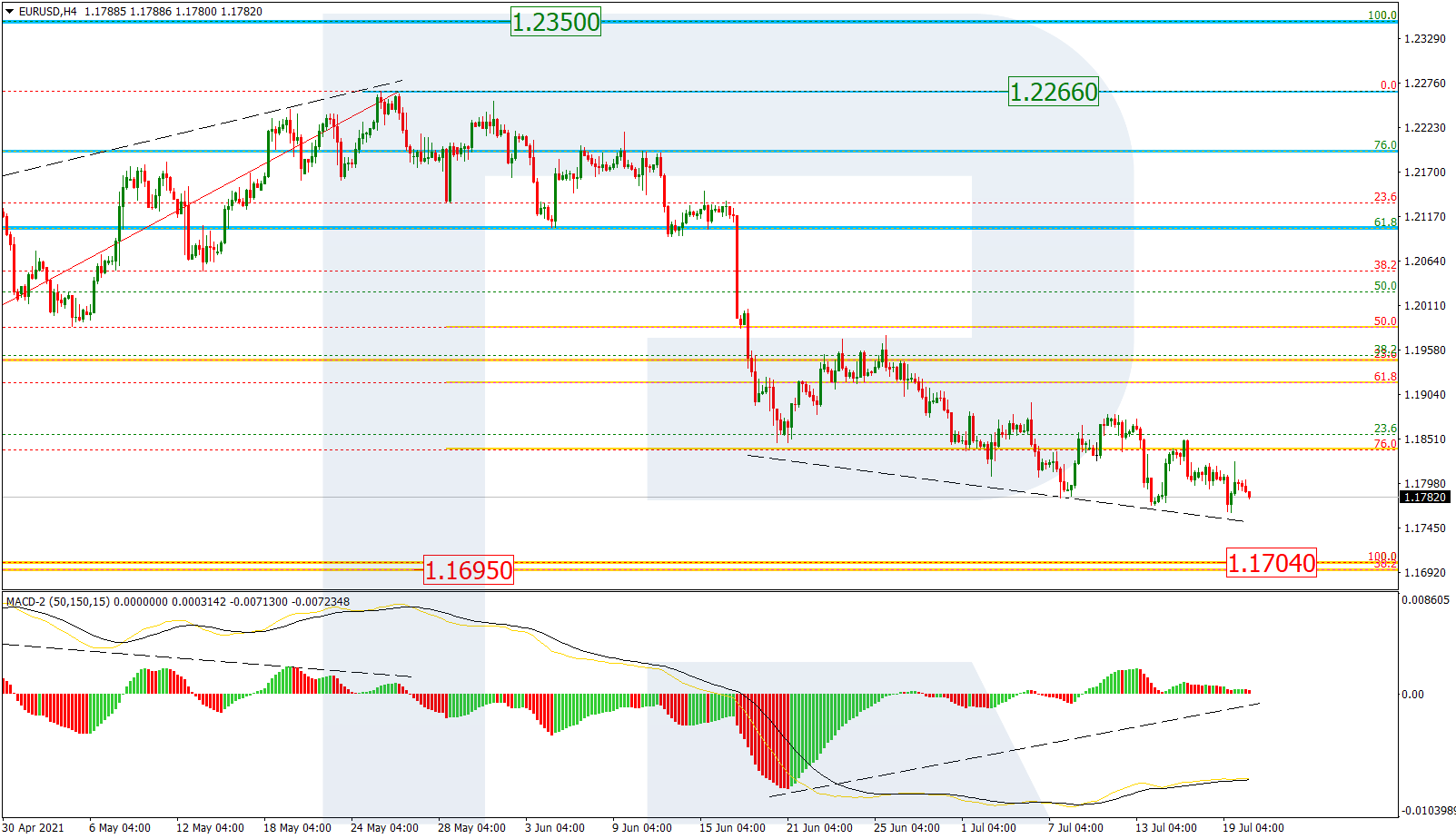

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, the asset is slowly falling towards the fractal low at 1.1704, a breakout of which may lead to a further downtrend to reach 50.0% fibo at 1.1695. The overall picture shows a series of updates of lows along with slight pullbacks. Coupled together with convergence on MACD, this factor implies a possible correction to the upside soon.

![]()

The H1 chart shows potential correctional targets after convergence. At the moment, the [pair is falling to test the low at 1.1764. After rebounding from this level, the asset may correct upwards to reach 23.6%, 38.2%, and 50.0% fibo at 1.1882, 1.1956, and 1.2015 respectively. A breakout of the local low and the support at 1.1764 will complete the pullback and lead to a further downtrend.

![]()

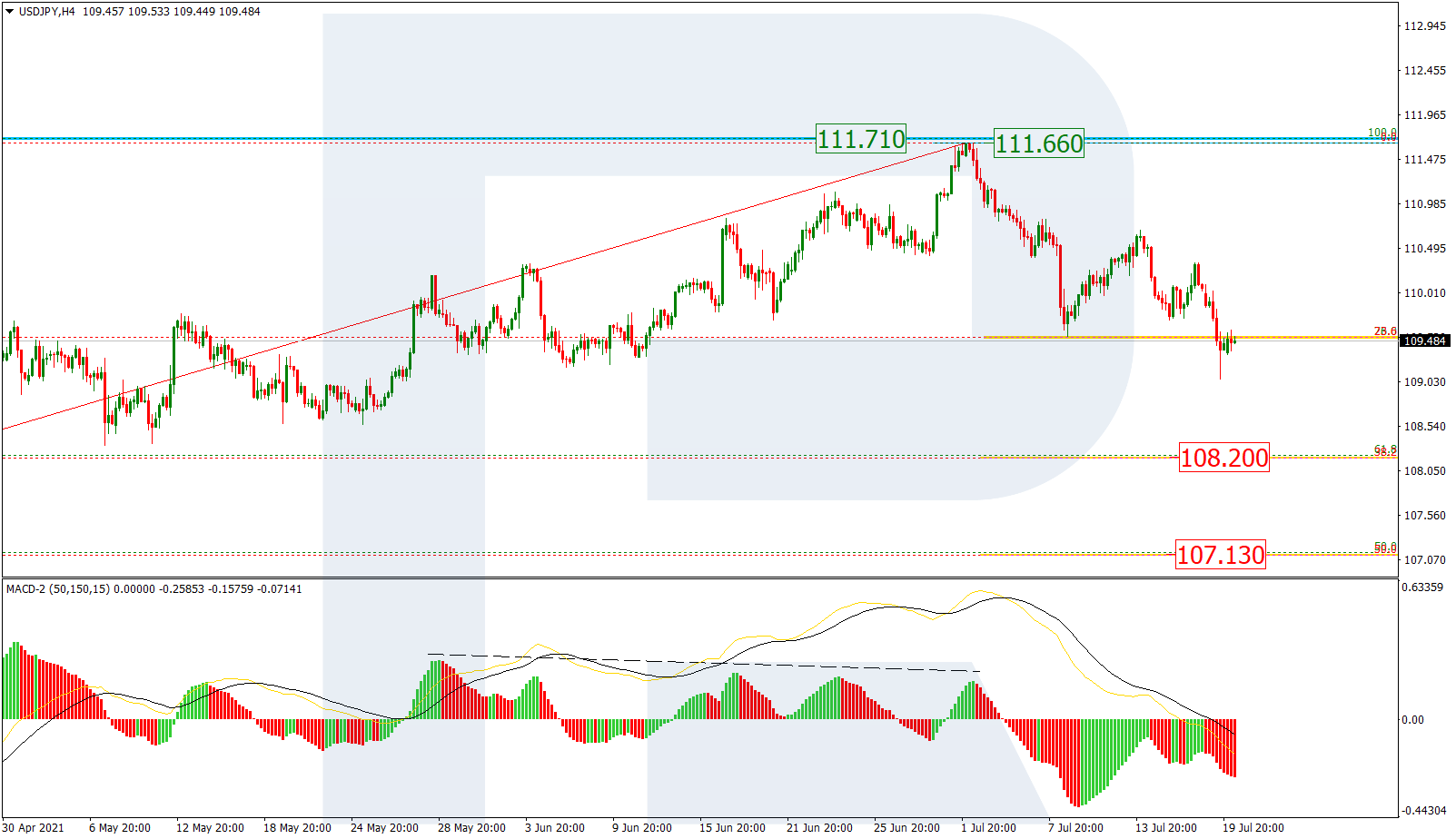

USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the H4 chart, the mid-term downtrend continues. The first descending wave after divergence on MACD tested 23.6% fibo at 109.52 and then rebounded from it, which may be considered as a pullback to the upside. After the pullback is over, the instrument may start another descending wave to reach 38.2% fibo at 108.20, while the next downside target will be at 50.0% fibo at 107.13. The local resistance is at 111.66.

![]()

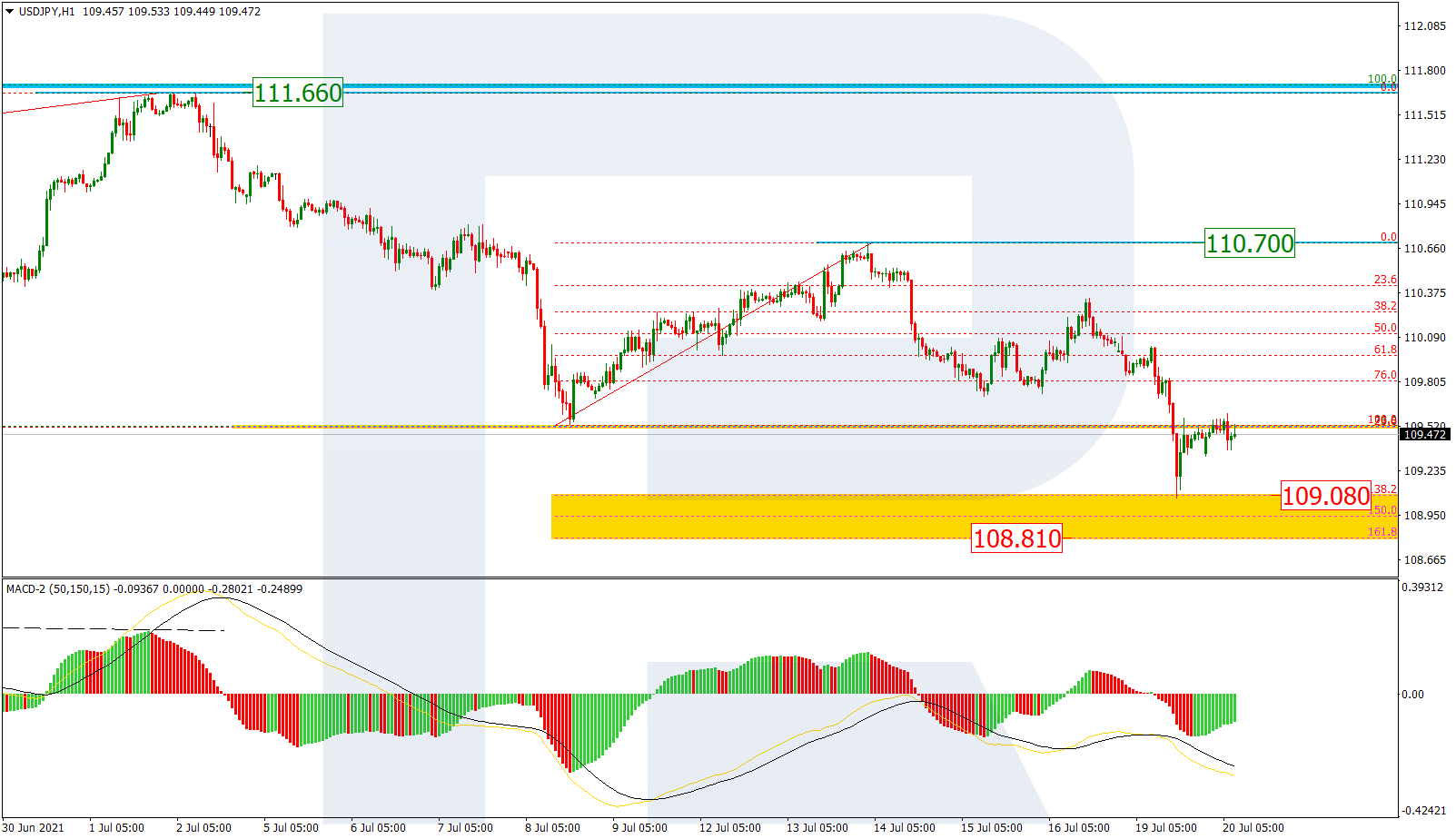

The H1 chart shows a breakout of 23.6% fibo and a test of this level from below. The closest downside targets are inside the post-correctional extension area between 138.2% and 161.8% fibo at 109.08 and 108.81 respectively. The local resistance is at 110.70.

![]()