Fibonacci Retracements Analysis 27.04.2020 (GOLD, USDCHF)

XAUUSD, “Gold vs US Dollar”

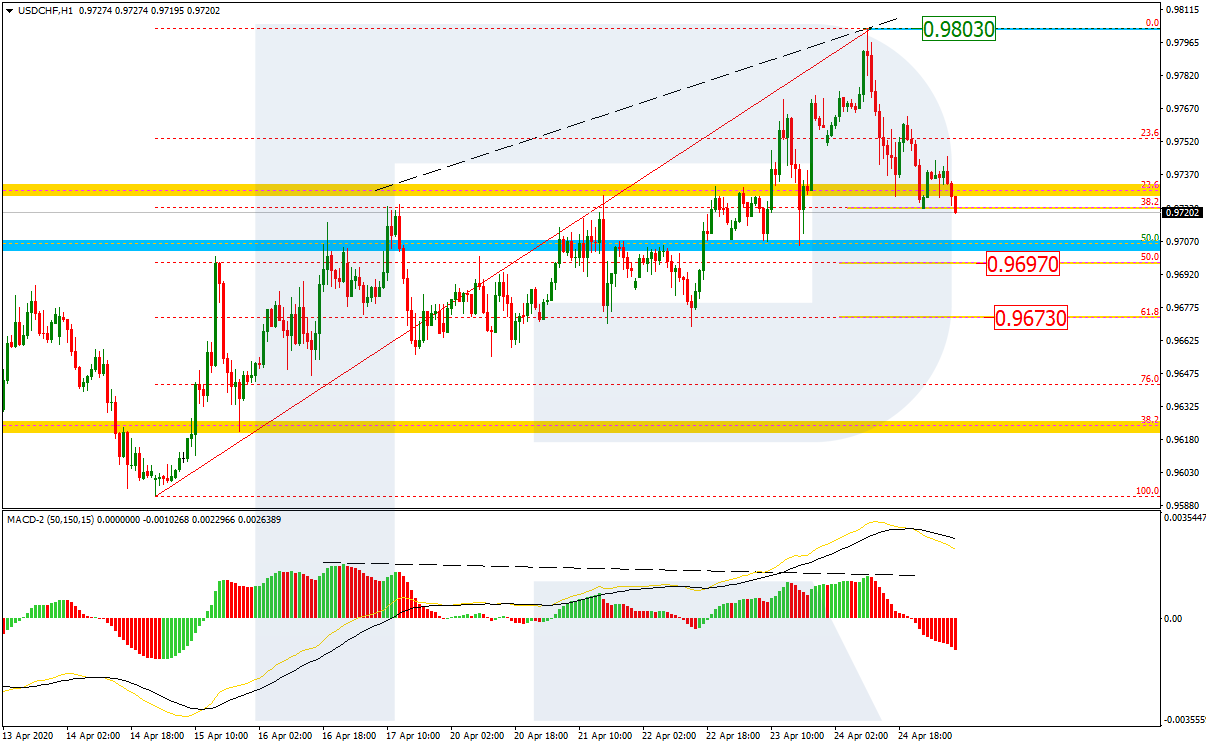

As we can see in the H4 chart, after falling and reaching 23.6% fibo, XAUUSD is moving towards the high at 1747.77. If the price breaks it, the pair may continue its growth to reach the post-correctional extension area between 138.2% and 161.8% fibo at 1798.90 and 1858.60 respectively. At the same time, one should note that the rising impulse was slowed down as it was approaching the high. In this case, there is a high probability of a new descending wave with the targets at 38.2% and 50.0% fibo at 1634.40 and 1599.50 respectively.

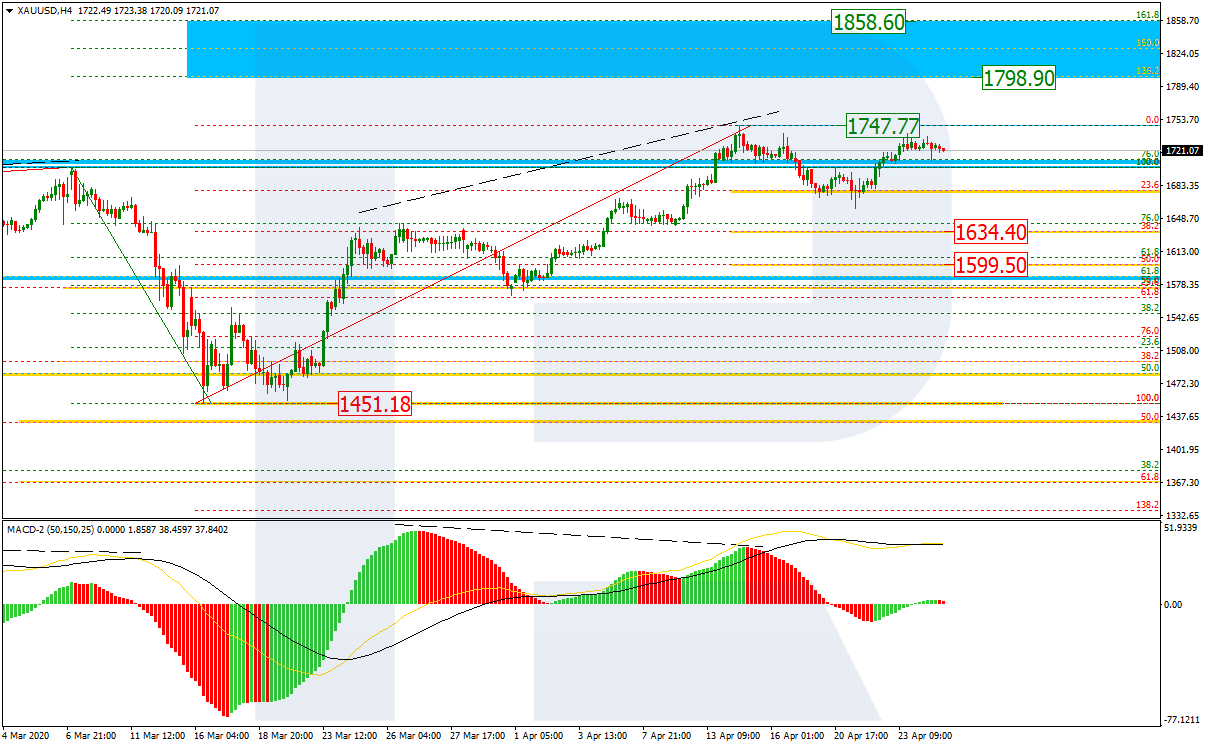

In the H1 chart, the convergence made the pair start a new growth towards the high at 1747.77 but the tendency changed. “Black Cross” on MACD indicates a potential decline towards 38.2% fibo at 1634.40.

USDCHF, “US Dollar vs Swiss Franc”

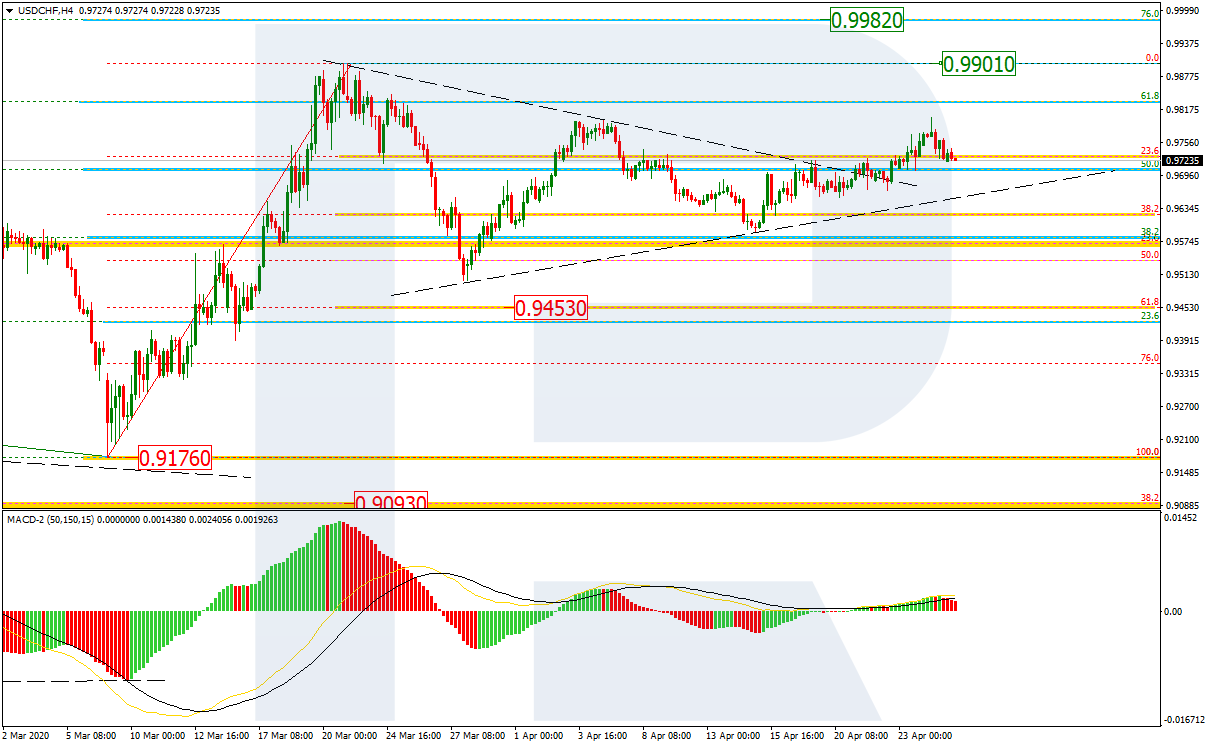

As we can see in the H4 chart, the pair has broken the upside border of the Triangle pattern. If the price manages to continue this rising impulseю it may grow to reach the high at 0.9901 and then mid-term 76.0% fibo at 0.9982. At the same time, one shouldn’t exclude the possibility that the pair may return to the downside border and then fall towards 61.8% fibo at 0.9453.

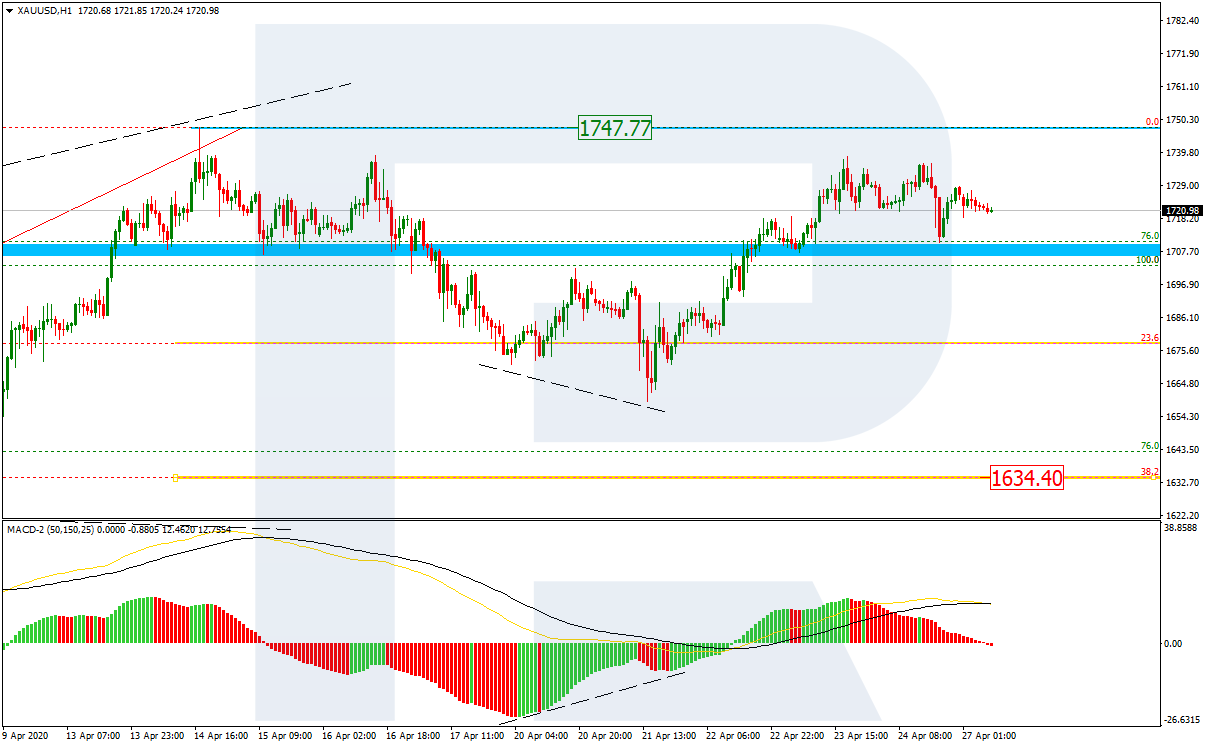

In the H1 chart, the divergence made the pair start a new decline, which has already reached 38.2% fibo. The next downside targets may be 50.0% and 61.8% fibo at 0.9697 and 0.9673 respectively. The resistance is the high at 0.9803.