16.10.2019

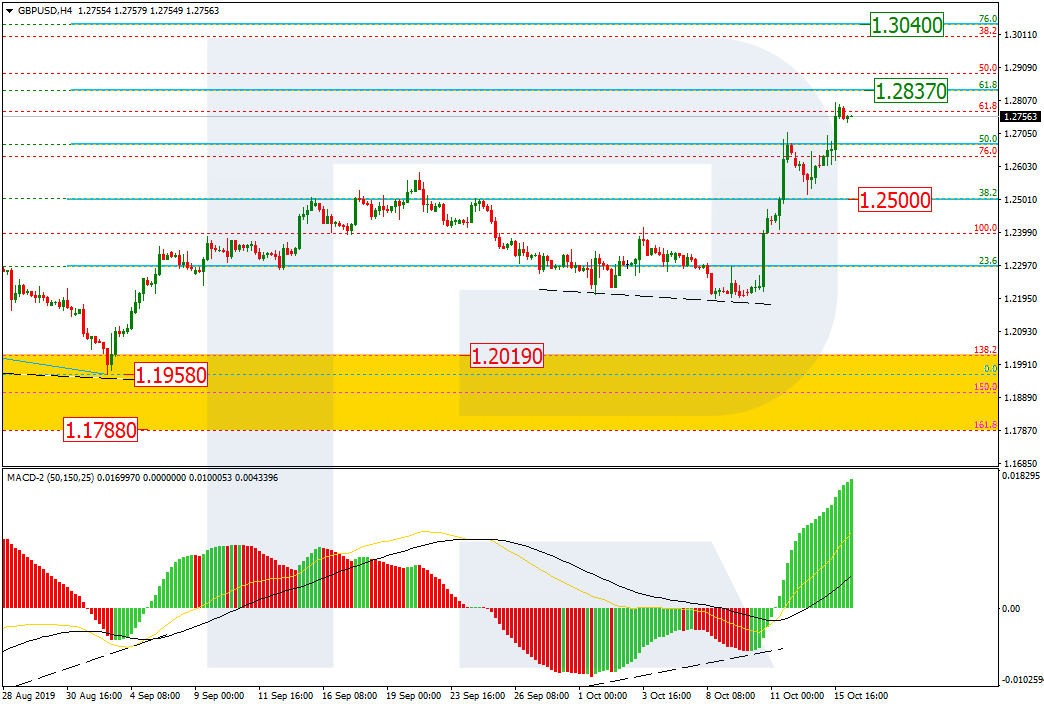

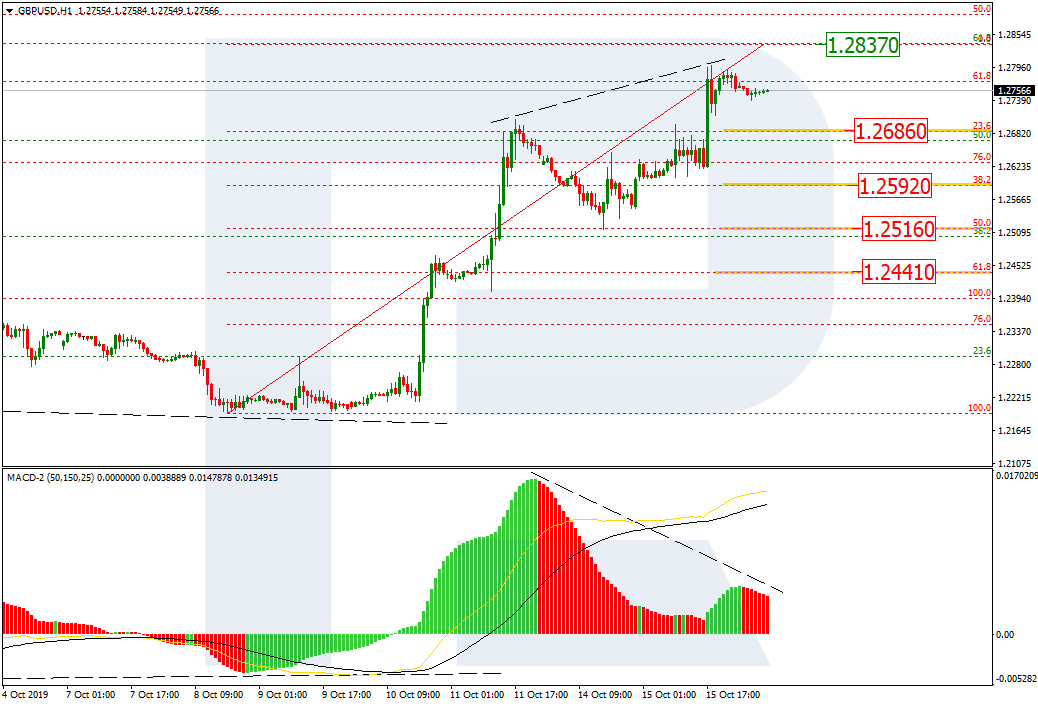

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, GBPUSD is rising within the mid-term correction. After the convergence, the pair has broken the high, as well as 50.0% fibo. Right now, the price is heading to reach its next upside target, 61.8% and 76.0% fibo at 1.2837 and 1.3040 respectively. The support is 38.2% fibo at 1.2500.

In the H1 chart, there is a divergence on MACD, which indicates a new pullback in the nearest future. Possibly, the pair may reach 61.8% fibo at 1.2837 and then start a new descending correction. The targets are 23.6%, 38.2%, 50.0%, and 61.8% fibo at 1.2686, 1.2592, 1.2516, and 1.2441 respectively.

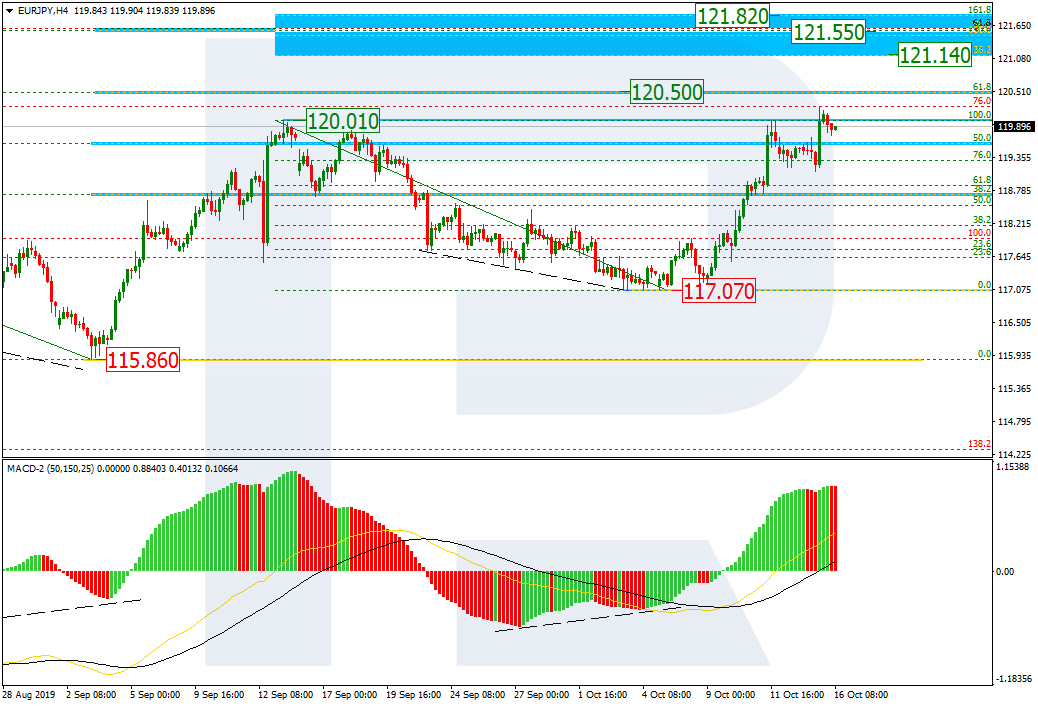

EURJPY, “Euro vs. Japanese Yen”

As we can see in the H4 chart, EURJPY is testing its previous high. The current rising impulse helped to continue the mid-term correction; the closest upside target is 61.8% fibo at 120.50. The next targets may be inside the post-correctional extension area between 138.2% and 161.8% fibo at 121.14 and 121.82 respectively. Inside the same area, there is mid-term 76.0% fibo at 121.55. The support is at 117.07.

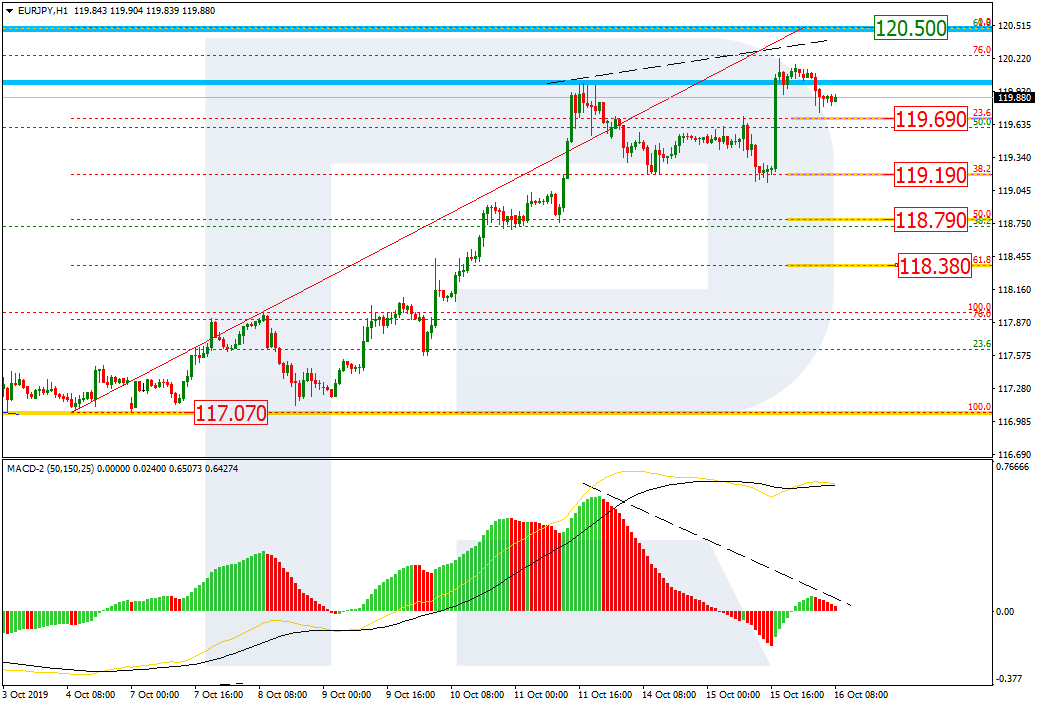

In the H1 chart, there is a divergence on MACD. We may assume that after reaching 61.8% fibo at 120.50, the instrument may resume falling towards 23.6%, 38.2%, 50.0%, and 61.8% fibo at 119.69, 119.19, 118.79, and 118.38 respectively.