Fibonacci Retracements Analysis 18.12.2019 (GBPUSD, EURJPY)

GBPUSD, “Great Britain Pound vs US Dollar”

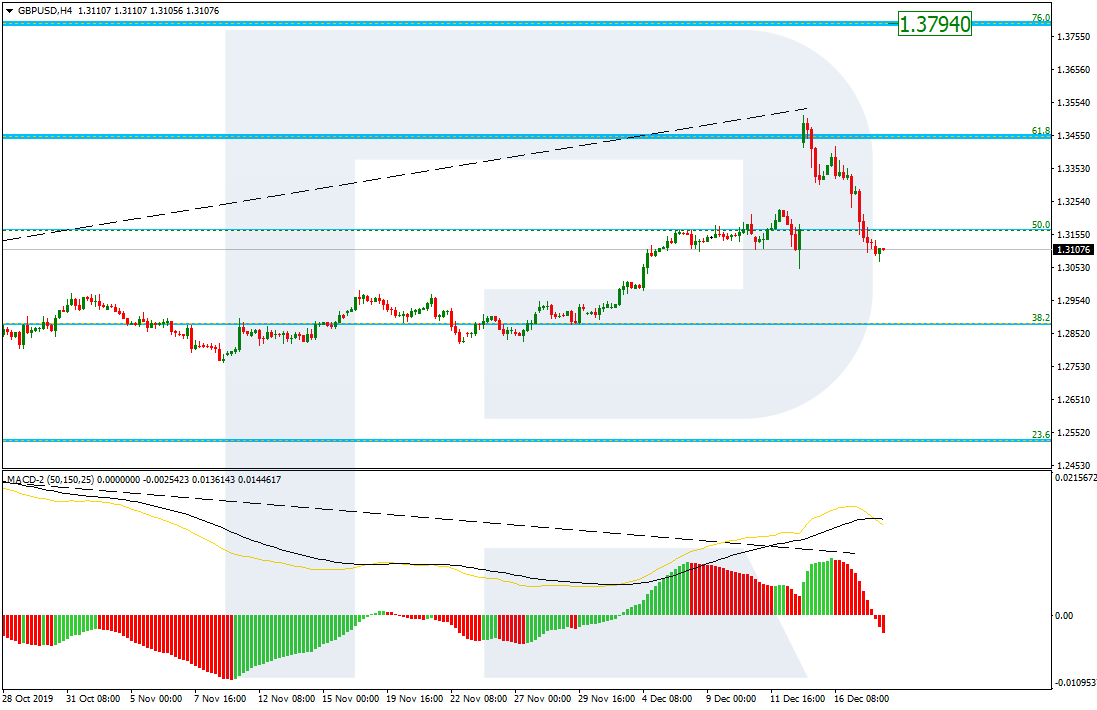

In the H4 chart, there was a gap on the price chart and a divergence on MACD, after which the pair reached 61.8% fibo. We can see that GBPUSD has already eliminated the gap and right now is correcting to the downside. After completing the pullback, the instrument may start another rising wave towards 76.0% fibo at 1.3794.

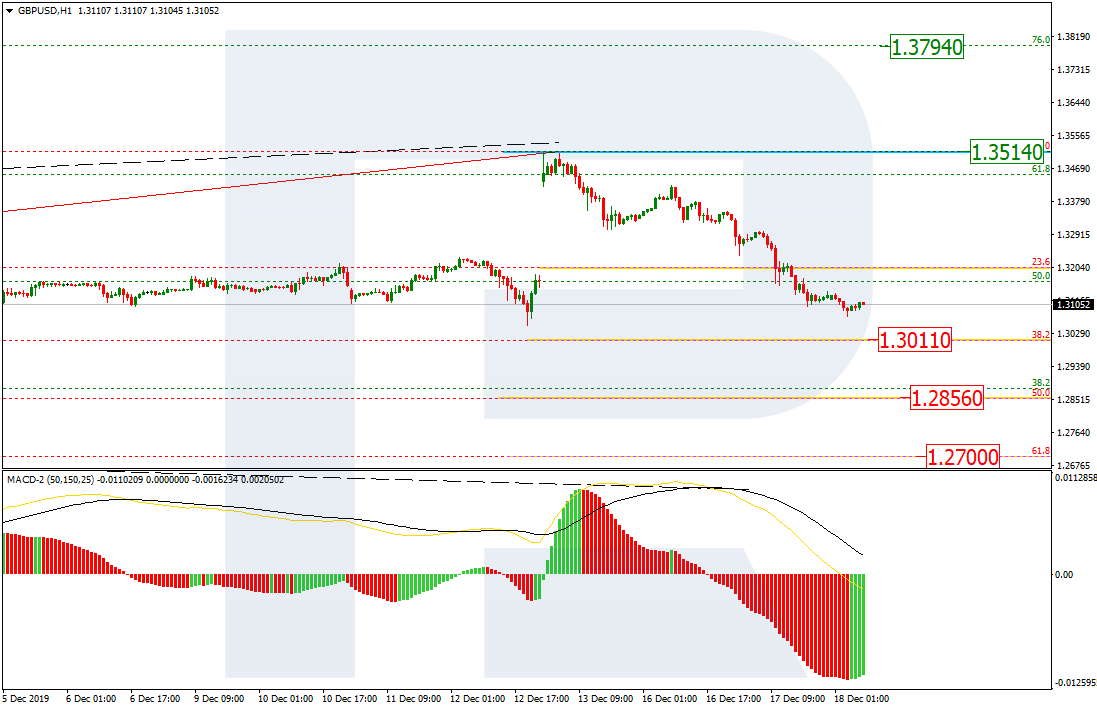

The H1 chart shows the more detailed structure of the current descending correction. At the moment, the pair is getting close to 38.2% fibo at 1.3011 and may later reach 50.0% and 61.8% fibo at 1.2856 and 1.2700 respectively. The resistance is the high at 1.3514.

EURJPY, “Euro vs. Japanese Yen”

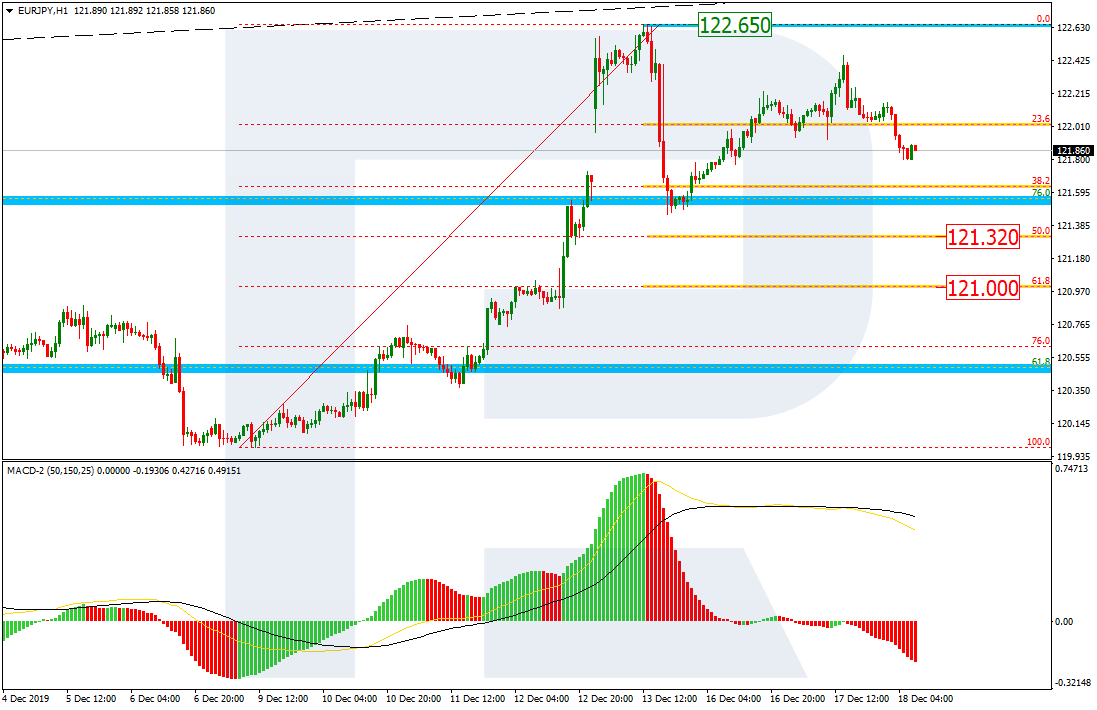

In the H4 chart, EURJPY continues the uptrend to break 76.0% fibo and reach its mid-term high at 123.36. At the same time, there is a divergence on MACD, which may indicate a possible pullback. The support is at 61.8% fibo (120.50).

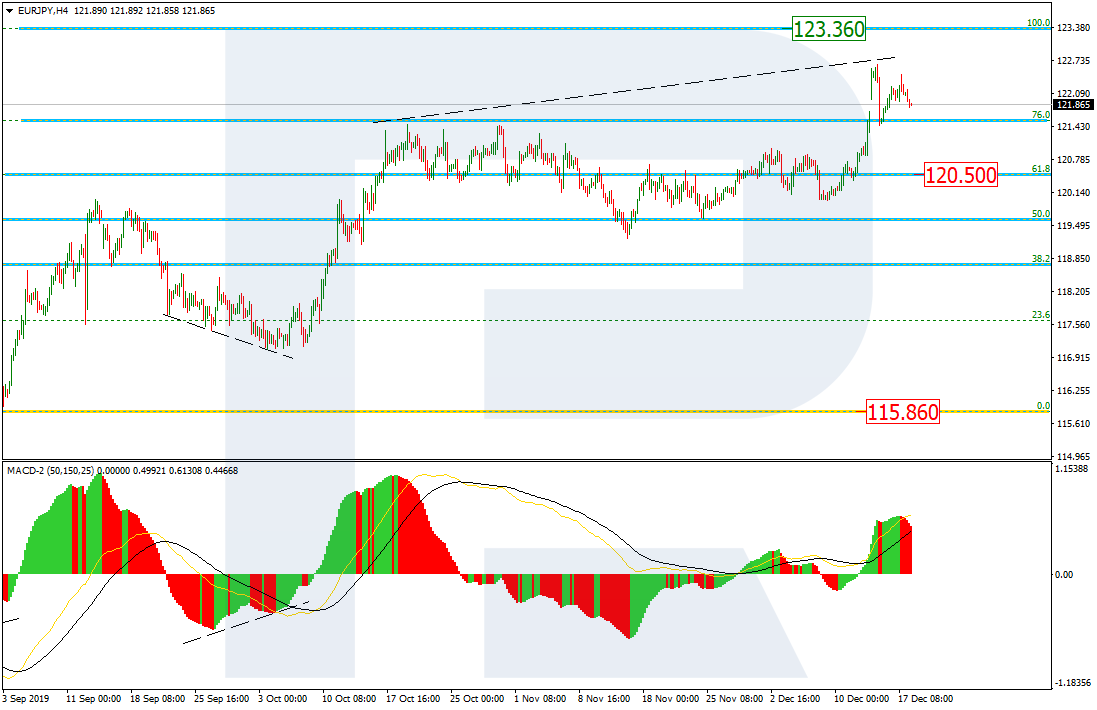

As we can see in the H1 chart, the first descending wave has reached 38.2% fibo. The next wave to the downside may be heading towards 50.0% and 61.8% fibo at 121.32 and 121.00 respectively. The local resistance is the high at 122.65.