Fibonacci Retracements Analysis 09.06.2020 (EURUSD, USDJPY)

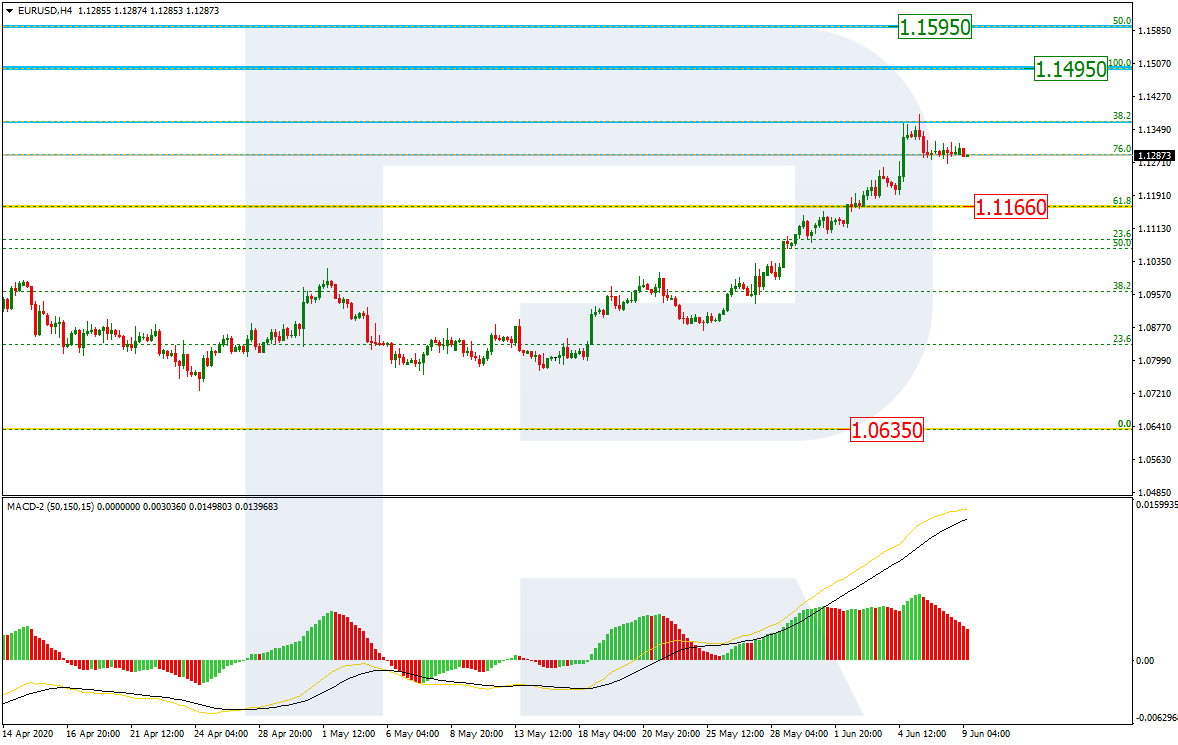

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, the convergence made EURUSD resume the ascending tendency, which has already reached the long-term 38.2% fibo and broken 76.0% fibo. The next upside targets may be the fractal high and the long-term 50.0% fibo at 1.1495 and 1.1595 respectively. At the same time, in the nearest future, there might be a pullback towards the support at 61.8% fibo (1.1166).

![]()

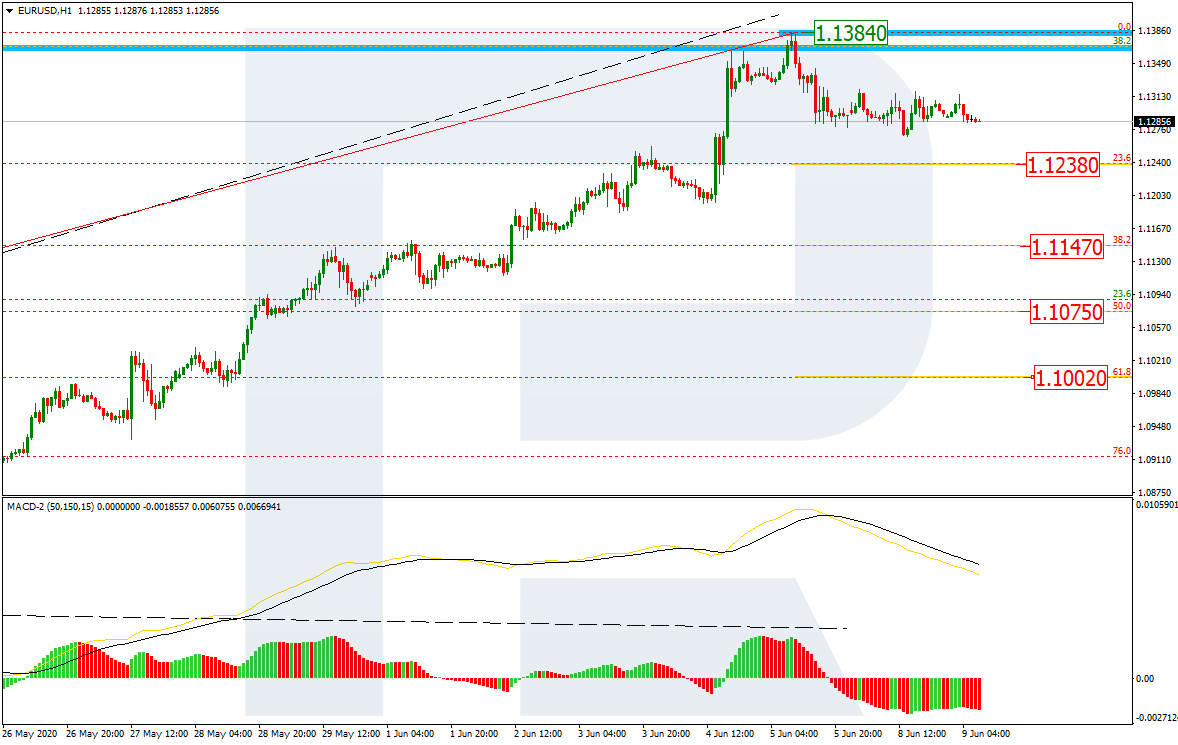

In the H1 chart, the pair is correcting downwards after the divergence on MACD and approaching 23.6% fibo at 1.1238. The next downside targets may be 38.2%, 50.0% and 61.8% fibo at 1.1147, 1.1075, and 1.1002 respectively. The resistance is the high at 1.1384.

![]()

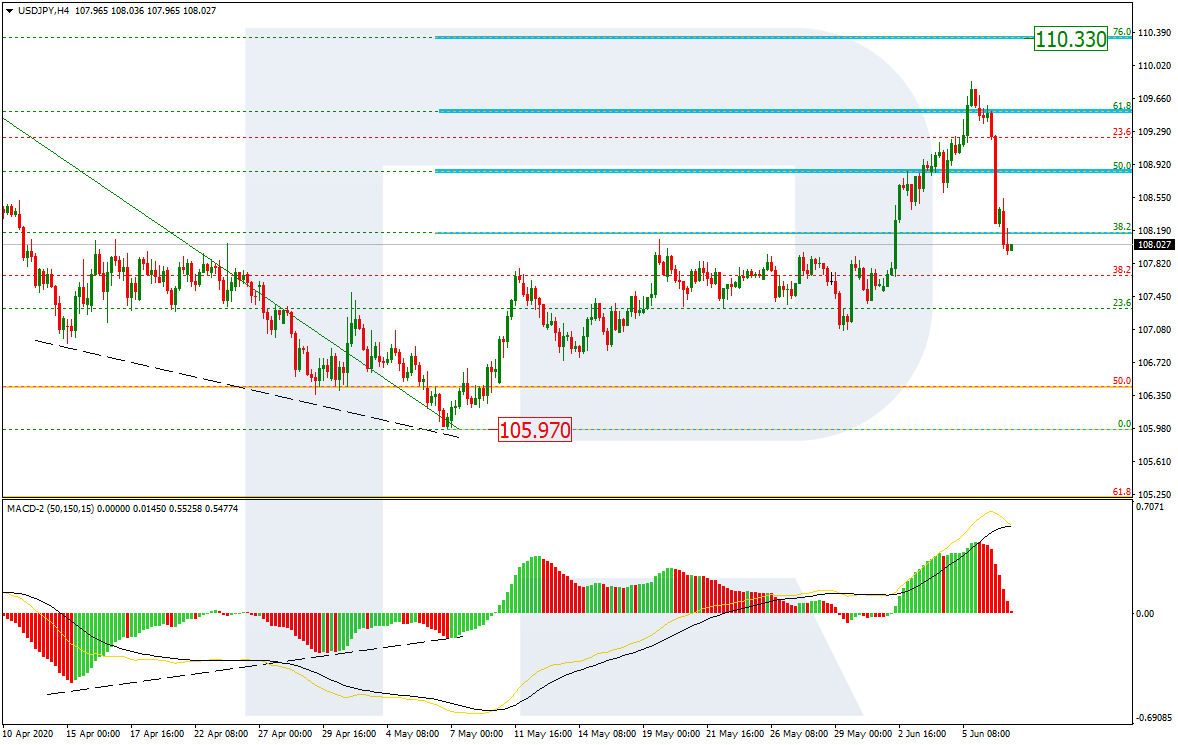

USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the H4 chart, the convergence made the pair start a new growth to reach 61.8% fibo, which was later followed by another decline to return to 38.2% fibo. The current situation may be described as a pullback within the rising tendency. After finishing the pullback, the instrument may continue trading upwards towards the next target at 76.0% fibo at 110.33.

![]()

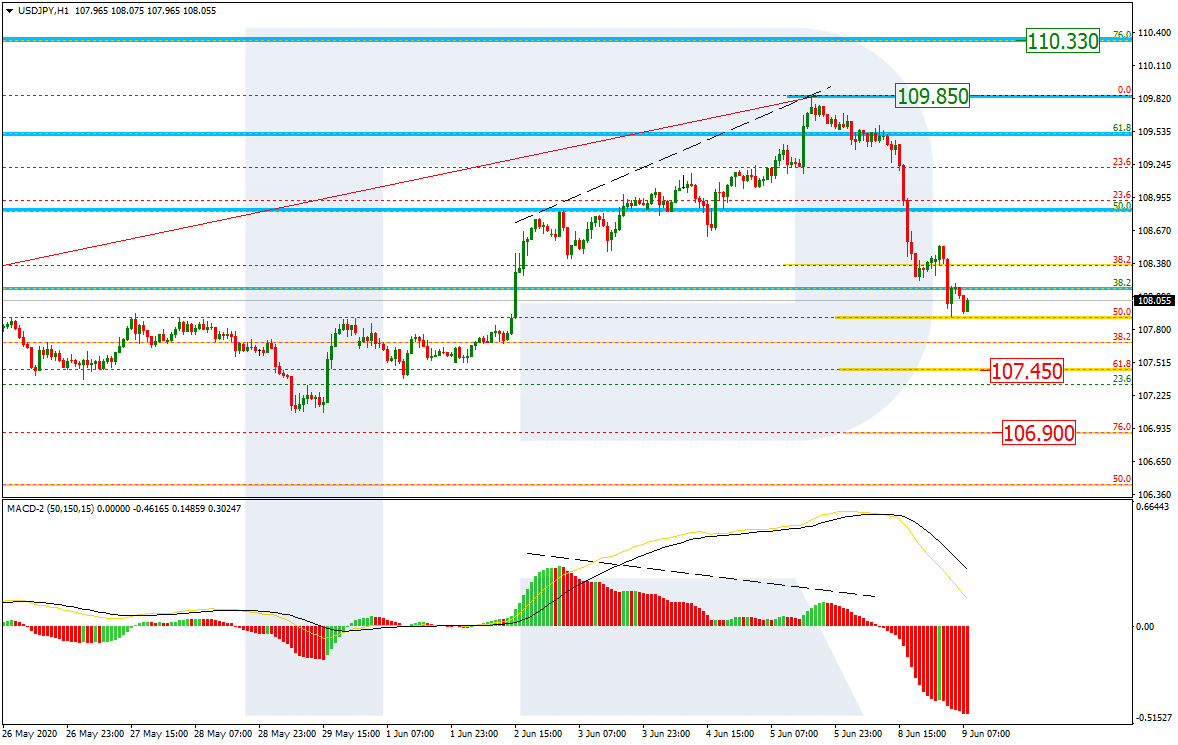

The H1 chart shows a more detailed structure of the current descending movement after the divergence. The price has reached 50.0% fibo and may continue falling towards 61.8% and 76.0% fibo at 107.45 and 106.90 respectively. The resistance is the high at 109.85.

![]()