16.09.2019

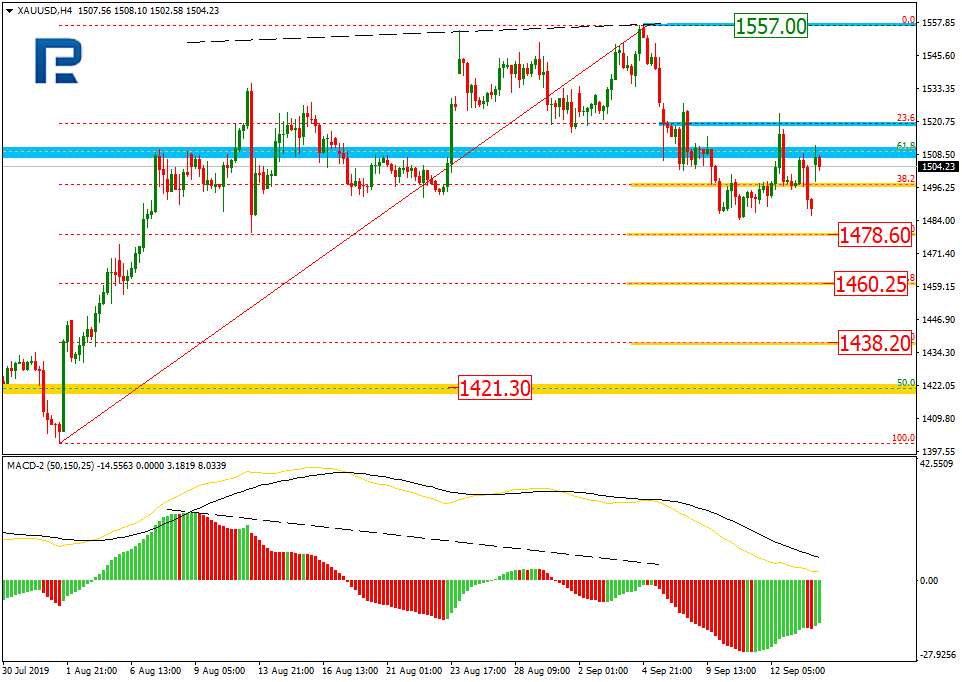

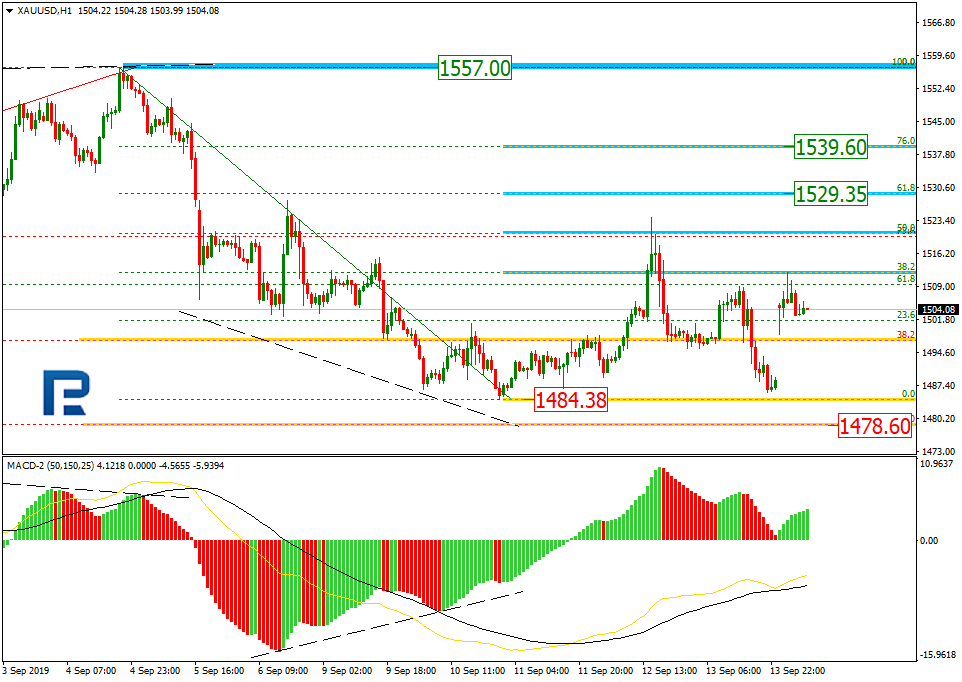

XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, after reaching 38.2% fibo, XAUUSD has returned to 23.6% fibo. The current movement may be considered as a short-term correction before a new descending wave. The next downside targets may be 50.0%, 61.8%, and 76.0% fibo at 1478.60, 1460.25, and 1438.20 respectively. The key resistance is the high at 1557.00.

In the H1 chart, the convergence made the pair start a new pullback to the upside, which has already reached 50.0% fibo. The next upside targets may be 61.8% and 76.0% fibo at 1529.35 and 1539.60 respectively. The key support is the low at 1484.38.

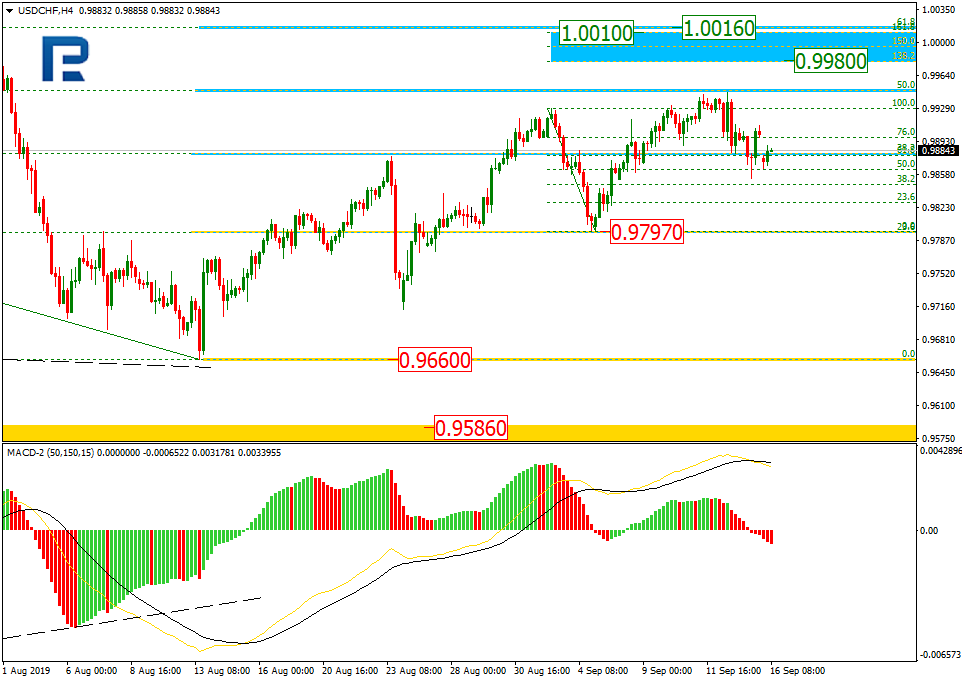

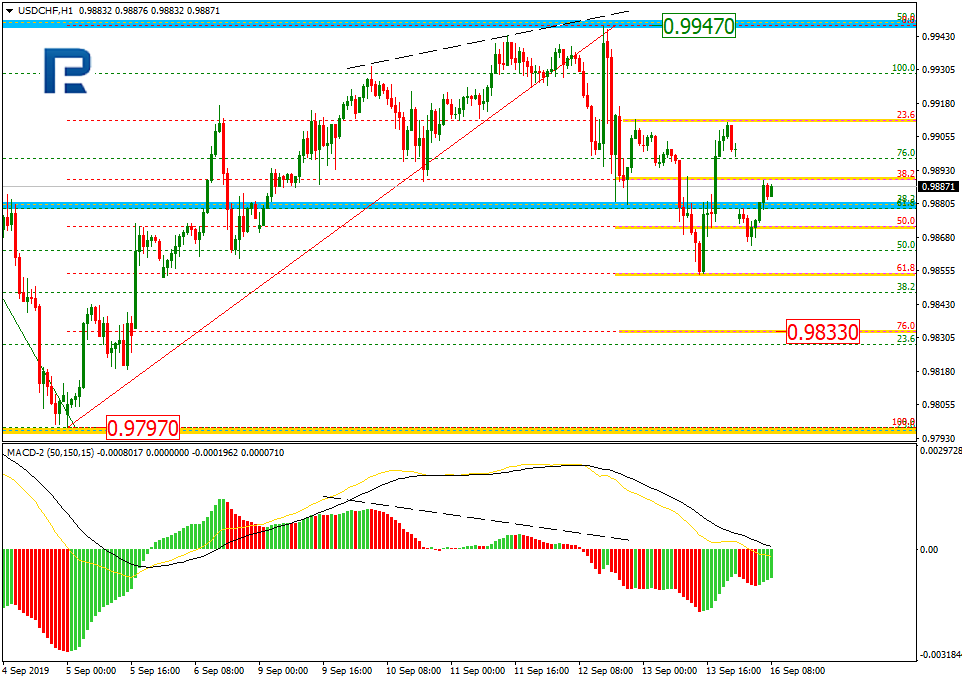

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the H4 chart, the correctional uptrend has already reached 50.0% fibo. At the same time, there is a divergence on MACD, which may indicates a new descending wave. However, as long as the price doesn’t break the support at 0.9797, USDCHF is expected to continue growing towards the post-correctional extension area between 138.2% and 161.8% fibo at 0.9980 and 1.0010 respectively, as well as 61.8% fibo at 1.0016.

In the H1 chart, after reaching 61.8% fibo, USDCHF is correcting upwards. As long as the indicator lines are directed to the downside, one shouldn’t exclude a possibility that the price may fall to reach 76.0% fibo at 09833, while the rising impulse will be heading towards 0.9947.

Back to listAttention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.