Fibonacci Retracements Analysis 31.12.2019 (EURUSD, USDJPY)

EURUSD, “Euro vs US Dollar”

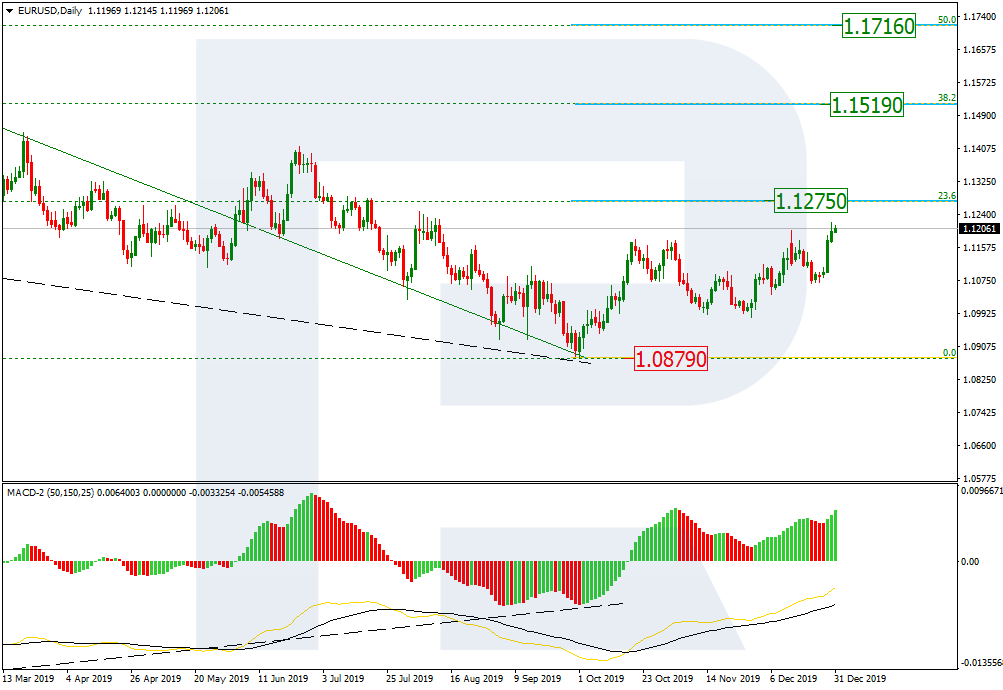

As we can see in the daily chart, after breaking the high, EURUSD is forming a new rising impulse inside the mid-term uptrend. The closest target is 23.6% fibo at 1.1275. If the price breaks this level, the pair may continue growing towards 38.2% and 50.0% % fibo at 1.1519 and 1.1716 respectively. The support is the low at 1.0879.

![]()

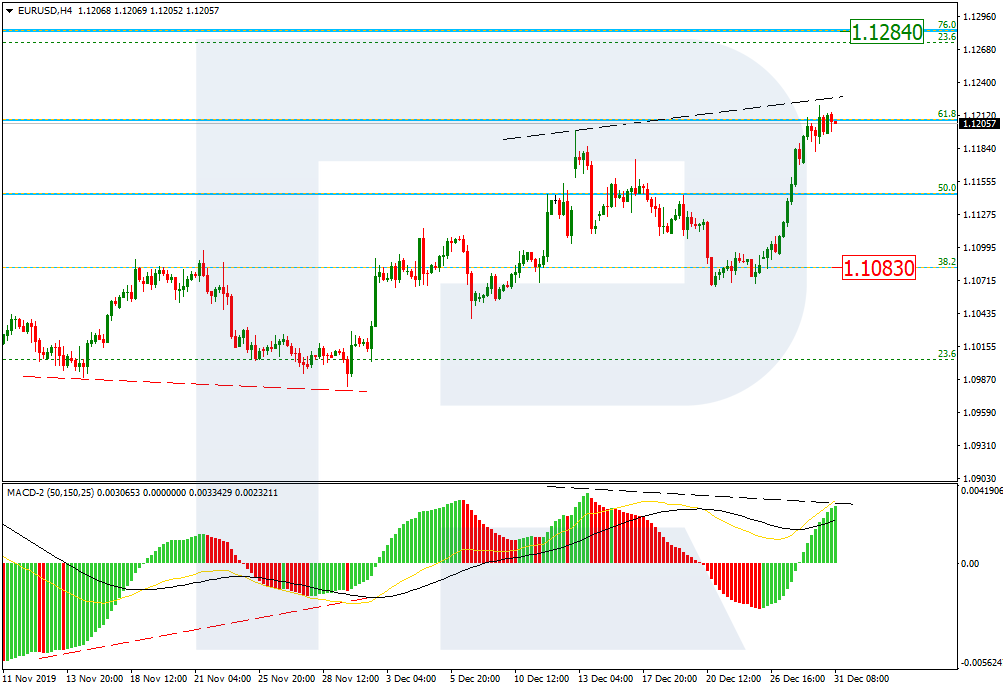

In the H4 chart, the ascending impulse has reached 61.8% fibo. The next short-term upside target may be 76.0% fibo at 1.1284. At the same time, there is a divergence on MACD, which may indicate a new pullback towards the support at 38.2% fibo (1.1083).

![]()

USDJPY, “US Dollar vs. Japanese Yen”

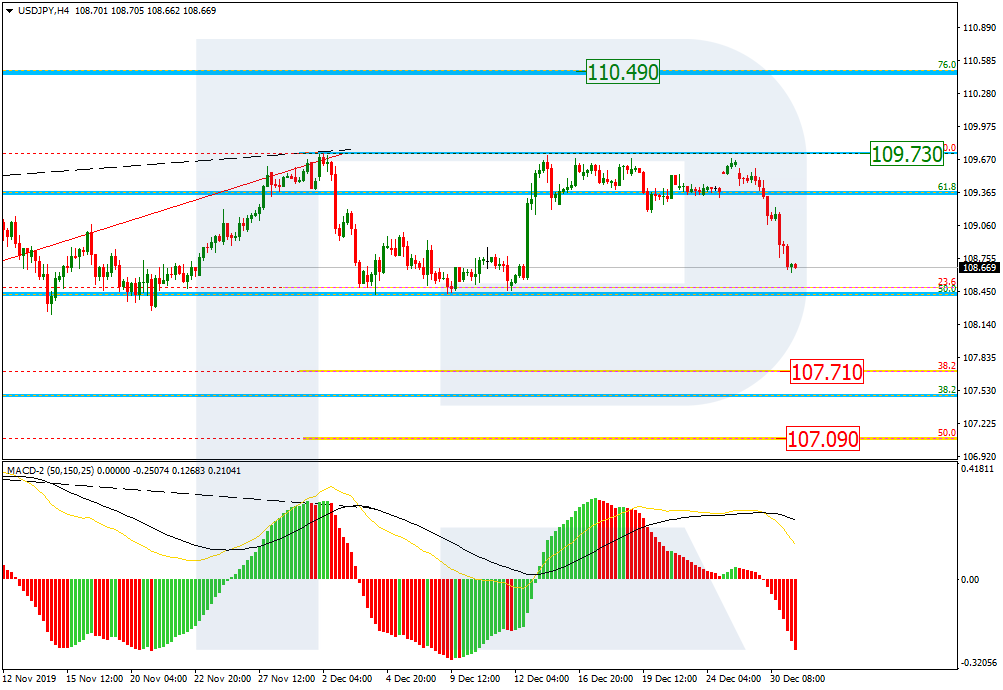

As we can see in the H4 chart, after testing 109.73, USDJPY is trading downwards to reach the fractal low. If the price breaks it, the instrument may continue falling towards 38.2%, 50.0%, and 61.8% fibo at 107.71, 107.09, and 106.47 respectively.

![]()

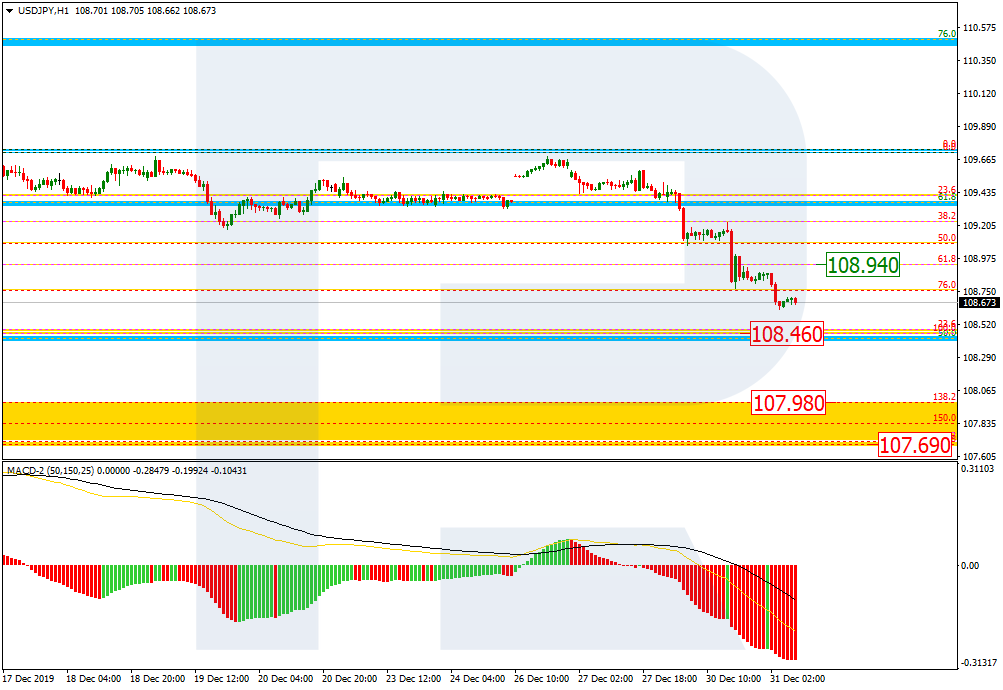

In the H1 chart, the descending impulse is heading towards the fractal low at 108.46. The local resistance is 61.8% fibo at 108.94.

![]()