Fibonacci Retracements Analysis 11.02.2021 (AUDUSD, USDCAD)

AUDUSD, “Australian Dollar vs US Dollar”

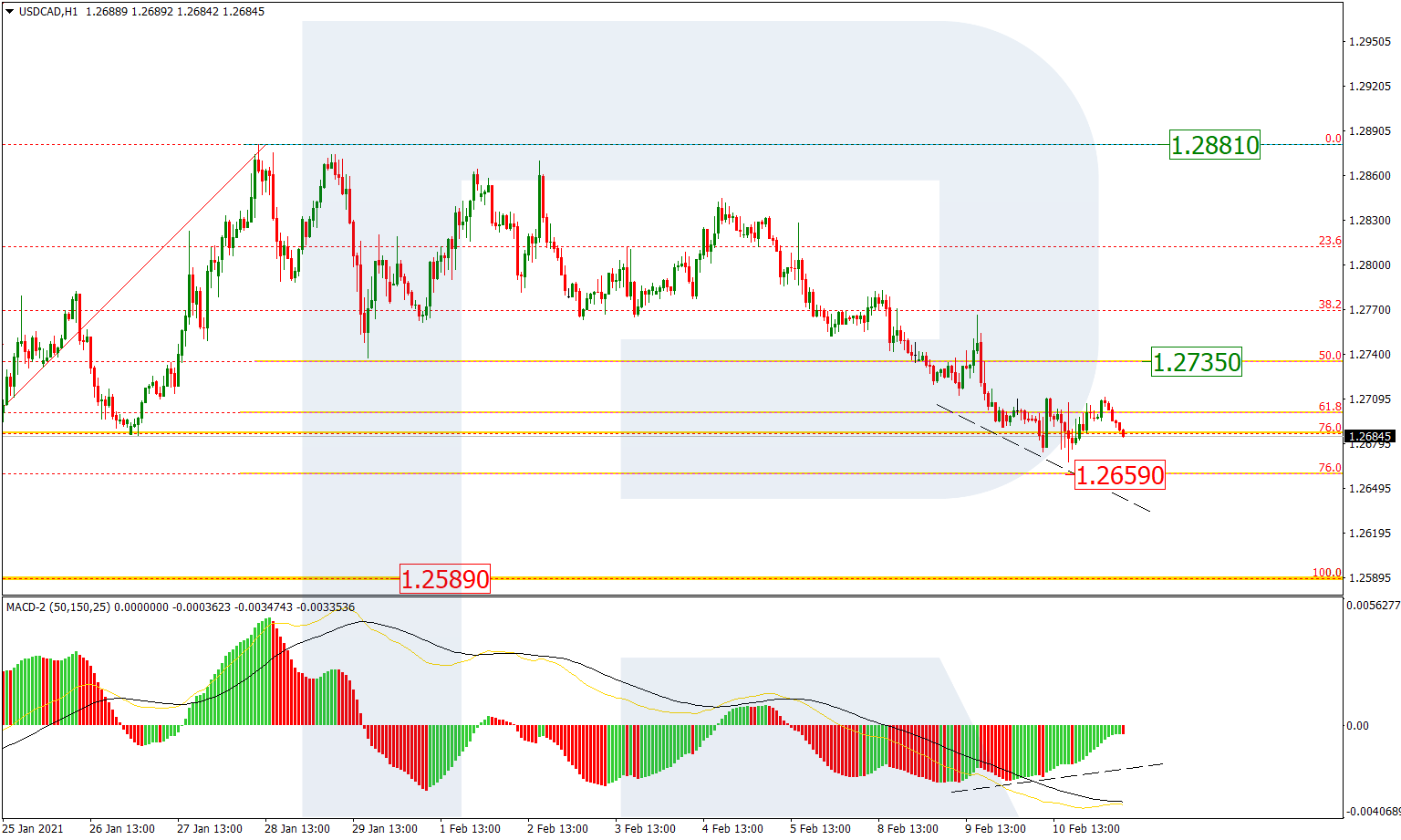

As we can see in the daily chart, after testing 38.2% fibo, AUDUSD is starting a new impulse to the upside. The next important upside target is 50.0% fibo at 0.8292, while the support is at 23.6% fibo at 0.6820. At the same time, there might be a divergence on MACD, which implies a new correction to the downside after the asset reaches the target.

![]()

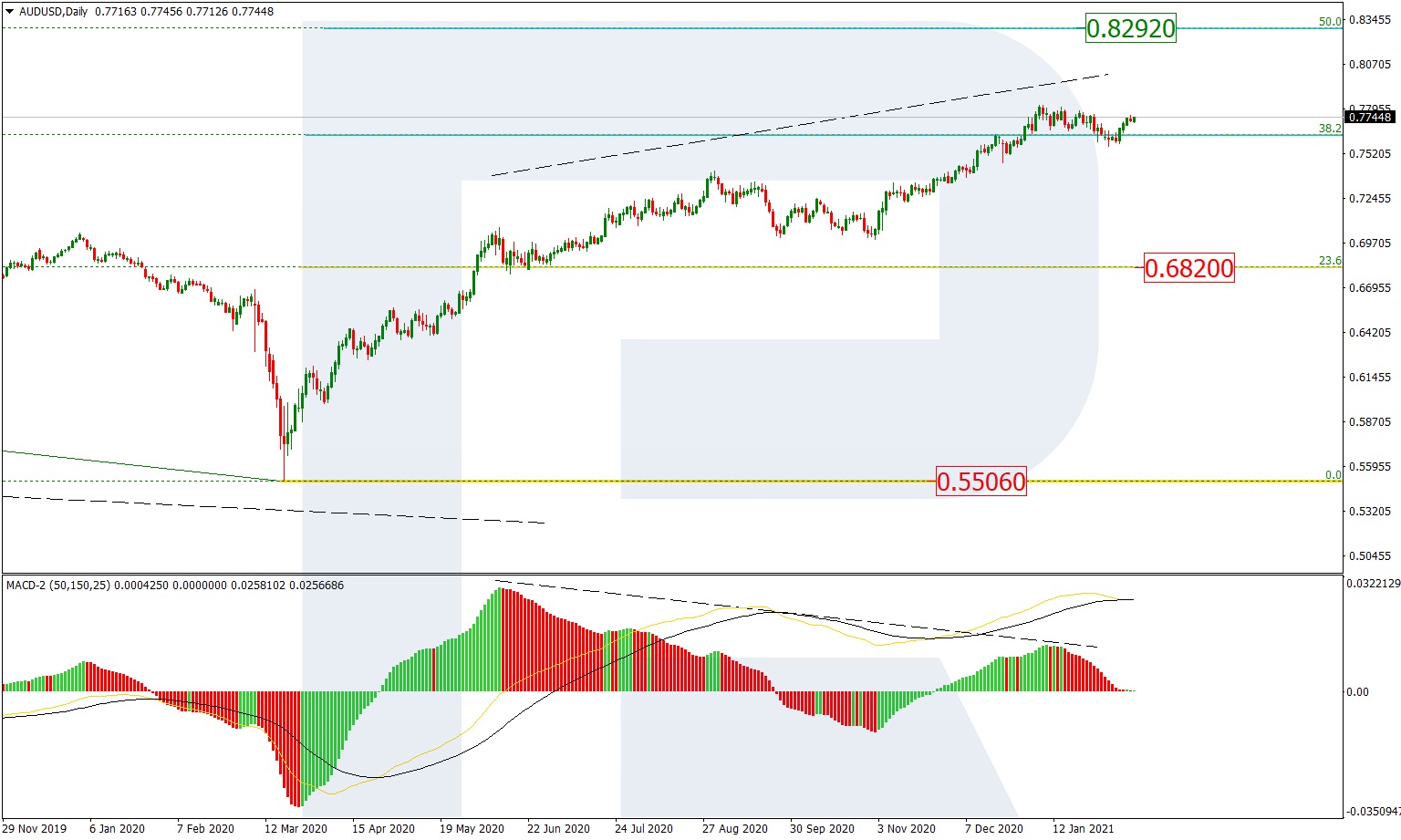

The H1 chart shows that after breaking 23.6% fibo but then failing to reach 38.2% fibo at 0.7503, the pair has started a new rising wave towards 76.0% fibo at 0.7759 due to convergence on MACD. Despite a local divergence, the pair is expected to continue growing towards the high at 0.7820. Later, the market may rebound from the high and resume falling towards the mid-term 38.2% and 50.0% fibo at 0.7503 and 0.7405 respectively.

![]()

USDCAD, “US Dollar vs Canadian Dollar”

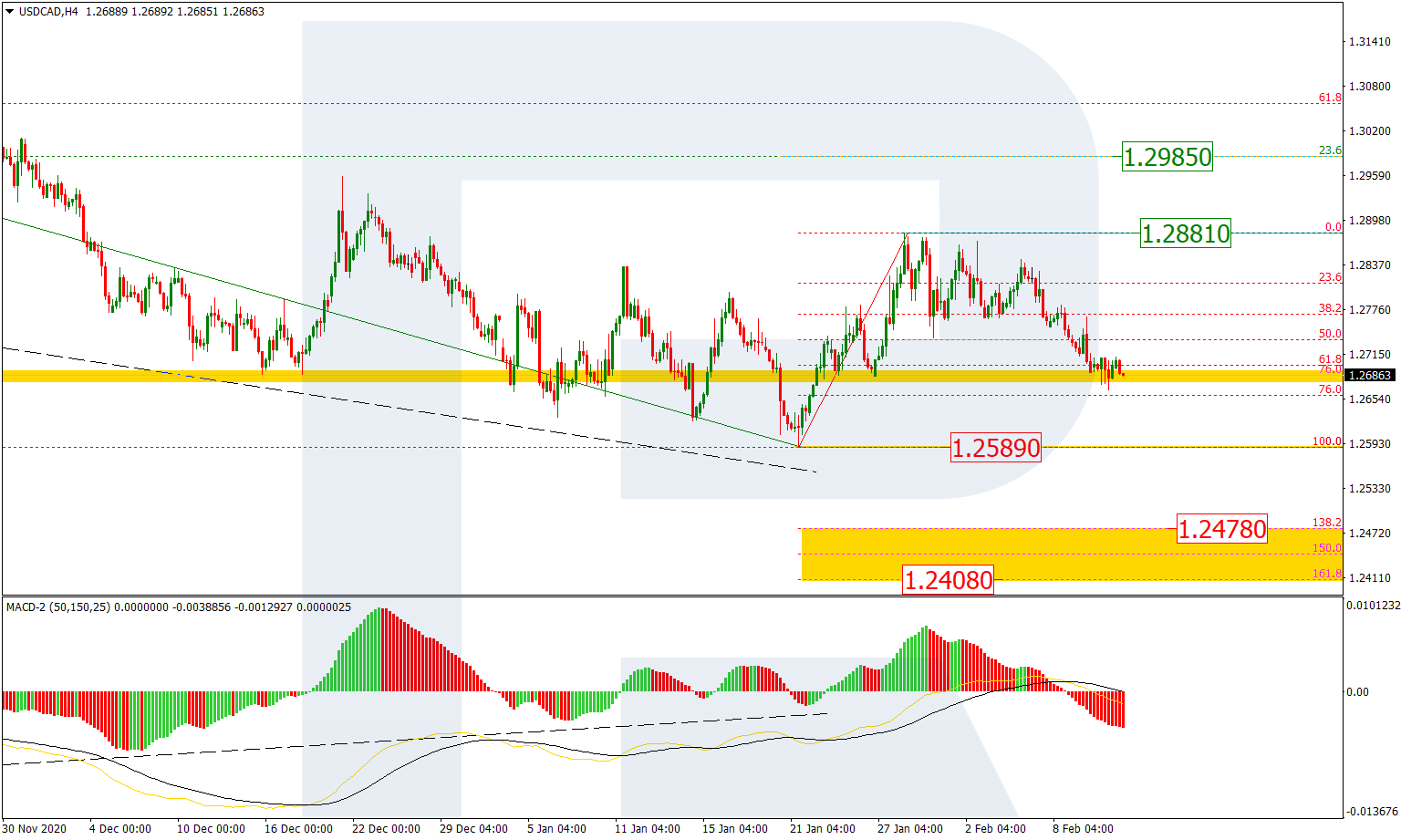

As we can see in the H4 chart, after breaking the consolidation range, USDCAD is falling. Despite a convergence on MACD, the pair may fall to break the low at 1.2589 and then continue trading downwards to reach the post-correctional extension area between 138.2% and 161.8% fibo at 1.2478 and 1.2408 respectively. However, as long as the asset is moving above the low, it may yet grow to break the local high at 1.2881 and then reach the long-term 23.6% fibo at 1.2985.

![]()

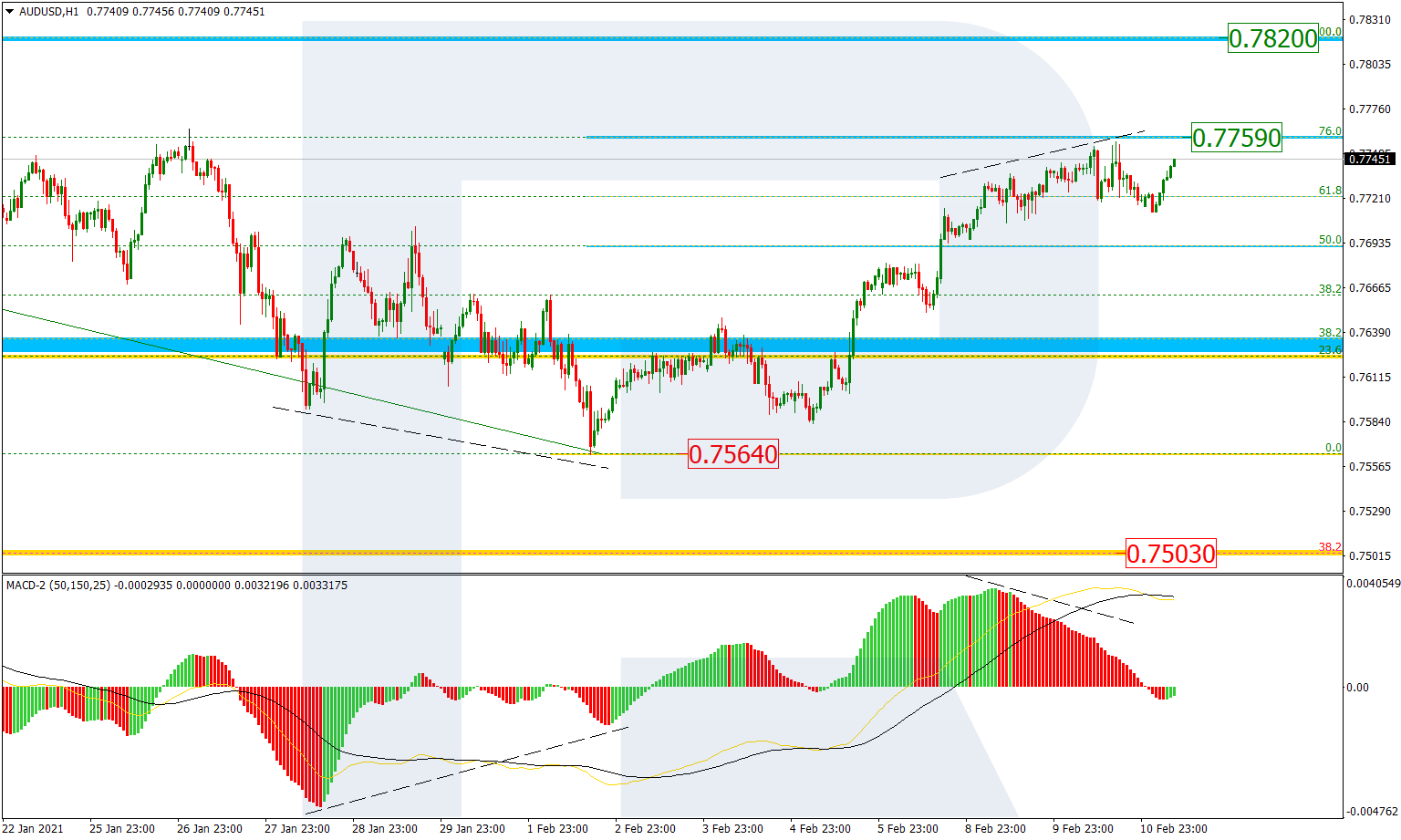

The H1 chart shows that the descending wave is approaching 76.0% fibo at 1.2659. At the same time, there is a convergence on MACD, which may indicate a possible reversal soon. A breakout of the resistance at 50.0% fibo (1.2735) will lead to a new mid-term wave to the upside.