Fibonacci Retracements Analysis 29.04.2020 (GBPUSD, EURJPY)

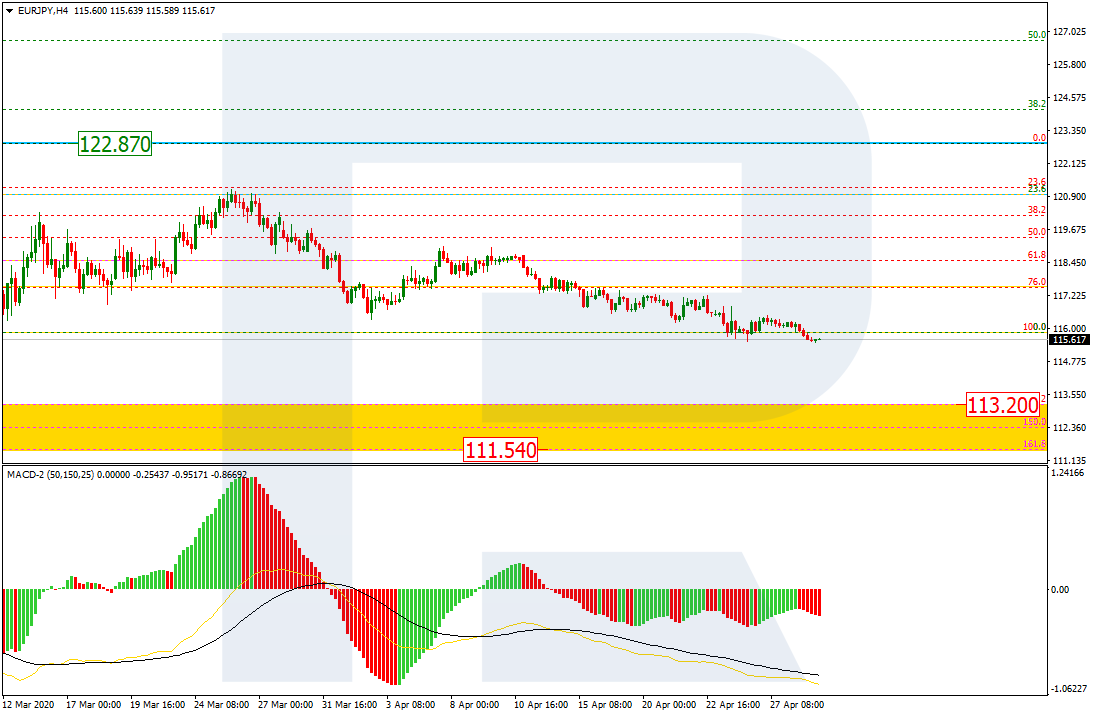

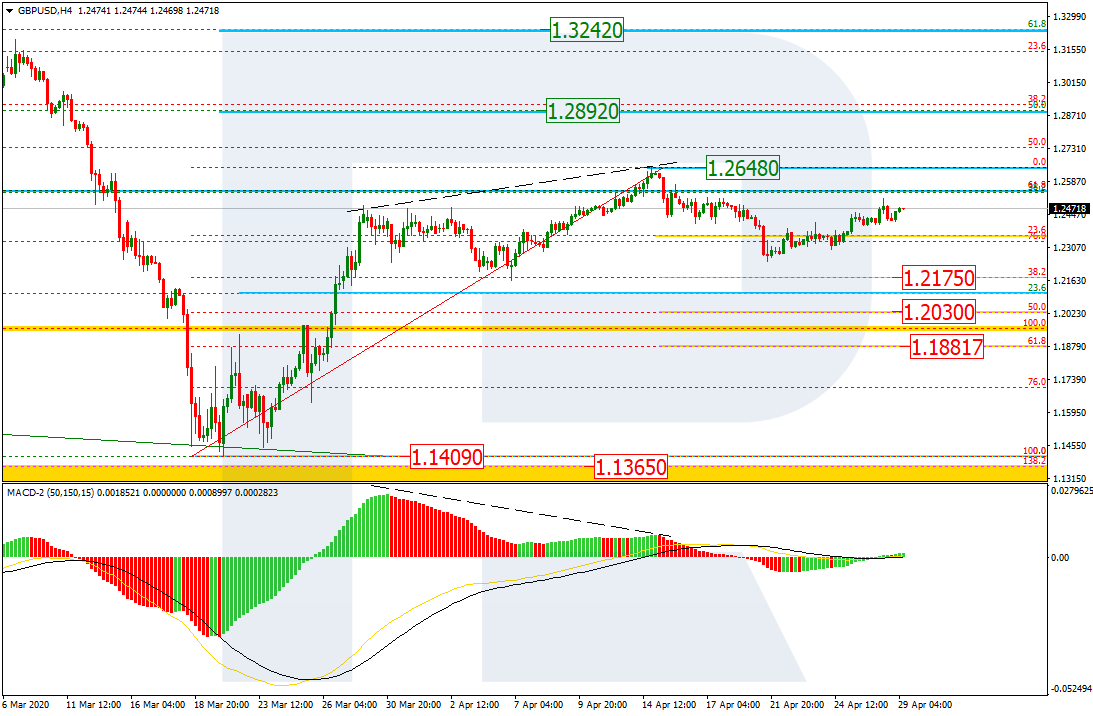

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, the divergence made the pair start a new bearish phase, which has already reached 23.6% fibo. At the moment, GBPUSD is forming a new ascending structure, which may be considered as an internal correction and later be followed by another descending wave towards 38.2%, 50.0%, and 61.8% fibo at 1.2175, 1.2030, and 1.1881 respectively. However, if the price manages to form a strong rising impulse and break the high at 1.2648, the instrument may start a steady growth to reach 50.0% and 61.8% fibo at 1.2892 and 1.3242 respectively.

The H1 chart shows a more detailed structure of the current ascending correction. The pair has already reached 61.8% fibo and may continue growing towards 76.0% fibo at 1.2552. At the same time, there is a divergence on MACD, which indicates that the market is already preparing for a new decline with the target at 1.2247.

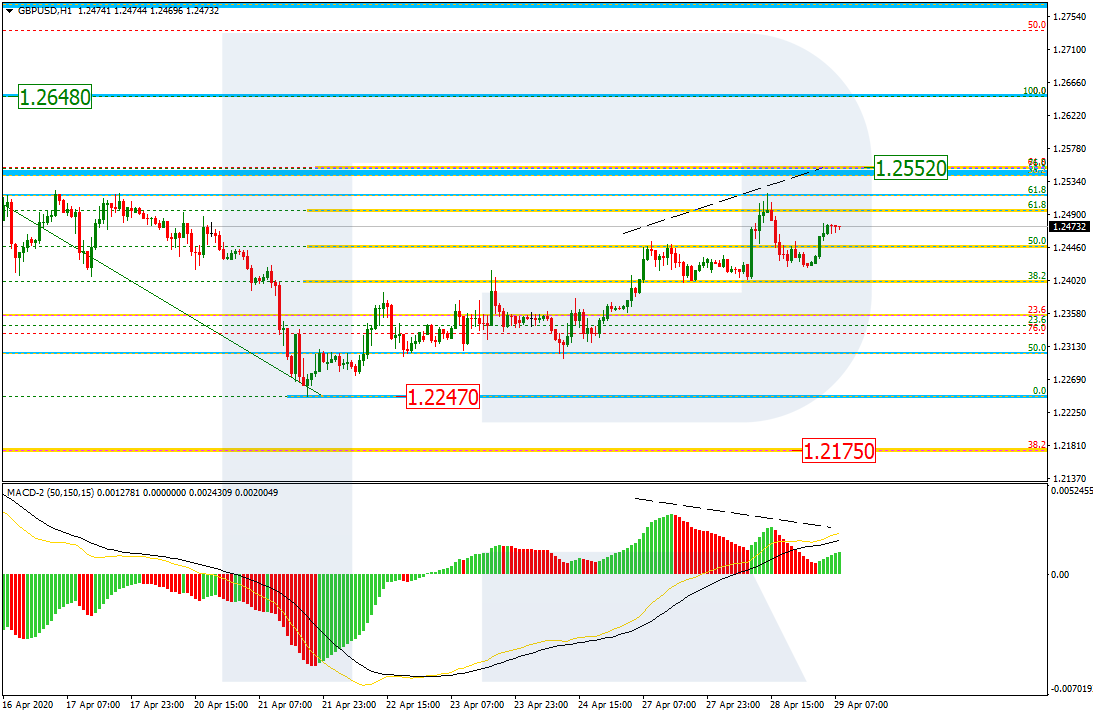

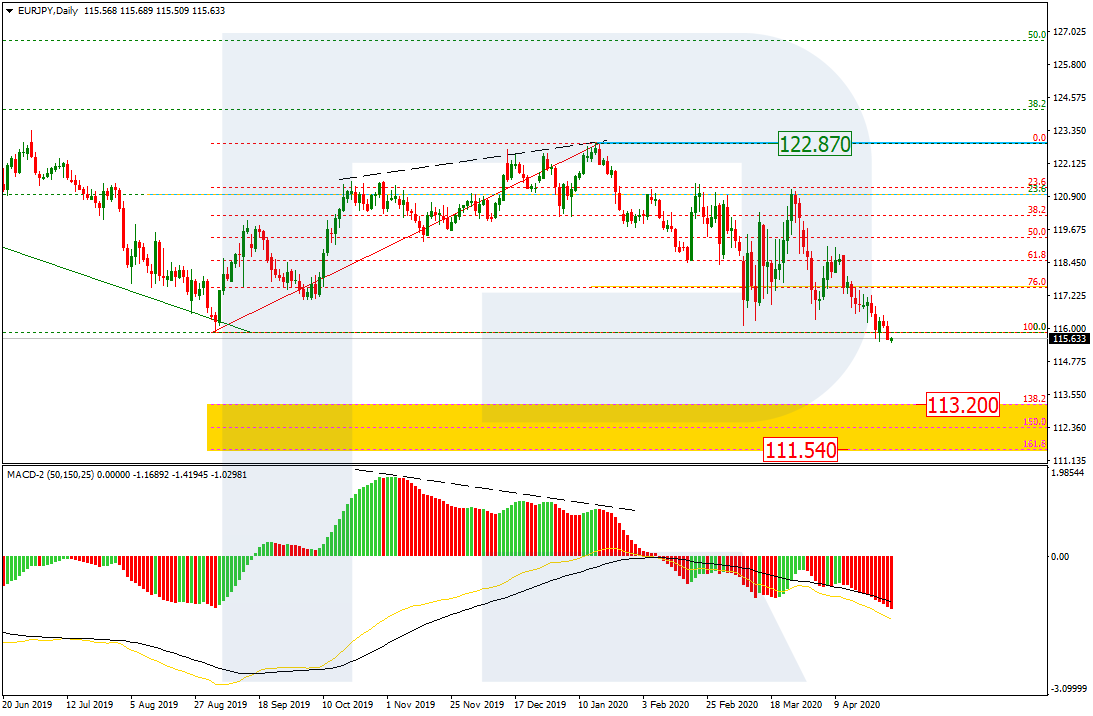

EURJPY, “Euro vs. Japanese Yen”

As we can see in the daily chart, EURJPY has broken the previous low and may continue falling towards the post-correctional extension area between 138.2% and 161.8% fibo at 113.20 and 111.54 respectively.

In the H4 chart, the current descending tendency is rather slow. At the same time, there might be a convergence on MACD to indicate a short-term pullback quite soon.