Fibonacci Retracements Analysis 22.12.2020 (EURUSD, USDJPY)

EURUSD, “Euro vs US Dollar”

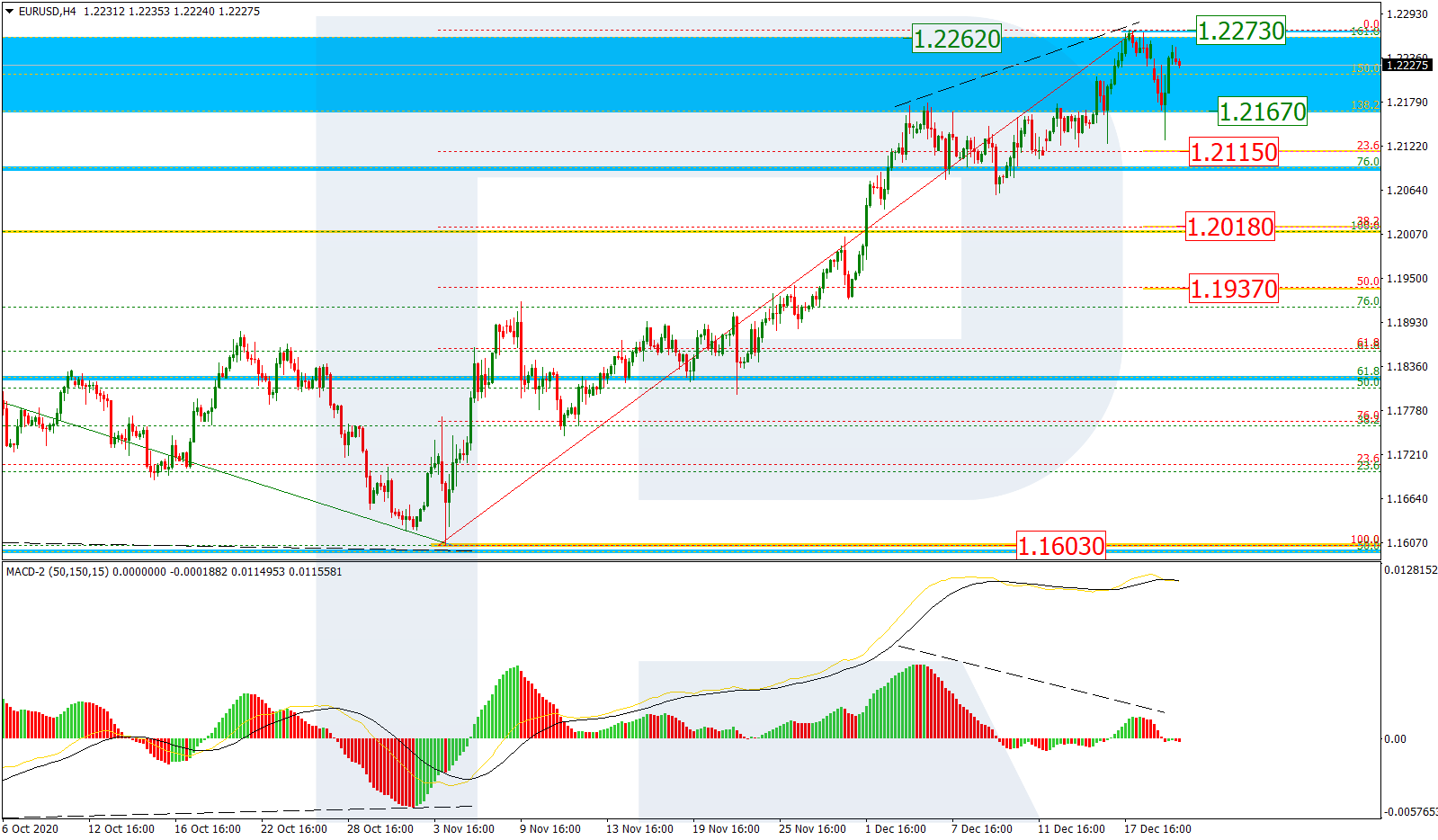

As we can see in the H4 chart, EURUSD is forming a new descending impulse within the post-correctional extension area between 138.2% and 161.8% fibo at 1.2167 and 1.2262 respectively after a divergence on MACD. The key downside targets may be 23.6%, 38.2%, and 50.0% fibo at 1.2115, 1.2018, and 1.1937 respectively. If the price breaks the high at 1.2273, the asset may continue growing to reach the long-term fractal high at 1.2555.

![]()

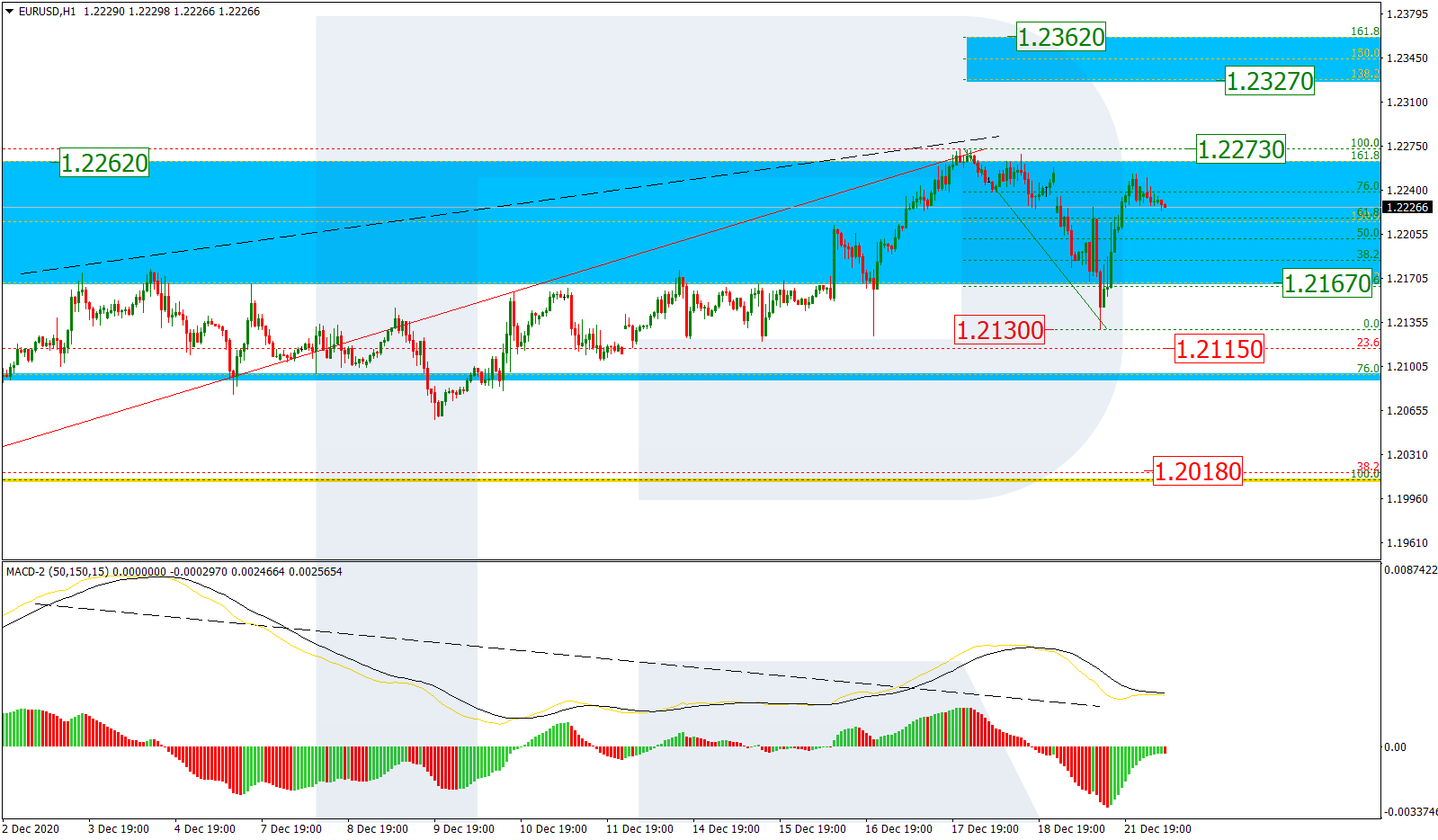

The H1 chart shows both potential downside and upside targets. On one hand, if the price breaks the high at 1.2273, it may move upwards to reach the post-correctional extension area between 138.2% and 161.8% fibo at 1.2327 and 1.2362 respectively. On the other hand, if EURUSD breaks the local low at 1.2130 again, the asset may continue trading downwards.

![]()

USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the H4 chart, after completing another pullback at 23.6% fibo and breaking the low at 103.17, USDJPY has started a new correction to the upside. However, the main scenario remains the same and hints at further decline towards the fractal low at 101.18.

![]()

In the H1 chart, after breaking 23.6% fibo, the correctional uptrend has failed to reach 38.2% fibo at 103.95. However, if the current decline breaks the low at 102.87, the downtrend will continue. At the same time, one shouldn’t exclude a possibility of a new rising impulse to reach 38.2% and 50.0% fibo at 104.28 and 106.61 respectively.