20.08.2019

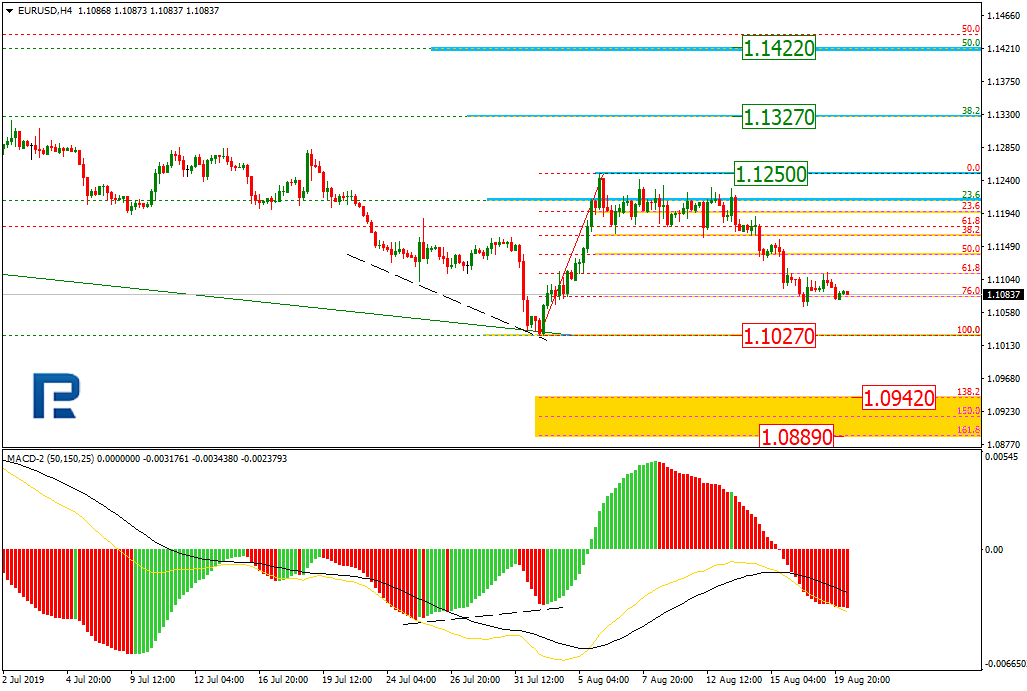

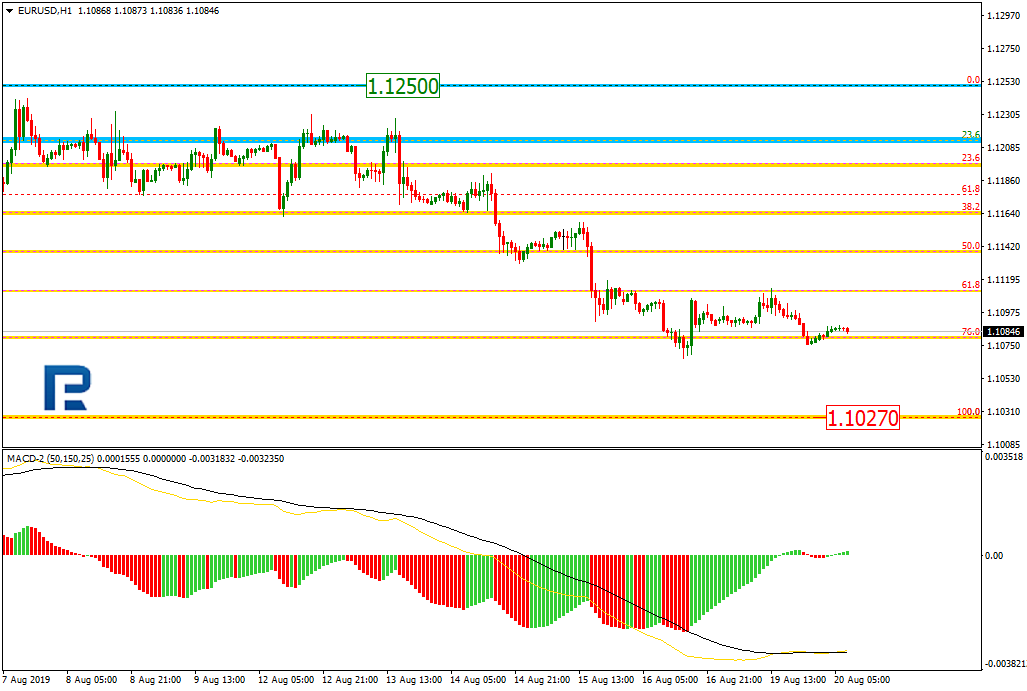

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, EURUSD has reached a very significant correctional level, 76.0% fibo and may continue falling towards the lows at 1.1027. After breaking the low, the price may continue trading towards the post-correctional extension area between 138.2% and 161.8% fibo at 1.0942 and 1.0889 respectively. Another scenario implies that the pair may start a new rising wave without breaking the low. In this case, the ascending correction may continue towards 38.2% and 50.0% fibo at 1.1327 and 1.1422 respectively.

In the H1 chart, the downtrend is slowing down at 76.0% fibo, but it may be just a local pullback. The resistance is at 50.0% fibo.

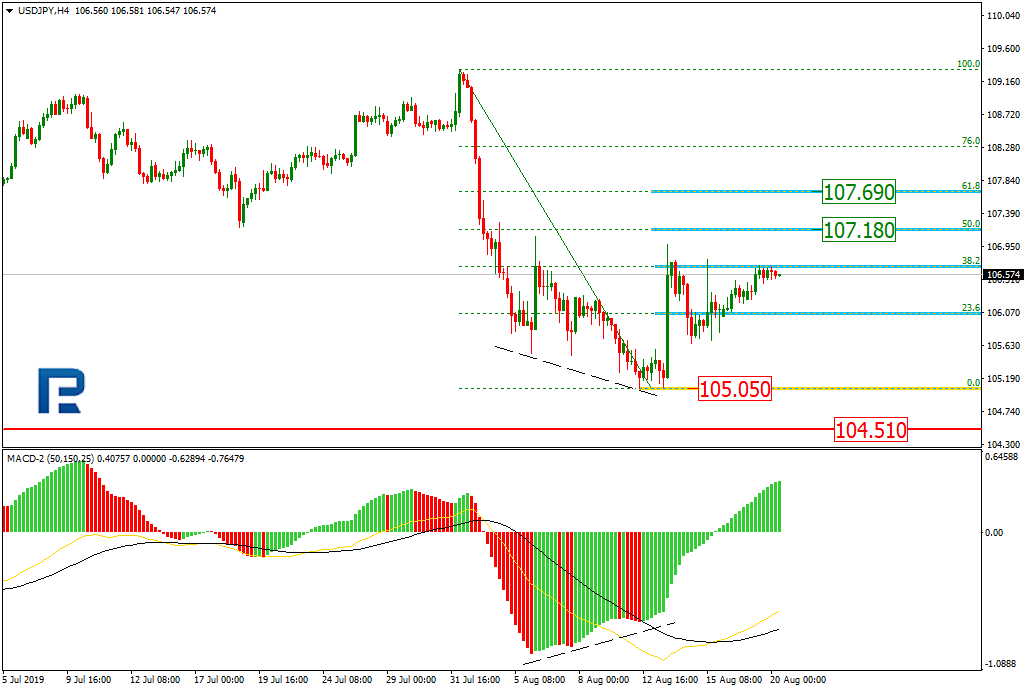

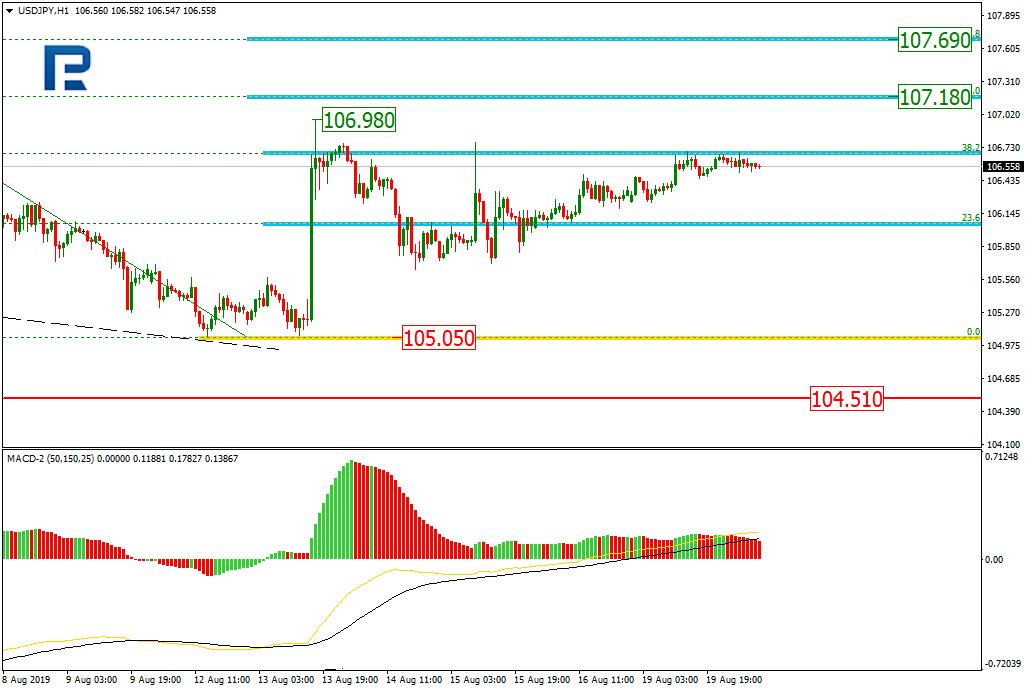

USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the H4 chart, the pair is being corrected to the upside and has already reached 38.2% fibo. In the future, the correction may continue towards 50.0% and 61.8% fibo at 107.18 and 107.69 respectively. After finishing the correction, the price may resume falling to break the current low at 105.05 and then continue moving downwards to reach the long-term low at 104.51.

In the H1 chart, USDJPY is growing towards the local high at 106.98. After breaking it, the instrument may trade towards 50.0% and 61.8% fibo at 107.18 and 107.69 respectively.

Back to listAttention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.