Fibonacci Retracements Analysis 11.12.2019 (GBPUSD, EURJPY)

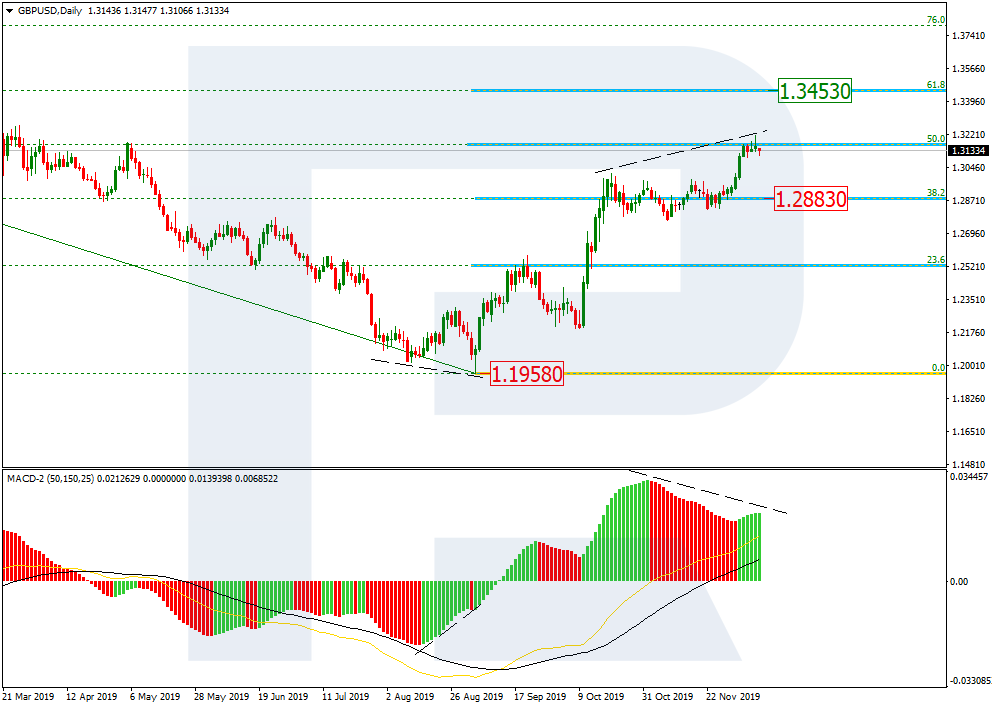

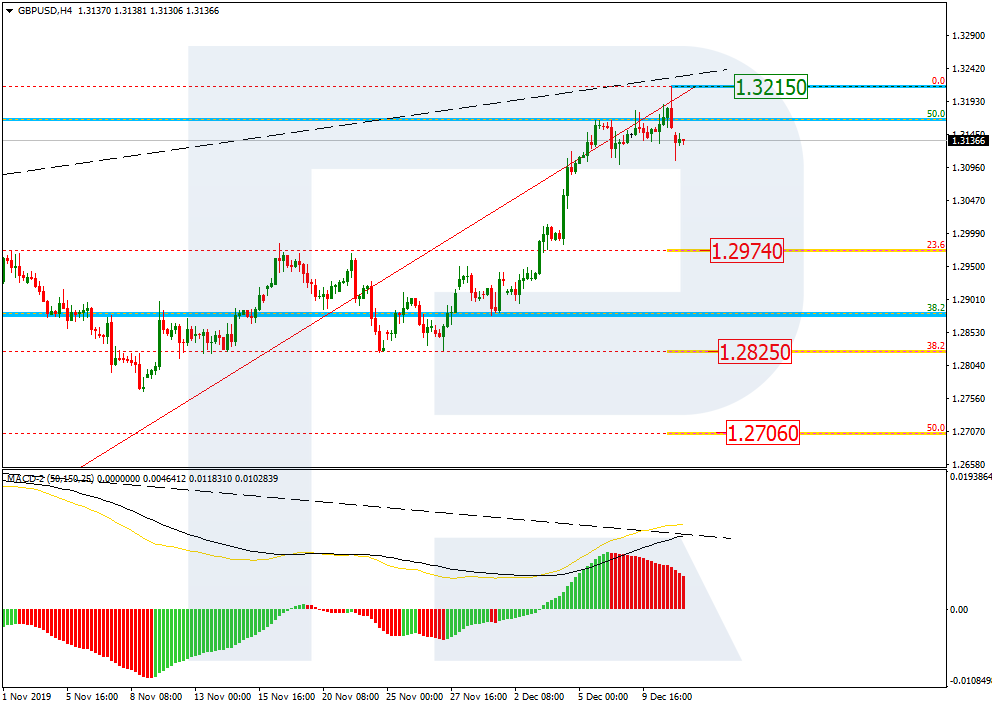

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the daily chart, the uptrend has reached 50.0% fibo. At the same time, there is a divergence on MACD, which may indicate a new pullback. However, the pair may yet continue growing towards 61.8% fibo at 1.3453. The short-term target of the above-mentioned pullback is the local support at 38.2% fibo (1.2883); the key support is the low at 1.1958.

In the H4 chart, the divergence made GBPUSD start a new correction to the downside; the targets at are 23.6%, 38.2%, and 50.0% fibo at 1.2974, 1.2825, and 1.2706 respectively. The resistance is the high at 1.3215.

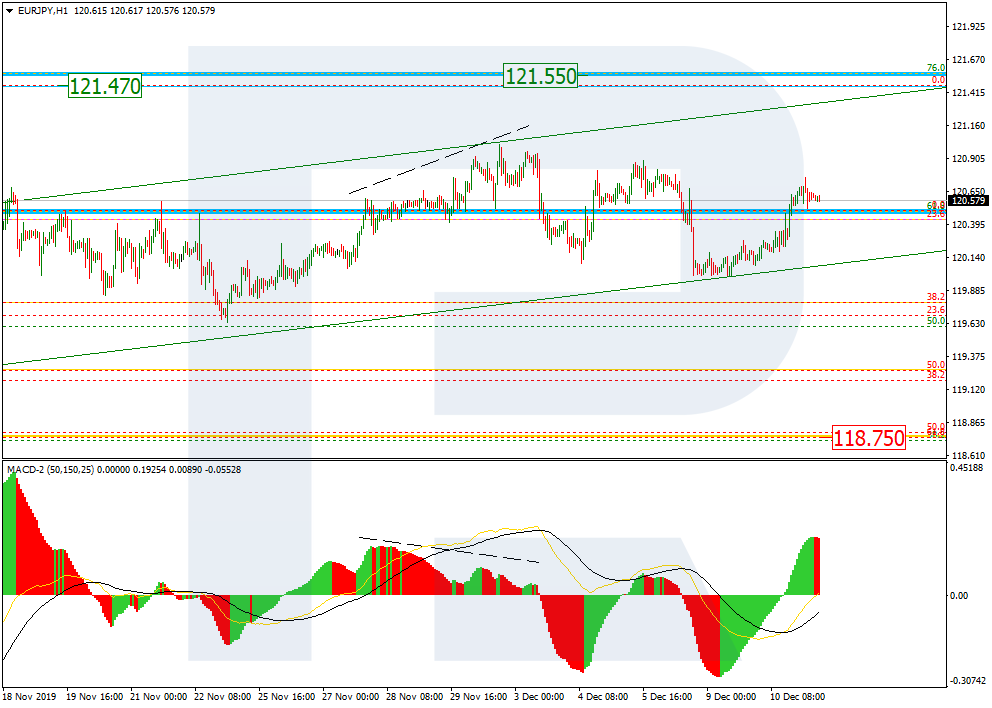

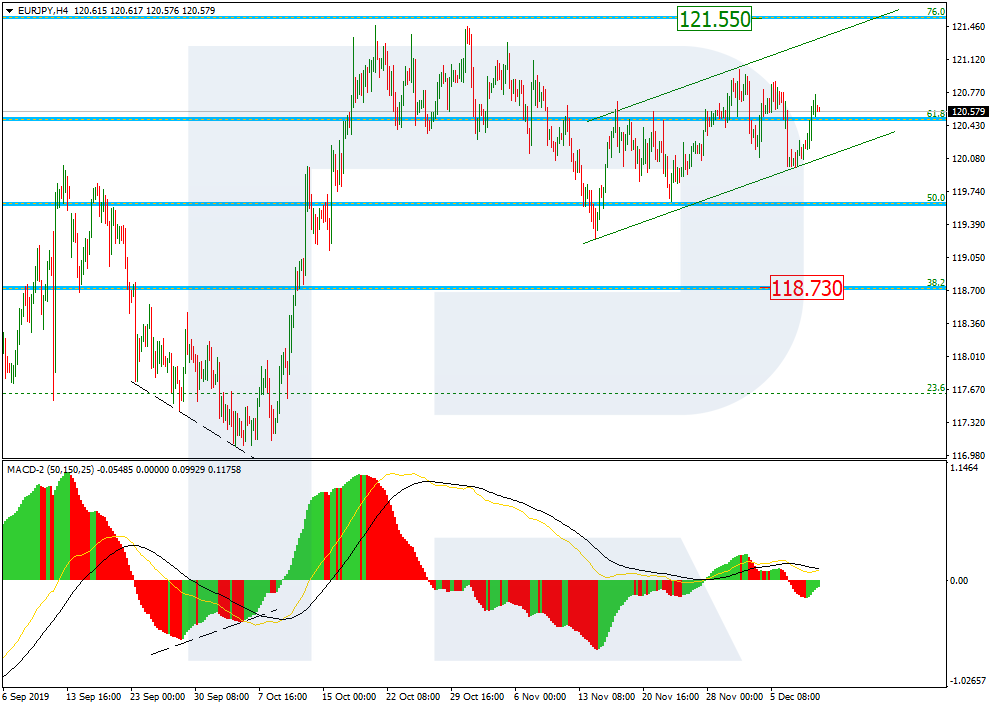

EURJPY, “Euro vs. Japanese Yen”

As we can see in the H4 chart, EURJPY continues the uptrend towards 76.0% fibo at 121.55. After breaking this level and fixing above it, the instrument may continue growing towards the high at 123.36. The support is at 38.2% fibo (118.73).

In the H1 chart, the divergence on MACD made the pair start a new decline towards the support. If the price breaks it, the decline may continue to reach 61.8% fibo at 118.75. The local resistance is the high at 121.47.