Fibonacci Retracements Analysis 14.06.2019 (BITCOIN, ETHEREUM)

14.06.2019

BTCUSD, “Bitcoin vs US Dollar”

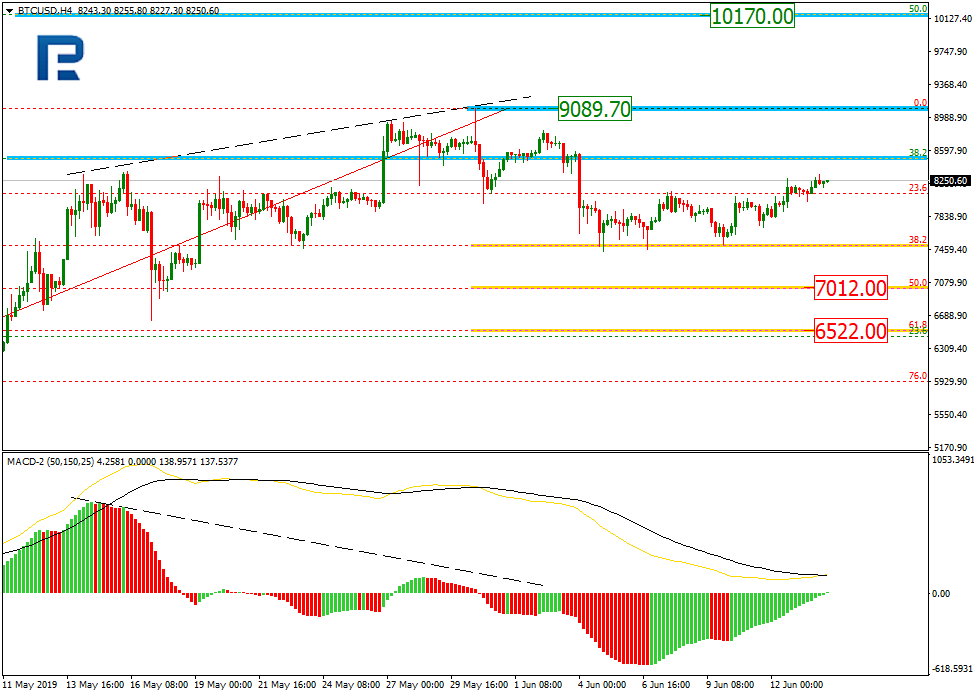

As we can see in the H4 chart, BTCUSD hasn’t completed the correction yet. After reaching 38.2% fibo, the pair may yet continue moving towards 50.0% and 61.8% fibo at 7012.00 and 6522.00 respectively. However, in the current attempts to grow transform into a new rising wave, the instrument may break the high at 9098.70 and then reach its mid-term target at 50.0% fibo (10170.00).

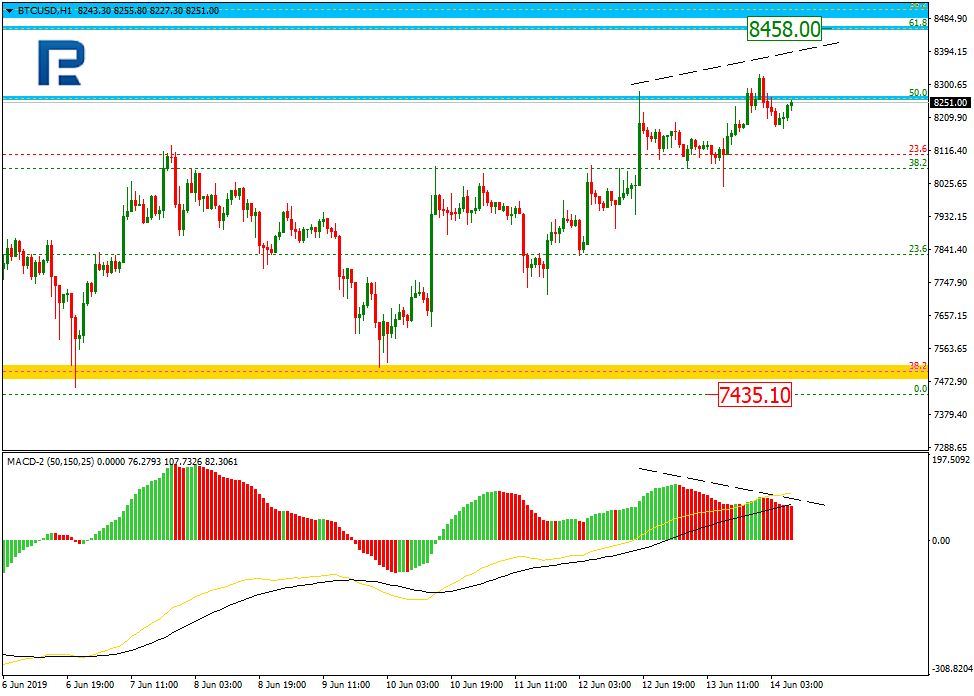

In the H1 chart. BTCUSD is being corrected upwards and has already reached 50.0% fibo. The next upside target may be 61.8% fibo at 8458.00. At the same time, there is a divergence on MACD, which may indicate the completion of the local tendency. The key target of a possible descending impulse may be the low at 7435.10.

ETHUSD, “Ethereum vs. US Dollar”

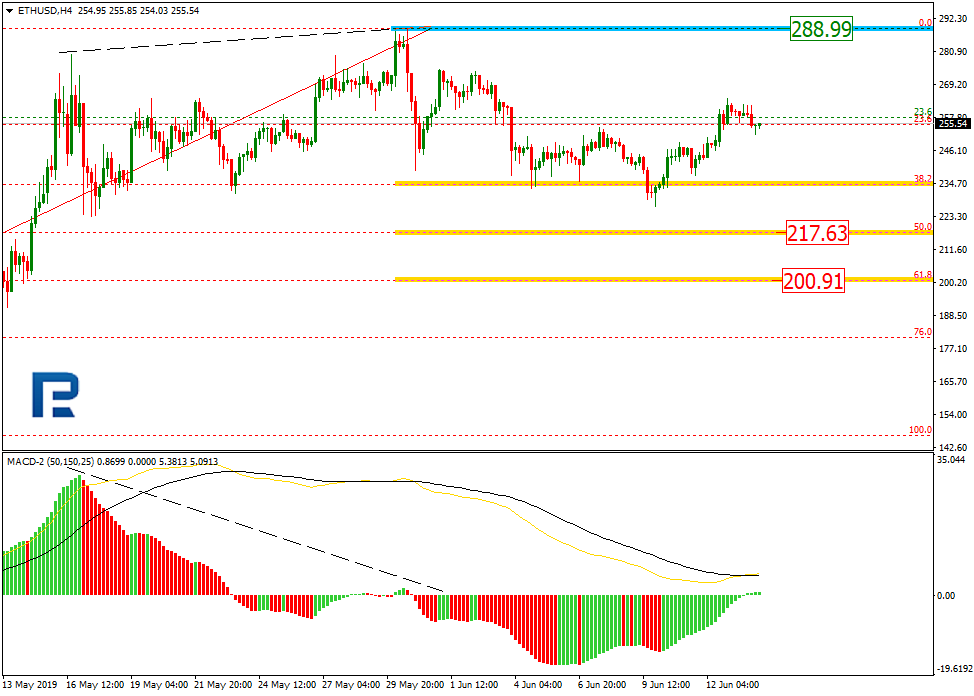

As we can see in the H4 chart, ETHUSD is finishing correctional descending wave at 38.2% fibo and may start a new one to the upside. If the price fails to form a proper rising impulse and break the high at 288.99, the instrument may start another descending wave to reach 50.0% and 61.8% fibo at 217.63 and 200.91 respectively.

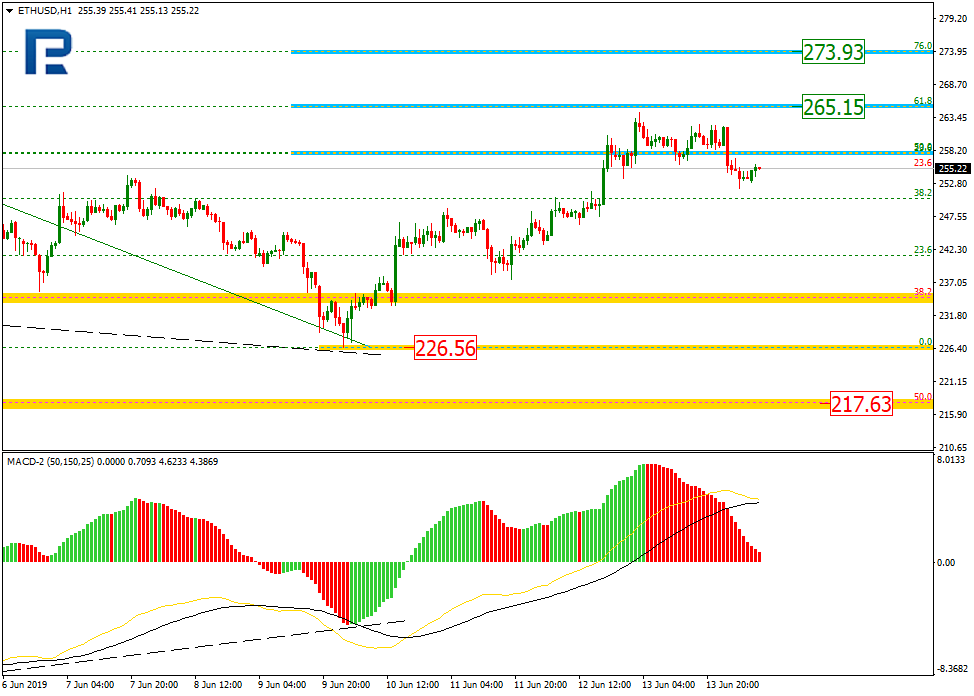

In the H1 chart, the convergence made the pair start a new uptrend, which has almost reached 61.8% fibo at 265.15. The next upside target may be 76.0% fibo at 273.93. If the instrument breaks the support at 226.56, it may continue its mid-term downtrend.