Forex Technical Analysis & Forecast 16.04.2020

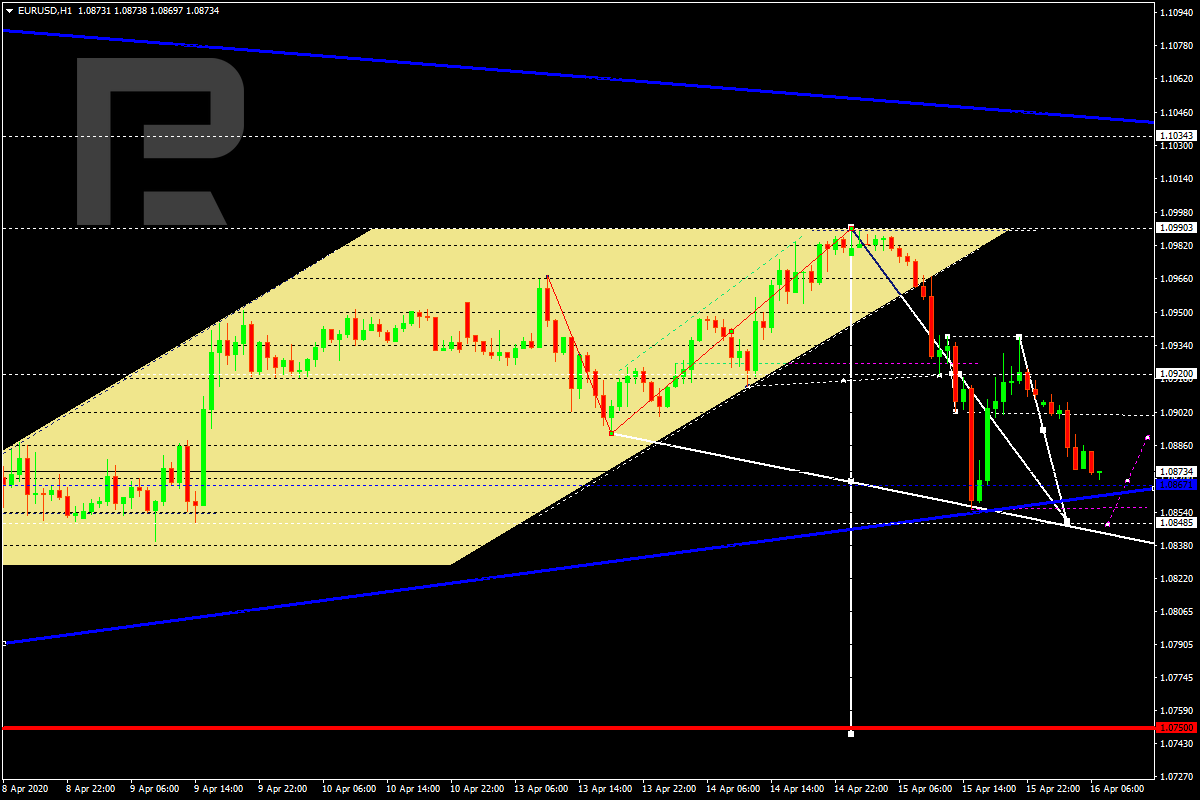

EURUSD, “Euro vs US Dollar”

After finishing the descending impulse at 1.0860 along with the correction towards 1.0938, EURUSD is moving downwards to reach 1.0848. Later, the market may form a new consolidation range. After breaking the range to the downside, the instrument may start another decline with the short-term target at 1.0795.

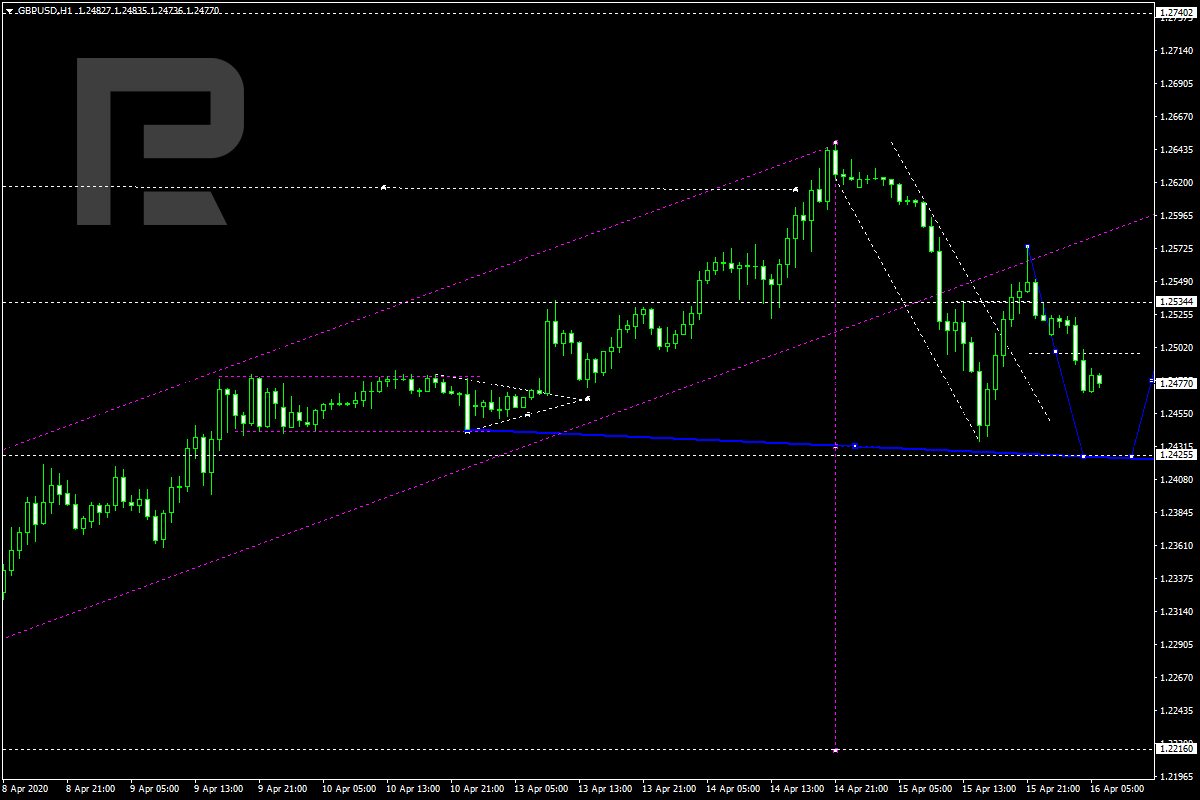

GBPUSD, “Great Britain Pound vs US Dollar”

After completing the descending impulse at 1.2440 along with the correction towards 1.2570, GBPUSD is forming the second descending impulse to reach 1.2425. After that, the instrument may form a new consolidation range. If later the price breaks this range to the downside, the market may resume trading downwards with the short-term target at 1.2330.

USDRUB, “US Dollar vs Russian Ruble”

After forming the consolidation range below 74.34 and breaking it to the upside, USDRUB is moving upwards to reach 75.75. According to the main scenario, the price is expected to reach this level and then resume trading downwards to break 72.90. Later, the market may continue falling towards the target at 68.00.

USDJPY, “US Dollar vs Japanese Yen”

After rebounding from 107.25 to the upside, USDJPY is moving to break 107.75. Possibly, today the pair may grow to reach the short-term target at 108.35. After that, the instrument may correct to return to 107.75 and then start another growth with the target at 108.68.

USDCHF, “US Dollar vs Swiss Franc”

USDCHF is growing towards 0.9700. Possibly, the pair may reach 0this level and then form a new consolidation range. Later, the market may break the range to the upside and resume growing with the target at 0.9770..

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD is falling towards 0.6255. Today, the pair may reach this level and then form a new consolidation range. Later, the market may break the range to the downside and resume trading downwards with the target at 0.6197.

BRENT

After finishing another descending structure at 26.30, Brent is consolidating below this level. Possibly, the pair may form one more ascending structure towards 28.40 and then resume falling to reach 27.30. Later, the market may start another growth with the target at 30.80..

XAUUSD, “Gold vs US Dollar”

Gold has completed the descending impulse at 1706.66. Possibly, today the pair may correct towards 1728.18, thus forming a new consolidation range between these two levels. If later the price breaks this range to the downside, the market may form a new descending structure to reach 1687.90; if to the upside – resume trading inside the uptrend to with the target at 1770.00.

BTCUSD, “Bitcoin vs US Dollar”

After completing the descending structure at 6700.00 and forming another consolidation range, BTCUSD has broken it to the downside to reach 6460.00; right now, it is growing to return to 6700.00. After that, the instrument may resume falling towards 6600.00 and then form one more ascending structure with the short-term target at 6900.00.

S&P500

S&P 500 has completed the descending impulse at 2754.0. Today, the instrument may reach 2814.5, thus forming a new consolidation range between these two levels. If later the price breaks this range to the upside, the market may start another growth to reach 2877.5; if to the downside – resume trading downwards with the first target at 2612.5.