Fibonacci Retracements Analysis 13.06.2019 (AUDUSD, USDCAD)

13.06.2019

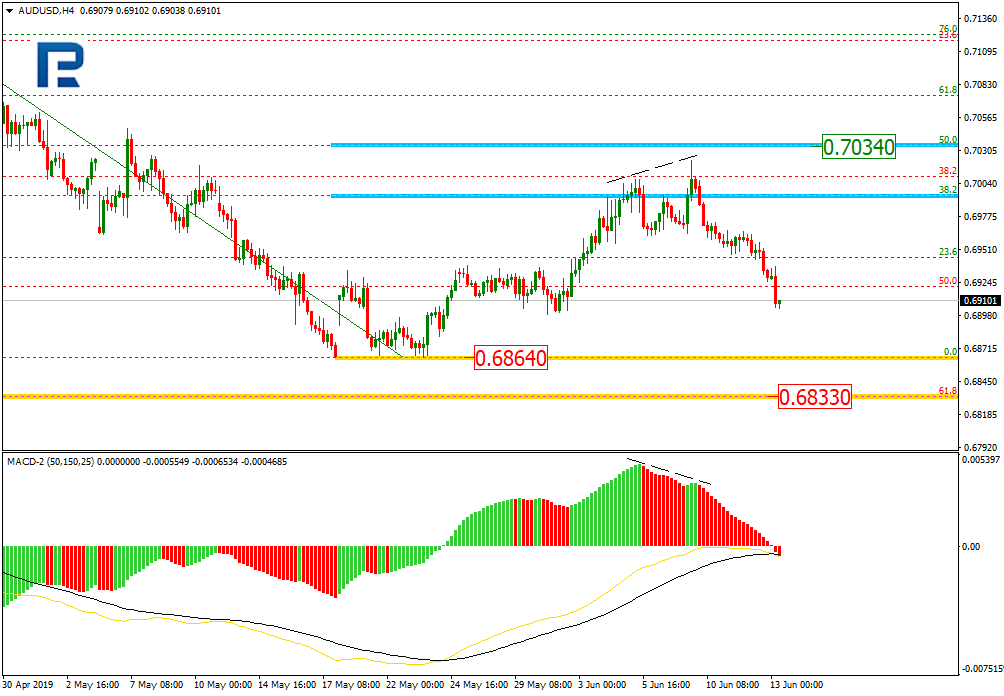

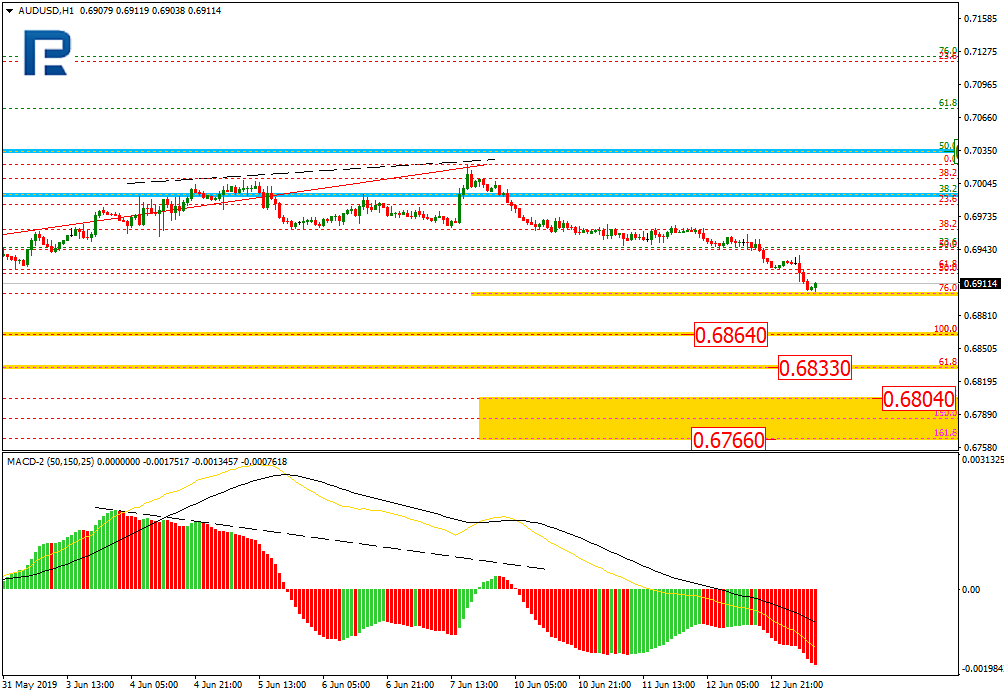

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, there was a divergence on MACD, which made AUDUSD complete the correctional uptrend at 38.2% fibo and start a new decline. If the price starts a new rising impulse, the upside target may be 50.0% fibo at 0.7034. Still, the current decline is looking quite stable, that’s why the instrument is expected to break the low at 0.6864 and mid-term 61.8% fibo at 0.6833.

In the H1 chart, the divergence made AUDUSD start a new downtrend, which has already reached 76.0% fibo. In this light, the instrument is expected to break the low and then continue falling towards the post-correctional extension area between 138.2% and 161.8% fibo at 0.6804 and 0.6766 respectively.

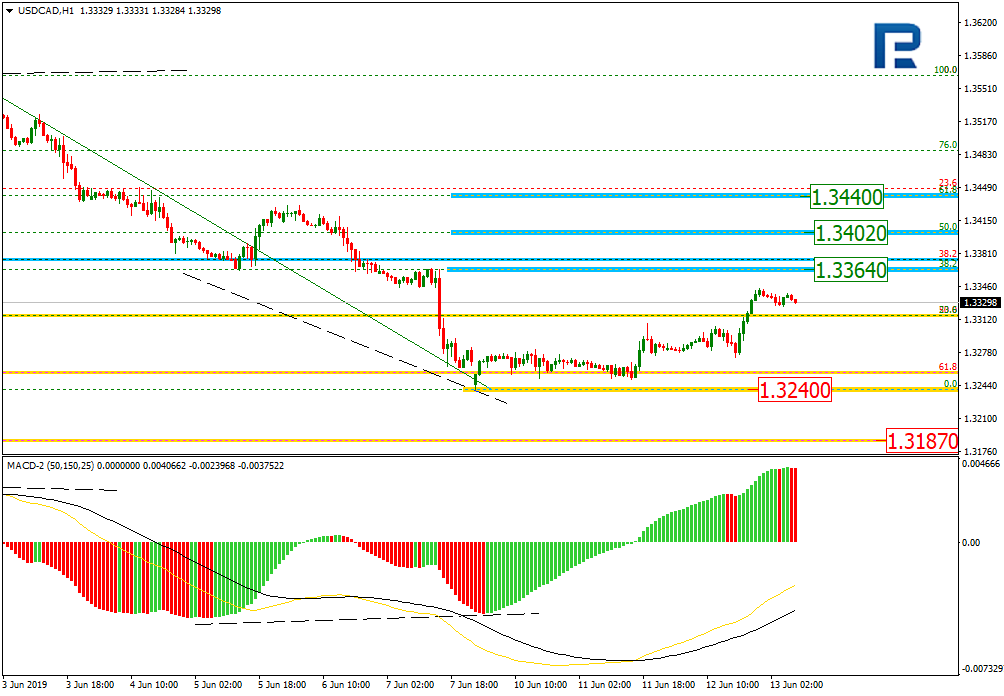

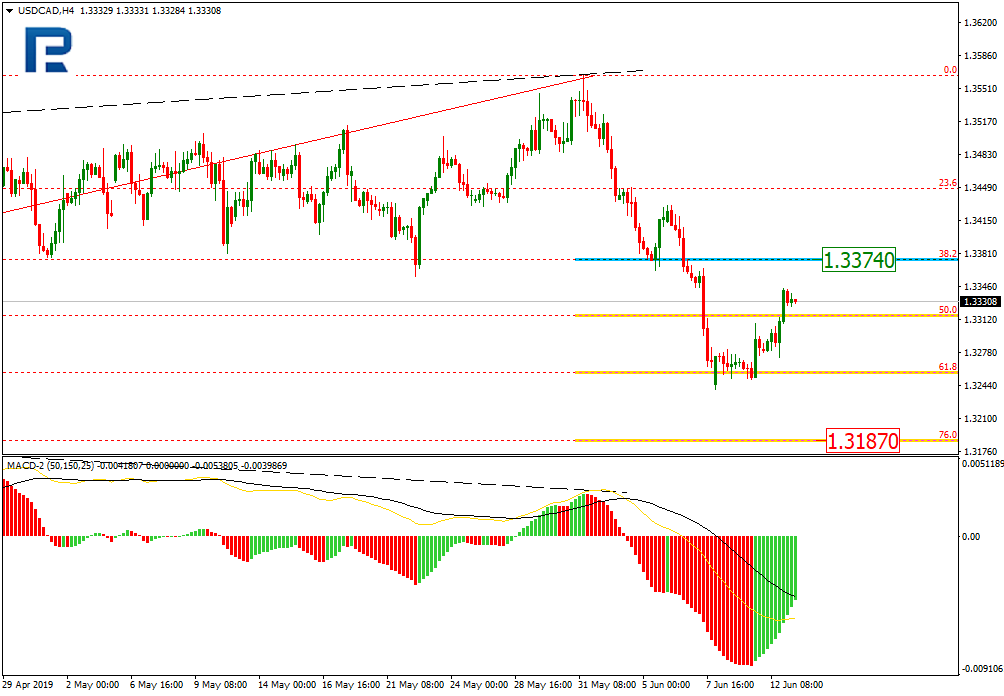

USDCAD, “US Dollar vs Canadian Dollar”

As we can see in the H4 chart, the current descending impulse has reached 61.8% fibo. Right now, the pair is forming an upwards pullback towards the resistance at 38.2% fibo at 1.3374. After completing the pullback, the price may start a new descending wave towards 76.0% fibo at 1.3187.

The H1 chart shows more detailed structure of the current correctional uptrend, which is heading towards 38.2% fibo at 1.3346 or even higher, 50.0% and 61.8% fibo at 1.3402 and 1.3440 respectively. The local support is the low at 1.3240.