Fibonacci Retracements Analysis 09.02.2021 (EURUSD, USDJPY)

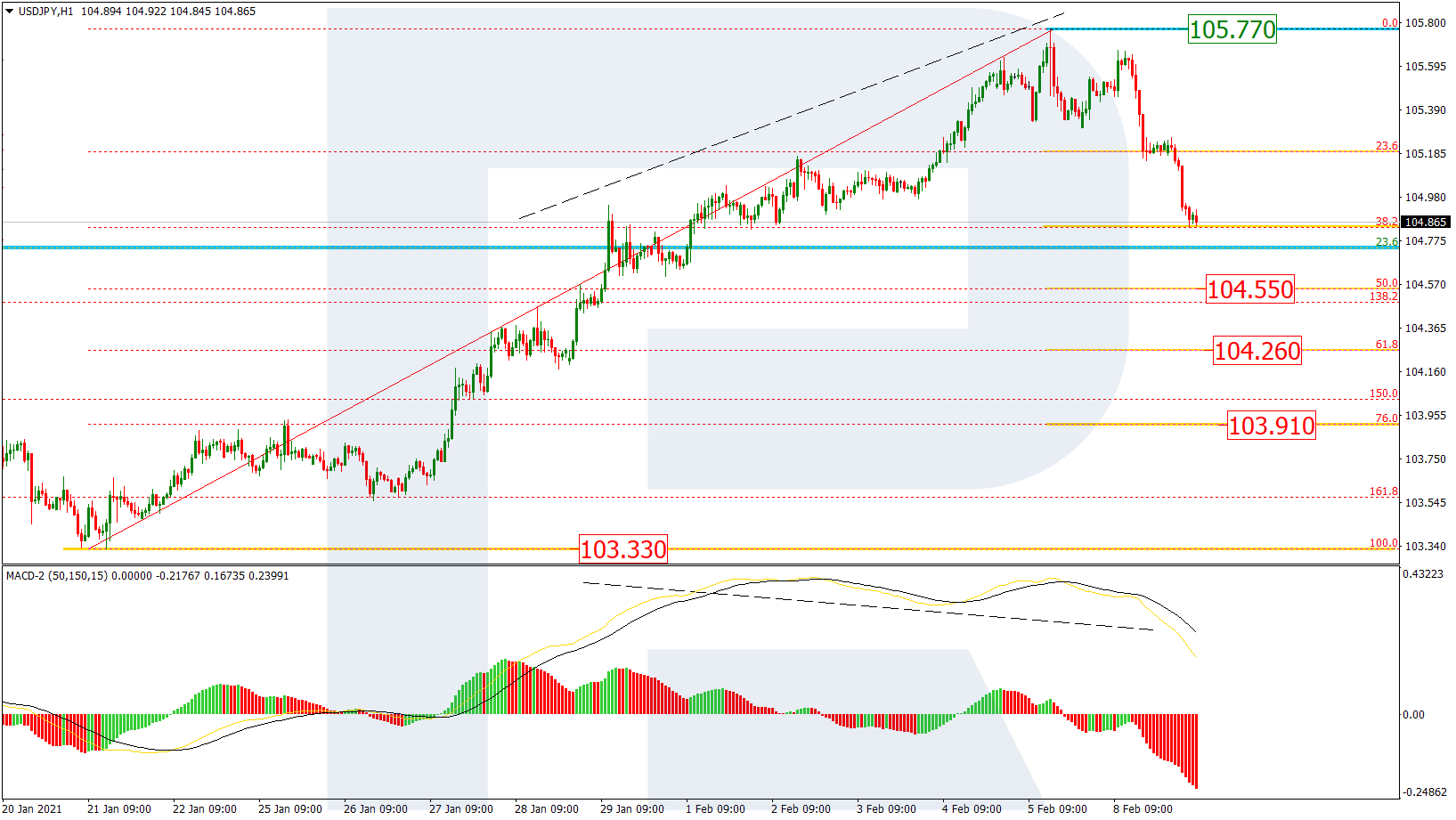

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, a convergence on MACD made the pair complete the correctional downtrend at 50.0% fibo. Possibly, the asset may be starting a new rising wave towards the high at 1.2350 and then the long-term fractal high at 1.2555. On the other hand, EURUSD may yet continue falling to reach 61.8% fibo at 1.1888 but this scenario is rather unlikely.

The H1 chart shows a more detailed structure of the current rising wave, which is heading to break 38.2% fibo at 1.2104 and may later then continue towards 50.0%, 61.8%, and 76.0% fibo at 1.2151, 1.2198, and 1.2254 respectively. A breakout of the local low at 1.1952 will hint at a further downtrend.

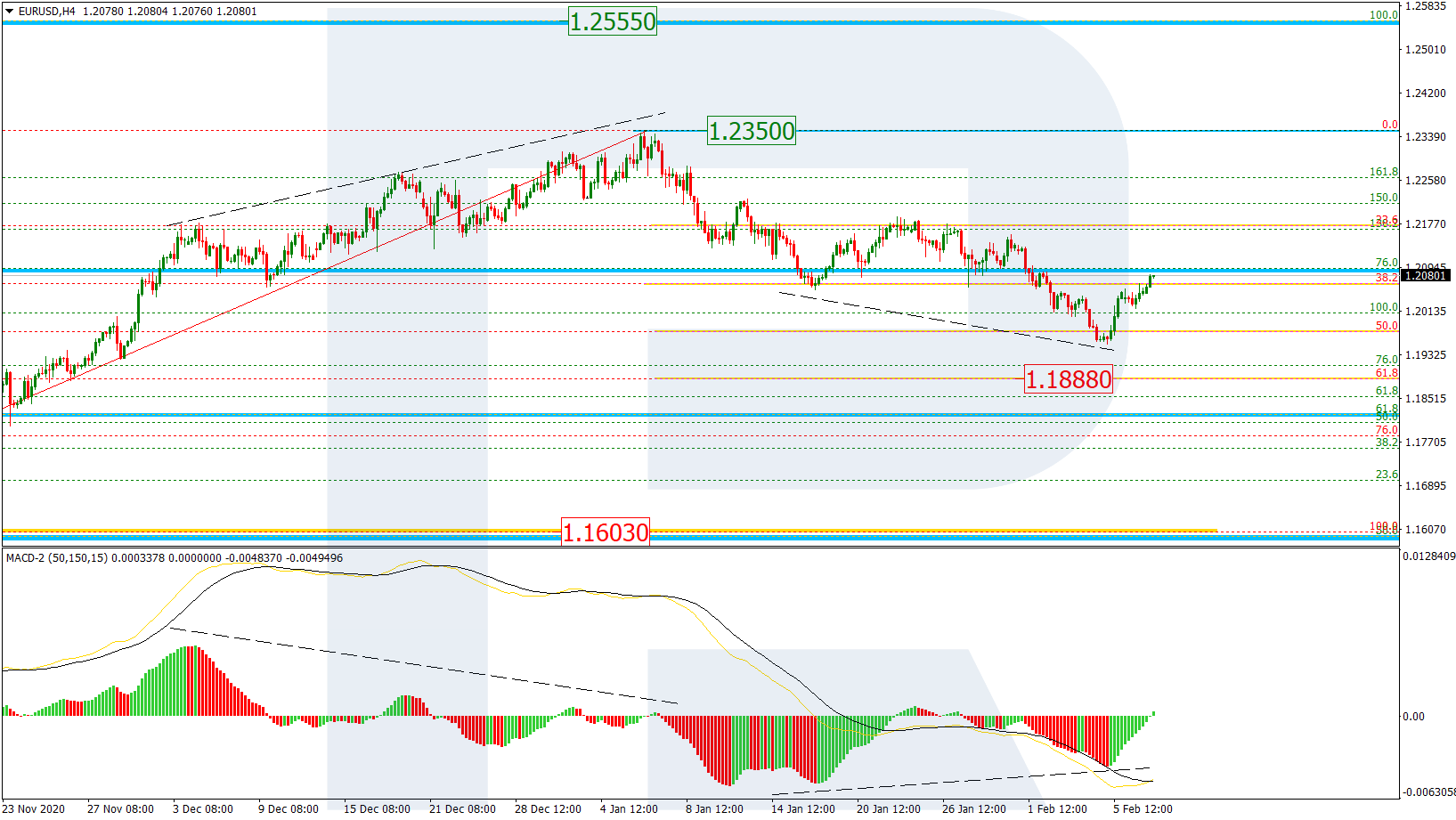

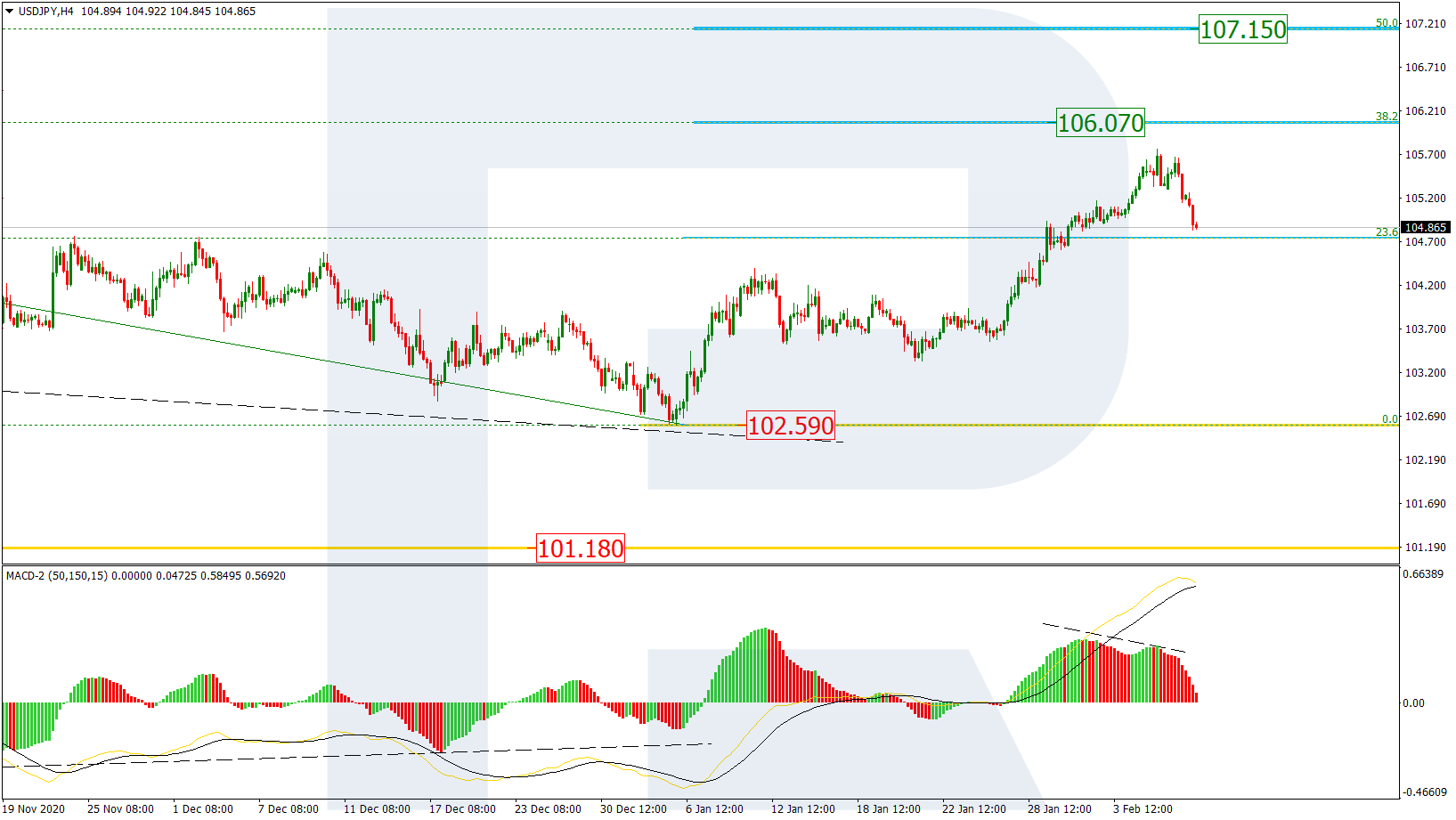

USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the H4 chart, after breaking the mid-term 23.6% fibo, USDJPY has failed to reach 38.2% fibo at 106.07; right now, it is correcting to return to the former level. After the pullback, the price may continue growing towards 38.2% and 50.0% fibo at 106.07 107.15 respectively. On the other hand, if the asset breaks the low at 102.59, the instrument may continue falling to reach the fractal low at 101.18.

The H1 chart shows a more detailed structure of the current descending correction, which has already reached 38.2% fibo and may later continue towards 50.0%, 61.8%, and 76.0% fibo at 104.55, 104.26, and 103.91 respectively. However, a breakout of the local high at 105.77 will complete the correction.