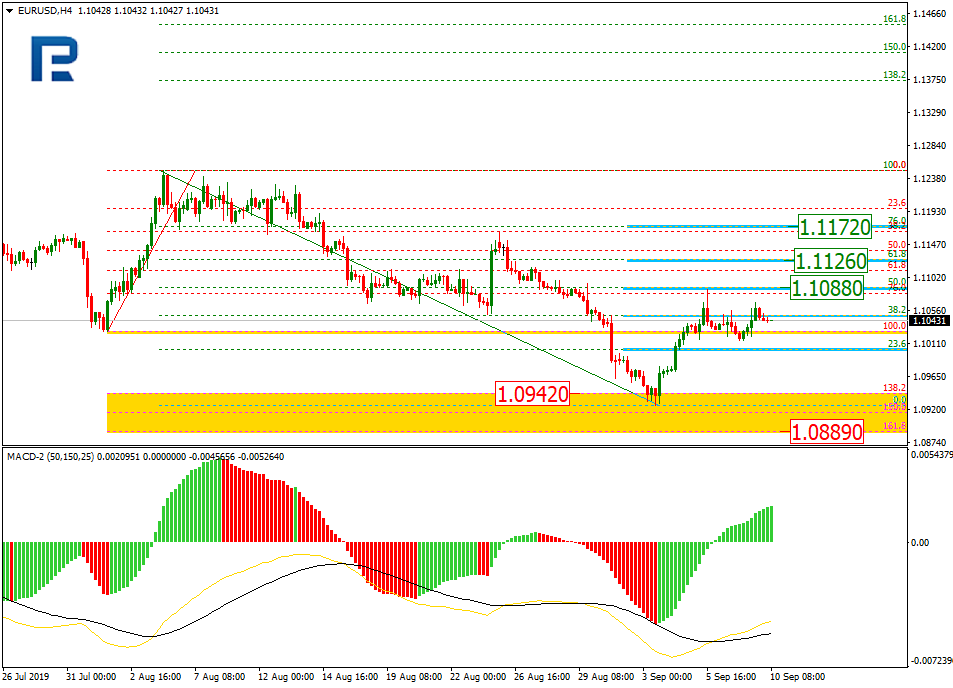

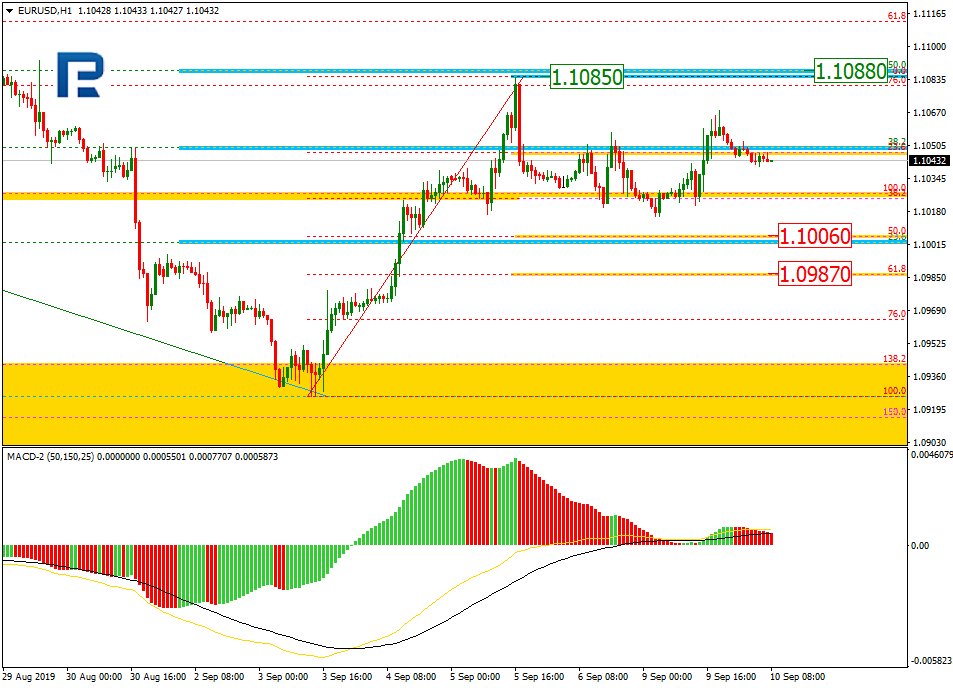

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, after entering the post-correctional extension area between 138.2% and 161.8% fibo at 1.0942 and 1.0889 respectively, EURUSD is correcting towards 50.0% fibo at 1.1088. In the future, the correction may continue to reach 61.8% and 76.0% fibo at 1.1126 and 1.1172 respectively.

In the H1 chart, after finishing the rising impulse, the pair is correcting downwards and has already reached 38.2% fibo. Later, the pullback may continue towards 50.0% and 61.8% fibo at 1.1006 and 1.0987 respectively. If the price breaks the high at 1.1085, the mid-term uptrend may continue.

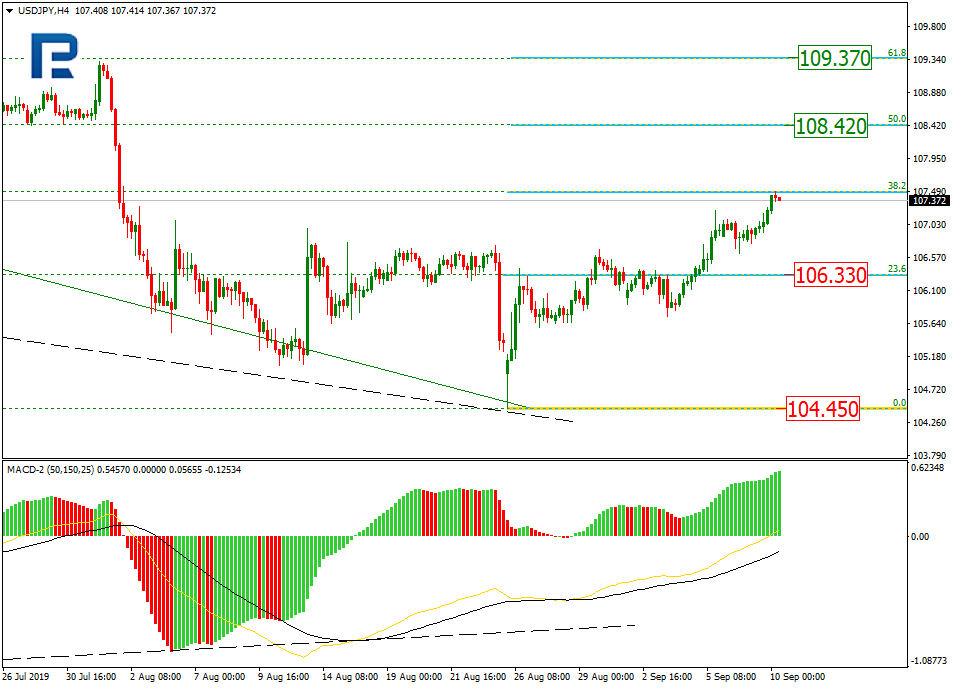

USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the H4 chart, the correctional uptrend continues; it has already reached 38.2% fibo. In the short-term, the price may start a new correction towards 23.6% fibo at 106.33. After the correction, USDJPY may resume moving upwards to reach 50.0% and 61.8% fibo at 108.42 and 109.37 respectively. The key support is at 104.45.

In the H1 chart, there is a divergence on MACD within the uptrend, which may indicate a new pullback soon with the target at 23.6%, 38.2%, and 50.0% fibo at 106.78, 106.33, and 105.98 respectively. If the price breaks the high at 107.50, the instrument may resume trading upwards.