Fibonacci Retracements Analysis 21.07.2020 (EURUSD, USDJPY)

EURUSD, “Euro vs US Dollar”

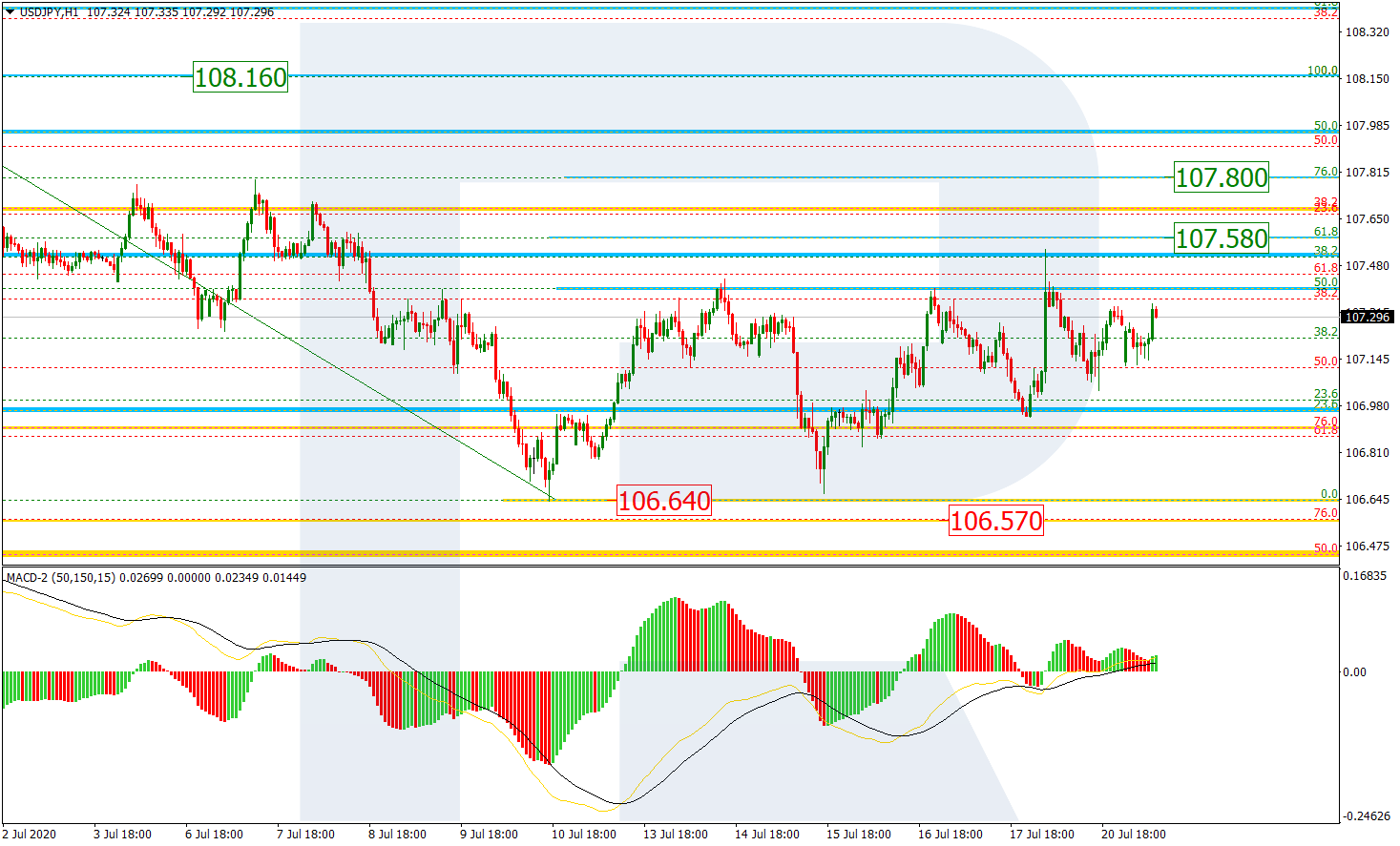

As we can see in the H4 chart, after finishing the correction at 38.2% fibo and breaking its previous high at 1.1422, EURUSD is still trading upwards and trying to fix above the broken high. If it succeeds, the instrument may continue growing towards the fractal high at 1.1495 and then the long-term 50.0% fibo at 1.1595.

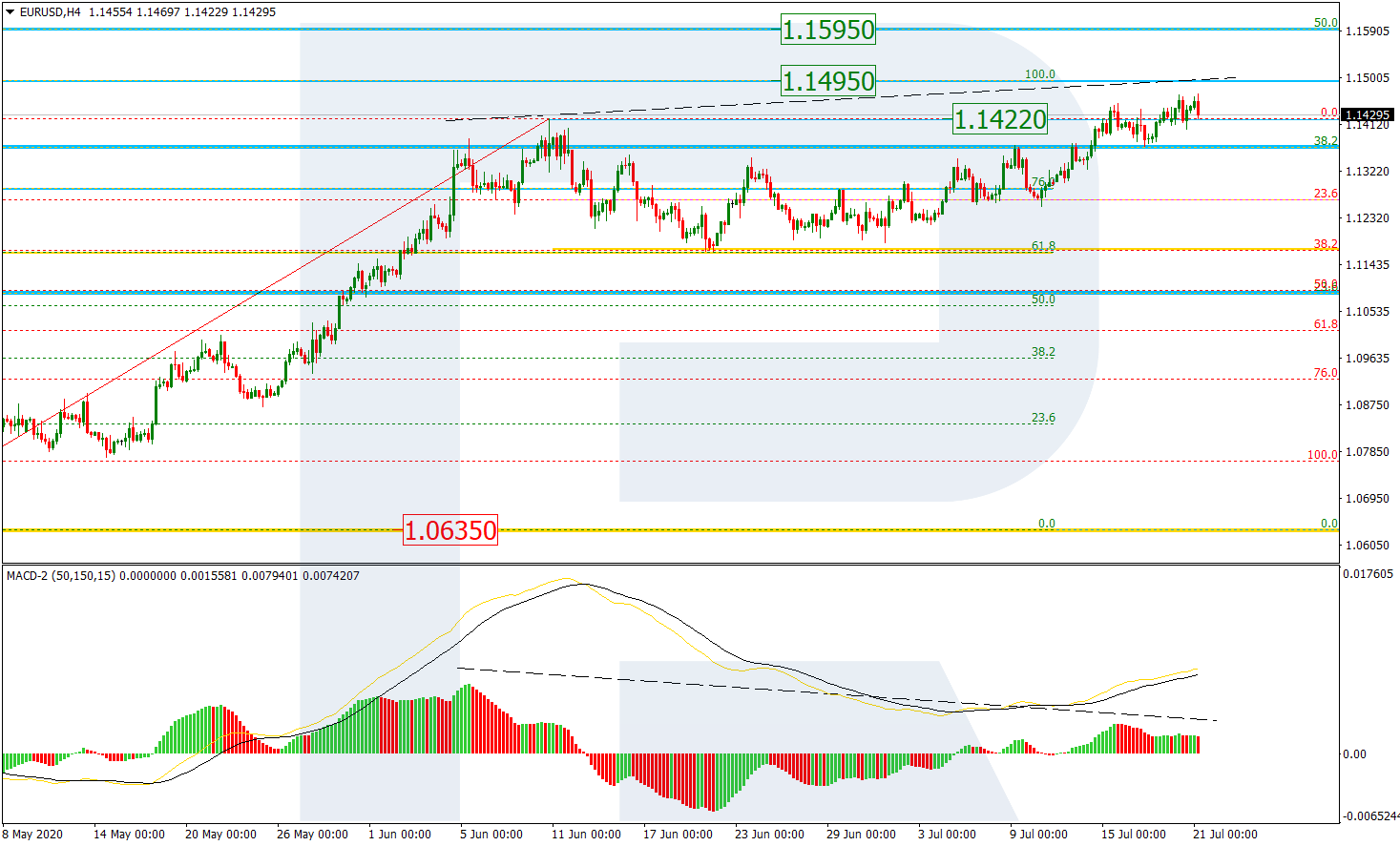

The H1 chart shows a more detailed structure of the current uptrend. The price is moving upwards but there is a divergence on MACD, which may indicate a possible pullback soon. After completing the pullback, the instrument may resume growing to reach the post-correctional extension area between 138.2% and 161.8% fibo at 1.1520 and 1.1578 respectively.

USDJPY, “US Dollar vs. Japanese Yen”

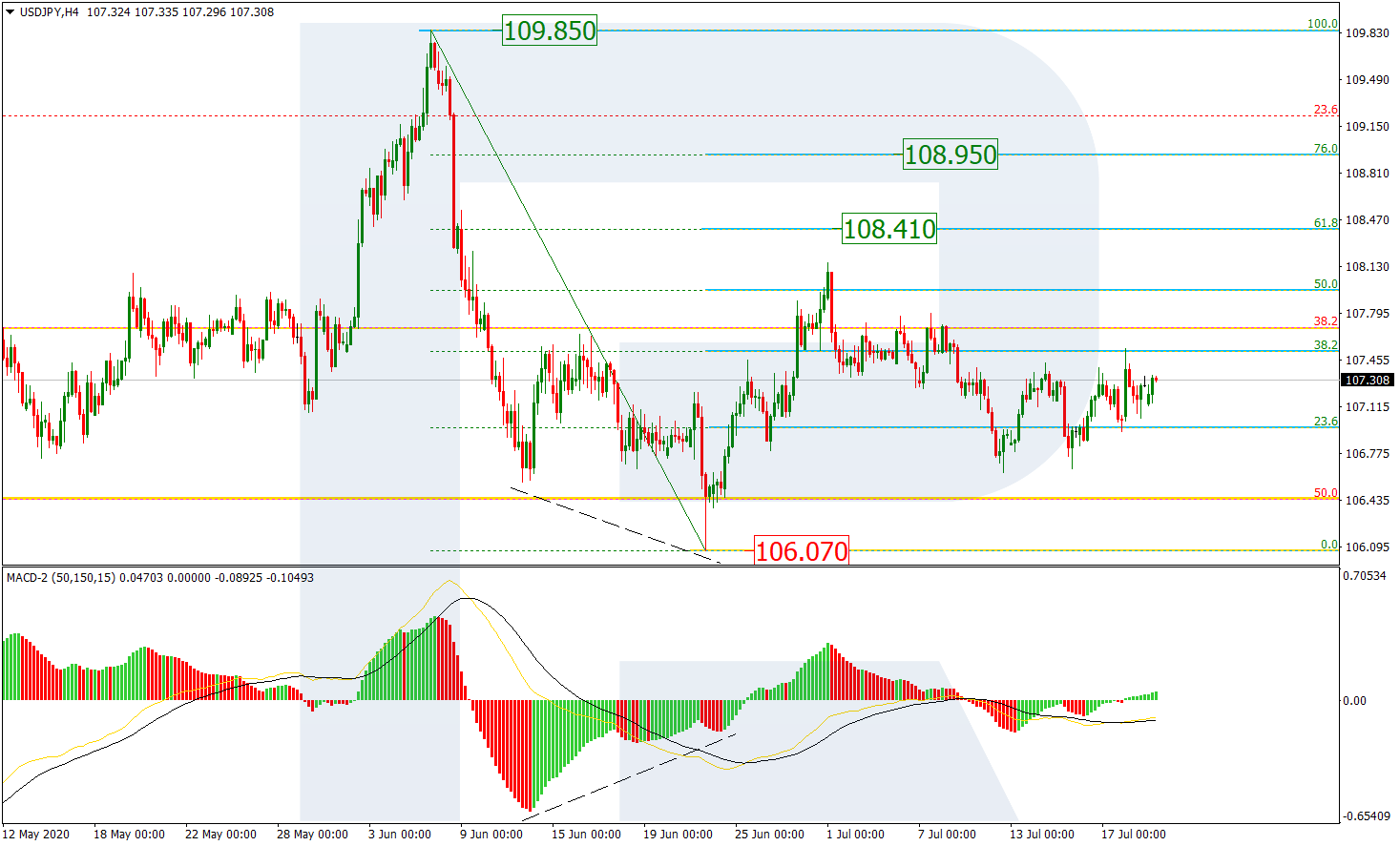

As we can see in the H4 chart, after finishing the descending wave at 23.6% fibo, USDJPY is trying to start a new rising structure to reach the targets at 61.8% and 76.0% fibo at 108.41 and 108.95 respectively. The key support is the low at 106.07.

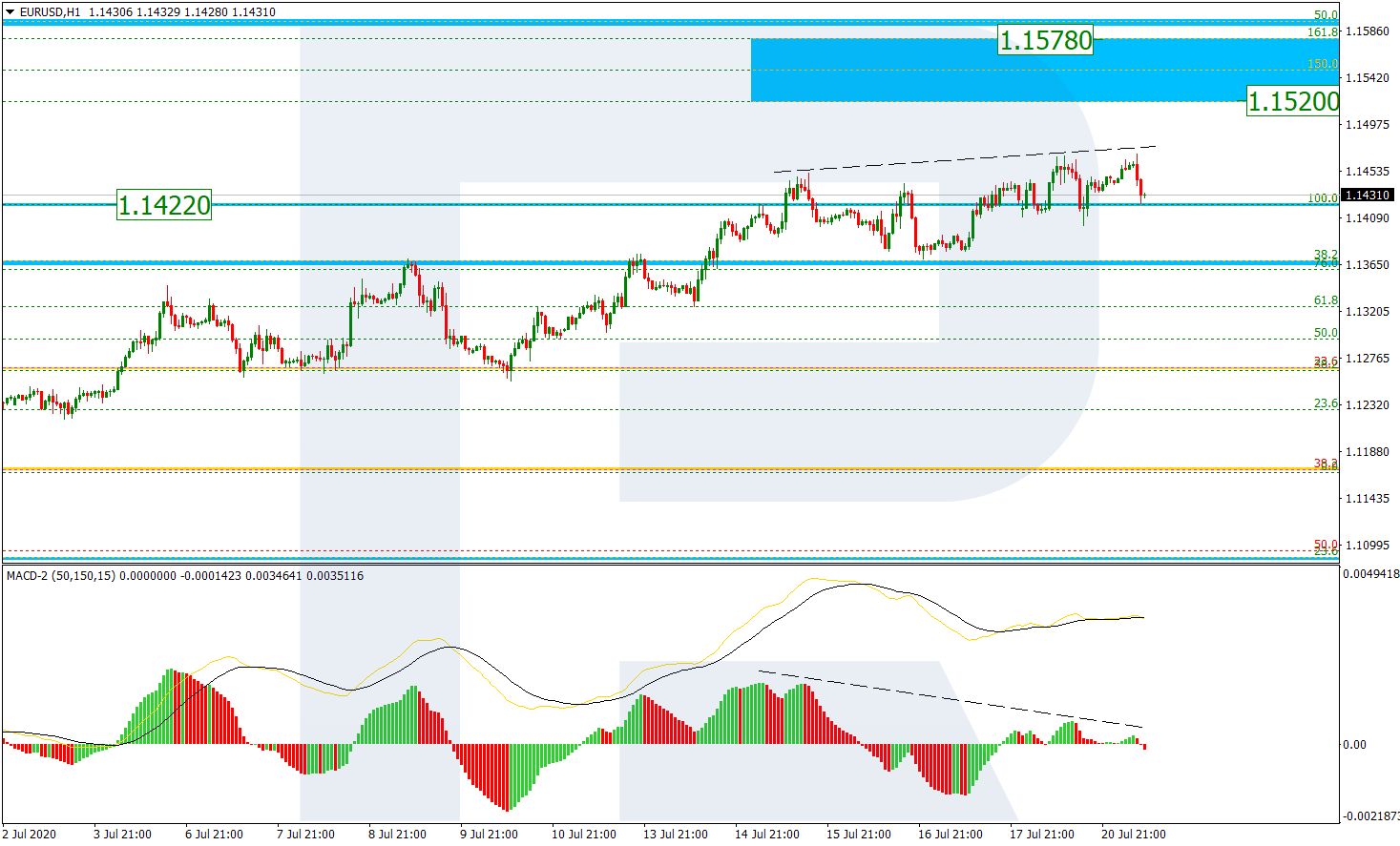

The H1 chart shows a correctional uptrend after the descending wave, which has reached 50.0% fibo. Later, the price may continue growing towards 61.8% and 76.0% fibo at 107.58 and 107.80 respectively, and then the high at 108.16. The support is the local low at 106.64.