17.09.2019

EURUSD, “Euro vs US Dollar”

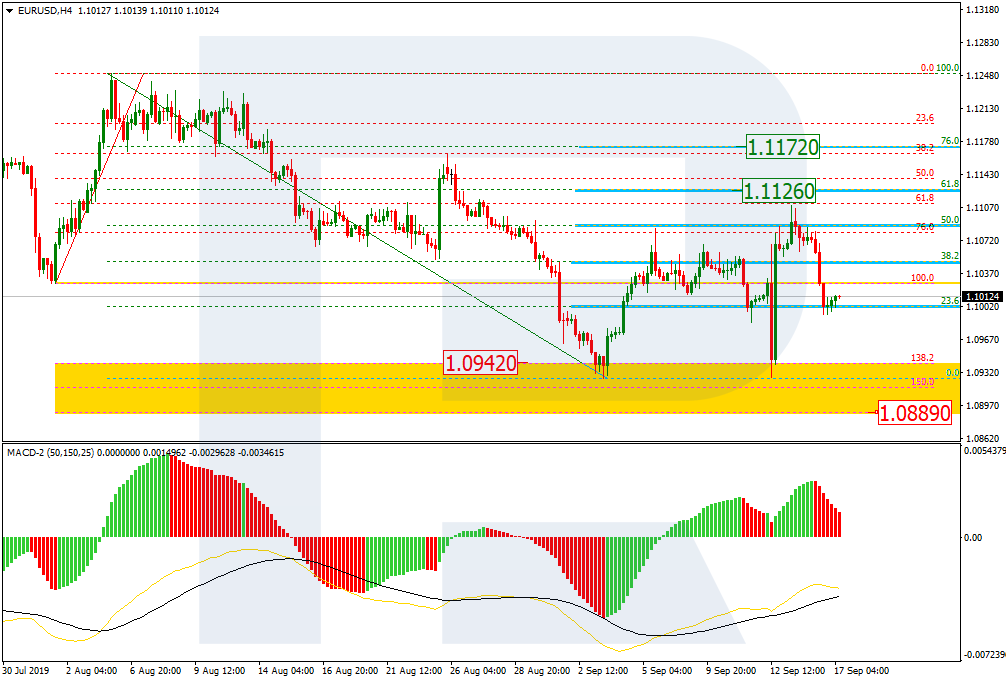

As we can see in the H4 chart, after reaching the post-correctional extension area between 138.2% and 161.8% fibo at 1.0942 and 1.0889 respectively again, EURUSD tried to grow and reach 61.8% fibo at 1.1126, but unsuccessfully. The current decline may be considered as a descending correction. The structure of this correction indicates uncertainty among investors, “turbulence” on the market, and a possibility of further expansion of the range, but the descending tendency is not over yet. Hence, the correction may yet continue to reach 61.8% and 76.0% fibo at 1.1126 and 1.1172 respectively in the short-term, but the key long-term targets are below the lows.

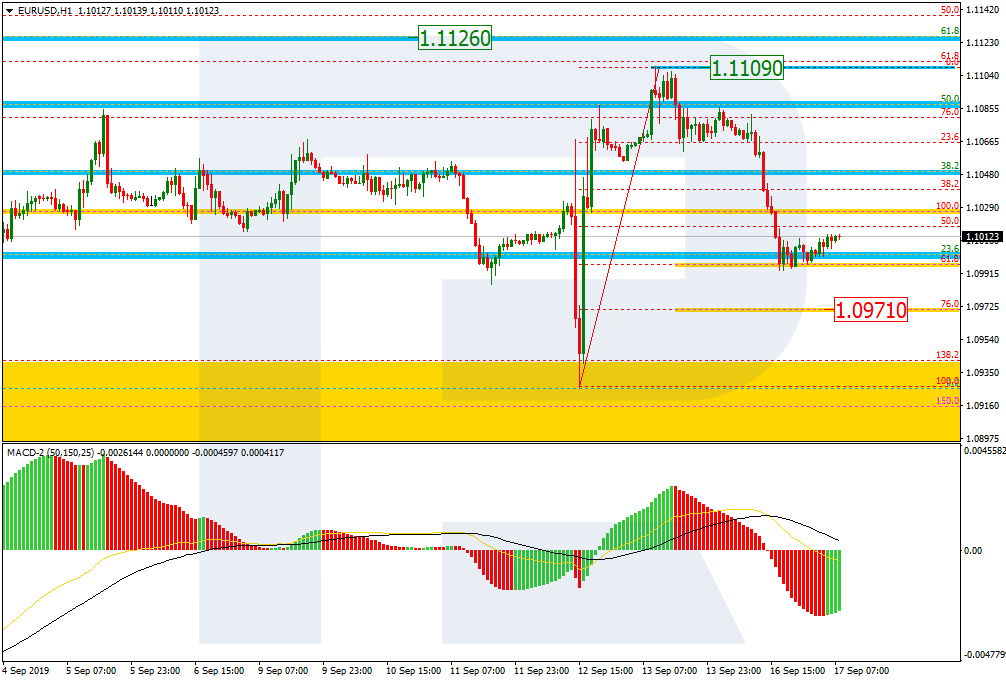

In the H1 chart, the local correction has reached 61.8% fibo, but the decline may yet continue towards 76.0% fibo at 1.0971. Later, the instrument may start a new rising impulse to reach the high at 1.1109.

USDJPY, “US Dollar vs. Japanese Yen”

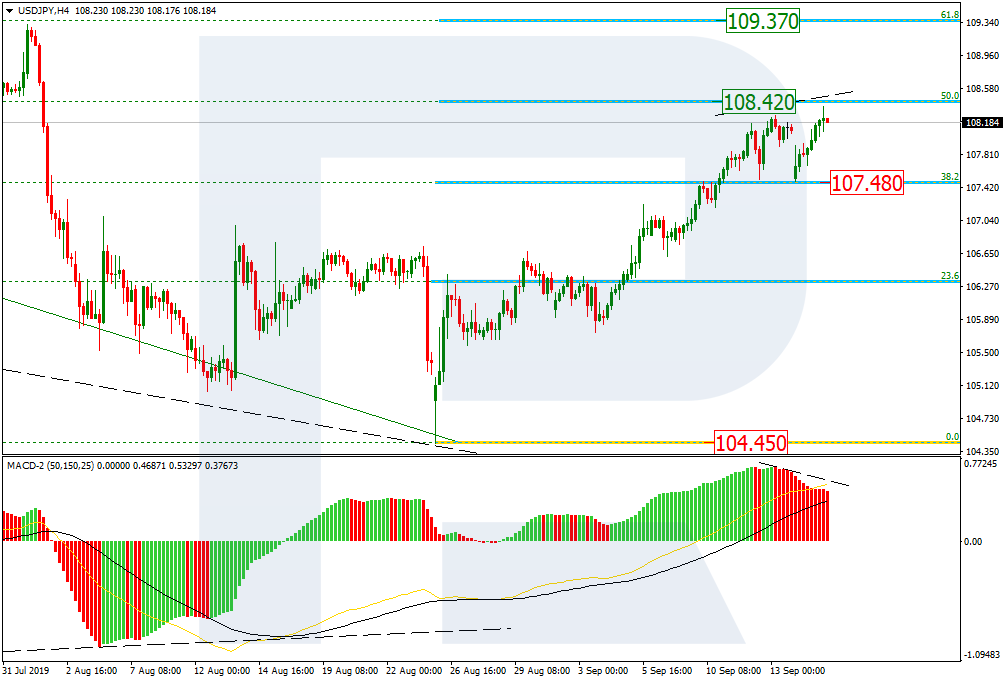

As we can see in the H4 chart, the correctional uptrend continues; it has almost reached 50.0% fibo at 108.42. At the same time, there is a divergence on MACD, which indicates a possible short-term pullback towards 38.2% fibo at 107.48. After the correction, USDJPY may resume moving upwards to reach 61.8% fibo at 109.37.

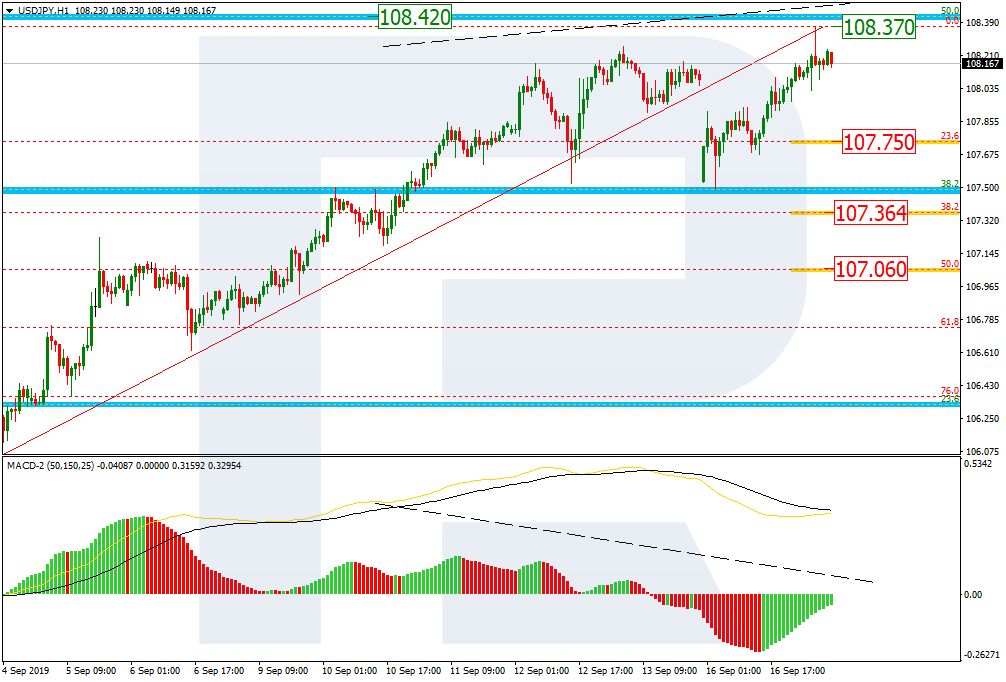

In the H1 chart, there is a divergence on MACD within the uptrend, so we may try to define possible targets of the oncoming pullback. In case of the correctional downtrend, they may be 23.6%, 38.2%, and 50.0% fibo at 107.75, 107.36, and 107.06 respectively.

Back to listAttention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.