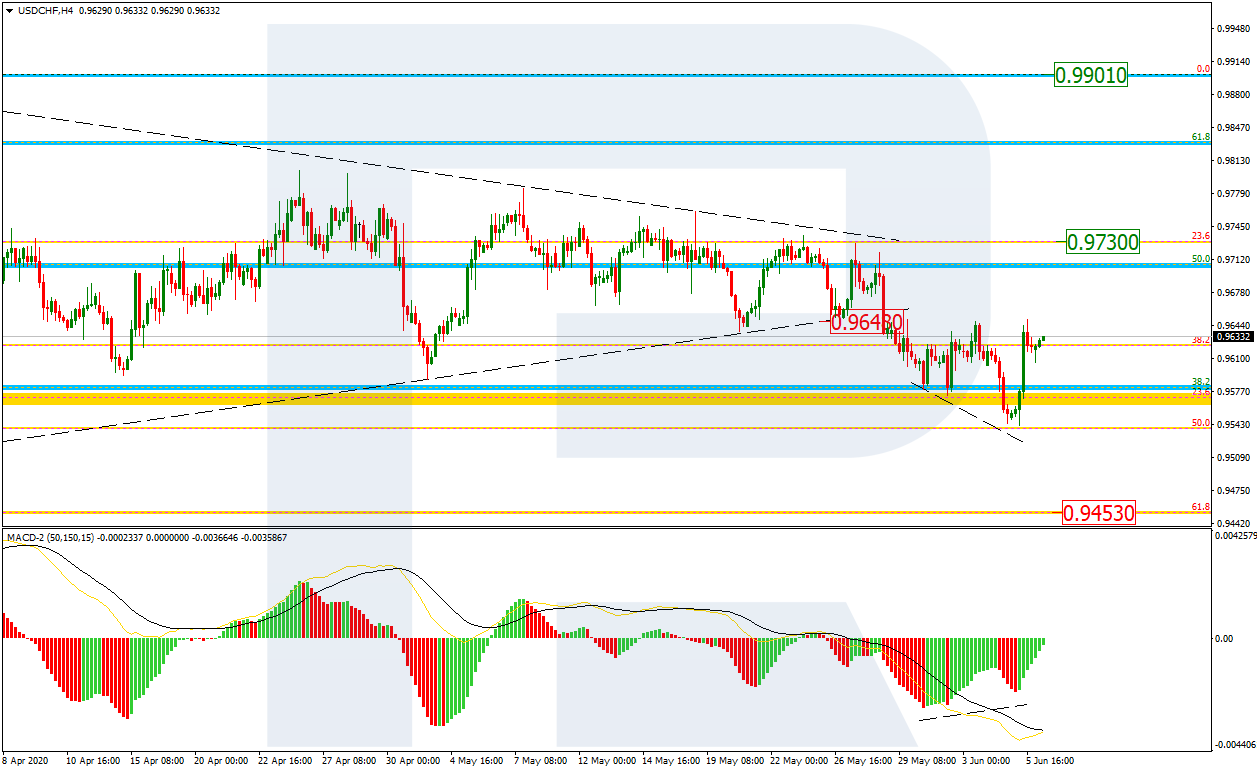

As we can see in the H4 chart, after breaking the downside border of the Triangle pattern, USDCHF attempted to re-test 50.0% fibo. At the same time, after the local convergence, the pair has started a strong rising impulse to break the resistance at 23.6% fibo (0.9730). if it succeeds, the market may reach the high at 0.9901. However, one shouldn’t exclude another scenario, according to which the instrument may continue falling towards 61.8% fibo at 0.9453.

![]()

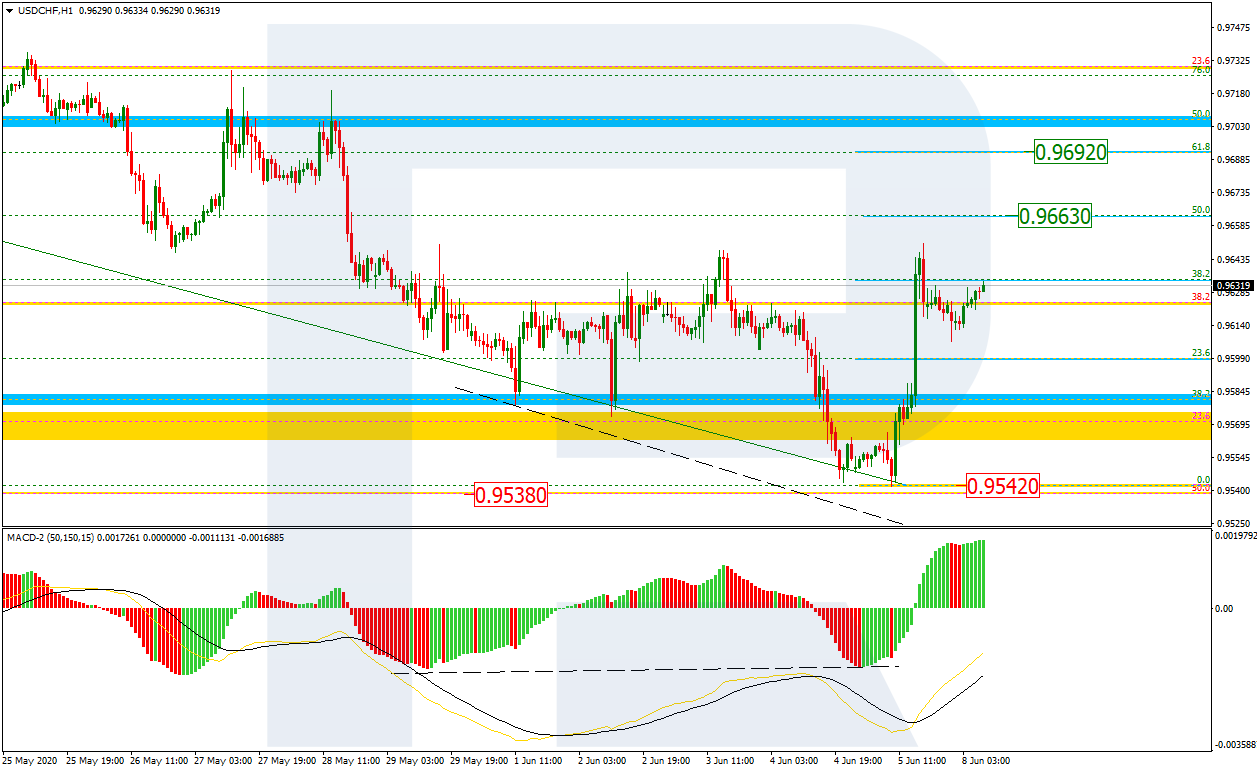

In the H1 chart, after the convergence, the pair has reached 38.2% fibo. The next rising impulse will be heading towards 50.0% and 61.8% fibo at 0.9663 and 0.9692 respectively. The local support is the low at 0.9542.

![]()