The London session breakout strategy provides excellent opportunities to profit on the high volatility and volume beginning at the opening of the London trading session at 7 AM GMT and lasting for the next 3 hours into the session. This strategy is based on the surge in volatility at the opening of the London session immediately following the much less volatile Asian trading session. |

Traders who are aware of this can trade accordingly and reap significant gains.

How to Set Up a Winning Breakout Trade in the London Session?

The hourly chart has proven to be the best timeframe to use for this strategy since the opportunities exist for just approximately 3 hours.

One indicator is used for this strategy and that’s the 50-period simple moving average (SMA).

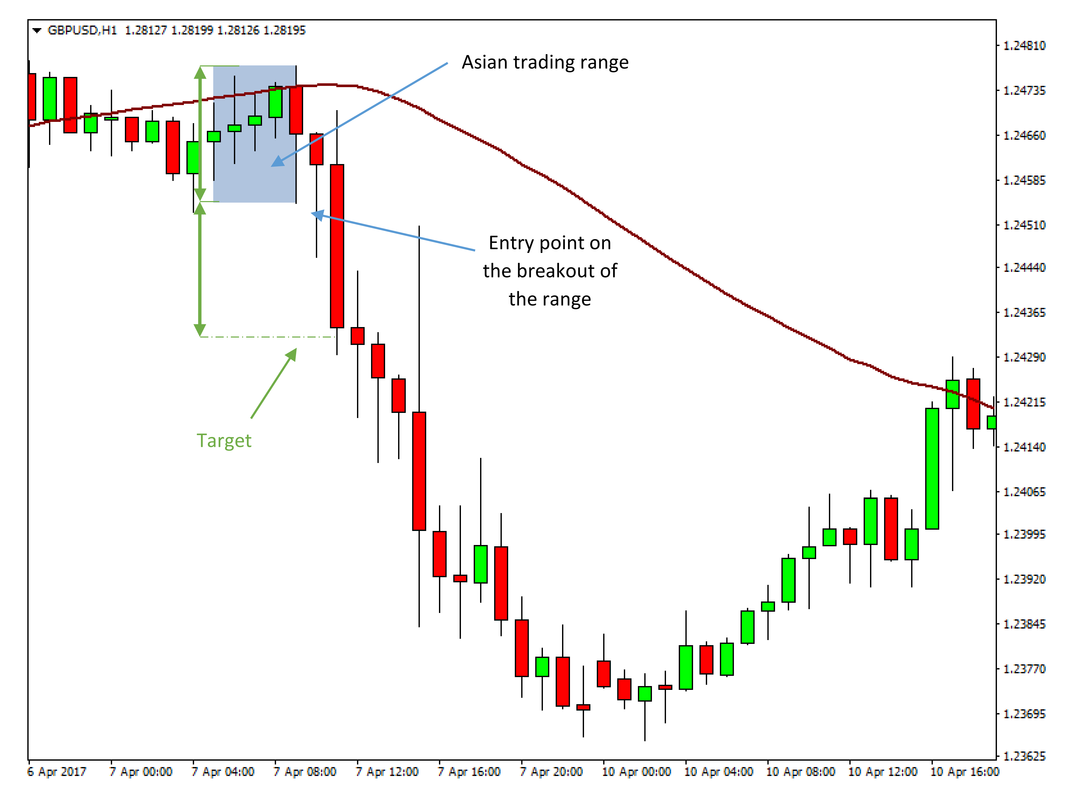

Ensure that you are online at 7:00 GMT at which point you should take a look at the last 4 candlesticks (considering we use H1 time-frame) and note the highest high and the lowest low of those 4 candlesticks (4 hour period). This is the Asian trading range that we are looking for price to break out of.

Buy signal

So, if the next candlestick goes above the highest high of the previous 4 candles, and if the price is above the 50 SMA, then that’s a signal to go long on the currency pair.

- Place your stop loss below the lowest low of the last 4 candles.

- The take profit target is the height of the range projected above the breakout.

Sell signal

If however, the price breaks below the lowest low of the range and price is below the 50 SMA then that’s a signal to take a short trade.

- Place your stop loss above the highest high of the last 4 candles.

- The take profit target is the height of the range projected below the breakout.

An example is shown on the 1-hour GBPUSD chart below.

The Asian trading range is marked with the blue rectangle.

It’s wise to take profit on half of the position at the target, and let the other half run in case the move continues.

Only one trade per day should be executed and all trades should be manually closed at the end of the day if the Stop-Loss or Profit-Target is not initiated.

Regarding risk management with the London session breakout strategy, it’s best to not risk more than 1% – 2% of your account (as with any other forex trading strategy – the exact risk % depends on your money management).

Some traders prefer to use the previous 3 candles rather than the previous 4 candles. Both strategies give similarly good results so, in the end, it’s up to you to test and decide which one works better for you.