25.10.2019

BTCUSD, “Bitcoin vs US Dollar”

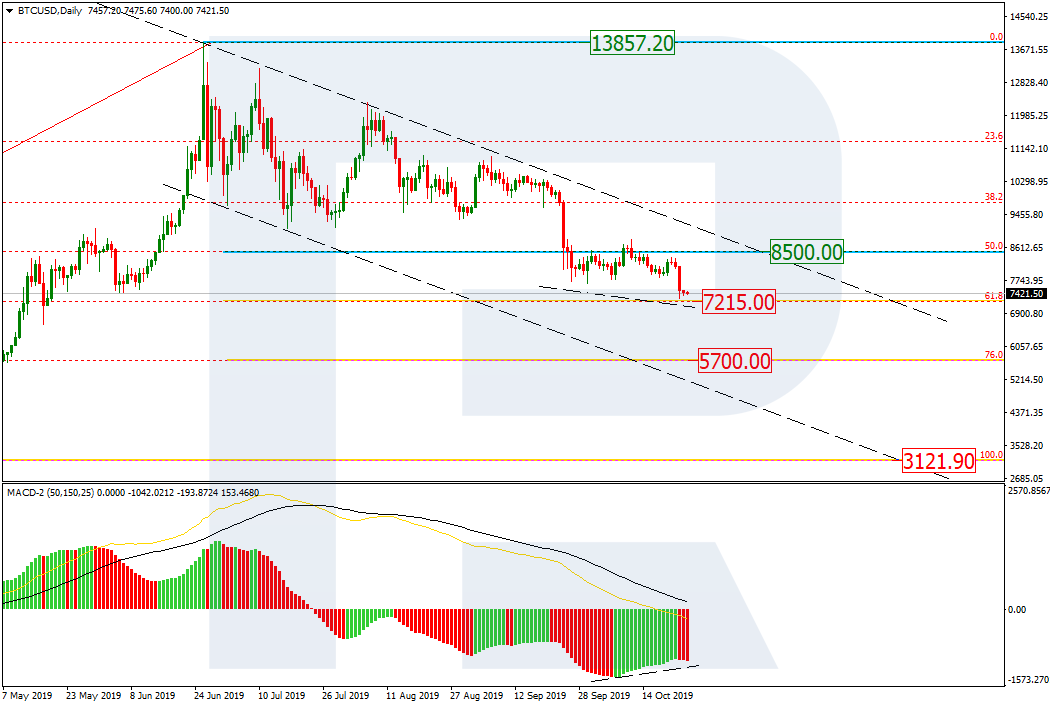

As we can see in the daily chart, the descending tendency continues. After completing the short-term correction, BTCUSD started a new descending impulse, which has almost reached 61.8% fibo at 7215.00. Later, the price may continue trading towards 76.0% fibo at 5700.00. However, the key mid-term target is the long-term low at 3121.90. The previous impulse has moved the resistance, which is currently at 50.0% fibo at 8500.00.

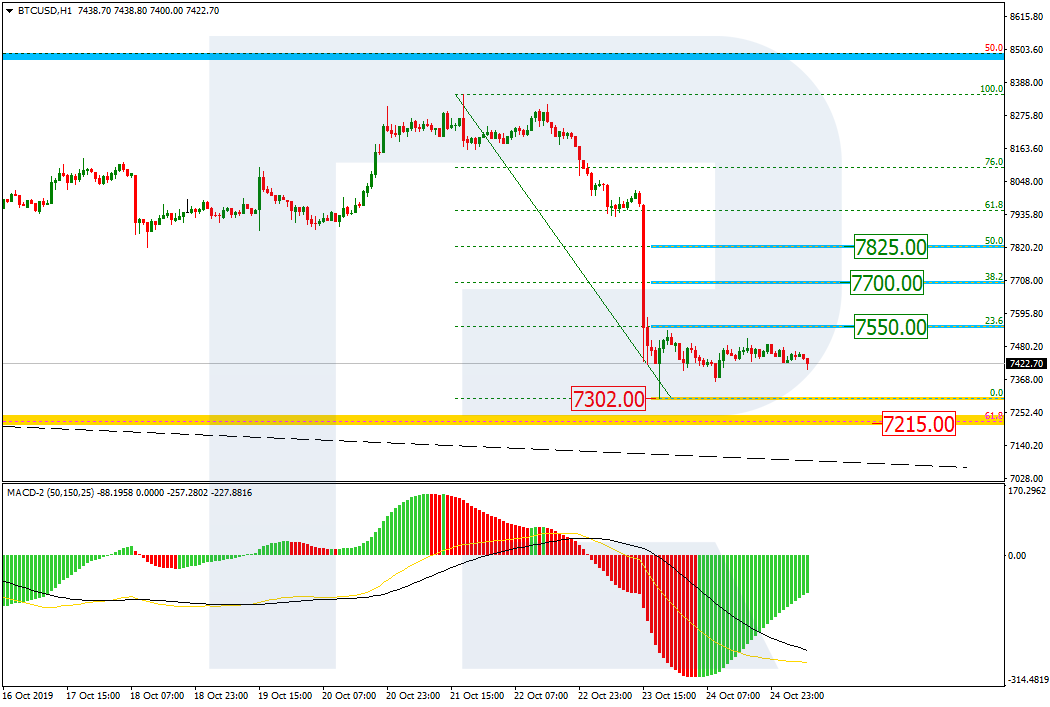

In the H1 chart, the pair is correcting sideways; right now, it is moving between the local low at 7302.00 and 23.6% fibo at 7550.00. In the future, the instrument may yet continue the correction towards 38.2% and 50.0% fibo at 7700.00 and 7825.00 respectively, but it’s highly unlikely.

ETHUSD, “Ethereum vs. US Dollar”

As we can see in the H4 chart, after finishing the correction, ETHUSD started a new decline, which has almost reached the low at 152.28. If the price breaks the low, the pair may continue trading towards 76.0% fibo at 148.60 and then the post-correctional extension area between 138.2% and 161.8% fibo at 135.30 and 124.40 respectively.

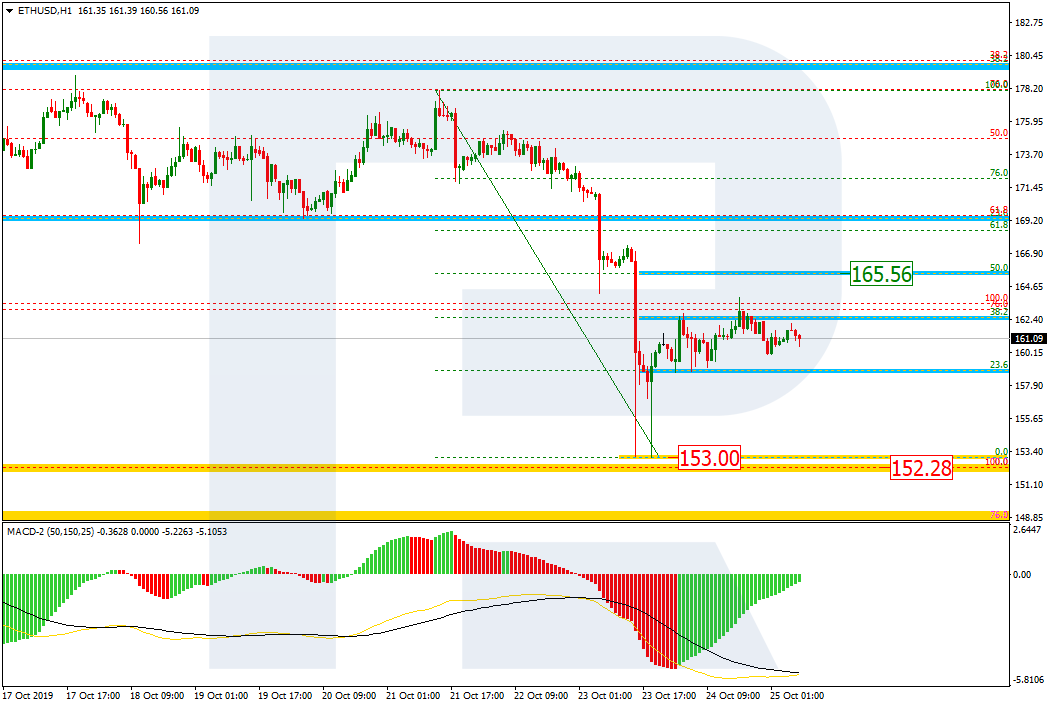

In the H1 chart, the instrument is correcting upwards and has already reached 38.2% fibo. The next upside target is 50.0% fibo at 165.56. the support is the local low at 153.00.