26.09.2019

AUDUSD, “Australian Dollar vs US Dollar”

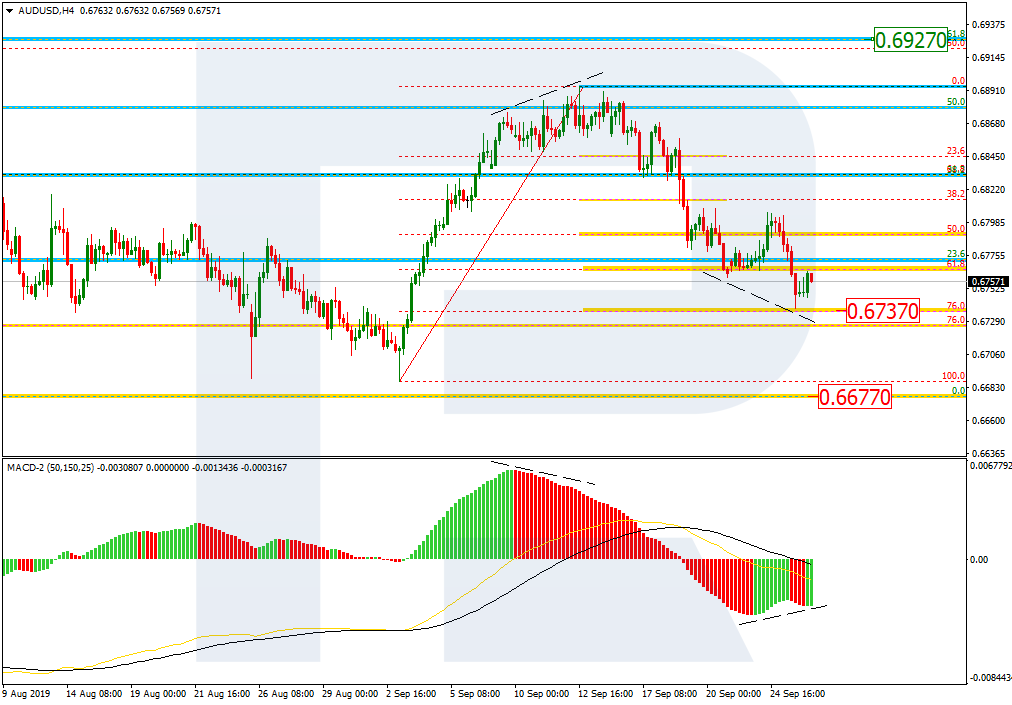

As we can see in the H4 chart, the current descending wave after the divergence has almost reached 76.0% fibo at 0.6737. The stable descending movement along with MACD lines indicate at further decline to reach and break the key low at 0.6677. At the same time, a local convergence on the Oscillator may hint at another pullback or even a new rising impulse towards 61.8% fibo at 0.6927.

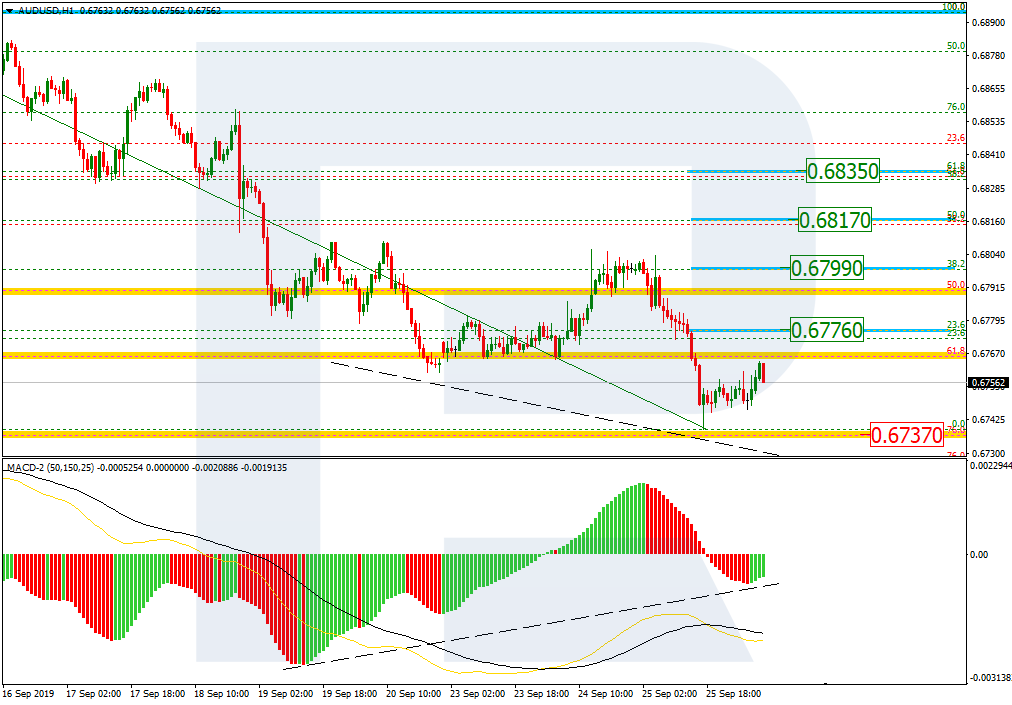

Taking into account the convergence on MACD in the H1 chart, we may assume that AUDUSD may correct towards 23.6%, 38.2%, 50.0%, and 61.8% fibo at 0.6776, 0.6799, 0.6817, and 0.6835 respectively. The support is the low at 0.6737.

USDCAD, “US Dollar vs Canadian Dollar”

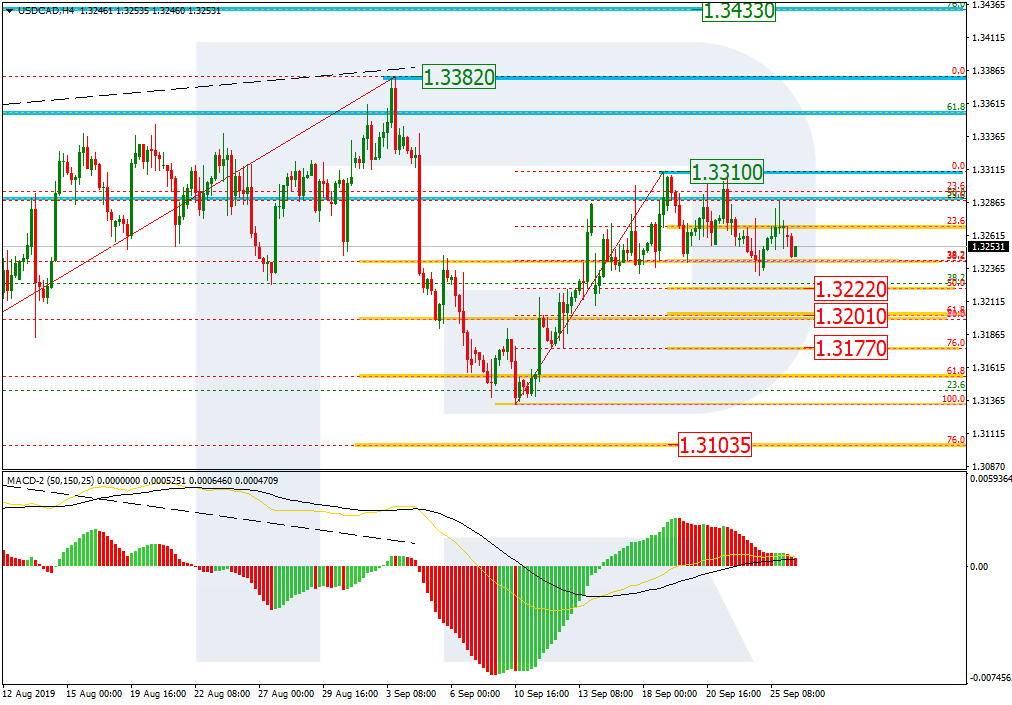

As we can see in the H4 chart, after finishing the ascending impulse, USDCAD has started a new correction, which may later transform into a new descending wave towards mid-term 76.0% fibo at 1.3103. However, if the correction breaks the local high at 1.3310, the instrument may continue growing to reach 1.3382.

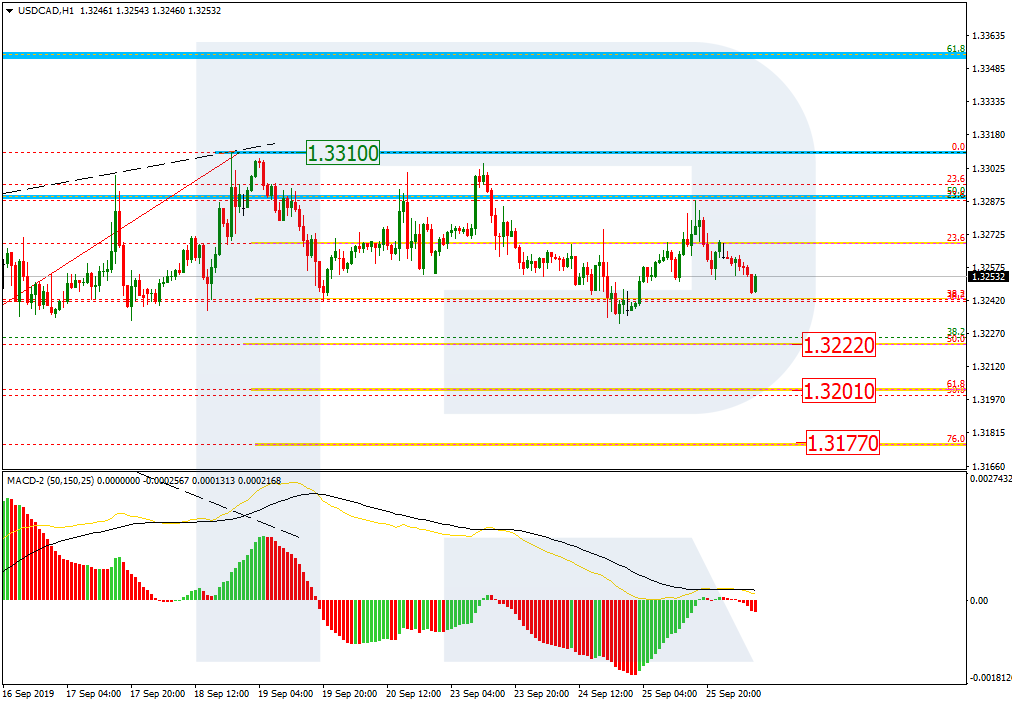

In the H1 chart, the divergence on MACD made the pair start a new decline, which has already reached 38.2% fibo. In the future, the price may continue falling towards 50.0%, 61.8%, and 76.0% fibo at 1.3222, 1.3201, and 1.3177 respectively. The resistance is the high at 1.3310.